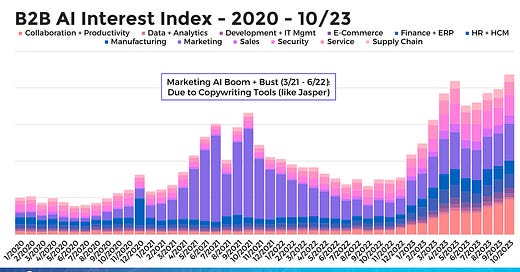

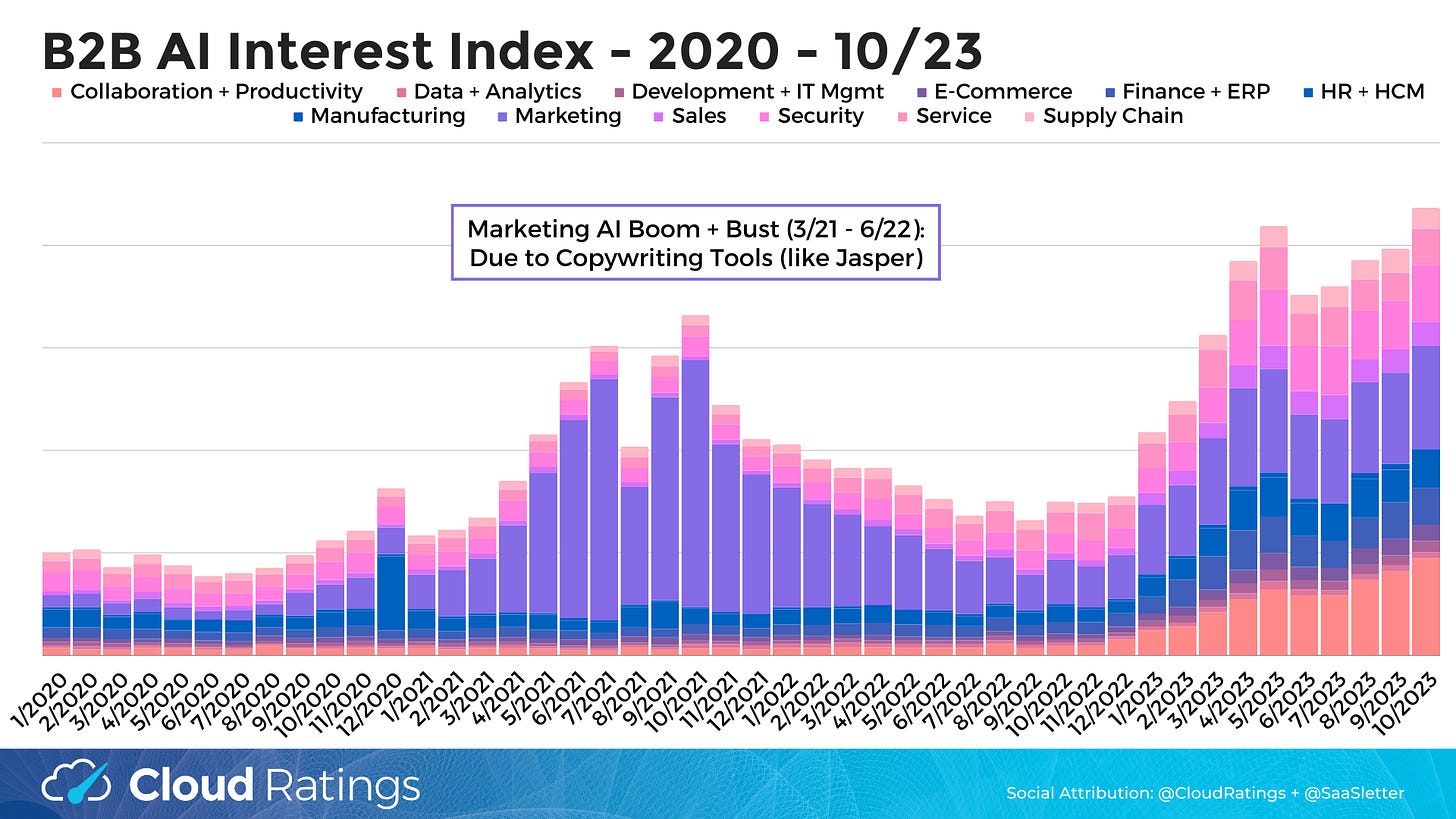

NEW: Cloud Ratings B2B AI Interest Index

NEW: Cloud Ratings B2B AI Interest Index1

This chart seems to validate the explosion of B2B/enterprise interest in exploring AI tools, with an acceleration in late 2023 after a lull.

That said, interest can wane - see marketing boom + bust in purple (data *indicates* highly influenced by copywriting tools like Jasper and CopyAI):

Interestingly, our preliminary look at enterprise AI interest at the product + company level shows less durable interest. Early AI interest examples from our preliminary product-level research:

Strong + Growing AI Interest: Hubspot, Asana, Salesforce, Smarthseet

Spike Then Decline: Microsoft Copilot, Superhuman, Notion

Altimeter On Dilution

from Altimeter’s “Tech Company Dilution: Finding Ground Truth” framed Software’s dilution rates (in-line with Internet; much higher than Big Tech + Blue Chips)…

while outlining his detailed methodology: averaging #1) Forward Dilution Method via Net Grants and #2) Trailing Dilution Method via Exercised Options.

With a good rule of thumb on “dilution market cap math”:

My Earnings Misses Matter So Much

One interesting + engaging aspect of writing this newsletter: is operators (especially sellers) reaching out with questions to better understand the investing side of SaaS.

In that vein, David Spitz’s post on the why + how of Confluent’s 3.7% guidance reduction could lead to a 50% stock price decline is useful reading:

But… people assume that if Q4 is down by 3.7%.... so are all the other quarters in the future, from what they thought previously.

Confluent is still a great company. Right? Just not quite as fast a grower as you thought.

Not such a big deal...

Aaaaahhhhh… but it is a big deal. Each year that you miss growth by 3.7% affects the next year… and then the next…etc.

In a word: COMPOUNDING.

And all those compounded changes over time….

…..cascade to be almost a 40% change in VALUE.

See also Nnamdi Iregbulem from Lightspeed’s “Beats and Misses Are Forever”

Cledara’s “State of the SaaS Market Q4 2023“

The SaaS spend management platforms continue to be a good source of data + market intelligence… like this recent conference presentation from Cledara’s Co-Founder Brad van Leeuwen: SLIDES

A few slides - like the divergences between Europe + US - stood out:

With larger versions available in their slides

Curated Content

’s B2B Marketing Budget Benchmarks - I particularly appreciated the breakdown between People vs Program vs Tech I missed Accel’s 2023 Euroscape (i.e. their 54-slide state of the European tech market report) - hat tip to Palmer from G2 for flagging. A few excerpts:

Lastly, despite the drama at OpenAI, our “SaaS GPT Lab” continues to grow - check it out here (if you have a ChatGPT Plus account):

B2B AI Interest Index Details:

Built using Google Search *volumes* (= different than what you see in publicly accessible Google Trends)

Keyword selection to approximate B2B queries and avoid B2C queries (i.e., impacted by college students)

Unlike our SaaS Demand Index which focuses exclusively on high-intent searches (think “okta pricing”), the B2B AI Interest Index focuses only on general interest searches (why? insufficient high-intent searches at this time)