SaaSletter - ICONIQ, ChartMogul, + Meritech

Plus more from RepVue, Scale Venture Partners + SaaStr 2023

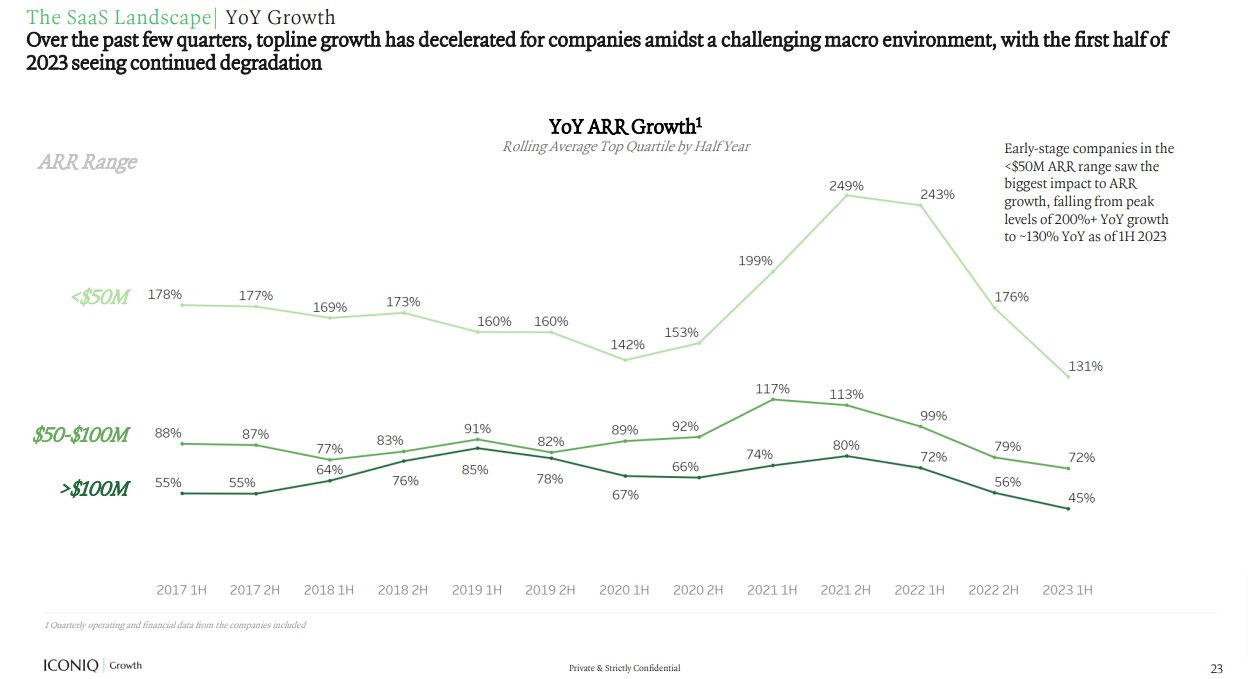

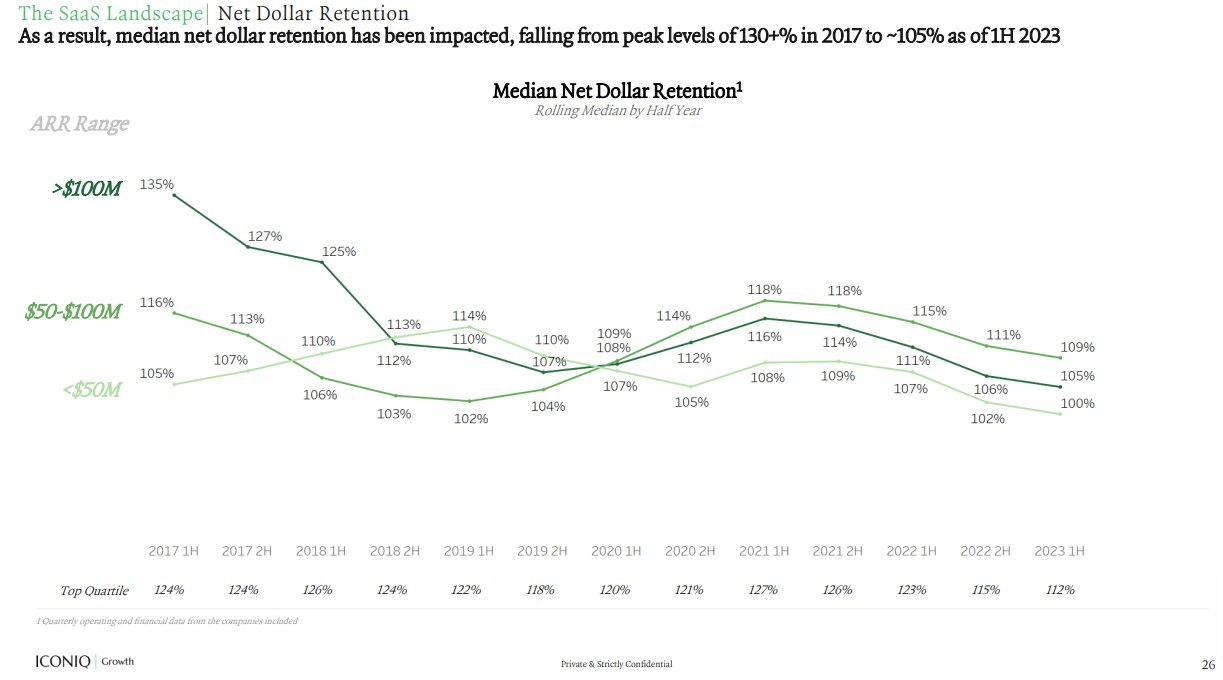

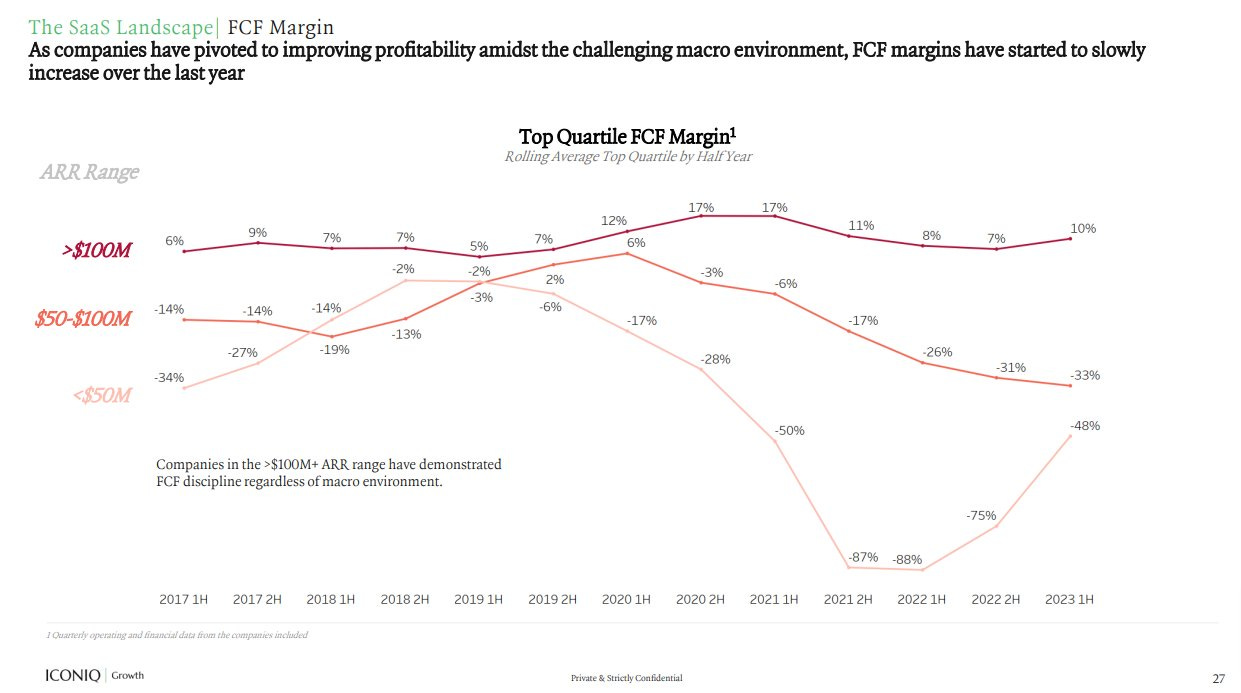

ICONIQ “Growth + Efficiency” Report

Easily one of the strongest benchmarking reports in SaaS, ICONIQ’s report (60+ slides) is available here.

Key Themes: Sub-$50m ARR companies have been hit the hardest, but reduced burn materially:

Without pasting *every* slide in here, other highlights included:

ARR/FTE and OpEx/FTE evolution - P&L breakeven at $100m-$135m ARR

There is a *LOT* more in the full 60+ slides, like CAC/LTV, paybacks, burn multiples, and PLG vs. sales-led data.

The G&A spend per FTE data inspired a rant from me (that aligned with a very smart private investor’s ongoing thesis):

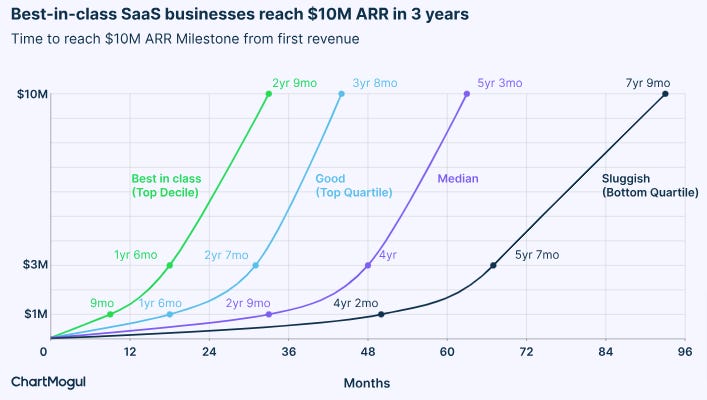

ChartMogul Benchmarks

ChartMogul released their n=2,000+ benchmarking report. Their CEO’s excerpts here, including this time to $10m ARR chart:

Summarized:

Median - 5 yrs

Top Quartile - 3.66 yrs

Top Decile - 2.75 yrs

The ChartMogul 5-year timeline is consistent with KeyBanc benchmarks but - as expected - lags BVP’s $100m Centaurs that achieve $10m in ~3 years:

RepVue Quota Data For August 2023

RepVue is rolling out new *Cloud Only* metrics with a 1st *Cloud Only* edition for August 2023 here - note the upward inflection for SMB and Middle Market in August

For clarity, the RepVue quota data we’ve been sharing over the past year has been their *all-industry, though very tech-heavy* data.

Our August summary of RepVue’s overall metrics is here.

Consistent with our forward-looking SaaS Demand Index research, I focus on Sales Engineer (SE) and SDR quota attainment as leading indicators - both remain above 50% (ahead of down-the-funnel AEs in the 40%’s) but registered slight declines in August.

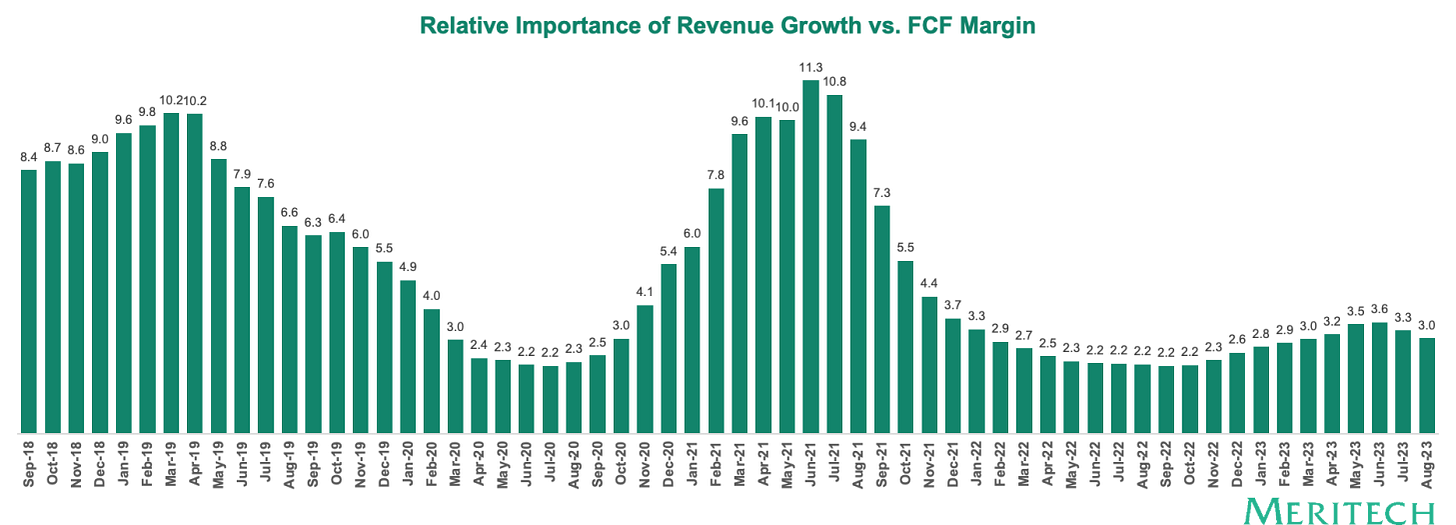

Meritech “Software Pulse”

Meritech - who already provides awesome live SaaS public comps - released a “Software Pulse” update.

The above relative importance of growth versus FCF margin chart stood out.

Other highlights here.

