I’m excited to update the SaaS Demand Index with data through February 2023.

For our new readers: the Demand Index is derived from high-intent (aka “okta pricing”) Google Search volume data.

Reminder: this is a directional, free, and ever-evolving analysis that I’m open-sourcing → always do your own due diligence.

Industry-Wide Data

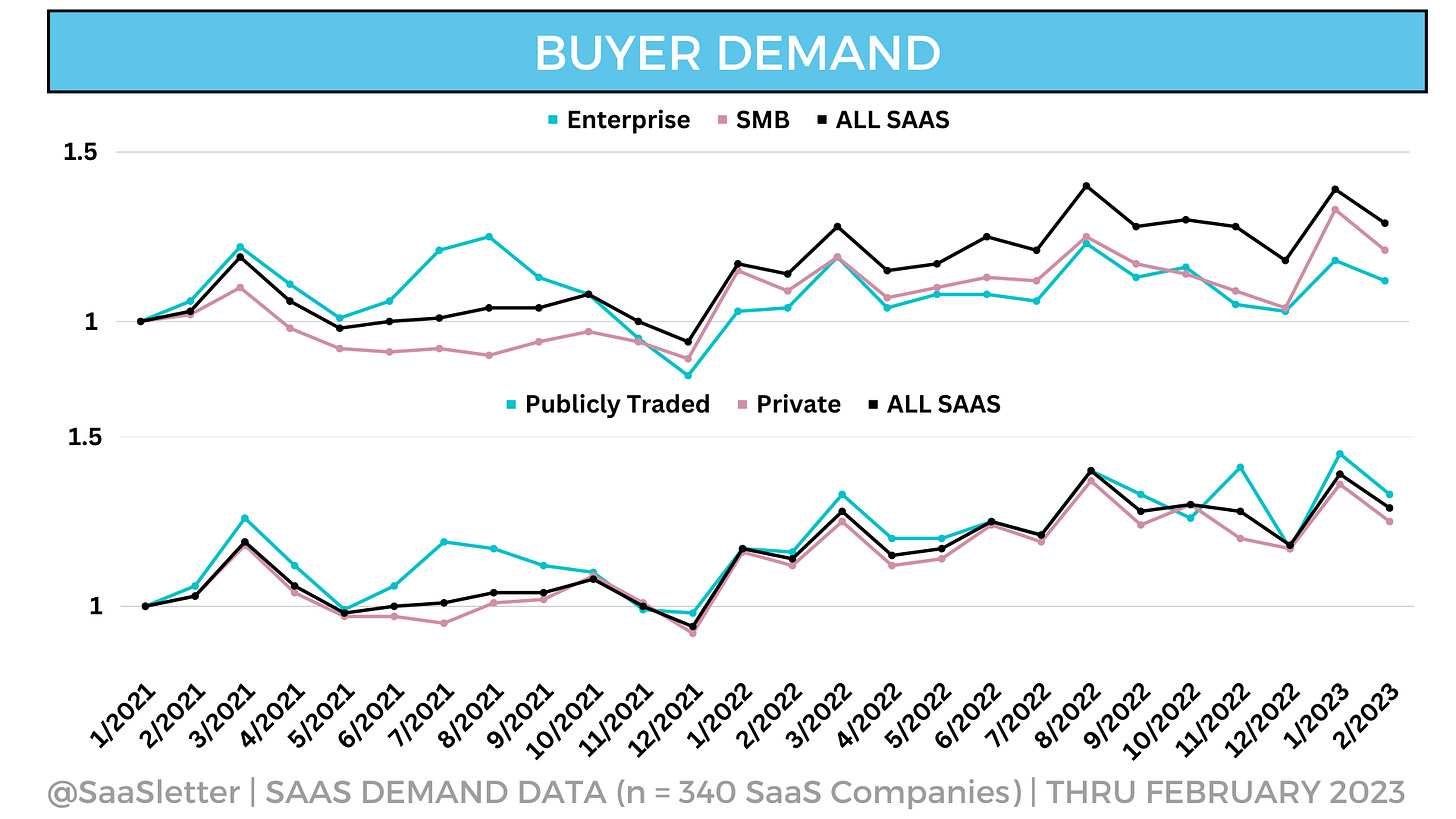

Looking through the “December down, January up” seasonality pattern (see past issue), I would characterize February 2023 demand data as “decent.”

A new analysis: comparing publicly traded SaaS to their private counterparts (in bottom graph) = no consistent top-of-the-funnel divergences since fall 2021:

Notably, RepVue (think Glassdoor for sales) data shows publicly traded companies outperforming in terms of quota attainment:

Taking our TOFU data and RepVue’s bottom-of-funnel (BOFU) data, it *might* suggest public companies are converting their funnel at a much higher rate.

(Of course, the quota attainment gap might be explained simply by staffing levels - mature public companies have predictable sales orgs less prone to overhiring vs startups + scale ups overestimating + overhiring their growth curves).

Interestingly, our customer size data (see top graph above) and RepVue’s data both show Middle Market as the top-performing segment.

Trends By Product Category

The trends at the product category level remain consistent and in line with consensus industry narratives:

Once again, Development + IT Management and Security are the strongest performing categories on an LTM basis.

Maybe a surprise: Sales is #3 on an LTM basis.

All of the category drill-downs - like this Data + Analytics example - are available in this PDF:

Even More SaaS Content

Battery Ventures released a very thorough “State of Cloud Software Spending - March 2023” report. Highly encourage you to read the entire deck. Some excerpts threaded here:

Three excellent software Substack posts:

“Ellison’s Gospel, The Evolution of Salesforce, and the (AI Driven) Re-Bundling of Software” by

“The Race to $100B: The Palo Alto Networks Story” - on @Software Analyst Newsletter

“The Software Slog” - from

Enterprise Technology Research (ETR) survey showing real deterioration in tech spending for the Global 2000:

Buck calling for a bad Q1 2023:

Nice one Matt! Now it's time for us to deep dive your PDF

Great post Matt! Super useful data!