SaaSletter - R&D Engineering -> Financial Engineering

Translating ICONIQ's R&D benchmarks into steady state cash flow

ICONIQ R&D Benchmark’s

My financially-oriented highlights of their “Engineering in a Hybrid World” 35 slide deck from October 2022.

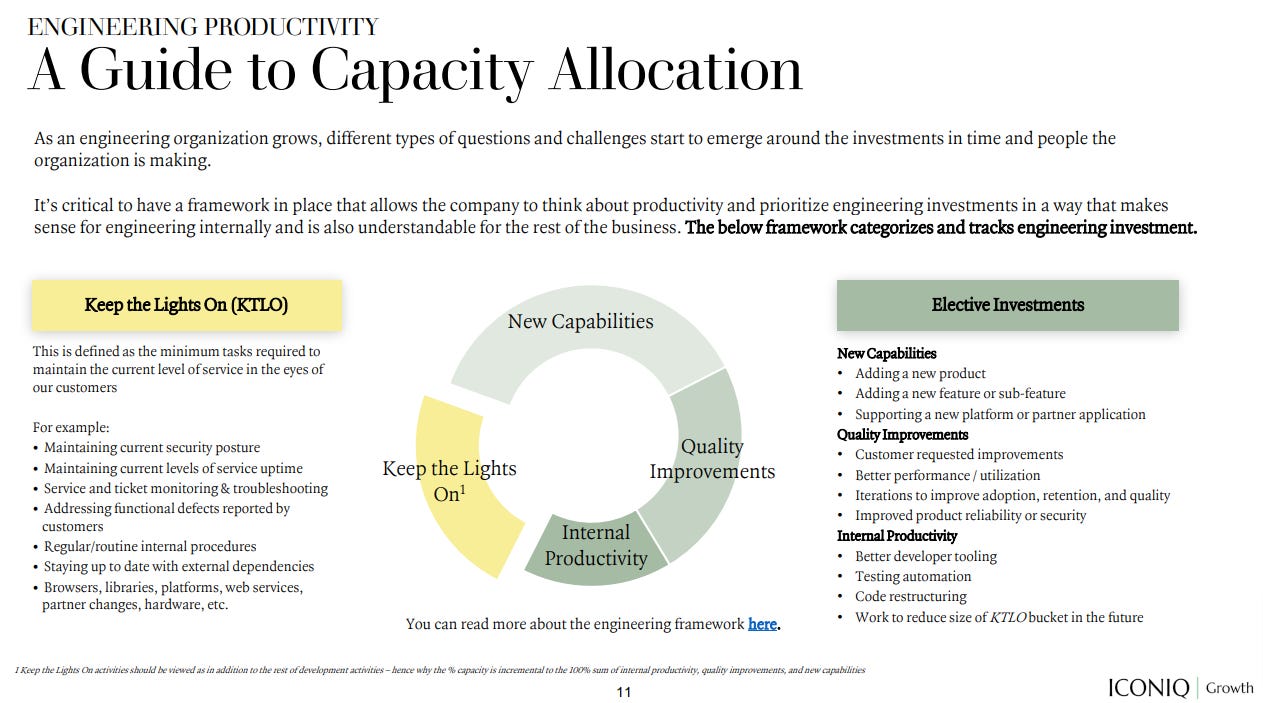

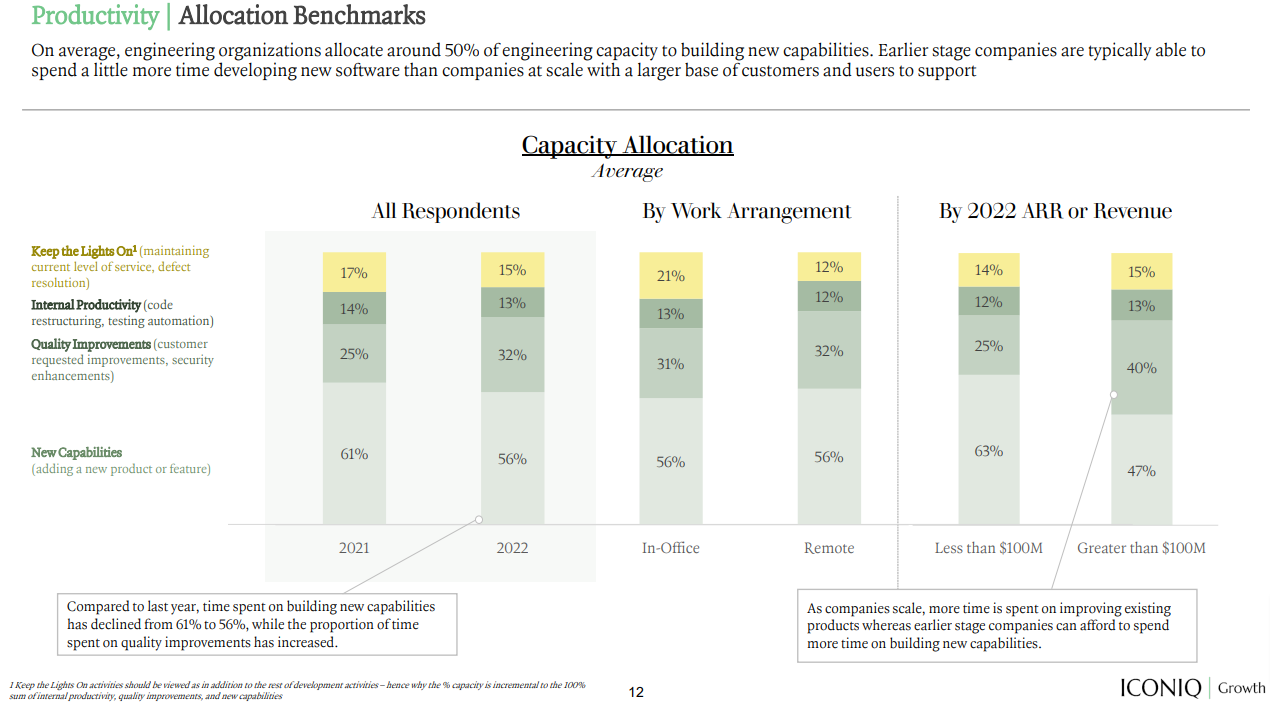

A rare granular break-down of how the R&D income statement line item translates to product development:

My biggest call out: 47% of R&D spend = “New Capabilities (adding a new product or feature)” (for ARR > $100m)

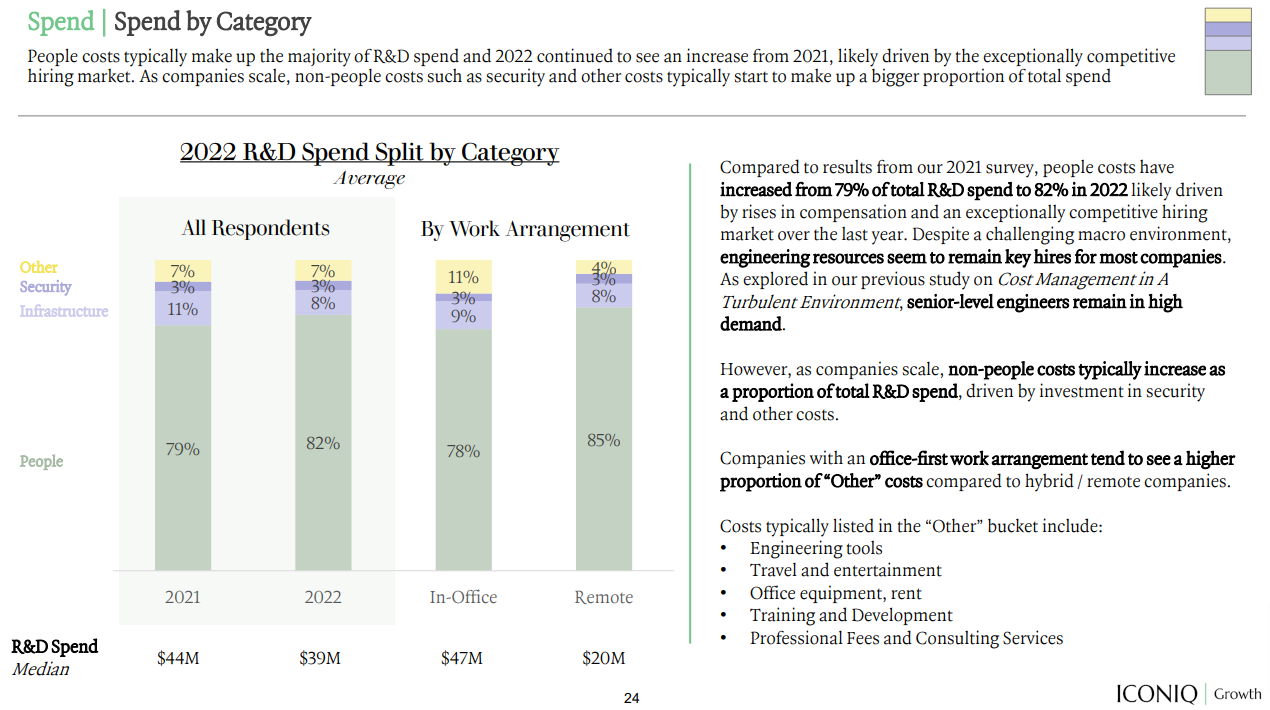

Flagging the spend by category data - 82% people - alongside ’s recent “Focus On People Costs”

There is a LOT more in the report like

Engineering Headcount Ratios

Developer mix (back-end vs front-end vs full stack)

Remote vs in-office

Use of 3rd party and offshore R&D resources

R&D headcount by role (QA, Data Science, Architects, PMs, Management, and so on)

Translating R&D Benchmarks To Long-Term Margins

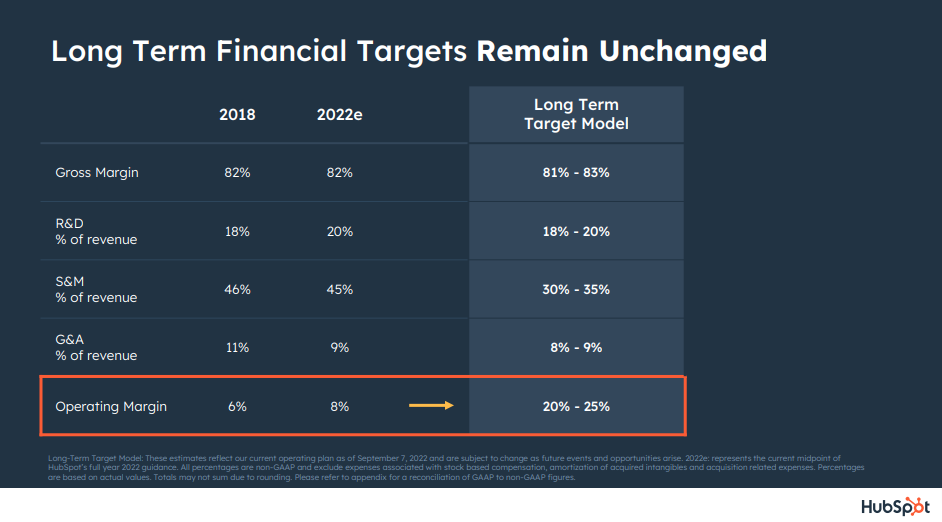

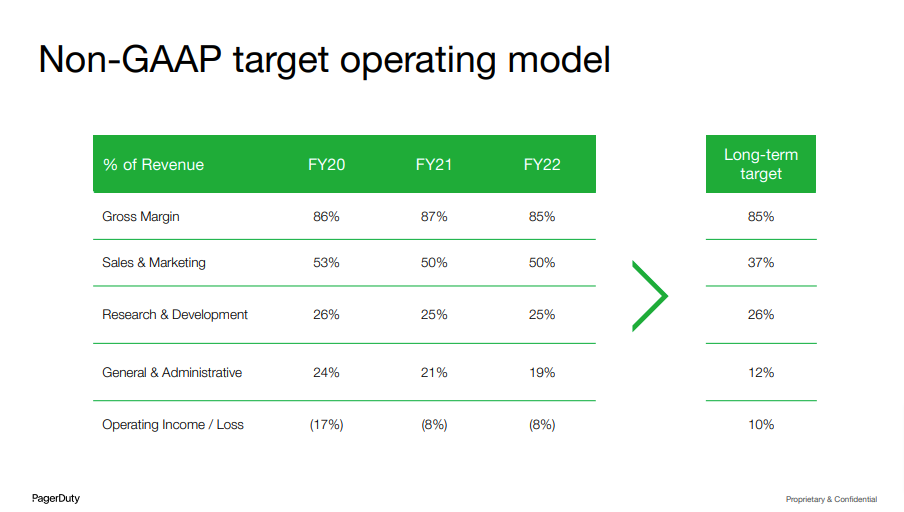

Amongst public SaaS stocks, company-guided “long-term target operating models” rarely contemplate reducing R&D spend all that much. Examples from Hubspot and PagerDuty are included below.

Generalizing, the margin bridge is primarily driven by improvements in Sales & Marketing plus a few hundred BPS from G&A leverage.

Related Resources:

Interestingly, Morgan Stanley’s “Margin X-Ray” earnings-power framework does NOT assume R&D reductions - May 2022 example here.

RBC’s Summary of Long-Term Targets across their software coverage (via @Jerry Capital)

Why Does This Matter?

Let’s go back to the ICONIQ report.

We saw 47% of R&D spend = “New Capabilities (adding a new product or feature)”

Arguably the next category is equally important from a cash flow-oriented investor viewpoint (aka many of our private equity newsletter subscribers):

40% of R&D spend = Quality Improvements (customer-requested improvements, security enhancements)

When modeling out a downside or “run for cash” scenario, the "quality improvements” *seems* to allow for reasonable logo retention and NRR with a software product that is responsive to customer needs.

Something like a 90% logo retention rate + plus 3-5% annual pricing = 95% NRR???

While stopping new feature development would obviously lower your revenue growth rate, this *theoretical* analysis suggests:

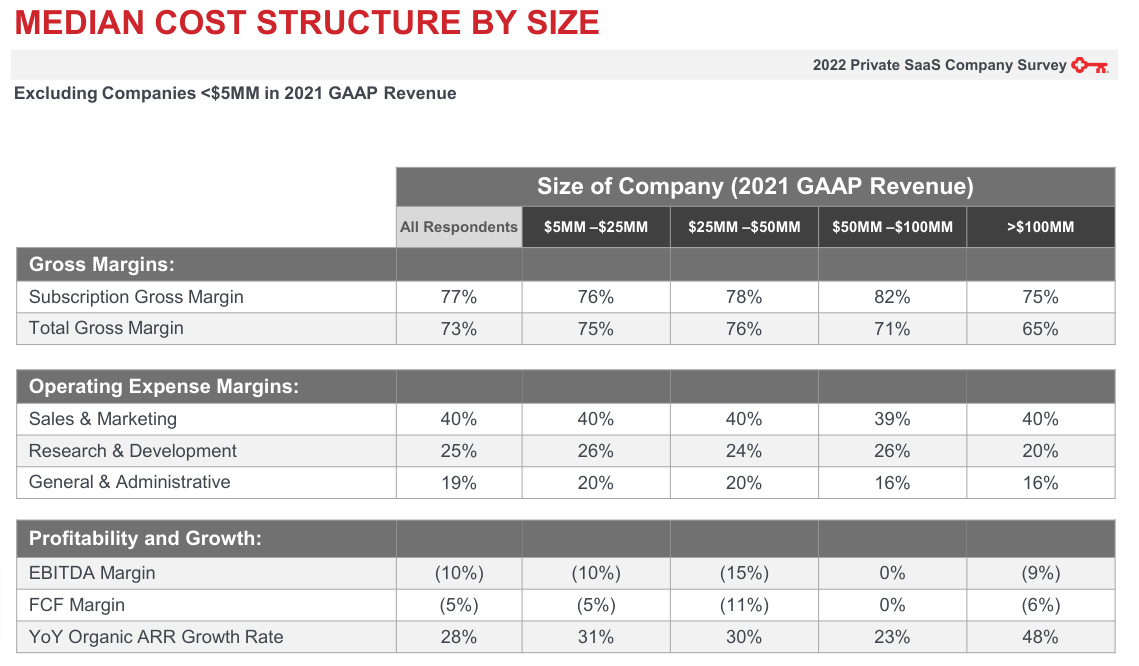

25% revenue on R&D (KeyBank below)

x 53% (i.e. 100% - 47% New Capabilities R&D)

= 13% operating margin improvement via R&D

Taking a very mechanical approach, that also implies new product capabilities should add at least 13% to your revenue growth rate; if not, growth R&D is dilutive to your Rule of 40.

Curated Software Content

This post from

on software developer purchasing patterns flagged the ICONIQ report too:Other highlights: