SaaSletter - October 2023 SaaS Demand Index

Plus SaaS GPT Lab - a beta ChatGPT for SaaS

SaaS GPT Lab v1.0

With OpenAI’s new features announced last week (Techcrunch recap of developer event + new capabilities here), we created a custom SaaS ChatGPT that prioritizes 100 experts:

A few notes:

Using requires ChatGPT Plus - $20 per month

Your searches are 100% private - we CANNOT see your questions

While originally planned, industry PDFs ultimately were not uploaded to GPT knowledge. Why? The 10-file limit in custom GPTs like this hurt answer quality since it over-indexed to the ten industry reports provided.

Since there are hundreds of Saas industry resources worth including, we will continue to look for a workaround.

Web search and data analysis features are enabled

Many Substacks are treated as expert sources by SaaS GPT Lab, including but not limited to: OnlyCFO Mostly metrics Hard Mode by Breaking SaaS Next Big Teng Clouded JudgementThe Bi-Weekly Bloom, by Bloom Equity Partners. The Software Analyst Newsletter Tidal Wave

More updates and context soon

We hope this community beta GPT adds value while encouraging more AI experimentation.

October Demand Index

We’re excited to update the SaaS Demand Index with data through October 2023. Yes, we are excited every month, even if this is a template.

For our new readers: the Demand Index is derived from high-intent (aka “okta pricing”) Google Search volume data.

Reminder: this is a directional, free, and ever-evolving* analysis → always do your own due diligence.

Moreover, the data captured here is best characterized as top-of-funnel or dark funnel → factoring in sales cycle length, do NOT use this Demand Index as a predictor of near-term financial results and/or financial guidance.

Industry-Wide Data

High-intent search volumes were up +2% year-over-year.

On a sequential basis versus September, the Demand Index declined -2%.

Trends By Product Category

Zooming out to recap almost three years of data on our cumulative growth since January 2021 slide:

Fits Consensus: Security remains #1. With MarTech last by a wide margin

A Bit Surprising:

Sales at #2 - despite headwinds like layoffs (see ZoomInfo recent earnings).

HR + HCM and Communications at #3 & #4 - each ahead of “trendy” categories like Data + Analytics or Development + IT Management

This slide presents growth for the last month and last three months, respectively:

Notably, Finance + ERP is the top performer over the last 12 months. It seems CFOs - like CJ Gustafson and OnlyCFO - have kept the budget open for their own SaaS tools… while cutting from other departments.

All of the category drill-downs - like this Security example - are available in this slide PDF:

Curated Content

2024 Whisper Numbers: With the annual planning season underway, Scale Venture Partners survey shows planned ~20% ARR acceleration in 2024.

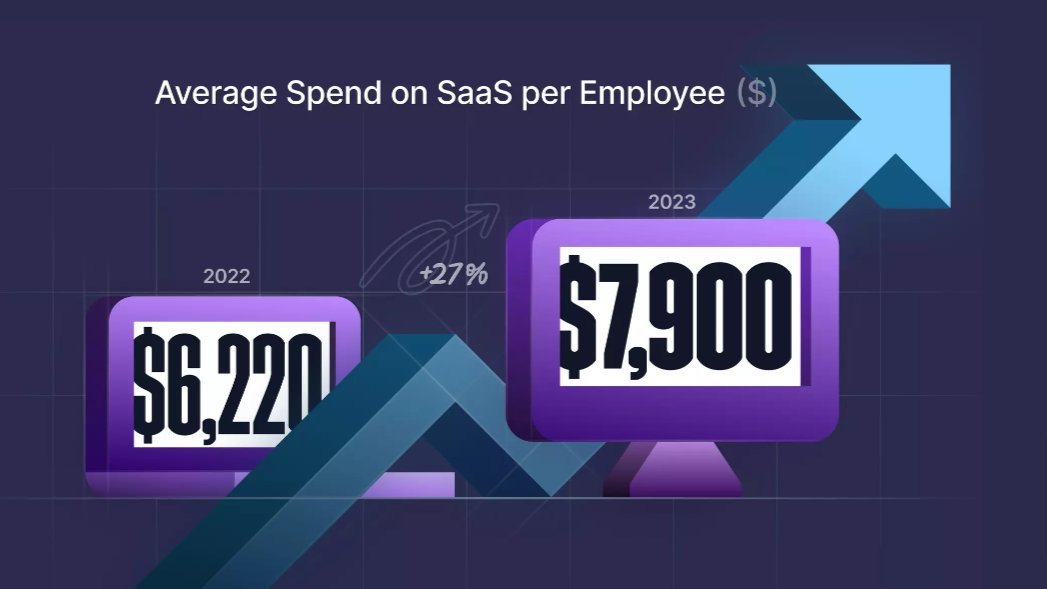

Software Price Inflation: Vertice’s latest report showed 8.7% average price inflation across SaaS. 2 exhibits below and my full excerpts here.

October 2023 Cloud Cost Optimization Trends: Plateauing at Big 3 + general term level. Even higher growth CSPs (like Snowflake, Databricks, and Datadog) are showing decelerating cost containment searches. All of this is consistent with recent public cloud earnings call commentary:

*In an effort to publish closest to month end, we are accessing the underlying API data “early” (relative to the typical SEO and PPC users that do not require such immediacy). Therefore data should be considered “provisional” (i.e. subject to revision by our data provider) and create volatility in the data presented in the 2 most recent months. For this month, Zoom was excluded due to nonsensical data via the API; the historical data presented, however, is also pro forma to exclude Zoom.

This report was first published on cloudratings.com.