SaaSletter - McKinsey on Cloud + AI ROI

Where does the ROI go?

McKinsey’s “In Search of Cloud Value: Can Generative AI Transform Cloud ROI?”

Hat tip to Madrona VC’s Aspiring for Intelligence for flagging McKinsey’s November 68-page report that I would have otherwise missed.

The report includes good tactical frameworks for CTOs, my notes are oriented toward the SaaSletter audience of investors and non-technical operators.

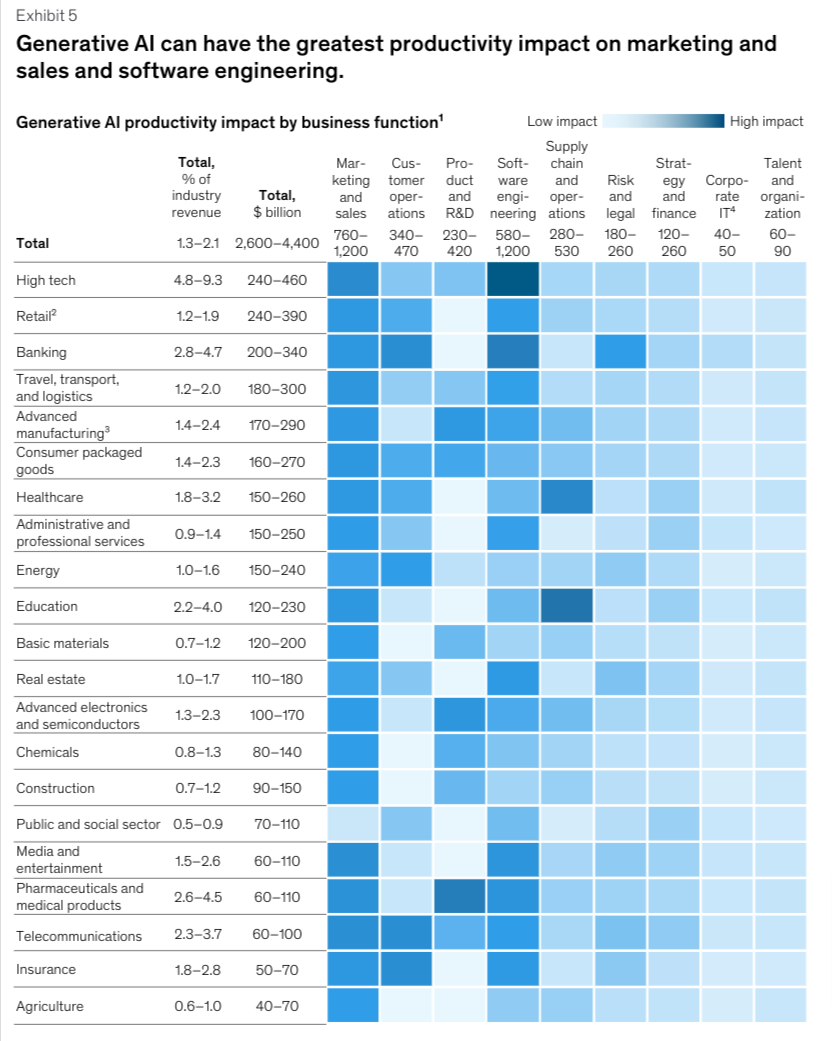

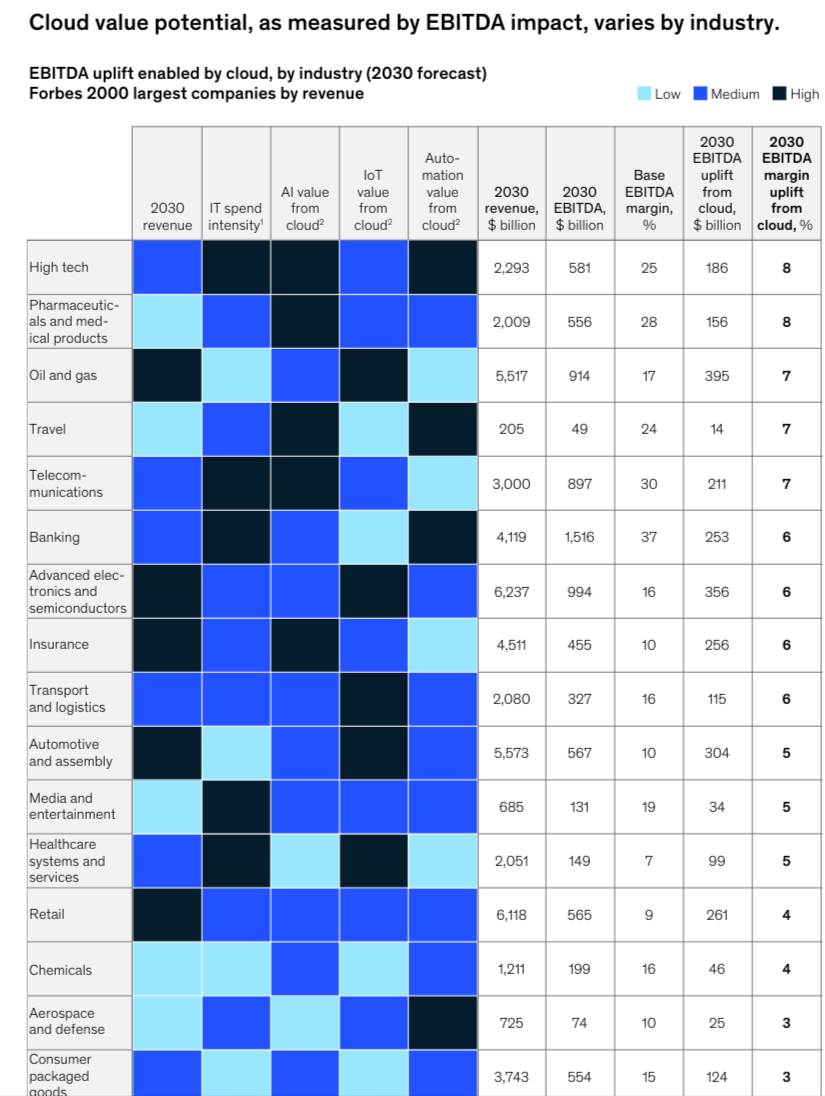

McKinsey’s estimates on the impact of Generative AI are especially relevant:

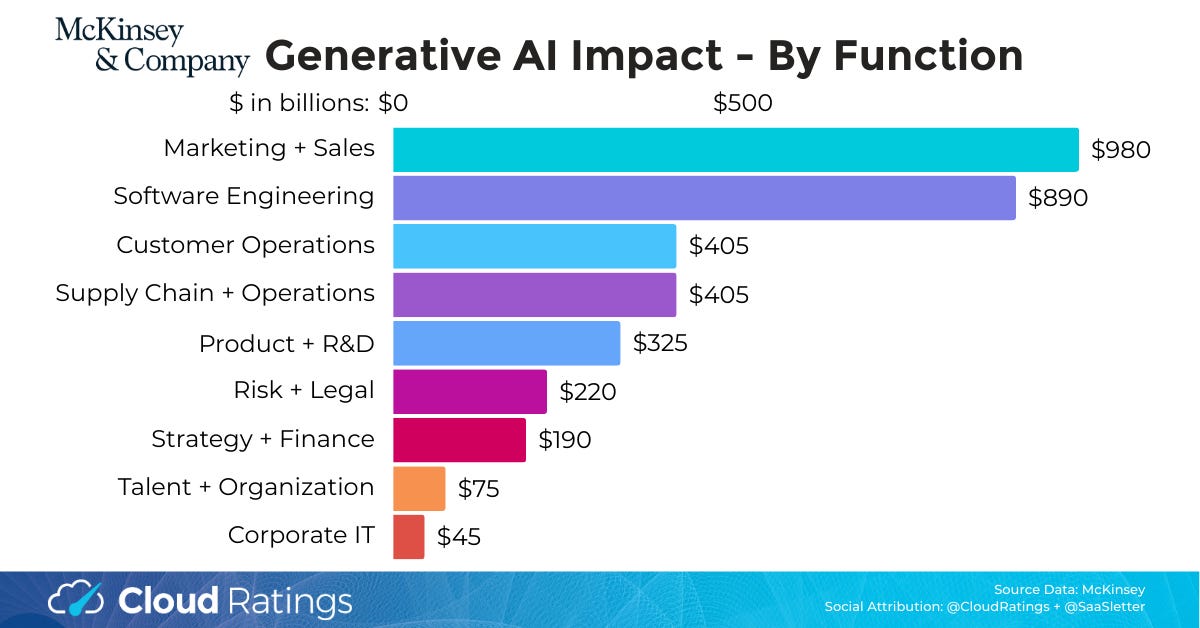

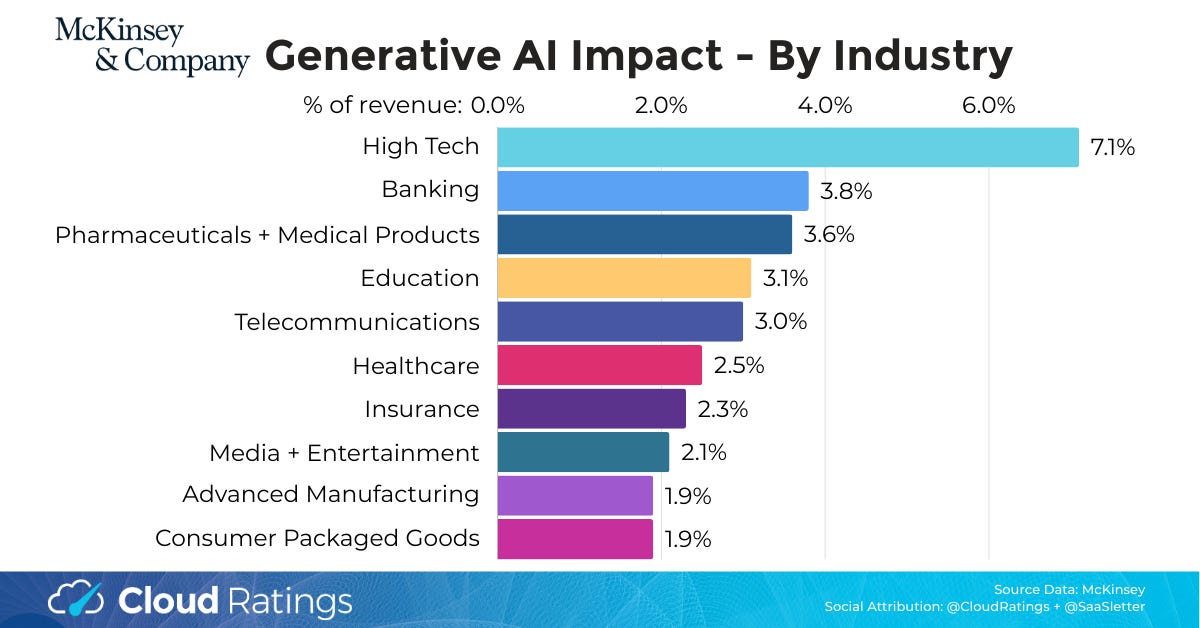

The outsized impact of Generative AI on the software industry is a bit understated in their table. So I re-cut the data into graphs using midpoints of McKinsey’s ranges:

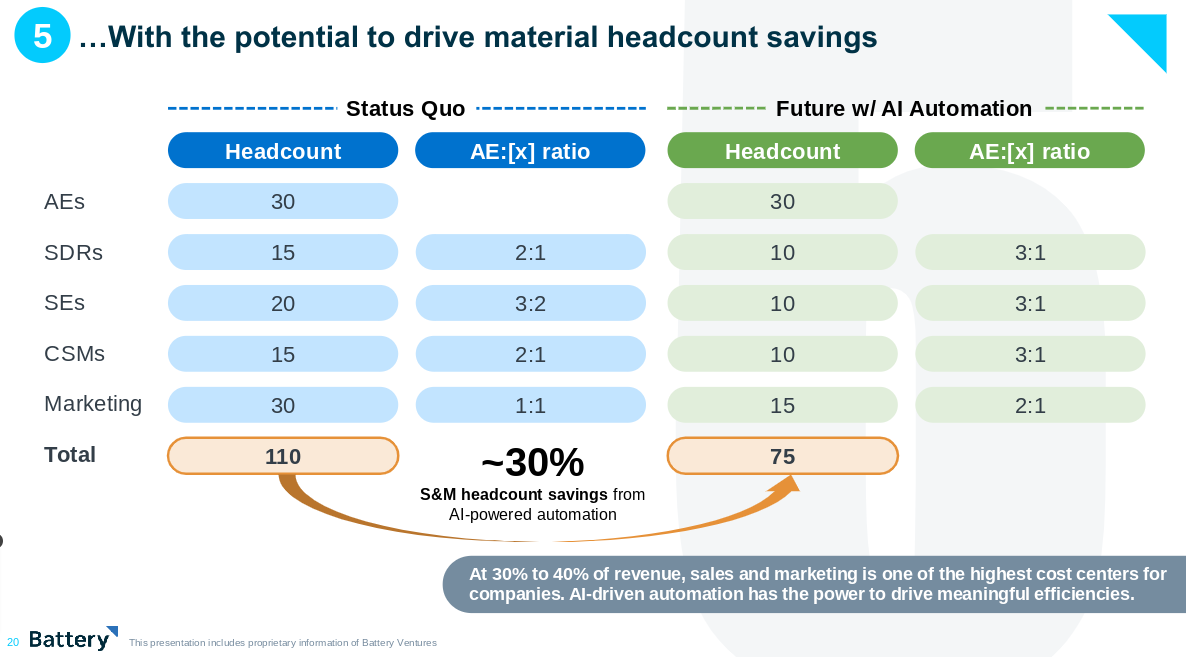

Given the software industry’s P&L composition (Sales + Marketing as the #1 cost, R&D at ~25% of revenue), the large impact of GenAI on GTM + Engineering flows through to an outsized increase in margins.

Related Earlier Post: Battery Ventures “State of The Open Cloud 2023”

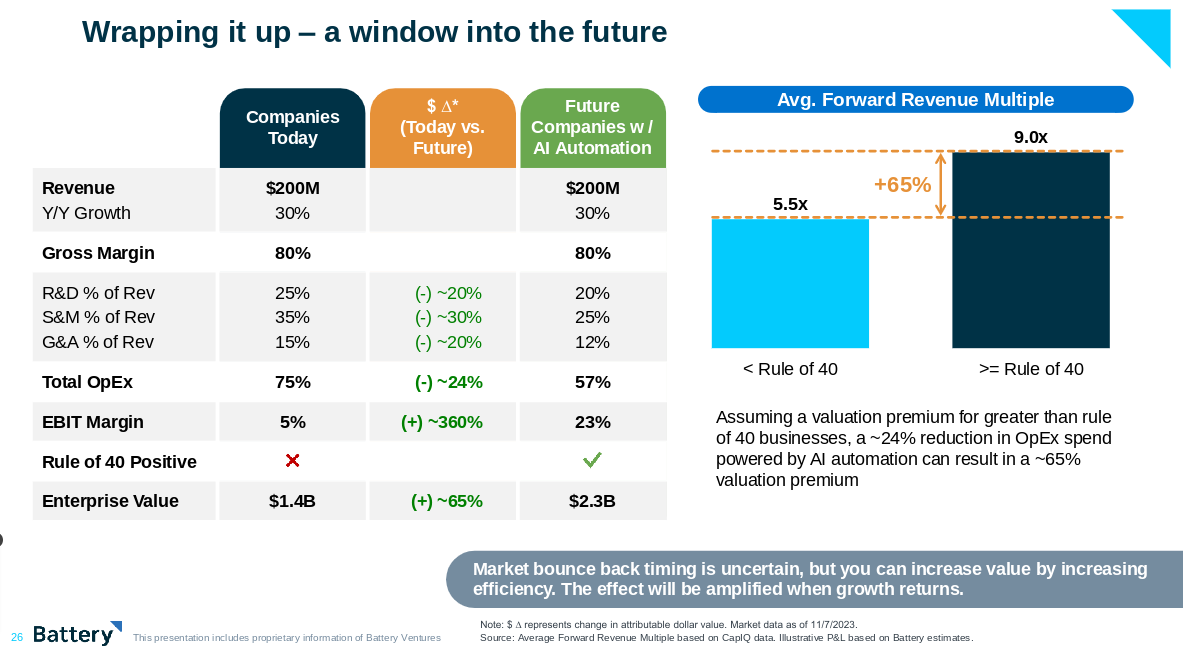

As a point of comparison, Battery Ventures estimated AI impacts at +1,800 bps for software vs McKinsey’s +710 bps for “High Tech” (caveat “High Tech” is broader than just software, so not 100% comparable to Battery estimates):

With more granular AI impact estimates by function, like this post-AI GTM org chart, in their report:

Where Does AI ROI Go?

Will these AI-led 7%-16% margin gains actually be realized on 2030 P&Ls?

AI Narratives Today = Step 1 Takes: Given the novelty + pace of change, most AI prognostications seem limited to Step 1 - “What is the impact of AI?” - without factoring in Step 2+ dynamic counter-responses to AI like:

content owners hard gating data from LLMs

more importantly for this newsletter, how will software categories re-adjust to material AI-led cost savings in GTM + Engineering?

Distribution of AI Gains: There are many ways for AI gains to be shared:

vendor re-investment: i.e. Engineering (add new features + product lines) or GTM (hire even more AEs + SDRs) → the P&L margin gains would be obscured (though likely offset by higher revenue $ + growth)

“shared” with investors + shareholders: if these margin gains are fully realized

“shared” with customers / competed away: this dynamic will be very category-specific. With key drivers around the number of competitors, moats, and especially - in my view - *vendor pricing models*:

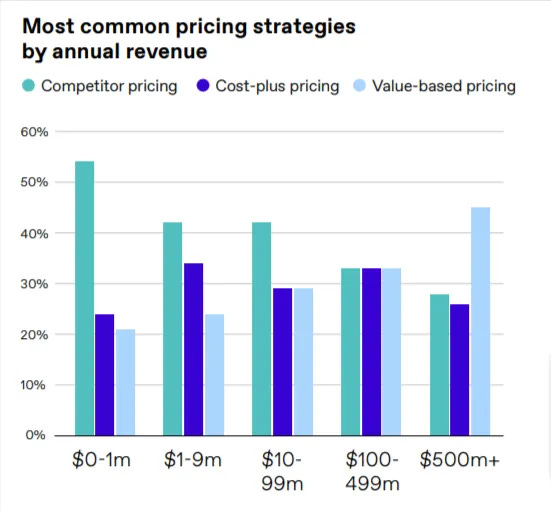

Using Paddle / Price Intelligently’s groupings + data from their 2023 SaaS pricing report, here are some *guesses* on whether vendors “give away” AI-led margin gains:

Value-Based Pricing (used by 33% of vendors… but ~45% for $500m ARR): Less likely - vendors price based on their customers’ ROI, not their own cost structure.

Cost-Plus Pricing (used by 30% of vendors): Gains are very likely to be given/competed away.

Competitor-Based Pricing (used by 38% of vendors): TBD, but somewhat likely to be given/competed away. Why? Competitor-based pricing is often prevalent in crowded + newer categories with many smaller vendors → this increases the odds for a “race to the bottom”

McKinsey On Cloud ROI = Concerning

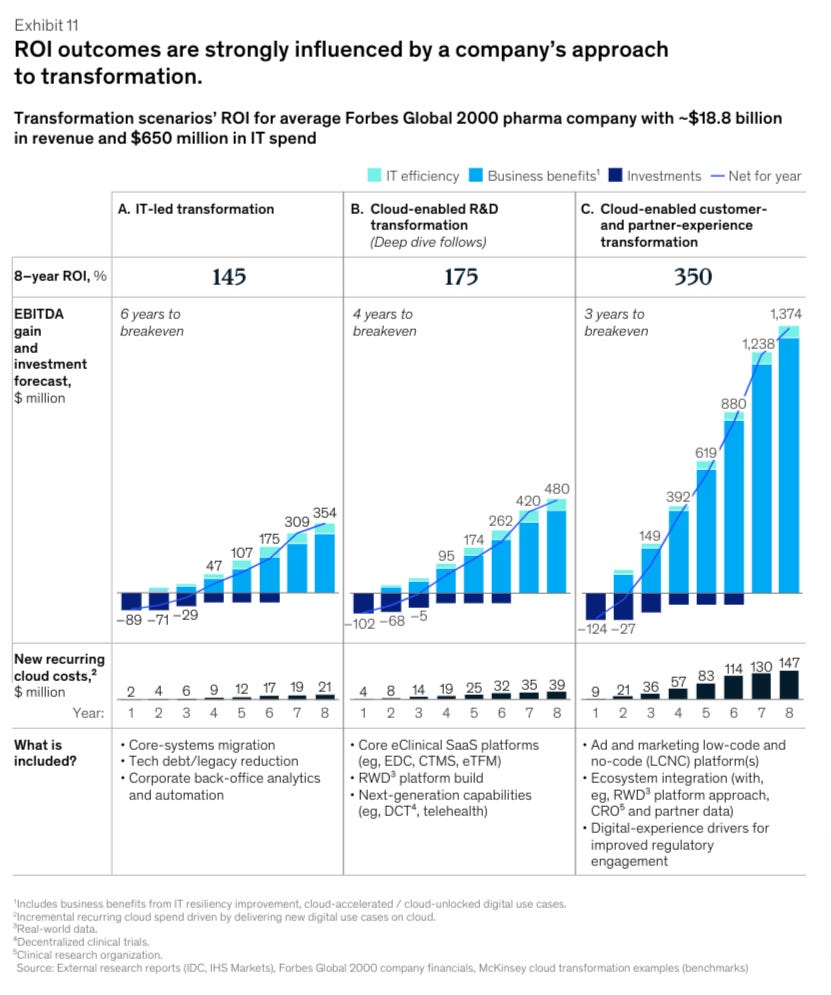

My highlights here are largely for investors - public + private - in cloud infrastructure

While *estimated* cloud returns are well below software application ROIs, they still work within broader corporate IRR hurdle rates and the absolute $ level of EBITDA gains generated ($480m in mid-case above; 2.6% margin lift).

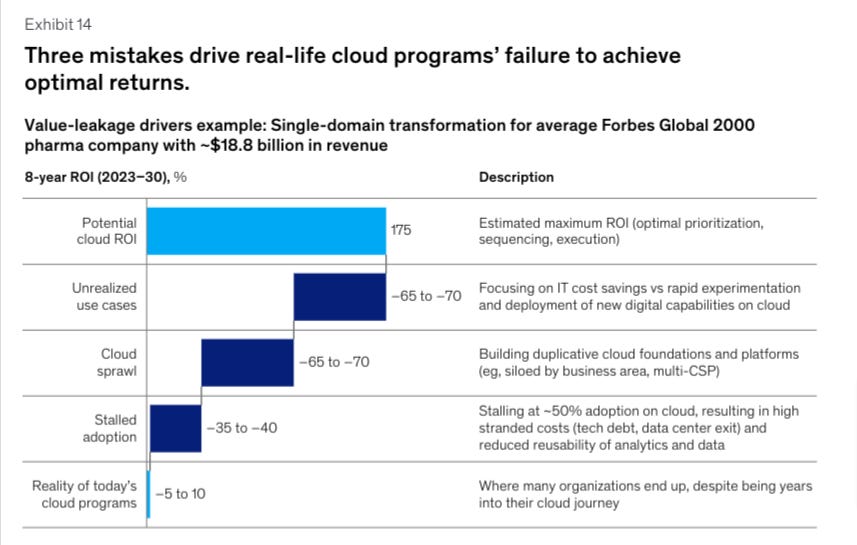

McKinsey’s calculations of actual cloud ROI are far more concerning for investors - are cloud growth estimates sustainable in light of these customer returns (reality = 96% below potential)?

New Cloud Ratings Product: True ROI

Just like the McKinsey report, Cloud Ratings can quantify ROI.

Our first True ROI report covers RELAYTO, a software suite that turns static files into interactive web-based content experiences.

Customer interview results were translated into a True ROI financial model with quantitative benefit and cost estimates, reflecting a 3-Year ROI of 4,748% (47x) and 2.0-month payback:

True ROI Reports can help you quantify and provide 3rd party validation of your software product’s business value.

If interested in learning a bit more by email, click here:

Curated Content

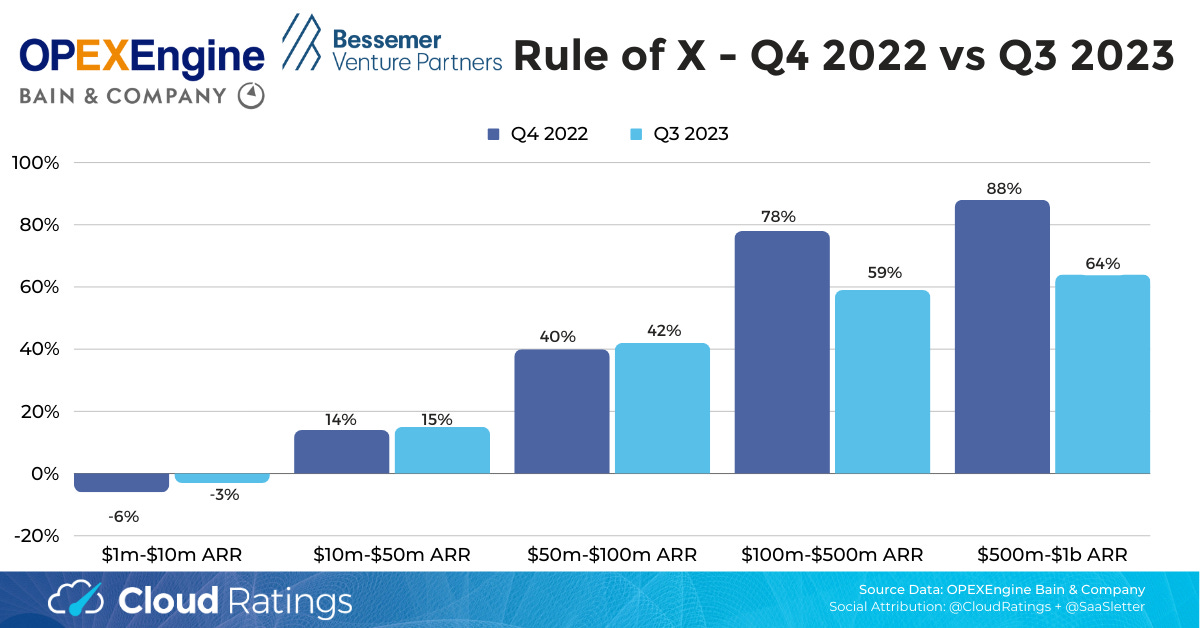

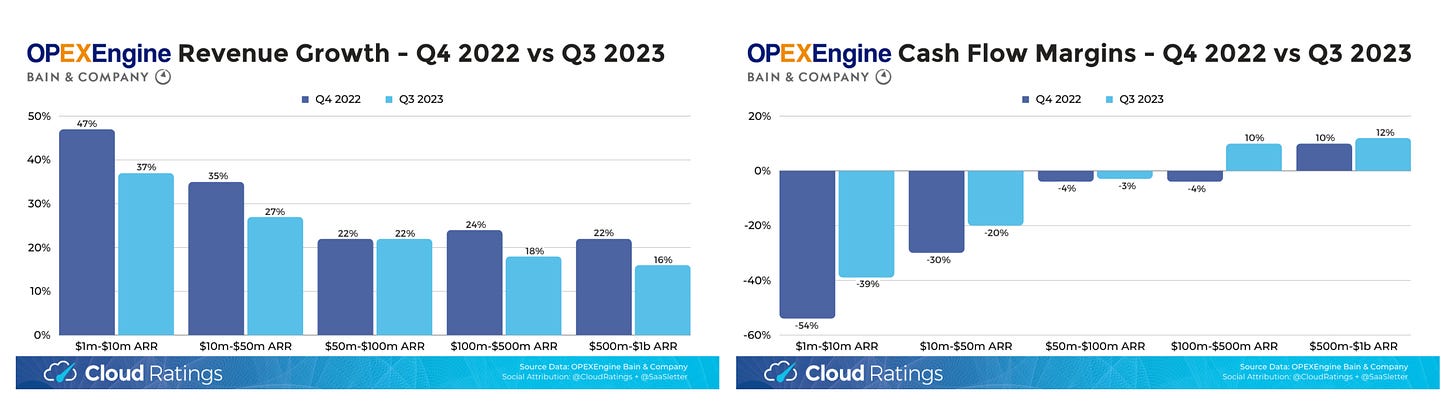

Testing The Rule of X From Bessemer: Bain’s OPEXEngine group released benchmark data through Q3 2023… which I used to visualize BVP’s Rule of X vs Rule of 40 - article here

“Competitor Research and Strategy” - an *insanely thorough* guide to competitive intelligence from Patrick Campbell (Founder of PriceIntelligently, sold to Paddle)

“The Top 7 Marketing Metrics for a QBR or Board Meeting” - by Dave Kellogg

Another SaaS Napkin - a look at Seed - Series E multiples using Carta’s latest data

December 2023 RepVue Quota Attainment: weak month, although forward looking roles (SDRs and Sales Engineers) remain healthy

Extra Content From McKinsey Report

At least for investors, a few of these were worth sharing… regardless of how well they fit into my own takes above:

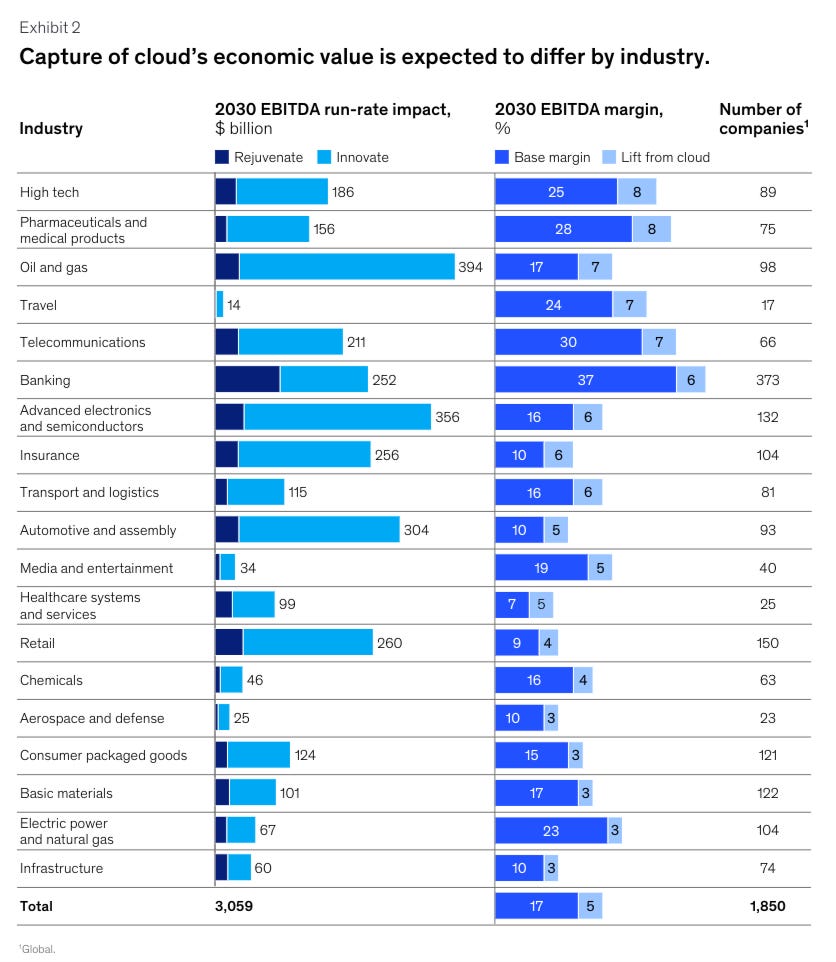

$3 Trillion of Cloud-Led EBITDA Growth by Industry:

Framing What $3t Means: the MSCI ACWI (top ~3,000 global companies) has an aggregate market cap of $64t. At an 8x multiple (to account for synergies like earnings quality here), McKinsey’s $3t of Cloud EBITDA (from their Global ~2000 proxy) should create $24t of enterprise value (or 38% of today’s market cap - while noting this is likely priced in).

GenAI Impact on Cloud ROI:

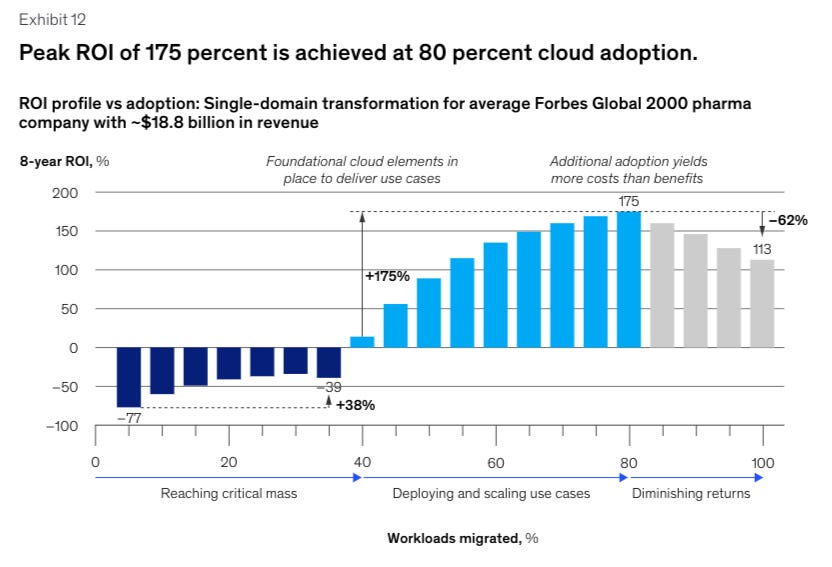

A useful model of workload adoption vs ROIs:

Another useful exhibit of how cloud returns evolve with migration + modernization: