SaaSletter - Fresh Data + Curated Links

Featuring RepVue, Insight Partners, ICONIQ, Dave Kellogg, Notion Capital, and ChartMogul

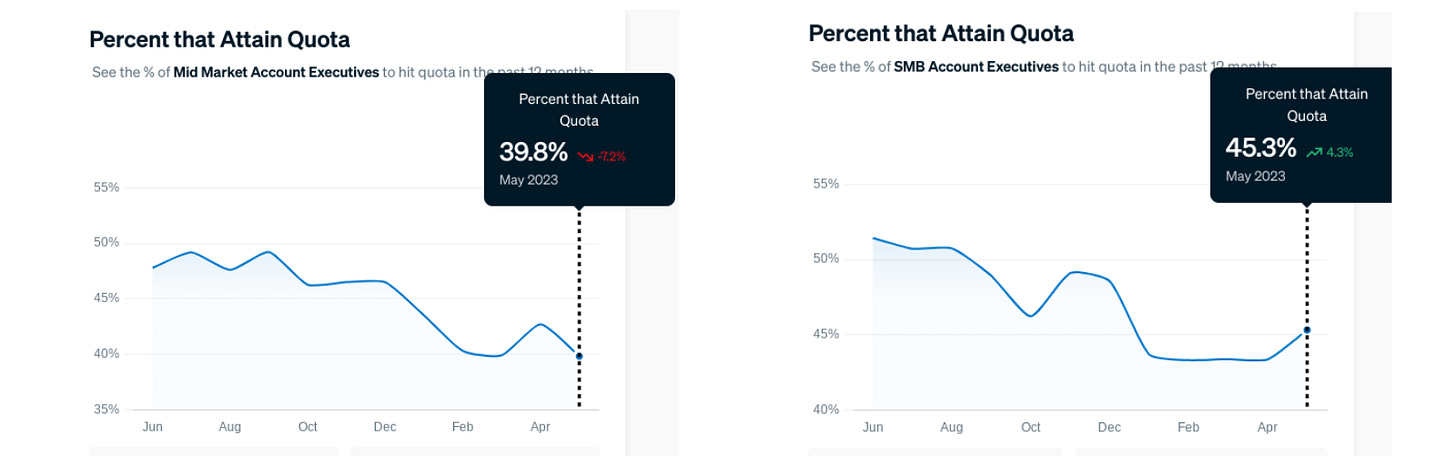

RepVue Quota Data for May 2023

I use RepVue (think Glassdoor for sales, but with better data) quota attainment as a proxy for the state of SaaS sales and revenue trends.

Not only is the data well-segmented + sizeable, but it is also very timely...

with May 2023 data available on June 1

The TL,DR = on a month-over-month basis:

50/50 up vs down split by role;

eyeballing it, the industry-wide quota achievement looks to be flat

absolute attainment levels are low (the high 30s - mid-40s for AEs), a bit better for forward-looking roles (SDRs and Sales Engineers in the 50's)

In chart form:

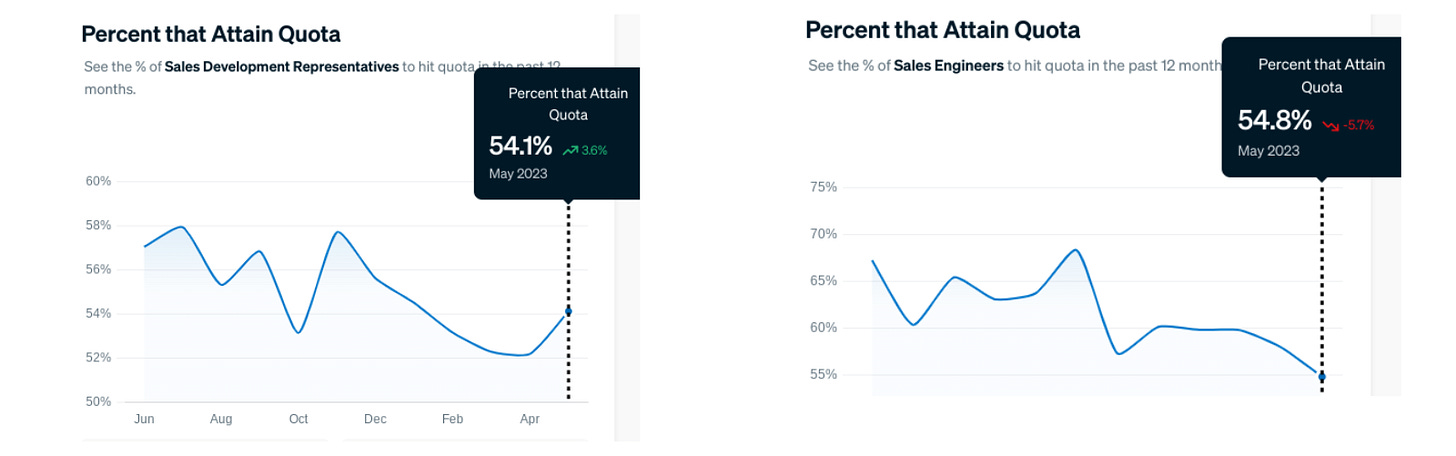

Sales Benchmarks From Insight and ICONIQ

Two strong sales benchmarking reports worth downloading:

