SaaSletter - A January Upturn?

Plus Sapphire Ventures' Capital Markets Report + Cloud Cost Optimization Trends

RepVue and ChartMogul = A January Upturn?

Fresh and positive January 2024 data from RepVue and ChartMogul caught my attention:

RepVue: Increases across all segments, especially SMB (LINK)

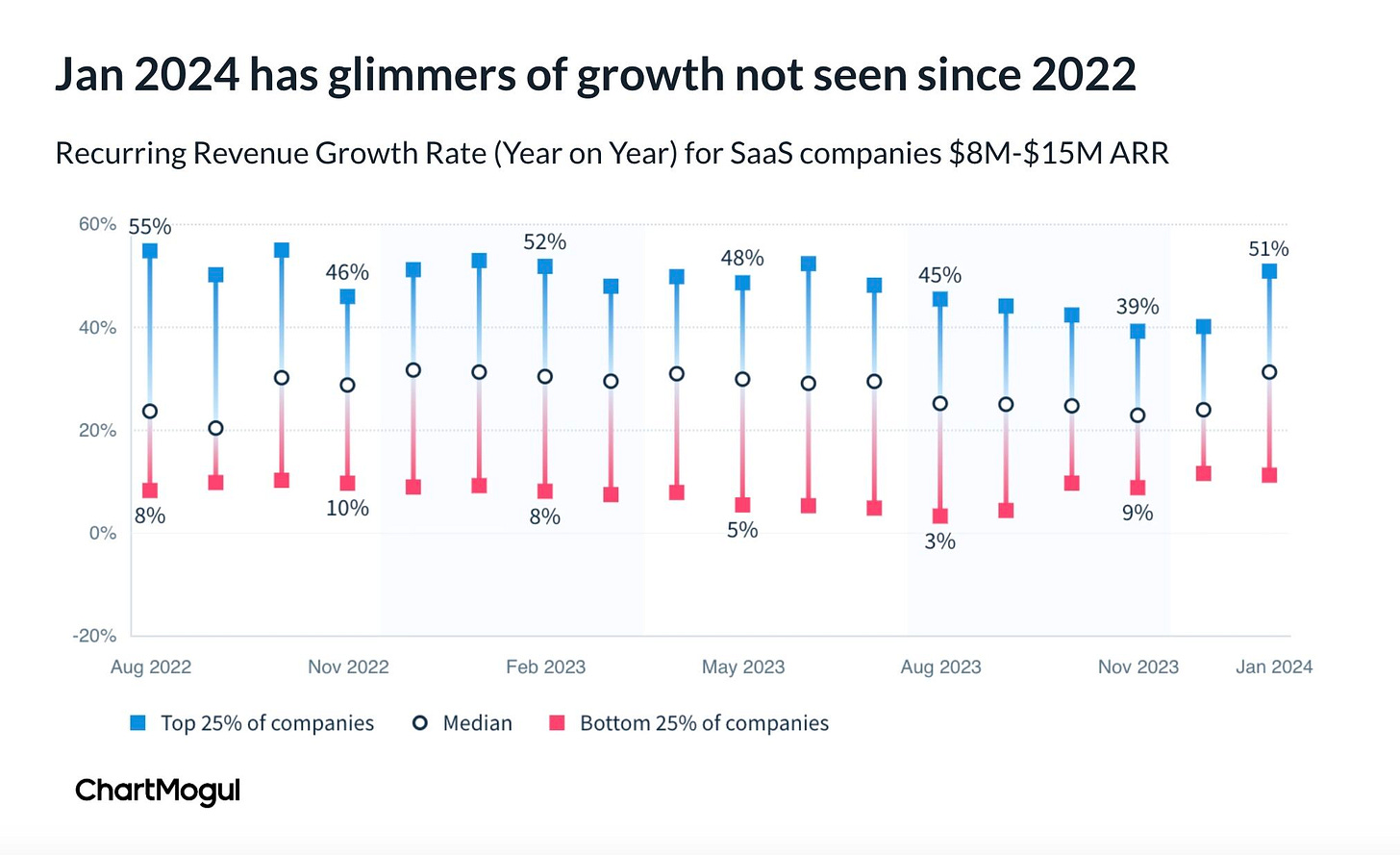

ChartMogul: While their $8m-$15m ARR data is easiest to see the acceleration (Top Quartile = Nov’23: 39% → Jan’24: 51%), their overall sample (n = 2,500 SaaS companies) also accelerated slightly in January.

Sapphire's "State of SaaS Capital Markets"

My quick excerpts from Sapphire Ventures (Steve Abbott + team)'s very comprehensive (71 slides) "State of the SaaS Capital Markets" report:

Great data on the mix of funding by category:

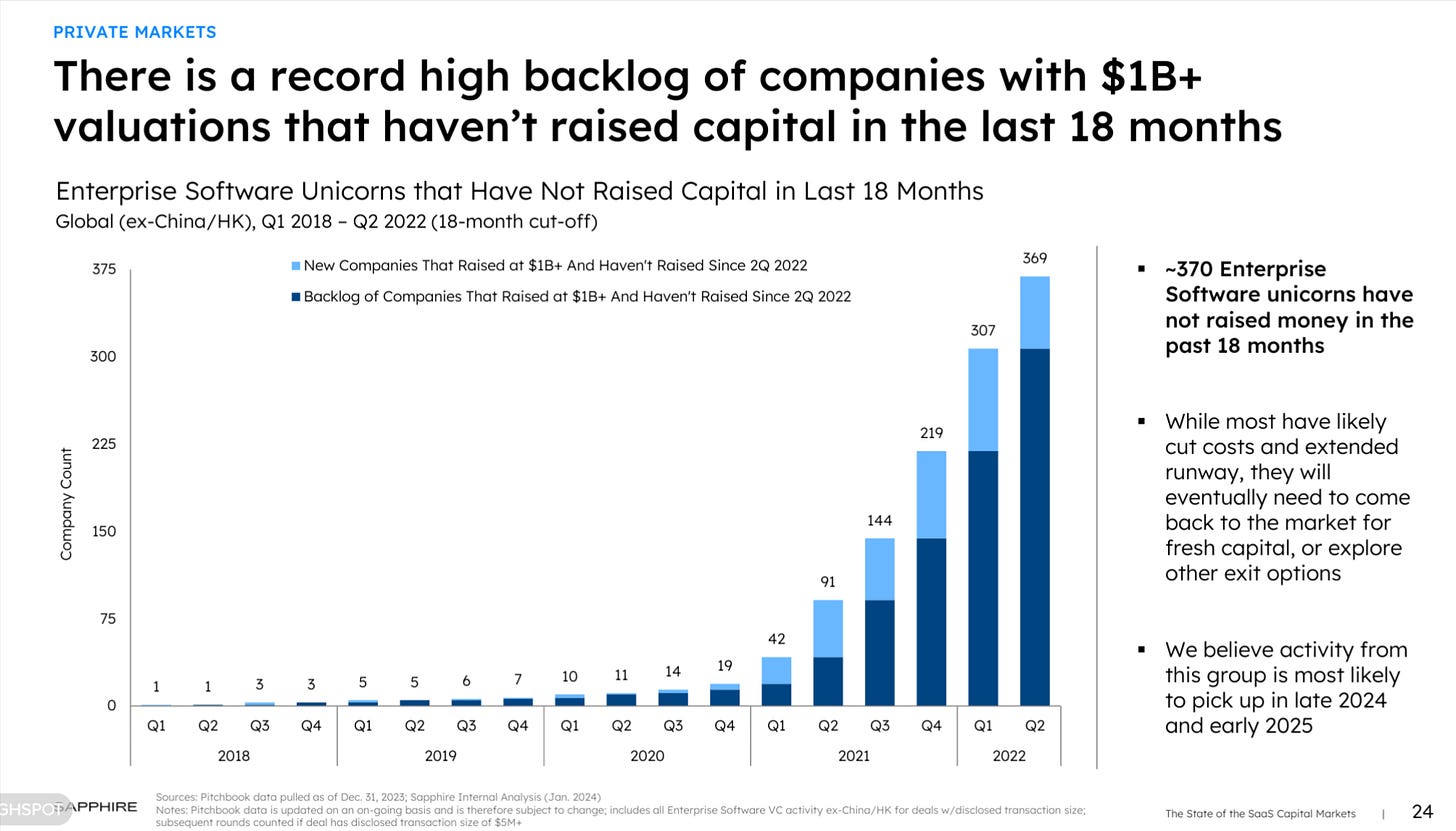

Key Slide: Sapphire’s "370 Unicorns have not raised at all in last 18 months" reminded me of Coatue’s East Meets West Conference (June 2023) slide → not enough dollars to sustain "unicorns"?

Good use of secondary market data by Sapphire:

Average secondary trading at 50%-60% discount

Large bid-ask spreads

Interest is concentrated in top ~200 companies…

while ~400 companies have ZERO secondary buyers

Great long-term chart: Public SaaS went from handily beating consensus estimates to just barely meeting estimates

A long-term chart on declining Sales + Marketing Efficiency - 2023 = GTM half as productive as 2014:

Great data on investment volume by firm - many firms now doing only 1 deal per year; late late-stage investing pace has slowed dramatically:

Curated Content

"RepVue Q4 2023 Cloud Sales Index" - my full excerpts are on LinkedIn, I wanted to call out:

Sales Cycle = No Longer An Excuse

Cloud Cost Optimization

Commentary from recent cloud earnings calls suggests cloud cost optimization is moderating:

Microsoft - Satya Nadella:

They will optimize the workloads and they'll start new workloads. So I think that, that's what we continue to see. But that period of massive, I'll call it, optimization only and no new workload start, that, I think, has ended at this point. So what you're seeing is much more of that continuous cycles by customers, both whether it comes to AI or whether it comes to the traditional workloads.

Google - Sundar Pichai:

And second, I think there are regional variations, but the cost optimizations in many parts are something we have mostly worked through.

Amazon - Andy Jassy:

I think that the lion's share of cost optimization has happened. It's not that there won't be any more or that we don't see it anymore, but it's just attenuated very significantly. And at the same time, what we've seen is that migrations, and this speaks to some of the backlog, migrations that were proceeding but maybe not at the pace that we saw before have started to pick up again. We've also seen that a number of the deals that typically signed more quickly were signing more slowly in more uncertain environments. A lot of those got done in the last quarter.

This hyperscaler commentary aligns with the cloud cost optimization search data we track:

New Cloud Ratings Product: True ROI

Our first True ROI report covers RELAYTO, a software suite that turns static files into interactive web-based content experiences.

True ROI Reports can help you quantify and provide 3rd party validation of your software product’s business value.

Our pricing and product overview slides are here: