SaaSletter - Sapphire On Non-AE GTM Bloat

Plus more from Lightspeed + Cloud Ratings

Non-AE GTM Bloat - Sapphire Ventures at SaaStr 2023

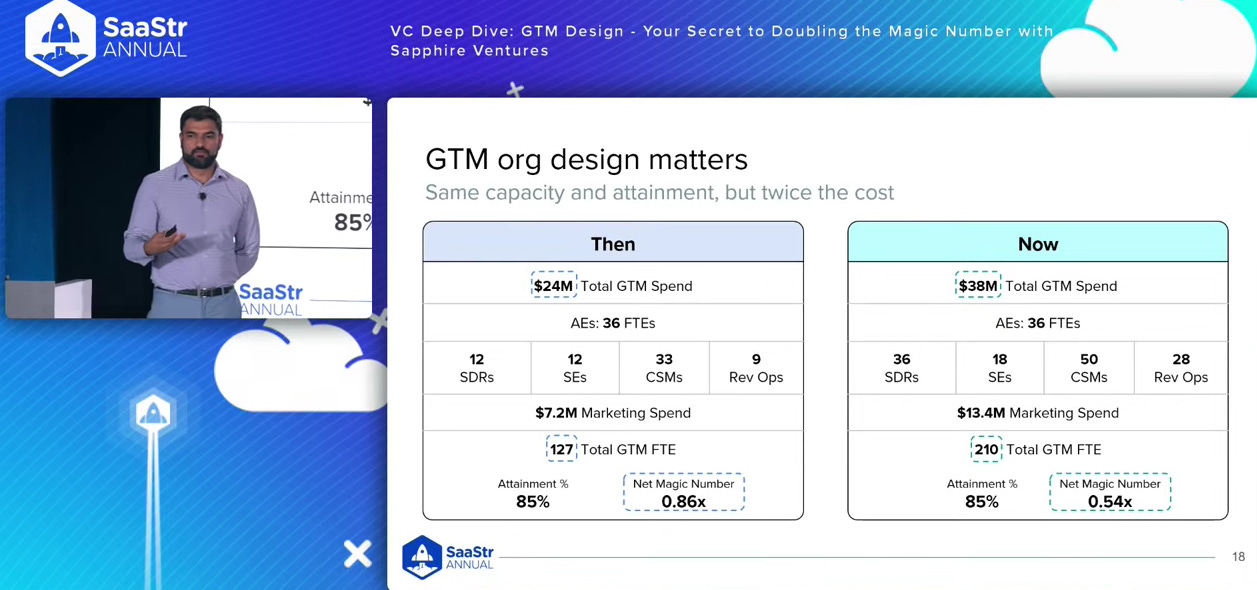

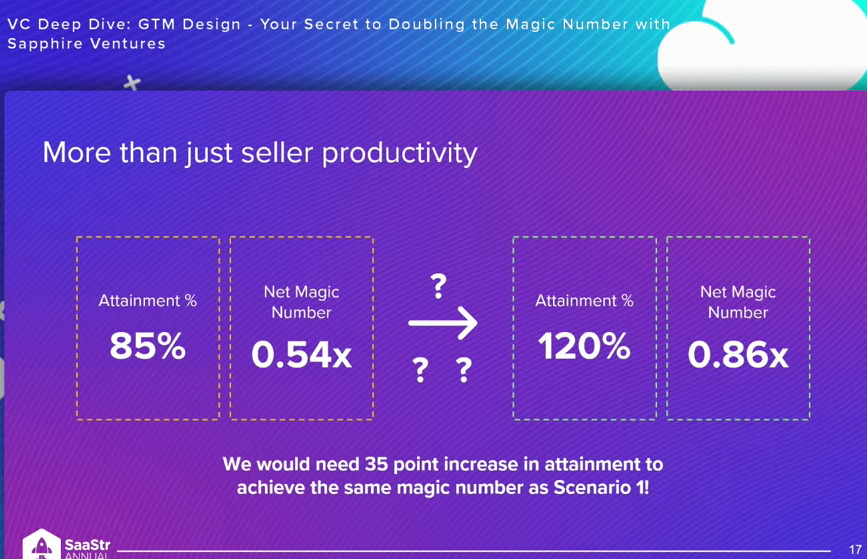

Sapphire Ventures’ “GTM Design” talk at SaaStr 2023 raised a critical data point: non-account executive (AE) GTM spend now represents 90% of GTM budgets, up from 70% in 2018.

Said differently, only 10% of GTM is spent on quota-carrying reps.

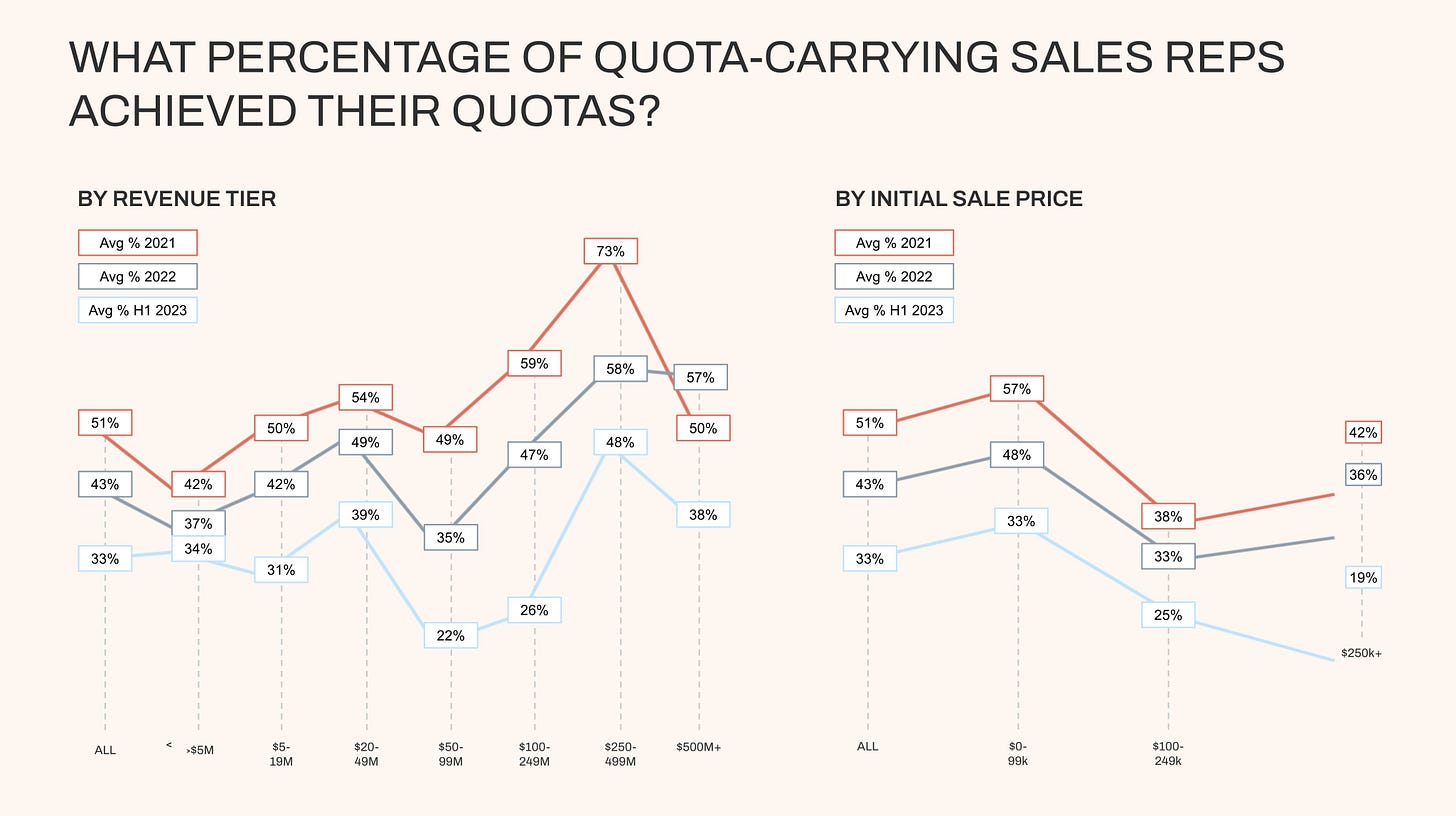

Given the relentless focus on poor AE quota attainment - whether RepVue or a Lightspeed report below - this context is important in highlighting poor returns from less observable areas of the GTM function.

Key slides below with further excerpts included in my Twitter thread:

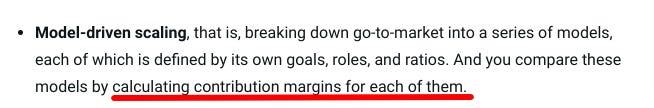

Dave Kellogg’s recent talk on scaling - including an emphasis on contribution margins - would have helped avoid these GTM issues:

SaaS Metrics Palooza 2023

Ray Rike has put together an A-list speaker line-up for his upcoming SaaS Metrics Palooza 2023, whether from the financial community (see above) AND operators (CEO Gong, CFO Gainsight, CEO Vendr, CEO Zylo)

Event Details: Date: October 10th-12th, 2023 | Time: 8:00 AM to 5:00 PM PT | Location: Virtual

Lightspeed “2023 GTM & Sales Benchmark Report"

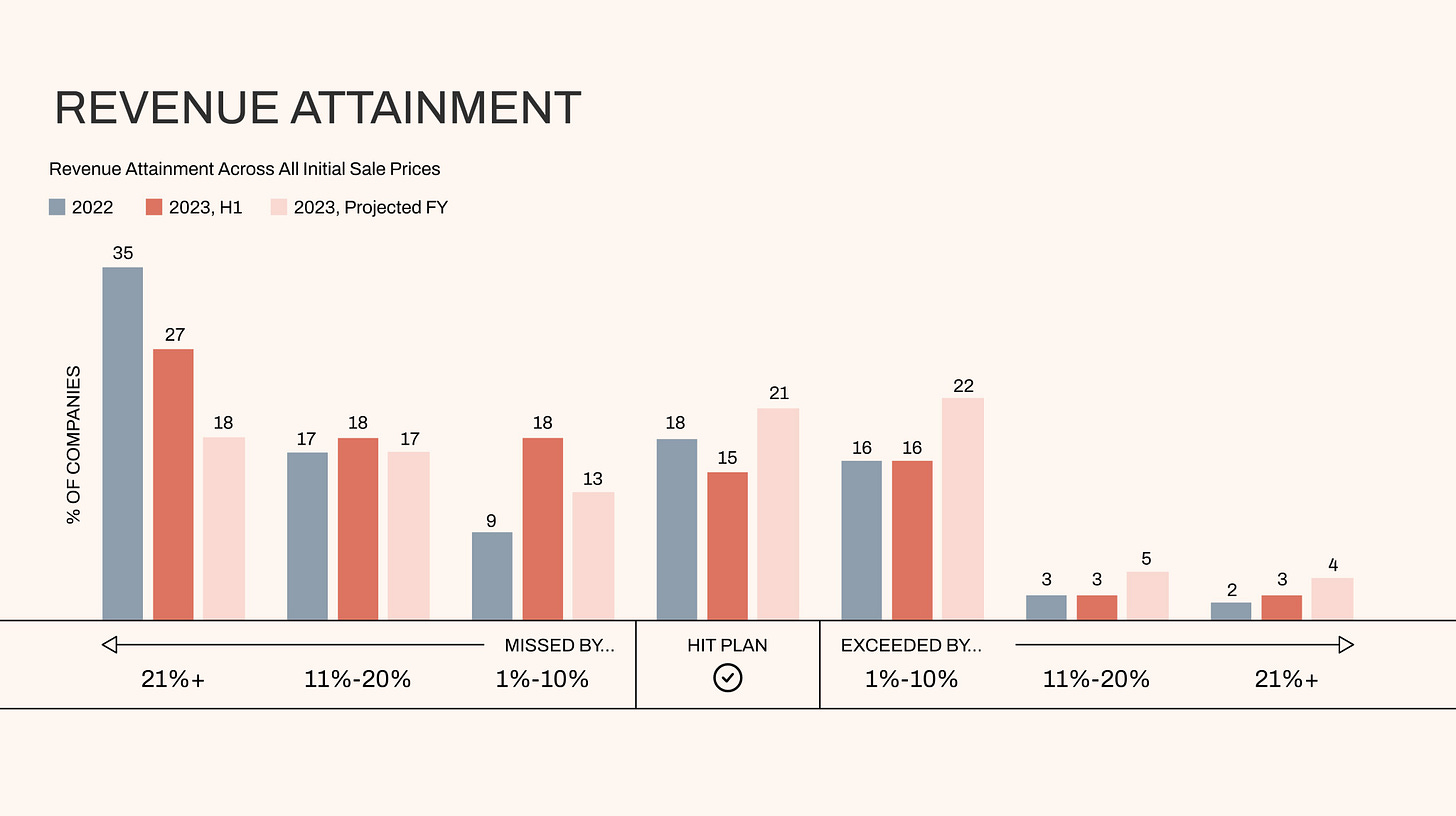

Speaking of quota, Lightspeed’s “2023 GTM & Sales Benchmark Report" (n = 143, largely Series A to Series C) included poor quota attainment data:

The overall report was grim:

"In the first half of the year, 63% of companies missed their revenue targets.

"... 27% of those companies missed their revenue targets by more than 21%"

plus data on:

and much more in the full Lightspeed “2023 GTM & Sales Benchmark Report"

Even More SaaS Content

A good write-up on the merits of constraints from Akash Bajwa

I endorse Battery Ventures’ Condensing the Cloud emphasis on new logo productivity

OnlyCFO on “Death From Benchmarking”

A ServiceNow case study in a “follow the workflow” lense from Dave Yuan, Managing Partner of Tidemark

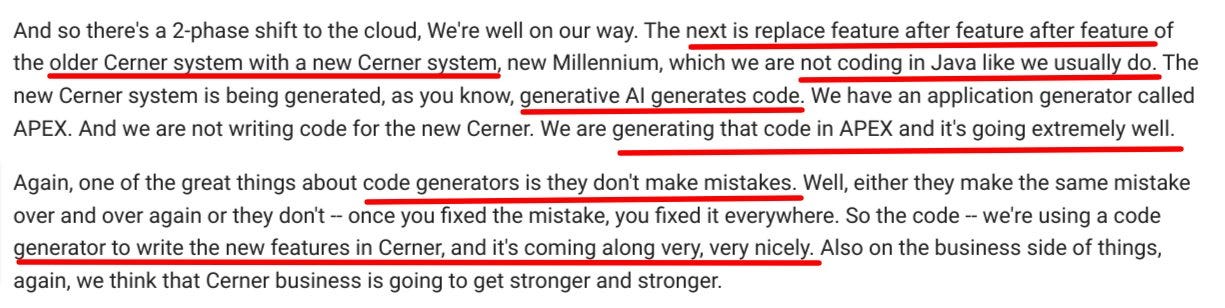

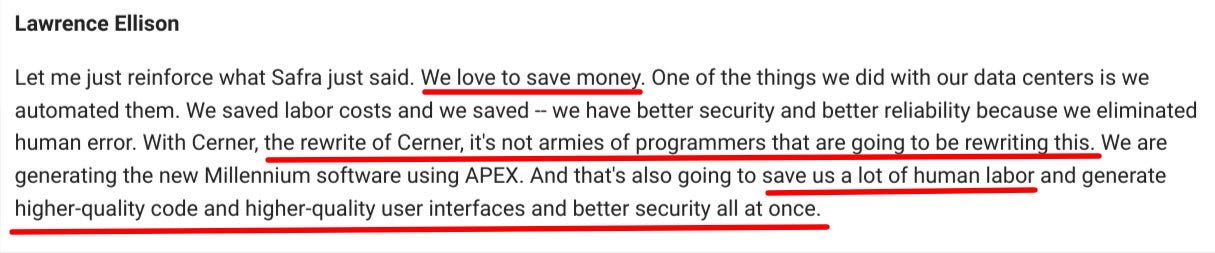

Oracle on their positive results using AI to re-write code base from the Cerner (founded in 1979!) acquisition → do AI coding gains change the investment thesis for legacy + roll-up software platforms?

Cloud Ratings Content

We recently initiated coverage of Account-Based Marketing Software.

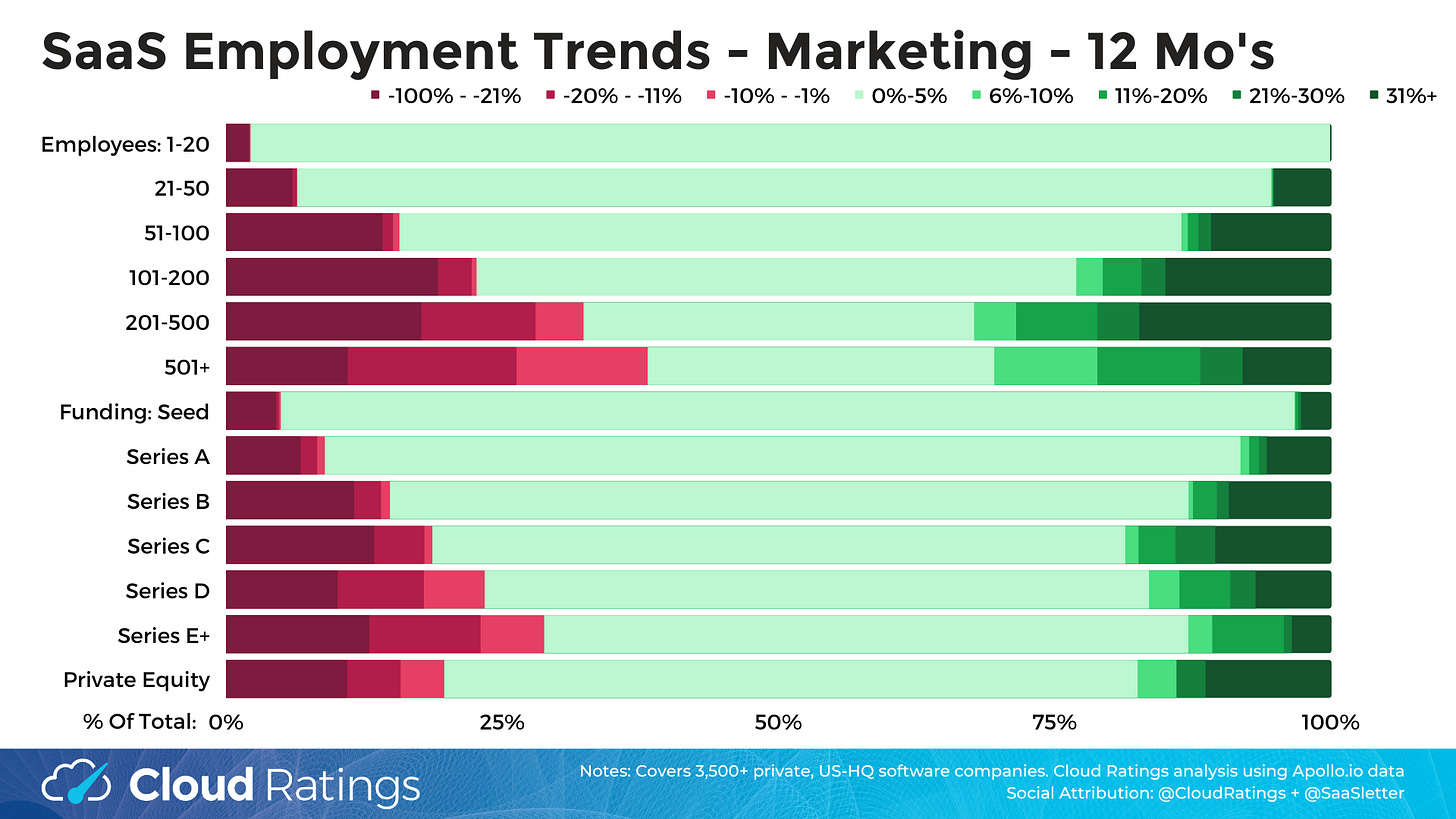

Our second edition of the SaaS Employment Index (covering headcount changes for 3,500+ private software companies) showed meaningful cuts in the Marketing function → this fits my takeaway from Sapphire’s non-AE GTM talk: