SaaSletter - September 2023 SaaS Demand Index

Plus Air Street's "State of AI" and Scott Leese

September Demand Index

We’re excited to update the SaaS Demand Index with data through September 2023. Yes, we are excited every month and not just repeating a template here.

For our new readers: the Demand Index is derived from high-intent (aka “okta pricing”) Google Search volume data.

Reminder: this is a directional, free, and ever-evolving* analysis → always do your own due diligence.

Moreover, the data captured here is best characterized as top-of-funnel or dark funnel → factoring in sales cycle length, do NOT use this Demand Index as a predictor of near-term financial results and/or financial guidance.

Industry-Wide Data

High-intent search volumes were up +3% year-over-year.

On a sequential basis versus August, the Demand Index declined 2%.

RepVue’s September 2023 quota attainment data was comparatively weaker - caveat: there is a significant timing gap between the SaaS Demand Index's forward-looking, TOFU emphasis and RepVue’s focus on closed sales.

RepVue’s data for forward-looking roles - SDRs and Sales Engineers - most comparable to the SaaS Demand Index show similar trends:

Trends By Product Category

We’ve added a slide showing cumulative growth since January 2021 - Security’s strength and weaknesses for E-Commerce and Marketing stand out:

This slide presents growth for the last month and last 3 months, respectively:

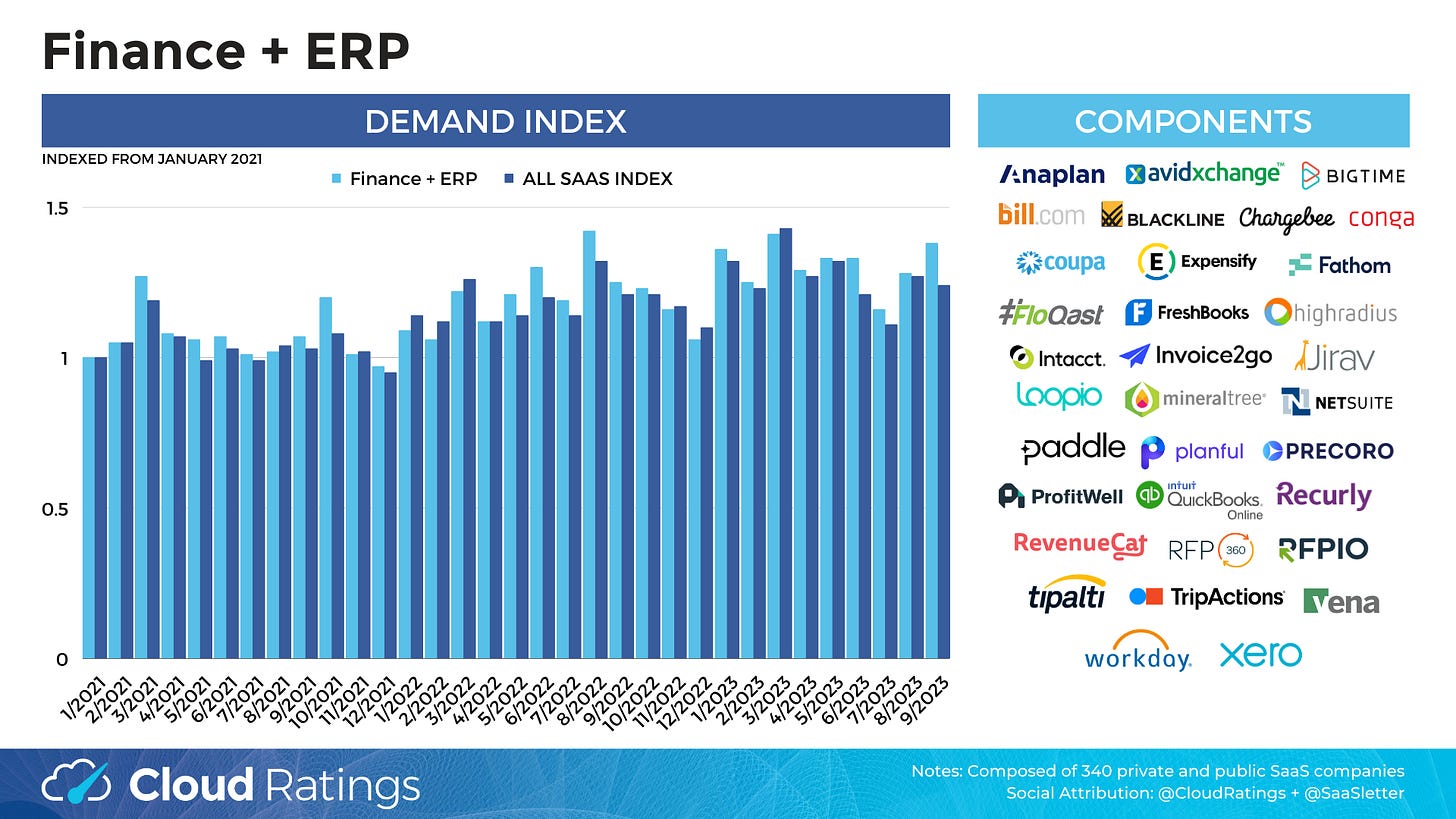

Strong Septembers: Finance + ERP, Industry Specific (aka Vertical Software), and Security.

All of the category drill-downs - like this Finance + ERP example - are available in this slide PDF:

Presenting this popular chart without comment for consistency - not much to say:

Top Performers: Top decile based on current quarter performance versus prior quarter (with public companies in bold for our many investor subscribers):

Ironclad, CS Disco, RevenueCat, Floqast, HighRadius, Wiz, Clari, Fathom, 6Sense, Xero, Messagebird, Planful, Veeva, Tripleseat, Klaviyo, Scoro, Dayforce, Guidewire, Mindtickle, Teamsupport, Olo, Elastic, Proofpoint, Appfolio, Trainual, Litmus, Brightwheel, Medallia

Curated Content

The State of AI Report: In its 6th year and at 163 slides these are always worth reading. I particularly like the translation of academic AI research into digestible takeaways.

Morgan Stanley Q3’23 CIO Survey - my excerpts here. TL,DR: largely stable IT spend environment, AI implementations a 2H’24 story, many vendors pushing through price increases.

Sept’23 Cloud Cost Optimization Trends: Plateauing at Big 3 + general term level, while Snowflake, Databricks, and Datadog cost containment searches continue to rise:

Cloud Radio SaaS Podcast Episode

Our conversation with sales expert Scott Leese covers the challenging and changing sales environment (like the SDR metrics above or 30%-40% RepVue quota attainment) and how a shift from go-to-market → go-to-network is needed:

Subscribe To “Cloud Radio” On: Spotify | Apple Podcasts | All Other Platforms

*In an effort to publish closest to month end, we are accessing the underlying API data “early” (relative to the typical SEO and PPC users that do not require such immediacy). Therefore data should be considered “provisional” (i.e. subject to revision by our data provider) and create volatility in the data presented in the 2 most recent months. For this month, Zoom was excluded due to nonsensical data via the API; the historical data presented, however, is also pro forma to exclude Zoom.

This report was first published on cloudratings.com.