Insight Partners - “Scale up by the numbers: SaaS Sales KPIs from over 300 companies”

ICONIQ - “The Definitive Guide to Sales Compensation”

Curated Links

Dave Kellogg’s latest conference talk + slides - SaaStock Presentation: How To Connect Your C-Suite to the Ground Truth

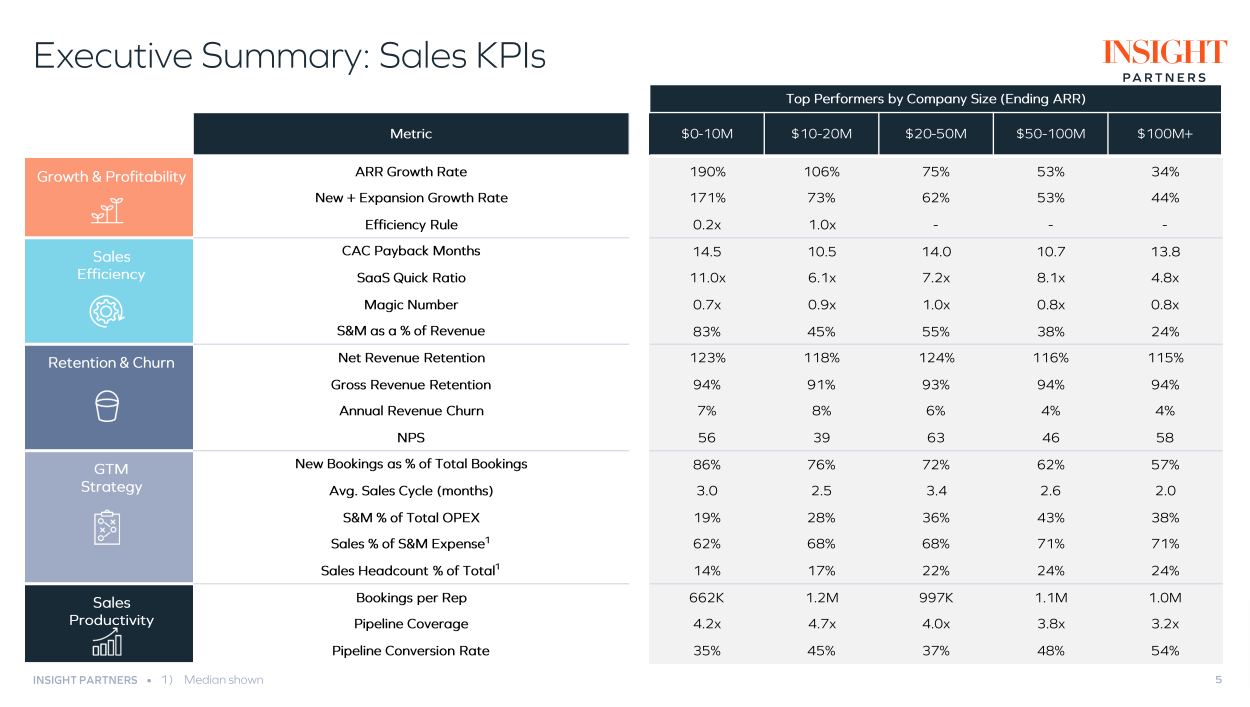

Janelle Teng with a compendium of consumption-based SaaS charts + her takes: “Consumption vs. subscription business models during downturns”

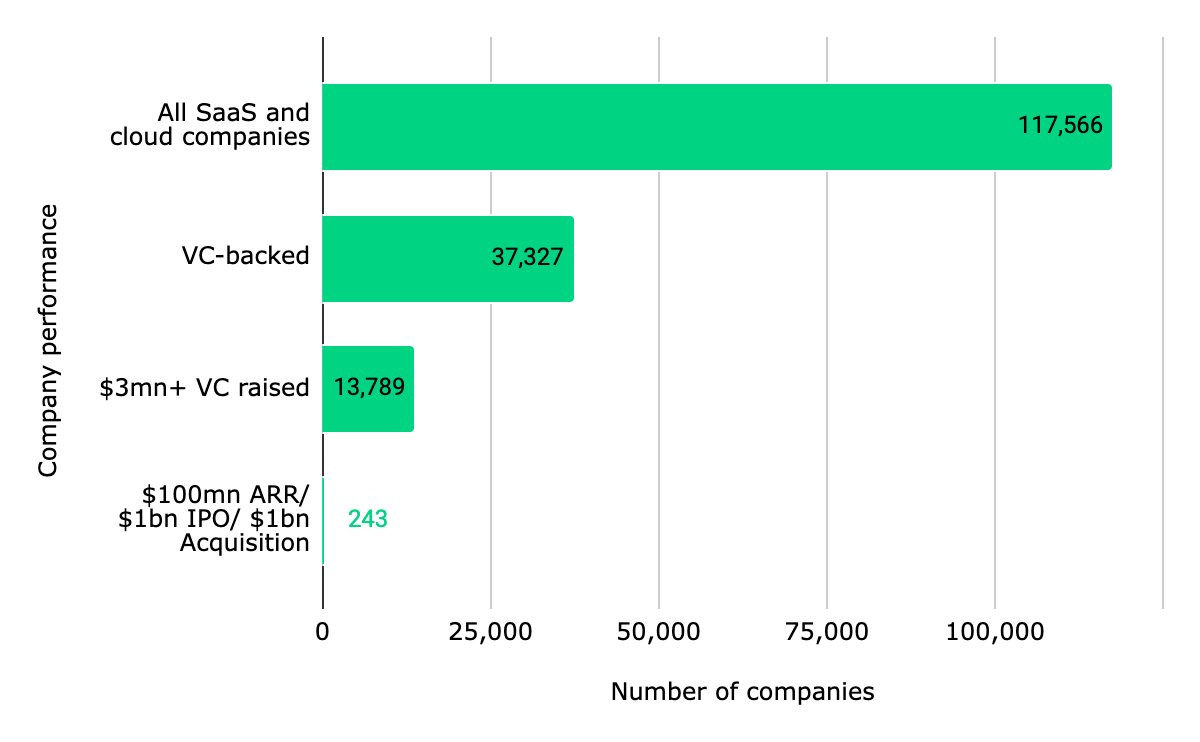

Notion Capital had a great study of base-rate success levels for VC-backed SaaS companies:

0.6% (i.e. 6 per 1,000 companies!) VC-backed SaaS/cloud companies hit $100m ARR or $1bn IPO/M&A threshold

Dave Yuan and Tidemark continue to release strong vertical SaaS content - this time highlighting an under-the-radar hotel SaaS that IPO’ed in Australia (SiteMinder, SDR:ASX).

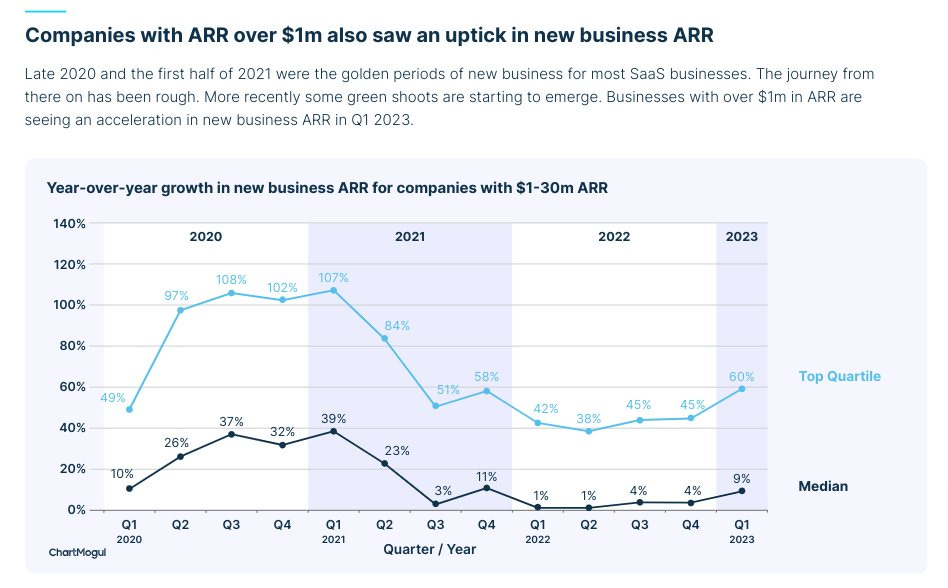

ChartMogul released its latest, comprehensive SaaS Benchmarks Report (n = 3,000+). Above I highlighted the early (1H 2021) deceleration prior to peak SaaS, suggesting $1m-$30m ARR SaaS might be a useful canary in the coal mine for larger, public SaaS companies.

Cloud Ratings Content

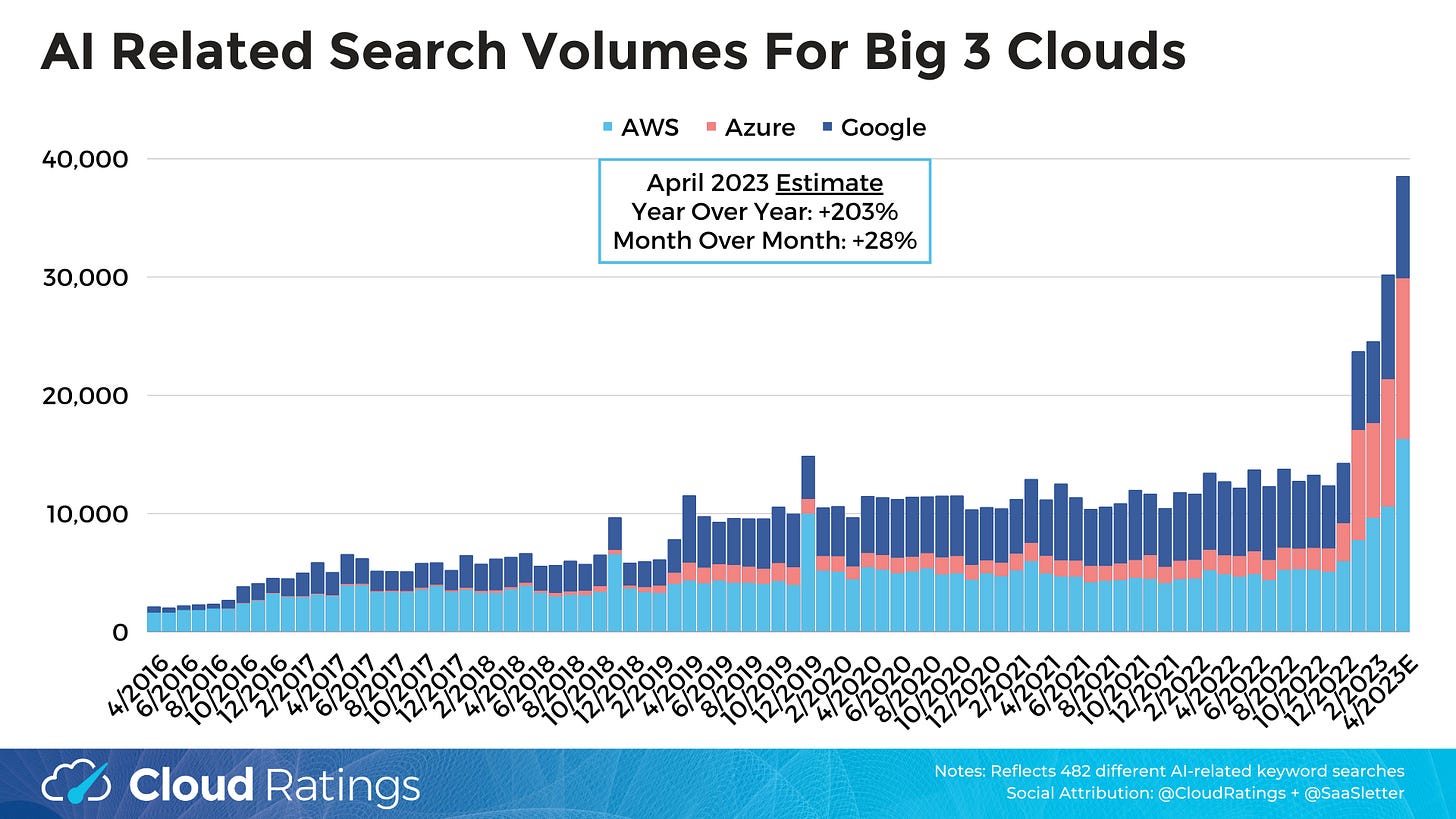

In light of NVIDIA’s historically great, AI-led quarterly guidance, we updated our tracking of AI-related searches (n = 400+ terms) for the Big 3 Clouds (AWS, Azure, Google Cloud): 203%+ YoY growth!

Nick Franklin (Founder + CEO of ChartMogul) joined our podcast to discuss their expansion in CRM:

We will be releasing an episode with CJ Gustafson (CFO PartsTech and prolific writer of Mostly metrics) next week - subscribe here for audio or to our YouTube.

Awesome benchmarking data, per usual