SaaSletter - Bigfoot Capital Provider Survey

Plus a Gartner indicator and reports from Capchase and OpenView

Bigfoot Capital: Survey + Podcast

Brian Parks + Bigfoot Capital (a non-venture debt provider focused on SaaS companies with roughly $2m-$15m ARR) just released their 2023 SaaS Capital Provider Survey

The highlights:

61 investment firms (67% equity, 33% debt)

36 slides quantifying sentiment, deployment, and portfolio bridge capital needs

Plus qualitative quotes on the state of the market and their strategy shifts

My excerpts of the report are here.

Brian also joined our new “Cloud Returns” investing-oriented podcast series:

Gartner Digital Markets Indicator

I am watching Gartner’s Digital Markets segment since it captures both buyer interest (i.e. traffic on sites like Capterra) and software vendor spend (i.e. their cost-per-click bids + budgets on Capterra).

An important caveat before extrapolating to all of SaaS - my look into SpyFu data suggests a good portion of this YTD decline is related to an SEO issue for Capterra.com.

Curated Links

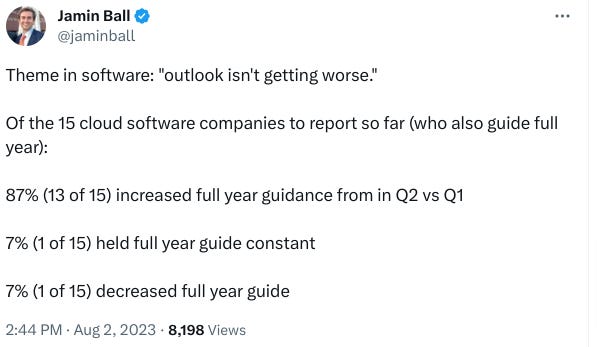

In the middle of a busy earnings season, a helpful aggregation from Jamin Ball:

Re: earnings, as we “build in public” with our SaaS Demand Index, we regularly try to check whether it has any signal. In *this* instance with ZoomInfo’s earnings, Apollo’s search share gains appear notable:

An instant classic from Dave Kellogg on the obvious but overlooked *real* role of a CEO - “The CEO Job Description: In Reductionist Form”

There were some signs of stability/defensibility for early-stage SaaS spending in AngelList / Brex’s latest report.

Capchase released their benchmark report (email required) - n=900 SaaS at $1m-$15m ARR → the *median* metrics (Rule of 40’s in the low single digits, LTV/CAC’s 1.8x-2.2x, monthly logo churn around 2.0%) are reminders of how tough SaaS is sub-$15m ARR

OpenView’s 2023 Product Benchmark Report highlighted the dramatic slowdown amongst PLG companies:

