SaaSletter - February 2024 SaaS Demand Index

Plus an AI podcast with Matt Slotnick + our SaaS Employment Index

Podcast: Matt Slotnick from Poggio Labs

VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

Matt Slotnick is the Co-Founder and CEO of Poggio Labs (backed by Accel and Spark Capital), an AI Sales Workspace purpose-built for Account Executives.

We cover his insights from early adopters of AI, lessons for building in AI versus traditional SaaS, and why the “data is the new oil” narrative might not make sense.

February Demand Index

We’re excited to update the SaaS Demand Index with data through February 2024.

For our new readers: the Demand Index is derived from high-intent (aka “okta pricing”) Google Search volume data for 339 companies, covering 350,000+ searches each month.

Reminder: this is a directional, free, and ever-evolving* analysis → always do your own due diligence.

Moreover, the data captured here is best characterized as top-of-funnel or dark funnel → factoring in sales cycle length, do NOT use this Demand Index as a predictor of near-term financial results and/or financial guidance.

Industry-Wide Data

High-intent search volumes were up +5% month-over-month and +17% year-over-year.

While noting an easy February 2023 “comp”, this +17% YoY reading is an acceleration that brings our TOFU proxy index closer to expected industry revenue growth rates for SaaS (Gartner at +19% industry-wide for 2024).

Trends By Product Category

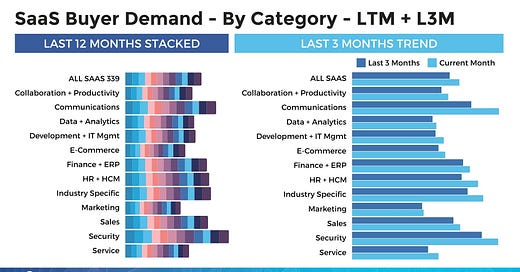

Zooming out to recap almost three years of data on our cumulative growth since January 2021 slide:

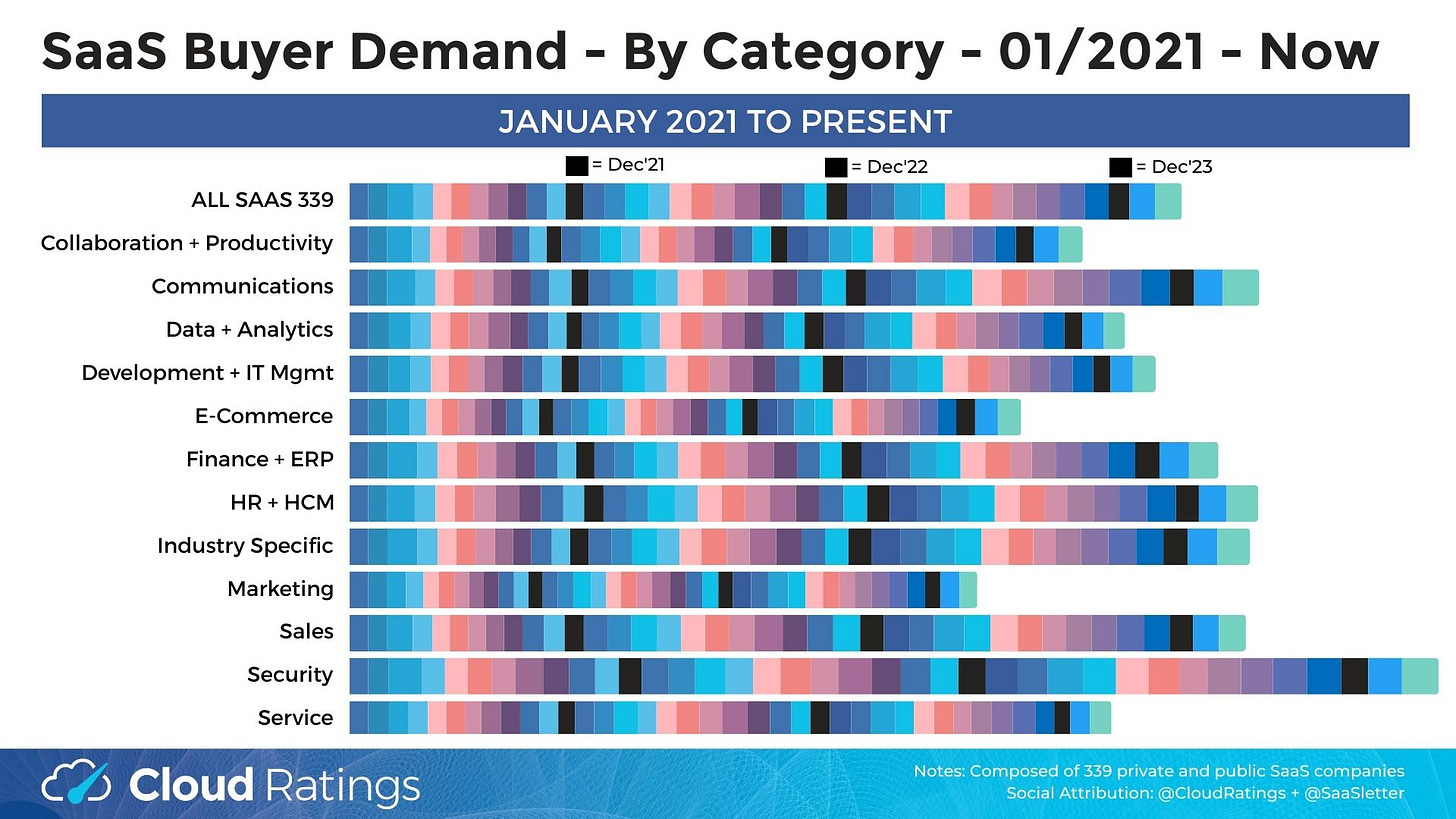

This slide presents growth for the last month and last three months, respectively:

Callouts from recent trends:

Communications: The notably strong February interest spike was driven by MessageBird’s pricing announcement. A 90% pricing cut serves as a reminder that not all search trends captured here are favorable:

Above Average Performers: Consistent with prior months, the strong performers were Communications, Finance + ERP, HR + HCM, Industry Specific / Vertical, and Security

Security: Strong performers within the Security category included Crowdstrike, Wiz, Cyberark, Cloudflare, Sailpoint, OneTrust, Forcepoint, and Auth0.

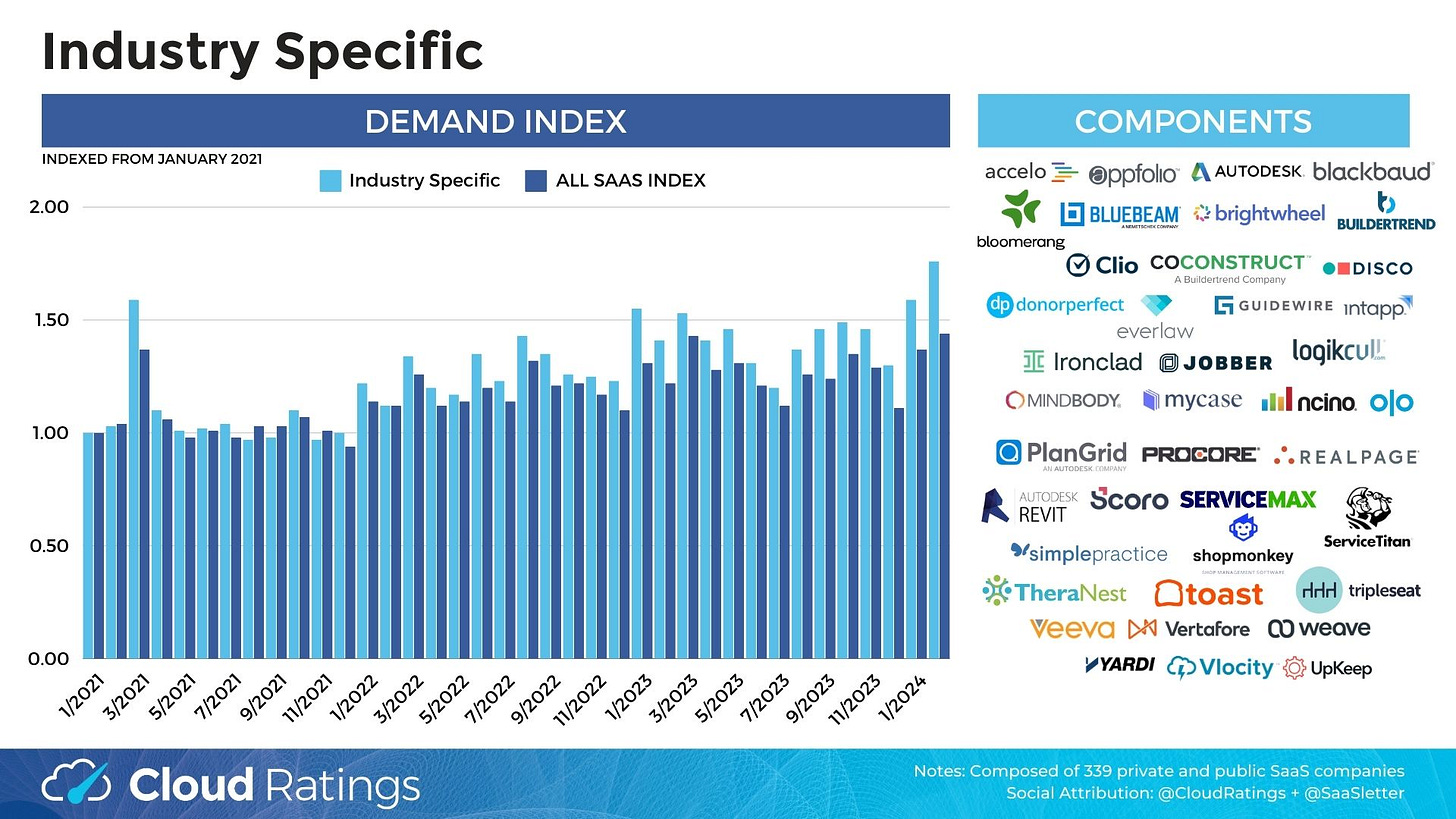

All of the category drill-downs - like this Industry Specific example - are available in this slide PDF:

Other Trends

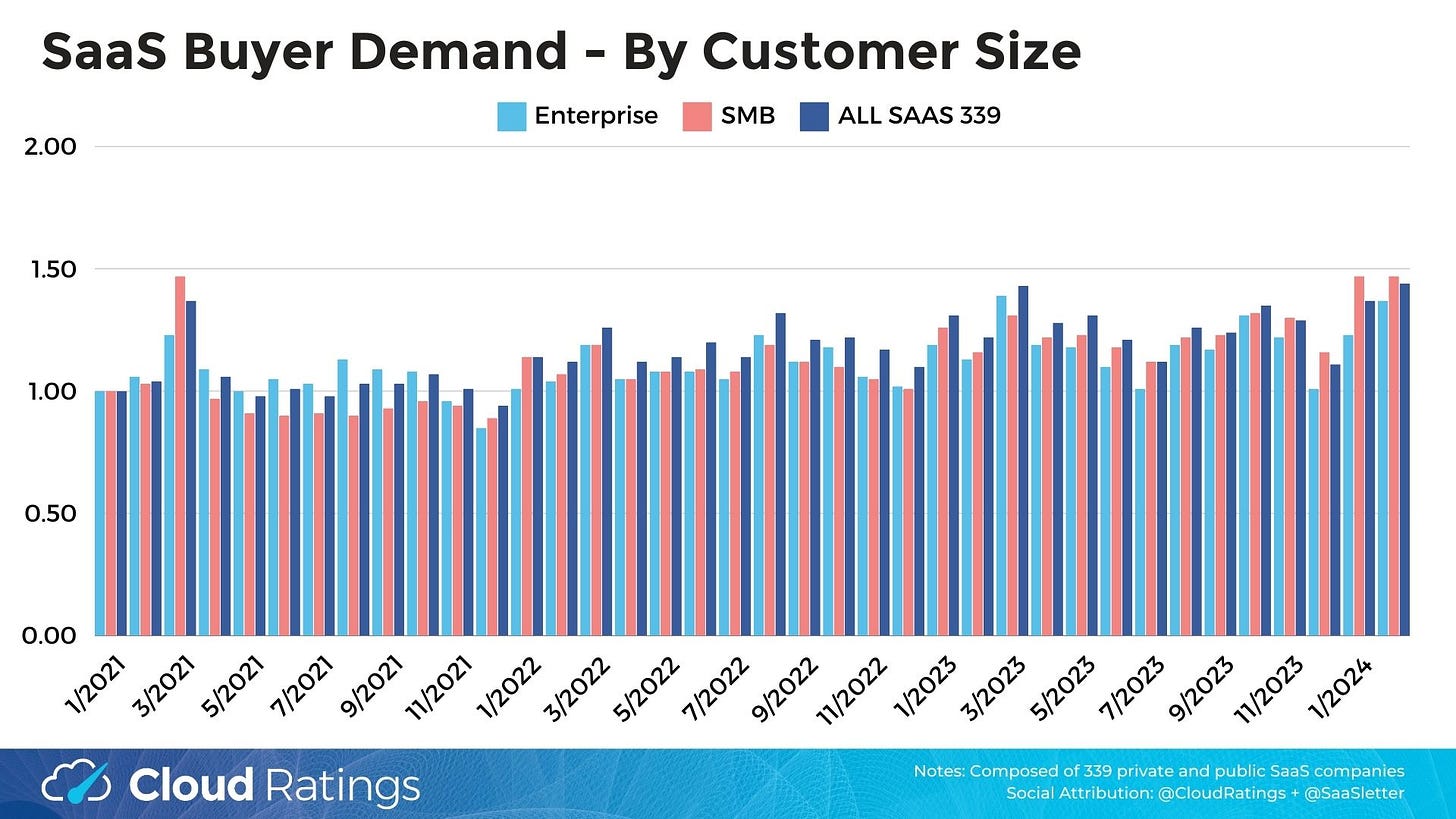

By customer mix, SMB has generally outperformed Enterprise recently:

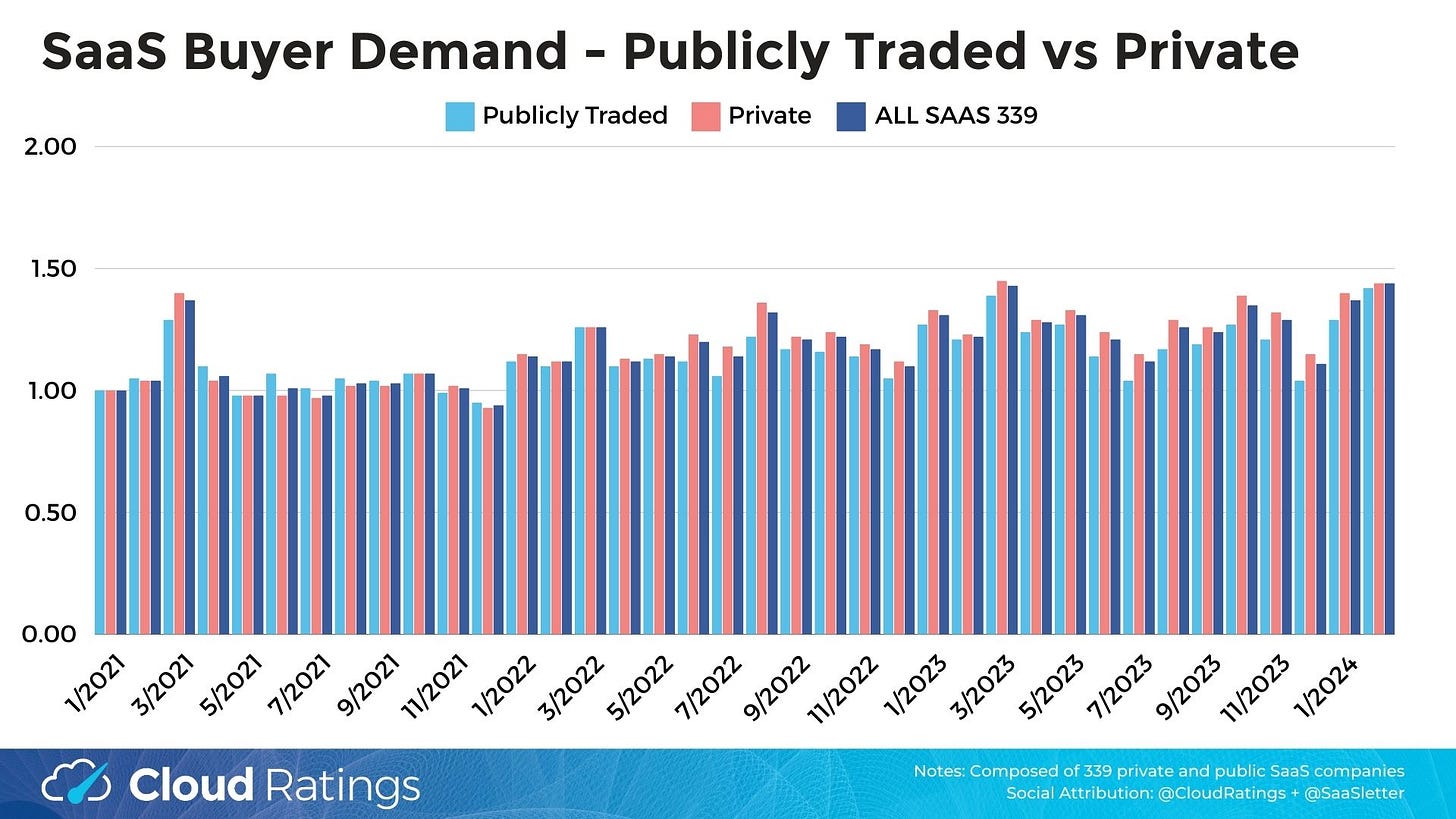

Private companies have been outperforming publicly traded SaaS of late:

February SaaS Employment Index

As a reminder, our SaaS Employment Index covers employment trends for 3,500+ US HQ’ed software companies. Slides for this month are available here:

The key points:

Strong hiring below 200 FTEs; 200+ = weak but improving

Engineering weakening - an AI CoPilot impact?

Marketing > Sales

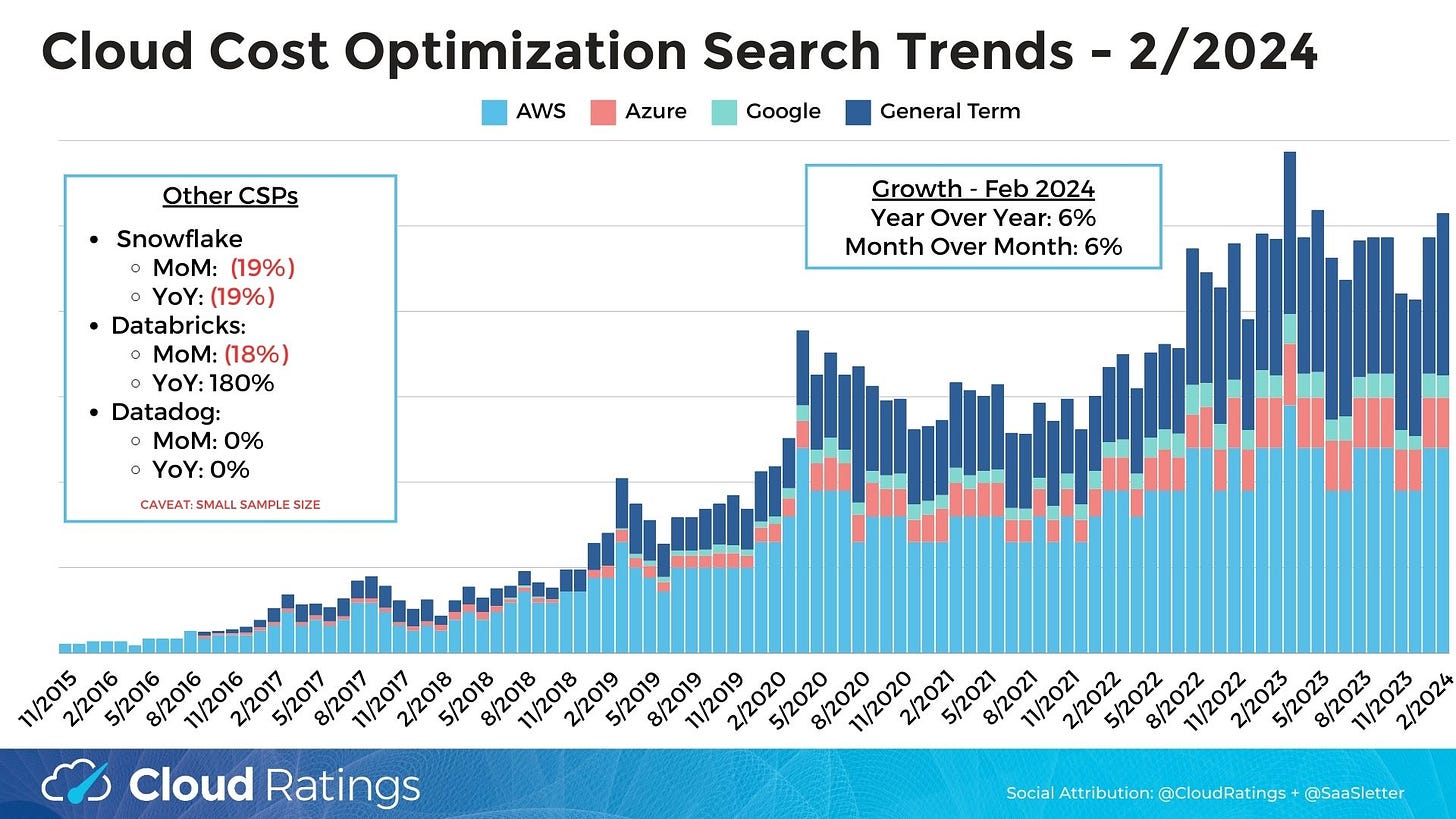

Cloud Cost Optimization Trend Update

The general trend toward cloud cost optimization abating (see recent Amazon, Microsoft, and Google earnings call commentary) reversed somewhat in February: cost containment searches were up +6% year over year and +6% month over month:

*To publish closest to month end, we are accessing the underlying API data “early” (relative to the typical SEO and PPC users that do not require such immediacy). Therefore data should be considered “provisional” (i.e. subject to revision by our data provider) and create volatility in the data presented in the 2 most recent months.

This report was first published on cloudratings.com.