SaaSletter - Cost Discipline Post SVB

With fresh spending data from Brex through *March 2023*

This post was written in collaboration with Brex, including access to their anonymized customer spending data, and will also be published on Brex Journal.

When I started writing this post in early March, I had concerns that phrases like “restructuring” or “draining liquidity” would be too alarmist.

The subsequent failure of Silicon Valley Bank marks a change in both tone and financial realities for start-ups and scale-ups.

The climate has moved from 40x ARR term sheets to rolling 4-week daily cash spreadsheets.

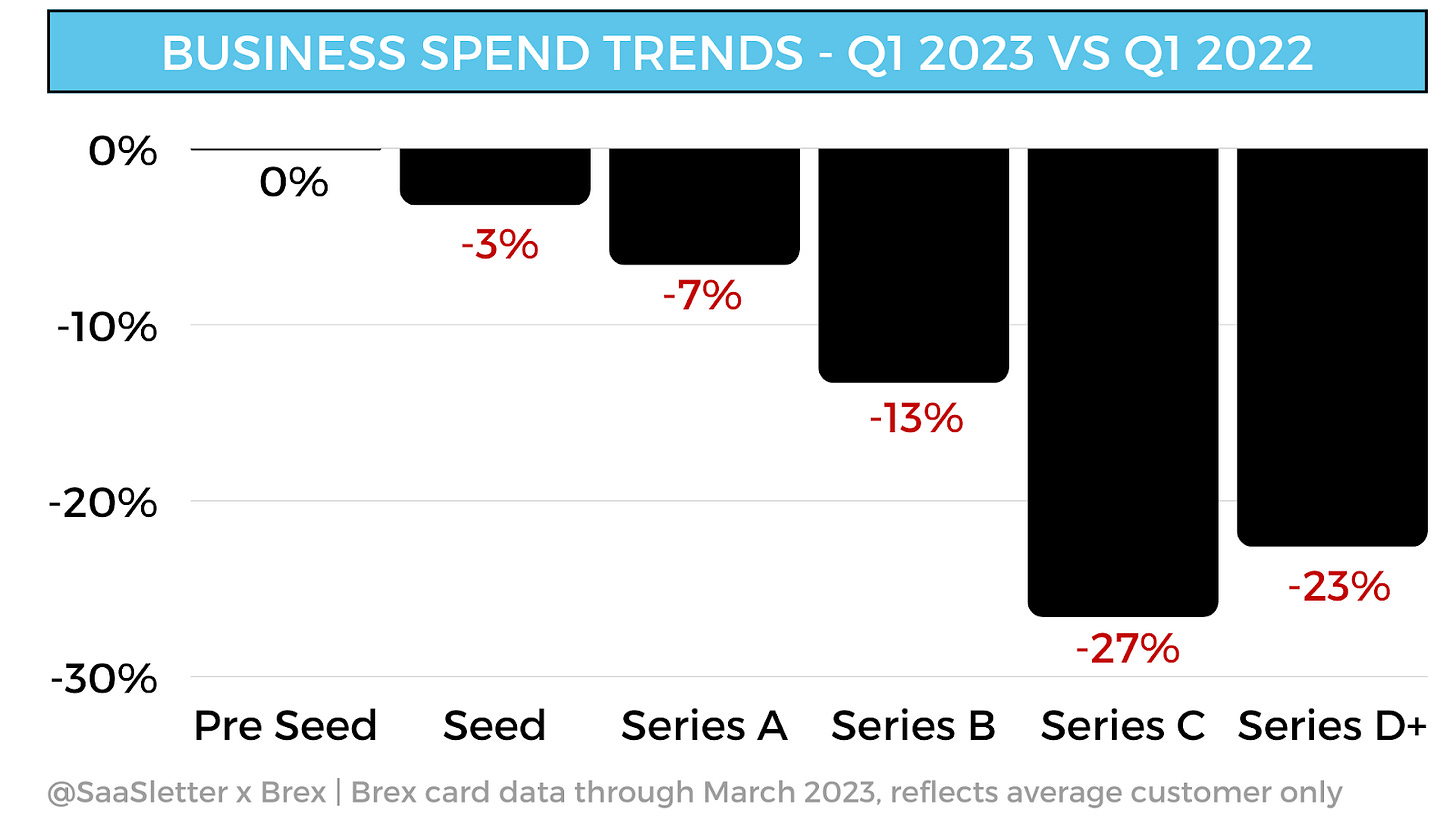

Brex customer card spend data has shown material declines in average spend per customer on a Q1 2023 versus Q1 2022 basis:

Series B: down 13%

Series C: down 27%

Series D+: down 23%

Analyzed using anonymized Brex internal customer data. They total the amount of spend across a spending category and/or funding round and divide by the number of currently active tenured Brex card customers to obtain the monthly average.