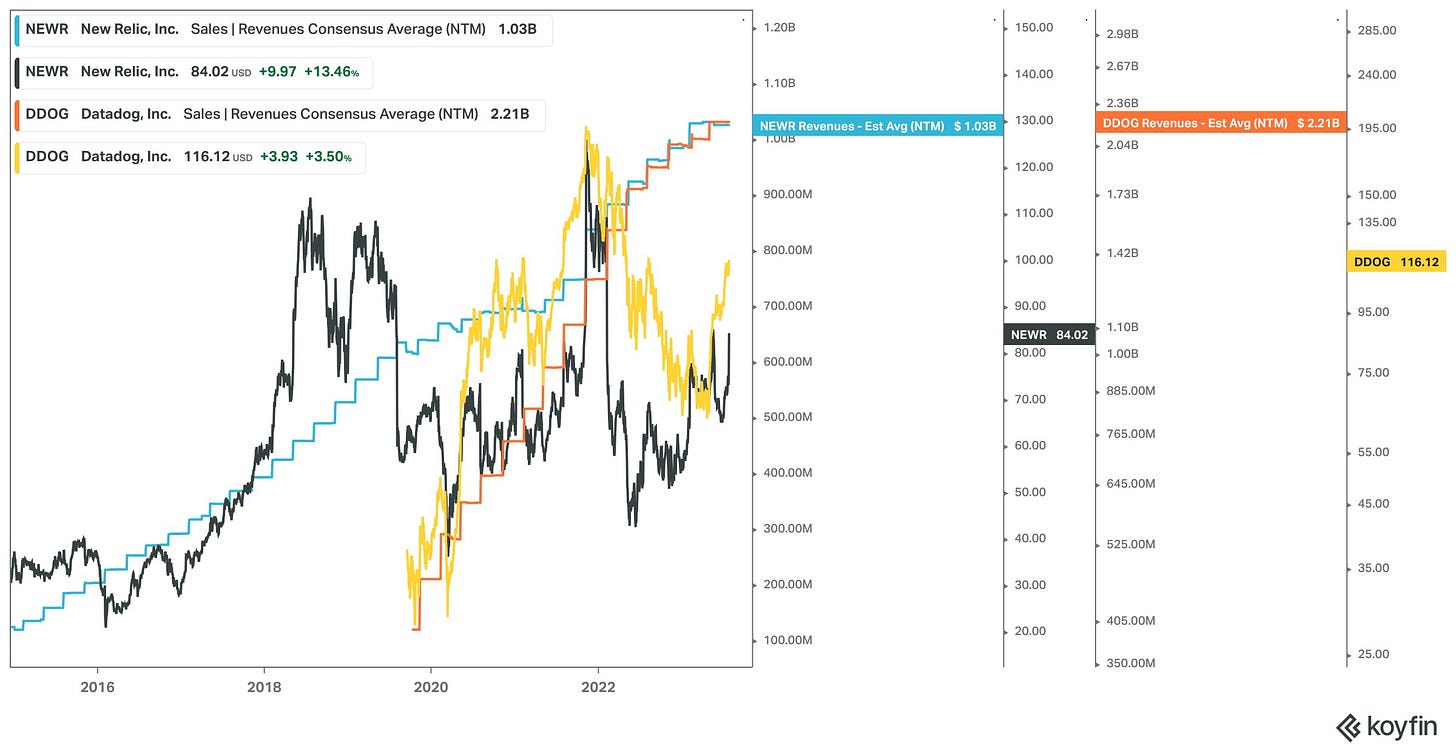

New Relic Take Private: In addition to my usual “EV / Revenue / Growth” multiple tracking for any announced SaaS M&A (NEWR: 0.39x EV/R/G vs post-2017 PE enterprise average of ~0.48x - more here), I tried to capture New Relic’s time on the public markets in one chart - the rise of Datadog:

Cloud Ratings Content

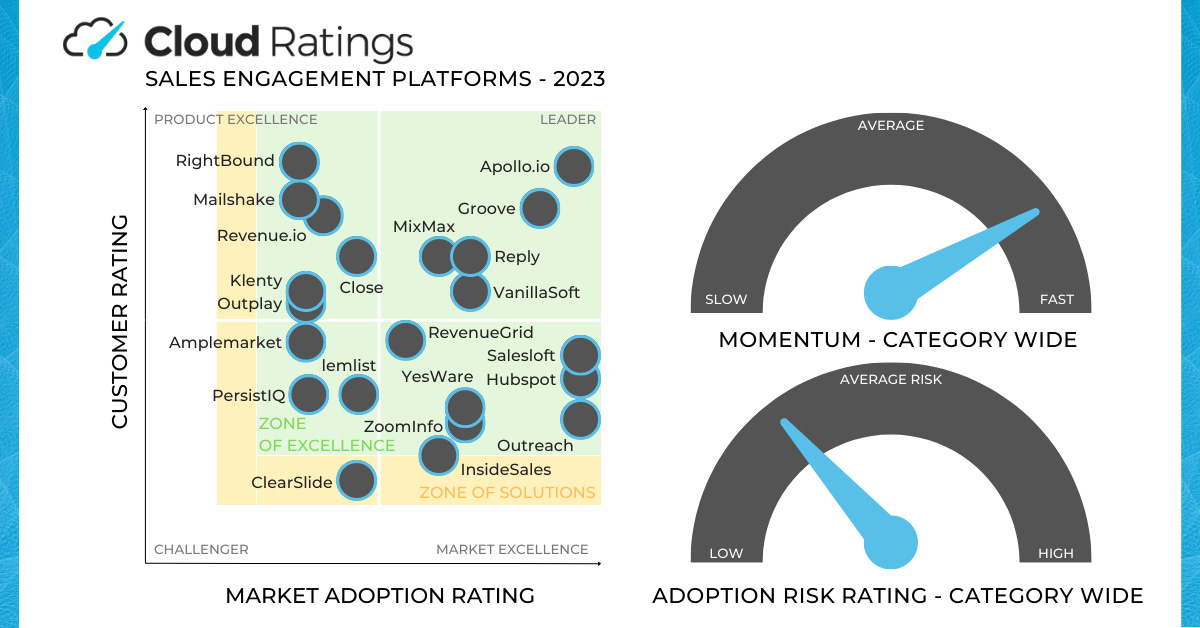

We recently initiated coverage of Sales Engagement Platforms.