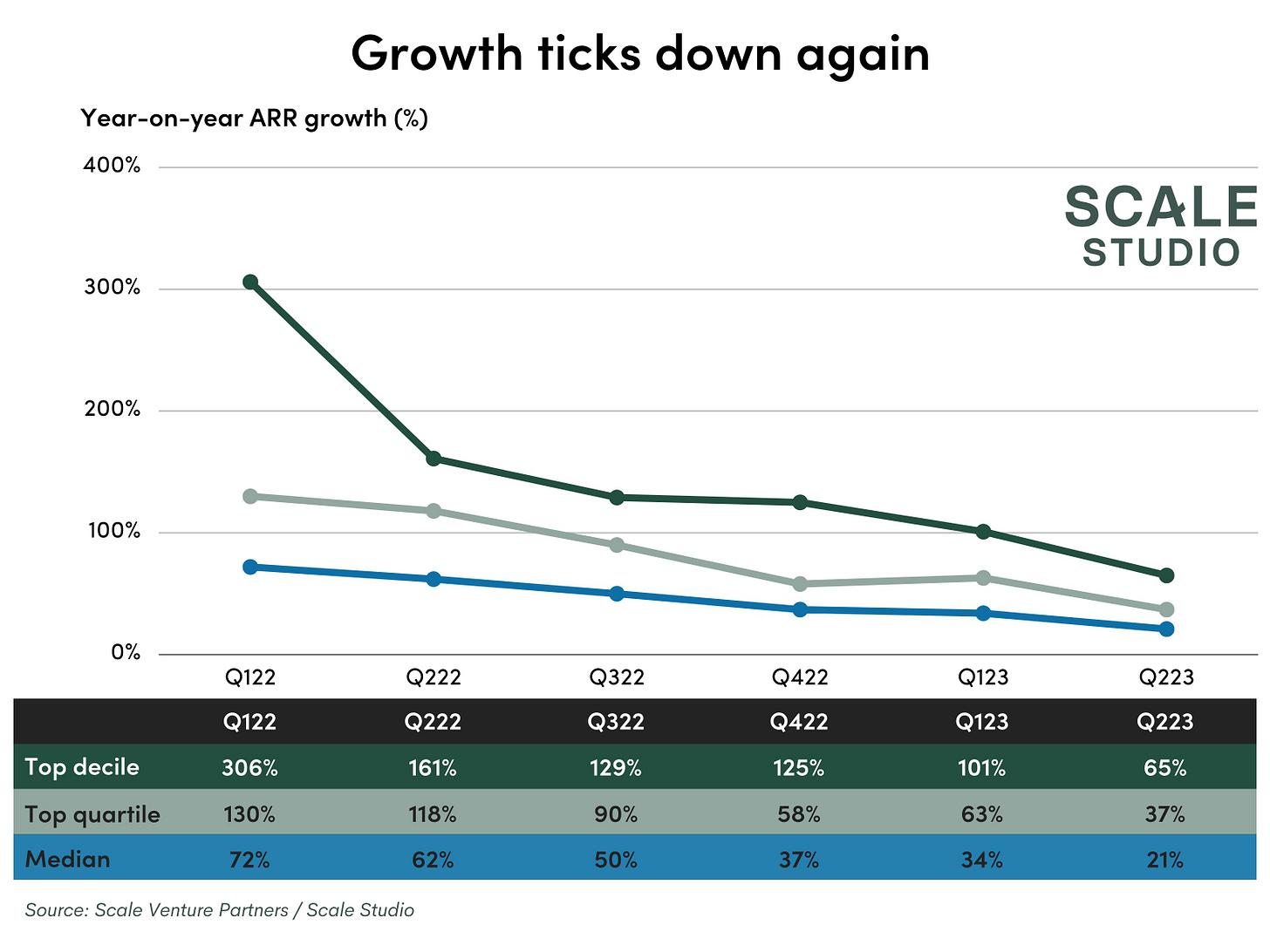

Scale Venture Partners Flash Report

Scale’s Flash Report showed continuing deceleration. Other excerpts here.

Even More SaaS Content

My highlights from 2 presentations at SaaStr 2023:

Mark Roberge (Stage 2, ex-Hubspot) - “Who Will Win the Go-to-Market AI Race:

Ryan Neu (Founder of Vendr) on discounting + pricing in SaaS - Excerpts | Video

and lastly, my highlights from Hubspot’s Analyst Day

Cloud Ratings Content

We recently initiated coverage of Cap Table + Equity Management Software (think Pulley + Carta).

ICYMI - re-highlighting our popular “Cloud Cost Optimization Explained” episode with Ben Schaechter, Co-Founder + CEO of Vantage, a pure-play cloud cost optimization platform covering over $1 billion in spend that recently raised a $21m Series A from a16z + Scale Venture Partners.