SaaSletter - November 2023 SaaS Demand Index

Plus True ROI, Bessemer, Dave Kellogg, + the Key Banc + Sapphire 2023 Survey

New Cloud Ratings Product: True ROI

Cloud Ratings has gone multi-product: our category quadrants are now complemented by True ROI reports.

Our first True ROI report covers RELAYTO, a software suite that turns static files into interactive web-based content experiences.

Customer interview results were translated into a True ROI financial model with quantitative benefit and cost estimates, reflecting a 3-Year ROI of 4,748% (47x) and 2.0-month payback:

True ROI Reports can help you quantify and provide 3rd party validation of your software product’s business value.

If interested in learning more, consider booking a demo with me:

If a demo is too much, but you would like to learn a bit more by email, click here.

November Demand Index

We’re excited to update the SaaS Demand Index with data through November 2023. Yes, we remain excited every month, even if this is a template you see every month.

For our new readers: the Demand Index is derived from high-intent (aka “okta pricing”) Google Search volume data.

Reminder: this is a directional, free, and ever-evolving* analysis → always do your own due diligence.

Moreover, the data captured here is best characterized as top-of-funnel or dark funnel → factoring in sales cycle length, do NOT use this Demand Index as a predictor of near-term financial results and/or financial guidance.

Industry-Wide Data

High-intent search volumes were up +9% year-over-year. Relative to expected industry growth rates for SaaS, these trends are disappointing.

On a sequential basis versus October, the Demand Index declined -5%. Caveat: with the holidays, November and December are prone to seasonal declines (i.e. fewer days worked).

Trends By Product Category

Zooming out to recap almost three years of data on our cumulative growth since January 2021 slide:

This slide presents growth for the last month and last three months, respectively:

Above overall industry trends: Communications (AI influenced?), Finance + ERP, HR + HCM, Industry Specific (aka Vertical), and Security.

Yet again, Marketing and E-Commerce are underperforming.

All of the category drill-downs - like this Security example showing stabilization after a dip in Q2 2023 - are available in this slide PDF:

Curated Content

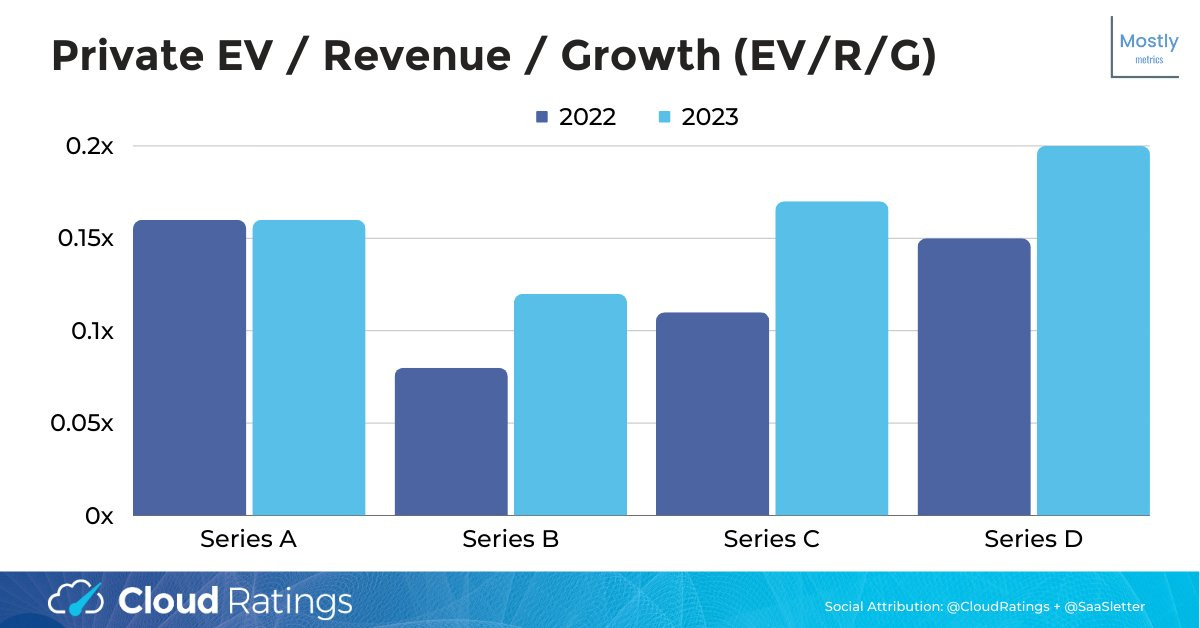

Rule of X From Bessemer: BVP debuted a modified approach to the Rule of 40 - the BVP X version places a higher weight on growth than the Ro40.

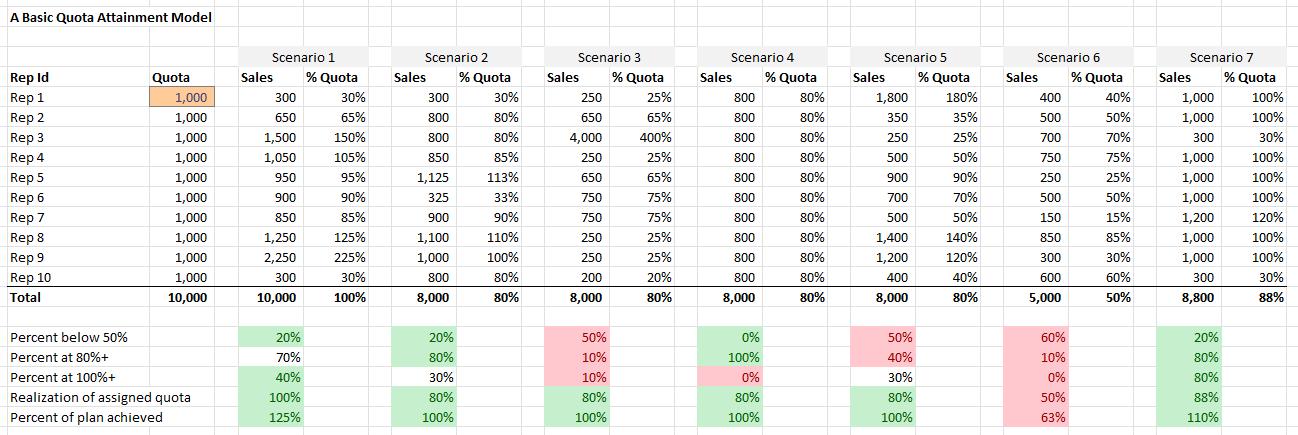

“Lessons from Playing with a Simple Quota Attainment Model” - yet another useful + interactive tool from Dave Kellogg

My “analysis on top of analysis” of CJ Gustafson’s Fundraising Napkin - my article that includes a Google Sheet

My excerpts from the 2023 SaaS Survey from Key Banc + Sapphire Ventures

For GTM operators: 6Sense published a real research-caliber look at the State of The Buyer Experience (link = my thread)

November 2023 Cloud Cost Optimization Trends: After relentless growth Q2 2022 through Q2 2023, searches are now declining (14% vs October) at Big 3 + general term level. Even higher growth CSPs (like Snowflake, Databricks, and Datadog) are showing decelerating cost containment searches.

*In an effort to publish closest to month end, we are accessing the underlying API data “early” (relative to the typical SEO and PPC users that do not require such immediacy). Therefore data should be considered “provisional” (i.e. subject to revision by our data provider) and create volatility in the data presented in the 2 most recent months. For this month, Zoom was excluded due to nonsensical data via the API; the historical data presented, however, is also pro forma to exclude Zoom.

This report was first published on cloudratings.com.