SaaSletter - Weakish Dec'22 Demand Index Data

Was this year-end seasonality or a red flag for SaaS Top of the Funnel (TOFU)?

With fresh data finally here, I’m excited to update the SaaS Demand Index with data through December 2022.

Reminder: this is a directional, free, and ever-evolving analysis that I’m open-sourcing → always do your own due diligence.

Industry-Wide Data

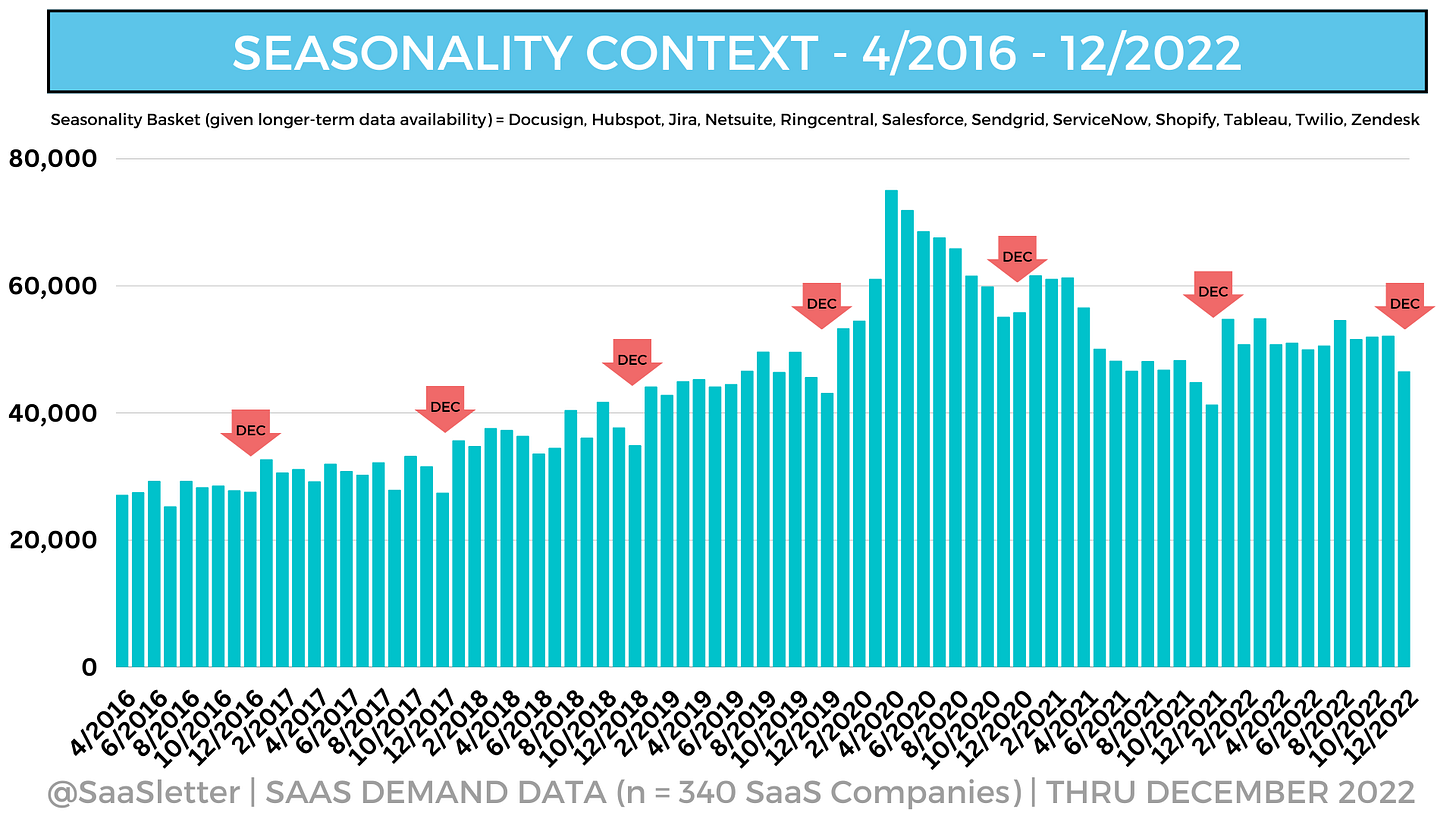

December high-intent search volumes were weak across the industry. How much of this was year-end, holiday seasonality?

Our data source is NOT seasonally adjusted. However, I’ve laid out a broader data set to set the context for December seasonality so you can make your own mental seasonal adjustment.

Trends By Product Category

Once again, Development + IT Management and Security are the strongest performing categories. With the Sales category showing greater strength than the macro narratives would imply.

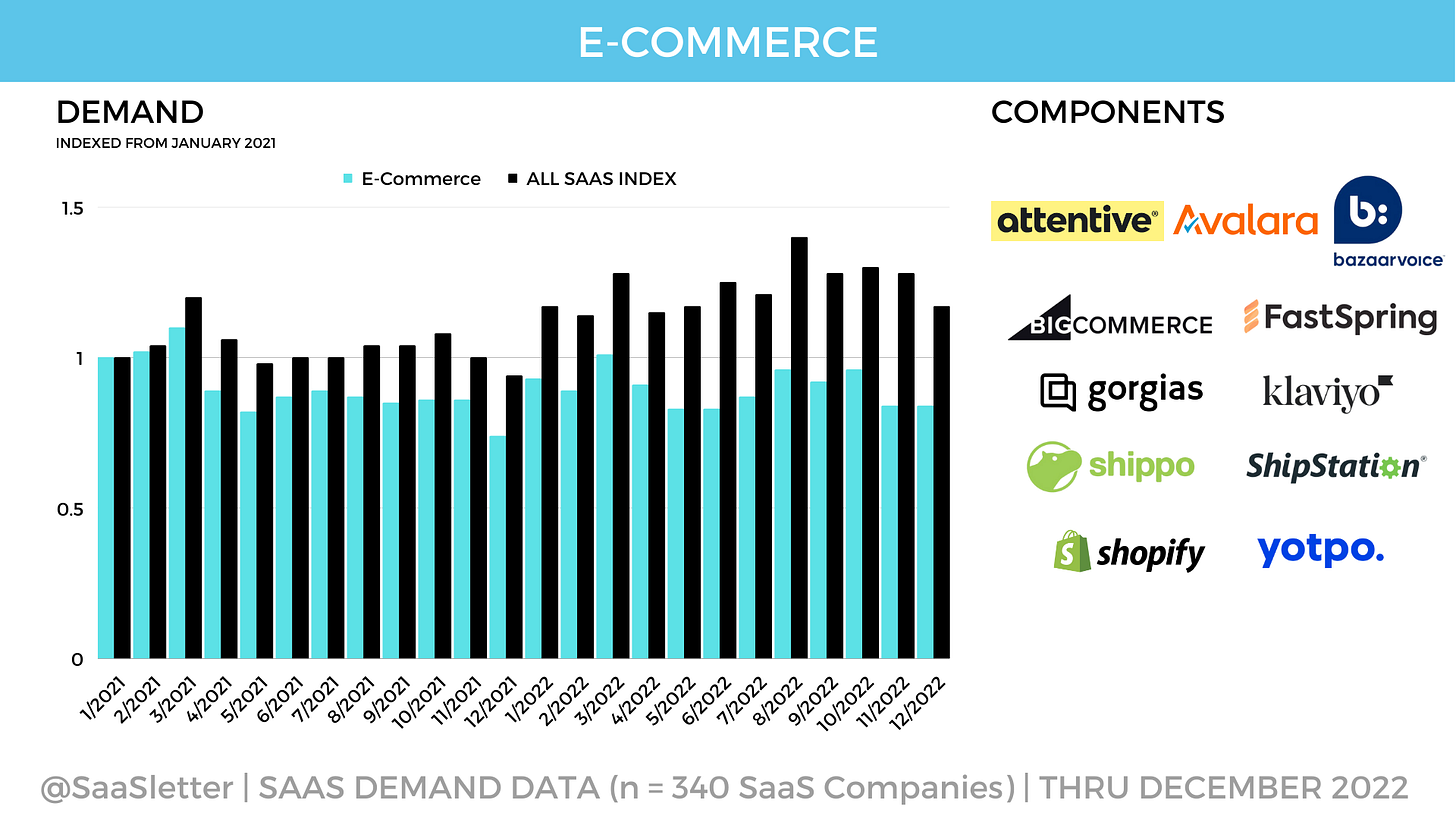

In line with my priors, E-Commerce and Marketing lag behind the industry.

Drill-down pages for these notable 5 are published below…

while the other category drill-downs are available in this Canva deck or this PDF.

Selected High-Performing Categories:

Selected Lagging Categories:

Ad Pricing + Competition

Comparing December to October, the weighted average cost per click (CPC) for the industry declined in the high single digits…

…and the index level of ad competition declined in the low double digits.

Key Caveat: Our data source has less functionality to lay out ad data historically by month and interpret seasonal impacts. While I have extremely limited paid ad knowledge, I *suspect* these declines were a byproduct of the holiday period. Said differently, there is no reason to run ERP Google Search ads on December 28th.

Please let me know in the Substack comments if you would highly value ad-related data in these reports.

Methodology Refresher

Driven by high-intent Google search data (i.e. "okta pricing")

Developed using a commercial SEO software suite

n = 340 SaaS companies - Selected for representation (by category, company stages, by customer type) to approximate the overall industry

Given the typical sales cycle, consider this a rough PROXY for top-of-the-funnel demand ONLY and NOT indicative of near-term bookings/revenue