SaaSletter - Redpoint InfraRed, Sales Cycle Data (n=12k) + Curated Links

Plus our podcast with Bowery Capital

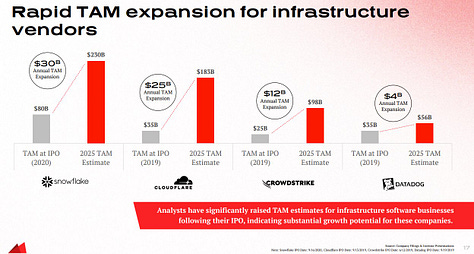

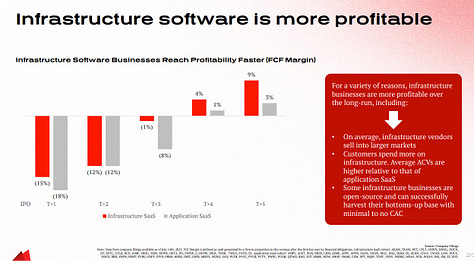

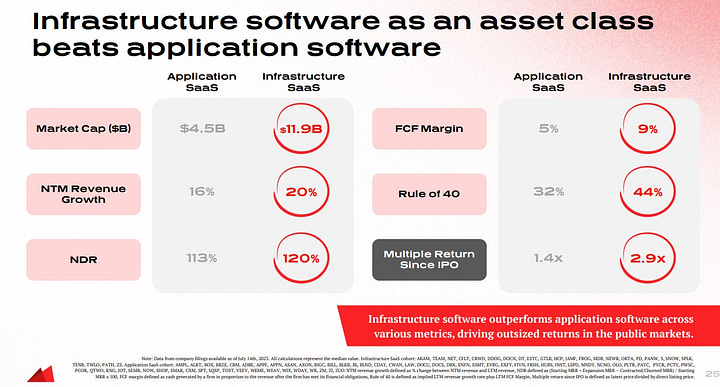

Redpoint InfraRed

Redpoint Ventures just released 1) an infrastructure stock index with NASDAQ, 2) their list of the top 100 private infrastructure companies, and 3) a strong 38-slide deck on the merits of infrastructure vs application platforms.

Full Redpoint InfraRed here. (No email required)

A few screenshots below - with my full excerpts Twitter threaded here.

RepVue Sales Cycle Data (n=12k)

Sales cycles largely up 2% - 5% in 2023:

Curated Links

WSJ on demand from software buyers for ROI-linked pricing: “Companies Look to Pay Tech Vendors Based on Business Outcomes, Not Usage”

Relatedly, Ryan Walsh (RepVue Founder/CEO) and @DealConfession (a good sales Twitter follow!) with their sales takes on ROI: Ryan here, DealConfession here + here

Nice charts + takes on new logos vs retention from Next Big Teng : “Land vs. Expand: Growth formula shifts during downturns”

ICONIQ Capital continues to release comprehensive compensation benchmarks:

For Customer Success Comp - my report highlights

For Marketing Comp - my report highlights

Good pre-IPO secondary market data from CapLight (via Zain Rizavi)

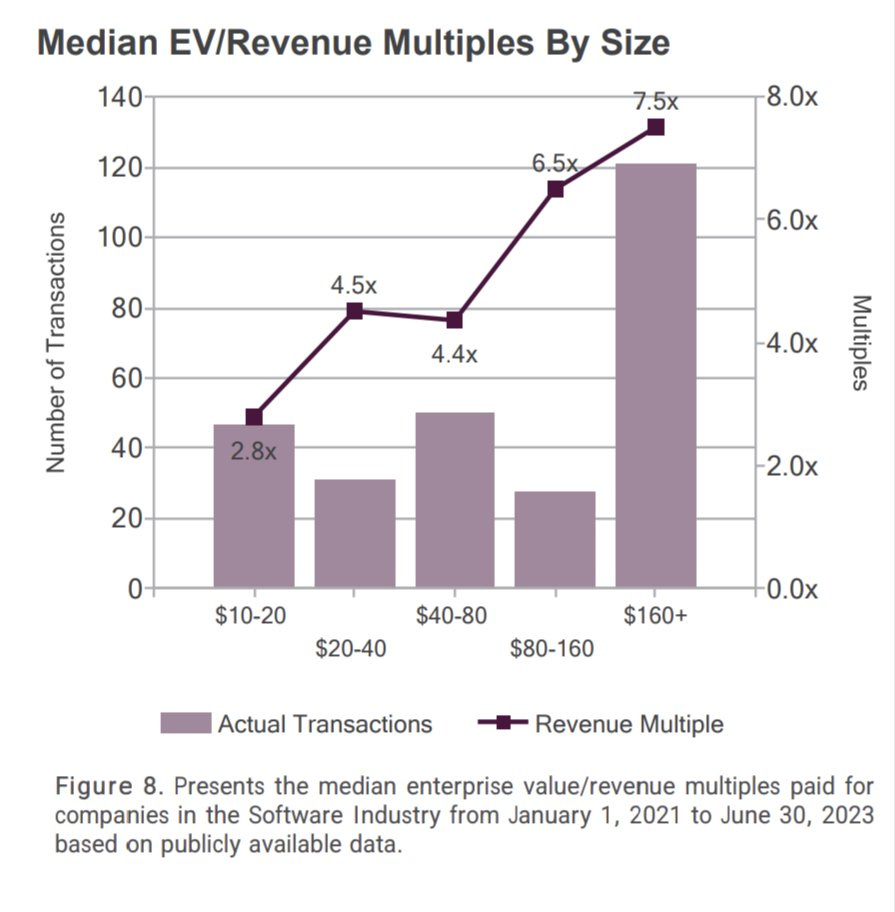

Increasing returns to scale applies to M&A (via Berkery Noyes):

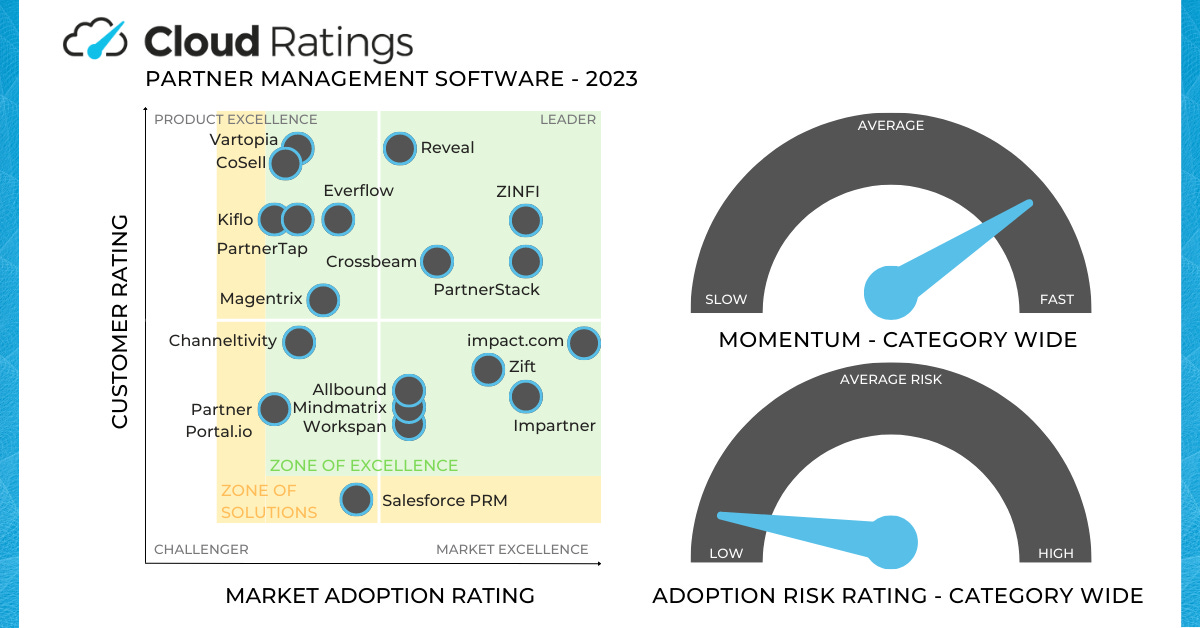

Cloud Ratings Content

We recently initiated coverage of two categories: Partner Relationship Management (PRM) Software and Subscription Management Software

We’ve launched a new investor-oriented podcast branded “Cloud Returns” - the tagline: “Cloud Returns covers ALL types of software investing, whether seed, VC, growth equity, private equity, debt, and public markets.”

Our first guest: Patrick McGovern from Bowery Capital where we focused on vertical SaaS at the seed stage: