SaaSletter - B2B AI Interest Index + AI Curation

Plus Our Latest Podcast: SaaS Sales Metrics With The Bridge Group

Latest Podcast: Deep Dive Into Sales + AE Metrics

VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

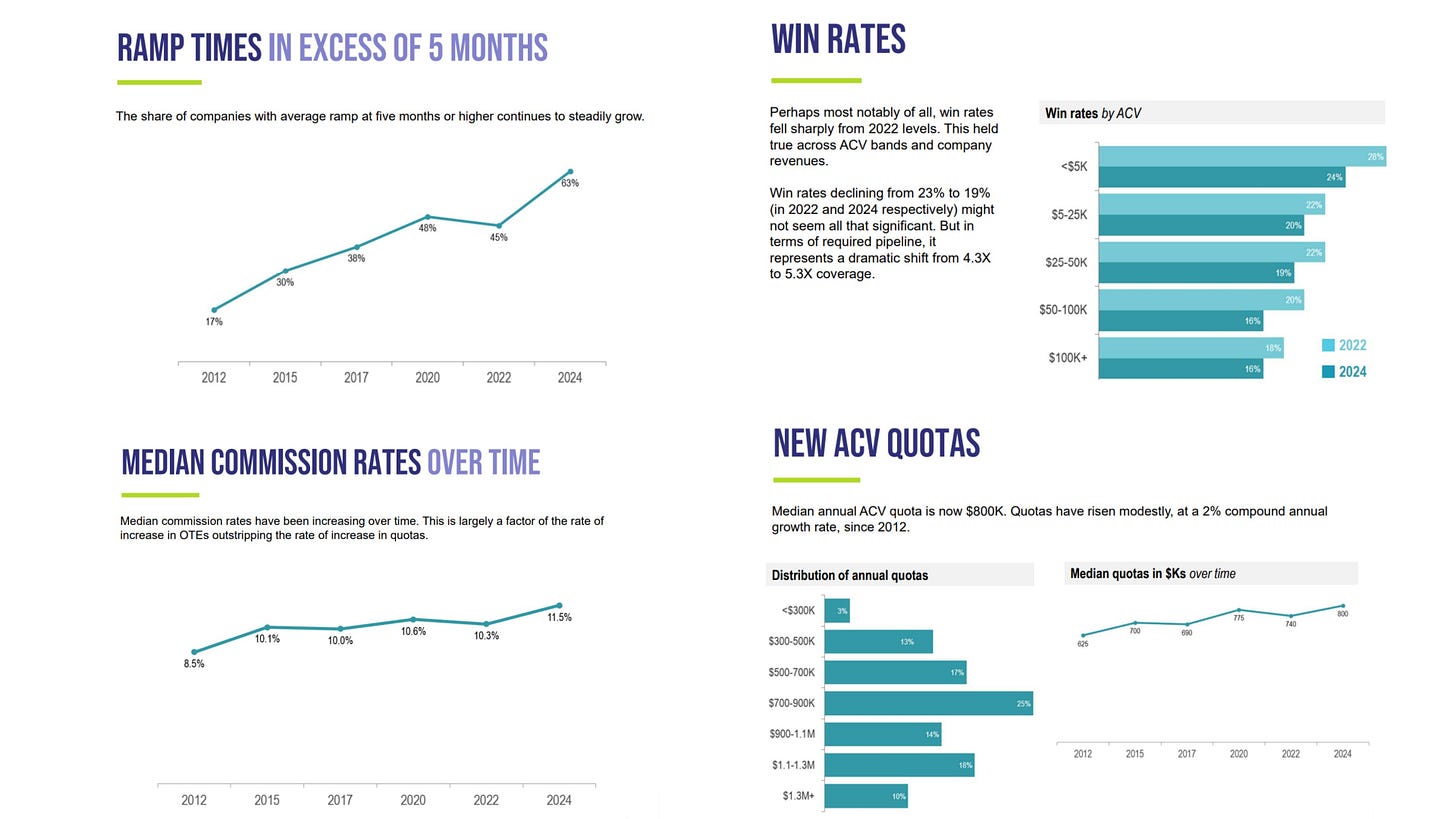

We did a deep dive into The Bridge Group’s excellent “2024 SaaS AE Metrics & Compensation: Benchmark Report” (excerpt graphs below), and then starting at 59:29 we switched to broader sales in 2024 Q&A