Why does cost discipline matter?

If you are a Series B-C-D executive, you are “playing for” a big outcome, like an IPO, strategic sale, or raising a later-stage growth round at a premium valuation.

I asked a senior technology private markets investor for their input on how they are evaluating executives in the post-Silicon Valley Bank environment:

Management teams that showed greater cost discipline will be viewed more favorably than those that didn't.

Given the incentive structure of both private markets - Growth Equity and VC - and public markets, growth at all costs in a low-cost capital environment is an understandable approach. Now that the cost of capital has risen, and is expected to stay elevated for a sustained period, management teams need to understand their spend allocation.

For Sales and Marketing, did they understand the J-Curve for a new hire to get to breakeven and evaluate the IRR of that hire? I would hope that management teams can walk me through their calculus for making that decision.

I view business decisions as stop signs (look at other cars/peers before moving forward) or red lights (wait for a signal to inform your decision). This was a red light scenario, you needed to look for the signal, not just at your peers.

In addition to this enhanced scrutiny, there are zero guarantees of raising future capital:

“The majority of folks funded in peak won't be fundable again by outside investors

The answer is super simple: the cash has to last forever.

Many founders have ended up needing the cash to last forever - and done OK.” - Jason Lemkin, SaaStr

Both quotes show capital allocation is critical whether you are one of the lucky few to raise a round or are forced to extend your runway.

While headcount (payroll) represents the majority of the SaaS cost structure (roughly 70% per OnlyCFO), setting the right go-forward org chart is far more nuanced and case-specific discussion than the other P&L areas this note covers:

PRINCIPLES: Spend Visibility -> Spend Control

My comments here are informed by my experience working on a successful but intense turnaround of a cash-flow-negative, $400M revenue engineering and construction company while at Ares Management.

Here are a few of my learnings from then:

A. Having the right financial instrumentation matters.

We were hobbled by an unsupported (thanks to unpaid maintenance fees) Oracle ERP that contributed to very slow, often inaccurate reports. Fixing - or more accurately, triaging - basic instrumentation to get true visibility to make decisions slowed our progress by around 9 months.

B. Drive controls downward.

A breakthrough occurred by adding regional controller positions.

Why? As a project-based construction business, the business was truly managed at the branch and project levels. However, all of the financial controls and reporting were done at a distant headquarters. Regional managers had limited visibility into their P&Ls and, more significantly, working capital positions that drove cash.

The new regional controllers were able to proactively spot project cost overruns, lead branch-level expense reduction initiatives, and gave regional managers visibility to truly own their operating results.

C. Prioritize by size and speed.

In a turnaround, finance and executive team bandwidth is limited and expensive. With the “liquidity clock” literally ticking, you can only spend time on the highest absolute dollar and fastest payback opportunities.

While this principle is obvious, the temptation to “get things done” - even if low impact - is strong, especially when compared to making painful but higher impact decisions.

Now, how do all of my old turnaround learnings map to 2023?

Instrumentation: Modern “Office of the CFO” software tools - like Brex - are radically better today. For a scale-up reading this, robust live dashboards and controls should be table stakes.

As technology improves, so do expectations of execution. Especially so for the finance function, where investors over-index on financial reporting as a proxy for management quality.

Dave Kellogg’s “Good CEO Habits” sets the standard:

“I am surprised by how many startup CEOs leave the board hanging at the end of the quarter. As a CEO my rule of thumb was that if a board member ever asked me about the quarter then I’d failed in being sufficiently proactive in communications. In tight quarters I’d send a revised forecast about a week before the end of the quarter — hoping to pre-empt a lot of “how’s it going” pings.

And every quarter I would send an update within 24 hours of the quarter-end.

Why should you do this?

It’s a good habit. Nobody wants to wait 3 weeks until the post-quarter board meeting to know what happened.

It shows discipline. I think boards like disciplined CEOs (and CFOs) who run companies where the trains run on time.

Driving Controls Downward: For a technology scale-up reading this, your operating expense profile will be radically different than “my” engineering and construction company. Relatedly, how you push spending control downward will differ.

Travel is the most obvious “bottoms up” spend control: invoking more stringent travel policies, like flight price caps and hotel classes, that are implemented at the employee level at booking. By the way, Brex has a newly launched Brex Travel product that does this.

Prioritization Principles: While any of these spend changes are case-specific, reducing work from home (WFH) stipends - Brex allows you to manage WFH spend too - is a good litmus test. The payback is rapid. But are the absolute dollars material here? For a 400-employee org, reducing the monthly WFH stipend by $20/month only adds up to $96,000. Are you avoiding harder decisions - like a price increase or exiting Europe - that actually move the needle?

Spend Visibility -> Spend Control Pros:

Mix of fast payback and…

Large absolute dollar opportunities (T&E can represent 8%-12% of operating expenses per Aberdeen Group)

Helps change the cultural tone

“Continuous finance” tools - like Brex - accelerate reporting with fewer budget surprises

Cons:

Certain cuts - like WFH stipends or Learning & Development budgets - likely to have a negative morale impact

Trends in expense discipline

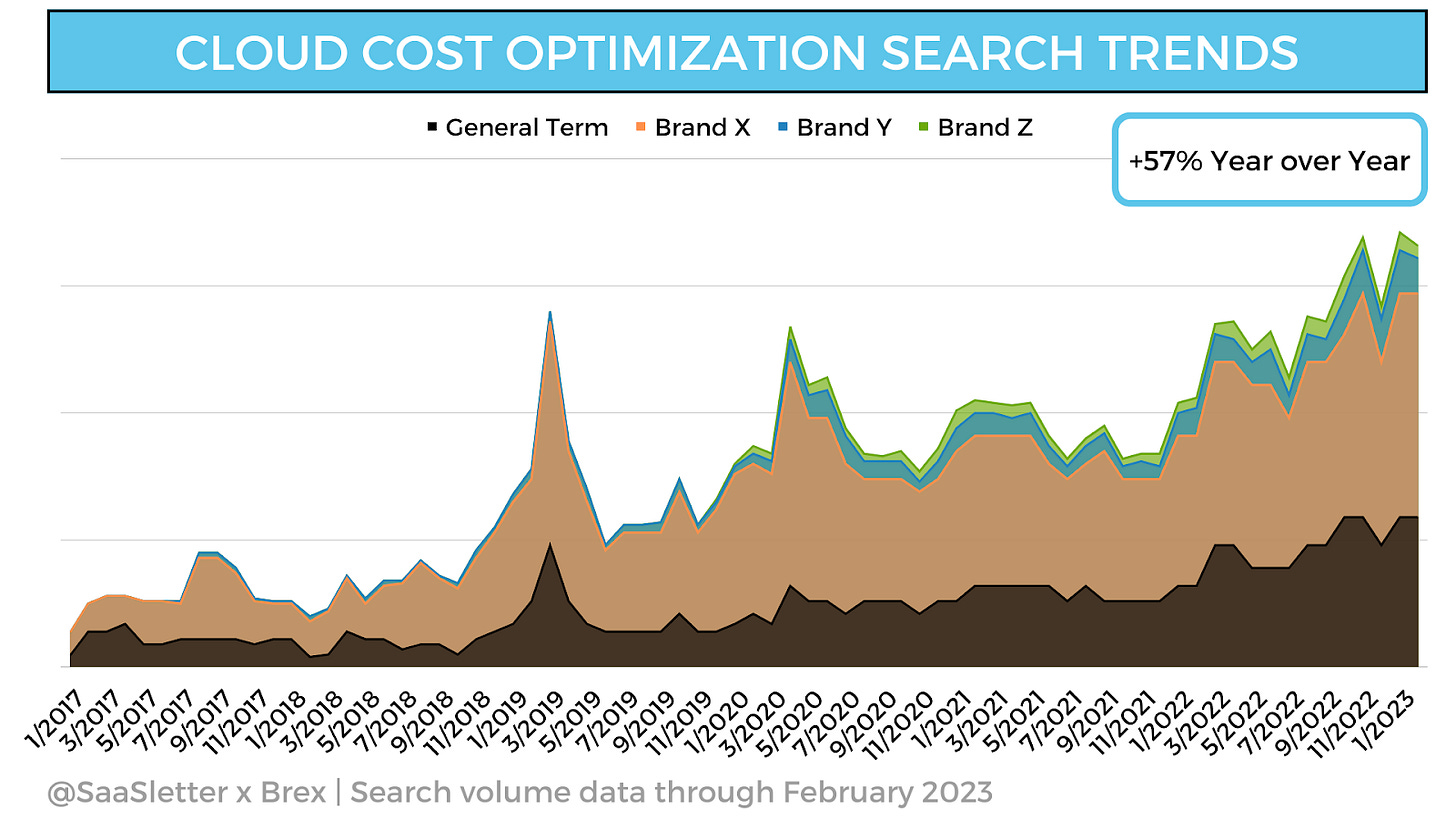

Trend #1: Cloud Cost Optimization

After steady rises since 2017, Google search volumes for “cloud cost optimization” have spiked by 57% year over year.

This trend is not limited to the “Big 3” clouds - cost optimization Google search volumes have increased by 320% and 200% for Snowflake and Databricks, respectively.

Pros

Large and growing absolute dollar line item

Improves unit economic measures investors focus on

3rd party cost containment tools can accelerate

Con

Need to carefully evaluate and quantify whether this is the “highest and best use” of an engineering team

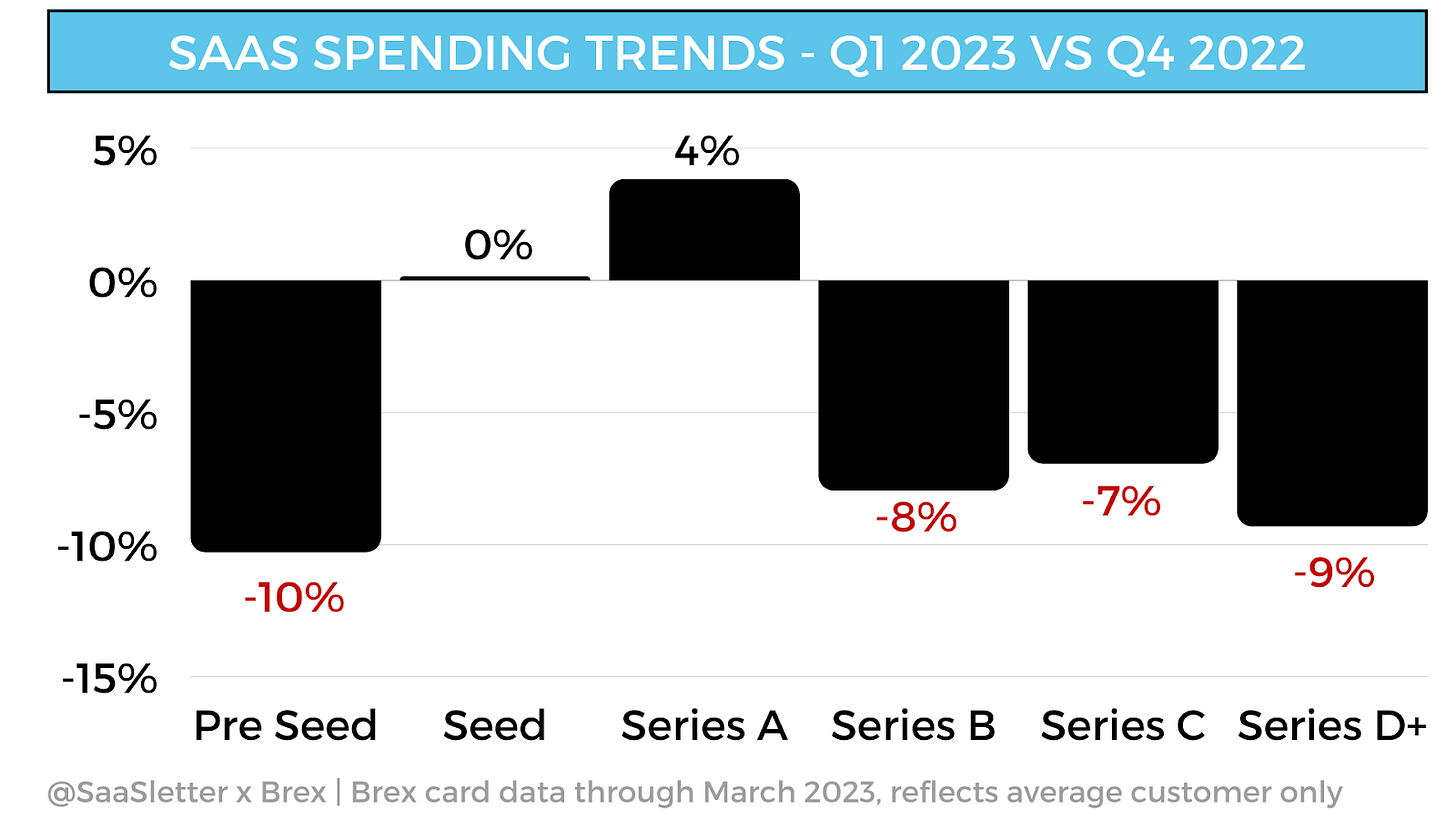

Trend #2: SaaS Spend Optimization

Analyzed using anonymized Brex internal customer data. They total the amount of spend across a spending category and/or funding round and divide by the number of currently active tenured Brex card customers to obtain the monthly average.

The proliferation of new SaaS apps during the buoyant past few years has made software spend optimization inevitable in a downturn:

According to Zylo, the average 500-2,500 employee company uses 255 SaaS apps while only utilizing 64% of their licenses.

82% of IT CXOs cited “SaaS license optimization” as a Top 3 priority in Battery Ventures’ recent enterprise IT spending survey

The SaaS spend optimization trend is evident in Brex’s customer spending averages, with Series B-D+ companies cutting SaaS expenses by 7%-9% in Q1 2023 on a sequential basis.

Pros

Fast payback from eliminating obvious waste

Growing line item

Visible way to spread a culture of cost discipline

Con

Medium-sized absolute dollar opportunity

Trend #3: Vendor Consolidation

Much like SaaS license optimization, vendor consolidation is an “obvious” opportunity:

Vendor consolidation is a top 3 priority for 93% of IT CXOs per Battery Ventures' recent survey

Capgemini estimates 5% to 30% savings from implementing vendor consolidation

However, Capgemini also estimates a timeline of up to 14 months

My opinion on vendor consolidation goes against consensus.

Why? Most IT tools have very similar productivity ROIs. For example, HelloSign should yield about the same benefit as DocuSign.

Absent material differences in license cost or wasteful utilization, the absolute savings net of switching costs are not material enough.

Particularly in light of the limited management bandwidth available in a “restructuring” scenario.

Pro

“On trend” and “obvious” - at times you need to follow the herd

Con

Long and labor-intensive implementation

Moving forward

Investors will reward management teams that precisely manage their business and cost structures while operating with urgency.

This quote from venture capitalist Dave Yuan captures the moment:

Was reflecting with some @tidemarkcap fellows who are Vertical/ SMB SaaS pros about surviving Covid and learnings for today's headwinds:

1) Recognize the problem / own the situation

2) Cut (hard) to the point you can look forward, rather than looking over your shoulder

3) Recognize your car is in the shop, work on the engine - focus on your most important assets - your people, your customers, and your product.

Perhaps "deep thoughts," but so few do #1 and #2 and run out of gas (to overextend the analogy).

Those who do #3, come ripping out of the gate once the headwinds shift

Go crush!

Plus Curated Content

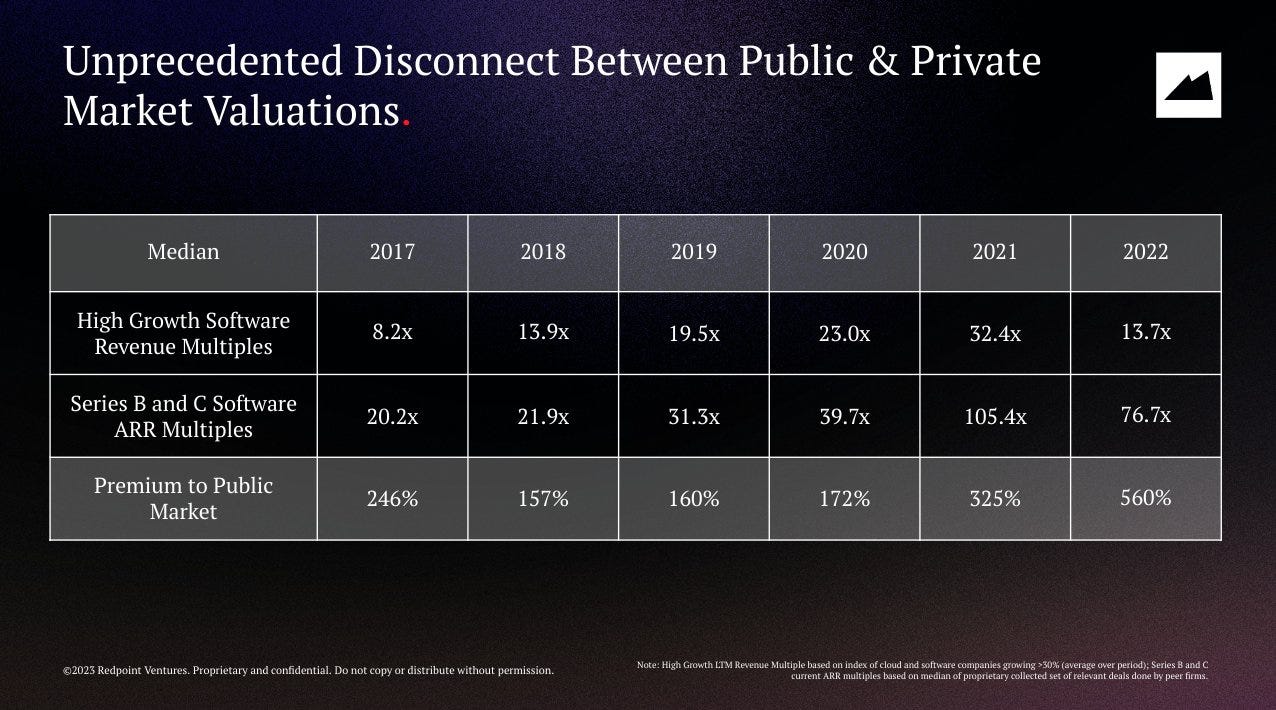

Logan Bartlett’s slides from the Redpoint annual investor meeting, like this highlight:

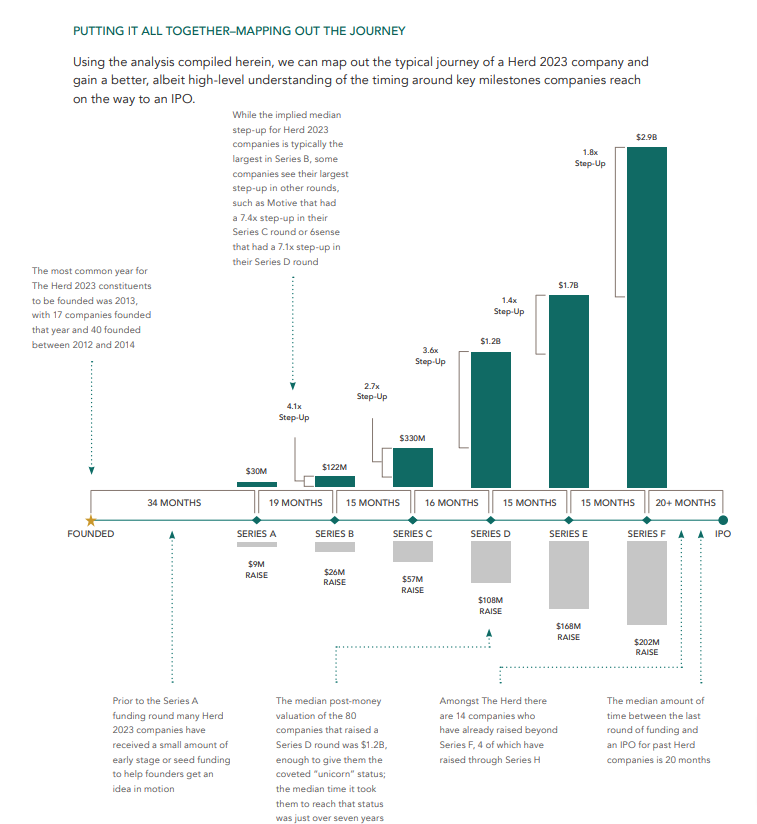

D.A. Davidson’s “The Herd: Top 100 Private Software Companies” had a great software funding journey visualization:

My thread of highlights from a great Zylo (SaaS Spend Management Platform) report.

Meritech published a great multi-product execution case study using Hubspot - my highlights here.

Arda Capital continuing the streak of "if Stratechery were raising a fund" level posts, this time with "Deep Dive: Workday, Power of the SOR, and the Platform Opportunity"

Lastly, I’ve included a PDF copy of the key Brex data/slides