B2B AI Interest Index - March 2024

We’ve updated our B2B AI Interest Index through March 2024 - full slides below:

The callouts:

Flat month-over-month interest levels for bellwether Microsoft Copilot, with modest gains for other “Blue Chips”

Encouraging trends at the Category Interest (i.e. “manufacturing AI” or “security AI”) level

Slight growth for Incumbent SaaS (n=340) and AI Natives (n=50)

AI Highlights From Microsoft + ServiceNow Earnings

Microsoft Q3 2024 Earnings Call - Selected Copilot Highlights:

This quarter, we made Copilot available to organizations of all types and sizes from enterprises to small businesses. Nearly 60% of the Fortune 500 now use Copilot, and we have seen accelerated adoption across industries and geographies with companies like Amgen, BP, Cognizant, Koch Industries, Moody's, Novo Nordisk, NVIDIA and Tech Mahindra purchasing over 10,000 seats.

We're also seeing increased usage intensity from early adopters, including a nearly 50% increase in the number of Copilot-assisted interactions per user in Teams, bridging group activity with business process workflows and enterprise knowledge. And we're not stopping there. We're accelerating our innovation, adding over 150 Copilot capabilities since the start of the year.

… this is faster diffusion, faster rate of adoption than anything we have seen in the past. As evidenced even by Copilot, right, it's faster than any suite we have sold in the past. And -- while it is going to require workflow and process change.

However, from a quarterly financial impact perspective, we understand Copilot performed slightly below investor expectations - per Morgan Stanley’s earnings recap:

Still Early Days for Copilot, but Office 365 Commercial Results and Guidance Underwhelm. O365 Commercial grew 15% in cc, in line with guidance at 15% cc but below investor expectations looking for a point of upside to 16% in cc. 15% YoY represents another deceleration from 16% YoY in cc last quarter. Guidance for 14% cc growth in Q4 implies another 1pt deceleration from this quarter and comes below investor hopes for durable growth in Q3 and Q4 at 16% cc.

ServiceNow Q1 2024 Earnings - AI Highlights:

curated ServiceNow’s AI commentary, which, like Microsoft, was best characterized as bullish on the adoption and impact of their “Pro Plus” AI SKU while light on $ specifics (more to be revealed at their May 6th Financial Analyst Day).AI-Centric Curated Content

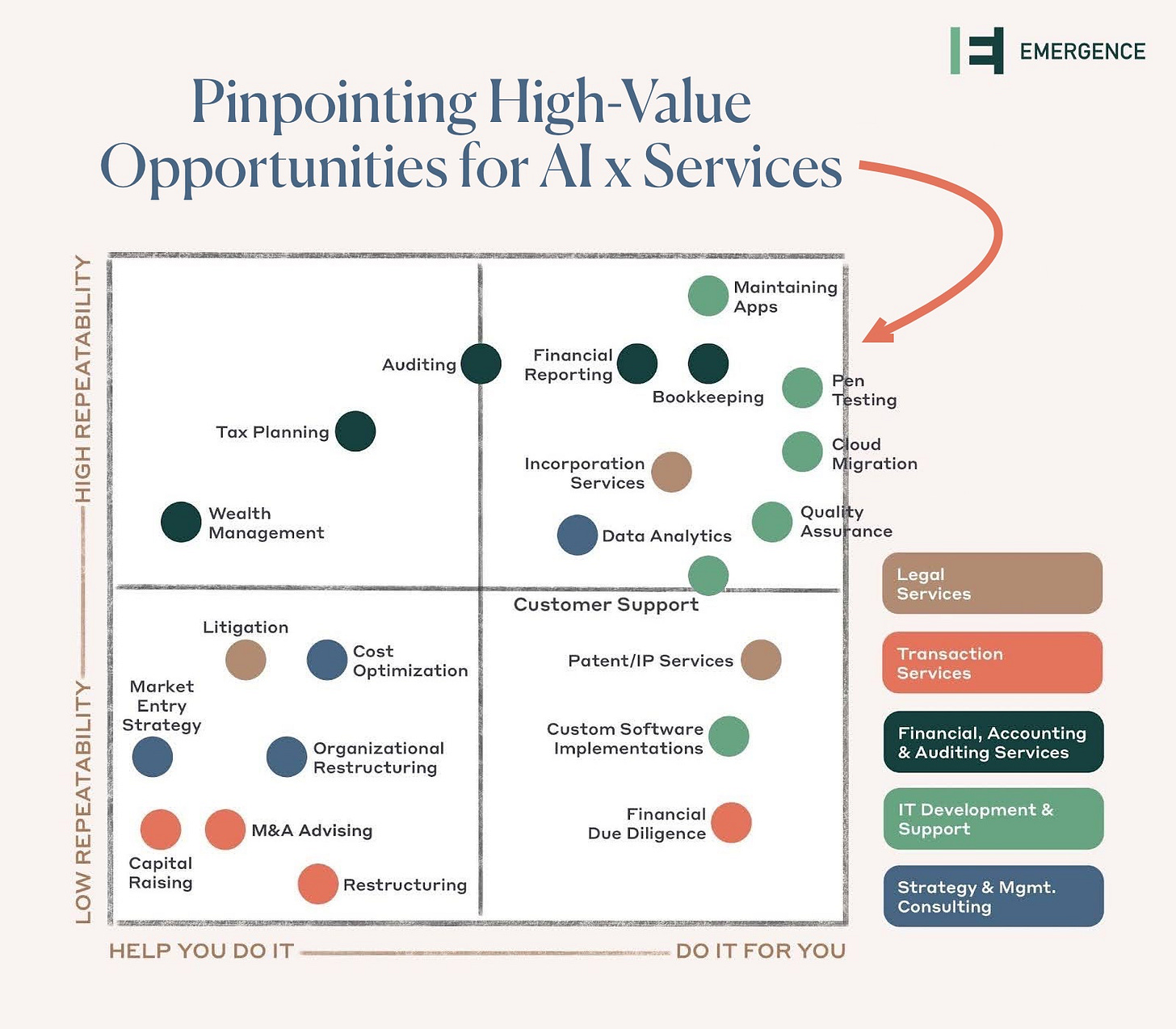

“The Death of Deloitte: AI-Enabled Services Are Opening a Whole New Market” - from

“Moving from AI Assistants to AI Agents” - from

“The Impact of AI on Go-To-Market: Slides from my Balderton Event” - from Dave Kellogg

“The Economics of Generative AI” - from

at Altimeter“Where AI is Headed in 2025: A Builder’s Guide” - from

“The AI SDR era? 11x’s journey from $0 to $2M ARR in six months” from

“The AI Workforce is Here: The Rise of a New Labor Market” from NFX’s Pete Flint and Anna Piñol

…and re-highlighting our recent “building in AI” themed podcast with Matt Slotnick, Co-Founder and CEO of Poggio Labs (backed by Accel and Spark Capital), an AI Sales Workspace purpose-built for Account Executives:

VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

Non-AI Curated Content

“Market Structure Drives Strategy” (Email Required) - from Dave Yuan and Tidemark

“An In-Depth Overview: The Future of Cloud-Native Identity Security” from Francis Odum on

“Who's Going to Consolidate All These Software Companies? Hint: it’s not big tech” - from