SaaSletter - Morgan Stanley On The ROI of AI

Plus new Cloud Radio episodes + RepVue September data

Cloud Radio Podcast Episode

First, a new + on-topic episode with Ashley Acosta, Founder and CEO of Maca (just emerged from stealth mode; has had strong paybacks for Series B+ initial software customer base).

Maca is “the first operating system for value-based pricing” → value-based pricing is directly linked with software ROI - the theme for this article.

Subscribe To “Cloud Radio” On: Spotify | Apple Podcasts | All Other Platforms

The ROI of AI Context

Anecdotally, the emergence of Generative AI has helped spark a rekindled interest in quantifying the ROI of software.

While other trends have increased the interest in software ROI, like:

ROI for New Deals: SaaS buyer surveys from G2 and Sapphire each documented vendor demand for ROI support while scrutinizing new app purchases

ROI for Renewals: On our podcast, Cory Wheeler (Co-Founder + CCO of Zylo) noted buyers beginning to request ROI proof at renewals

… the ROI of Generative AI discussion is more intensely quantitative.

Software is a wildly transparent and quantified industry. No matter your ARR level, a set of Robust benchmarks will exist: NRR, Magic Numbers, logo churn, quota attainment, sales per AE, and so on.

However, the universe of software ROI benchmarks is remarkably limited.

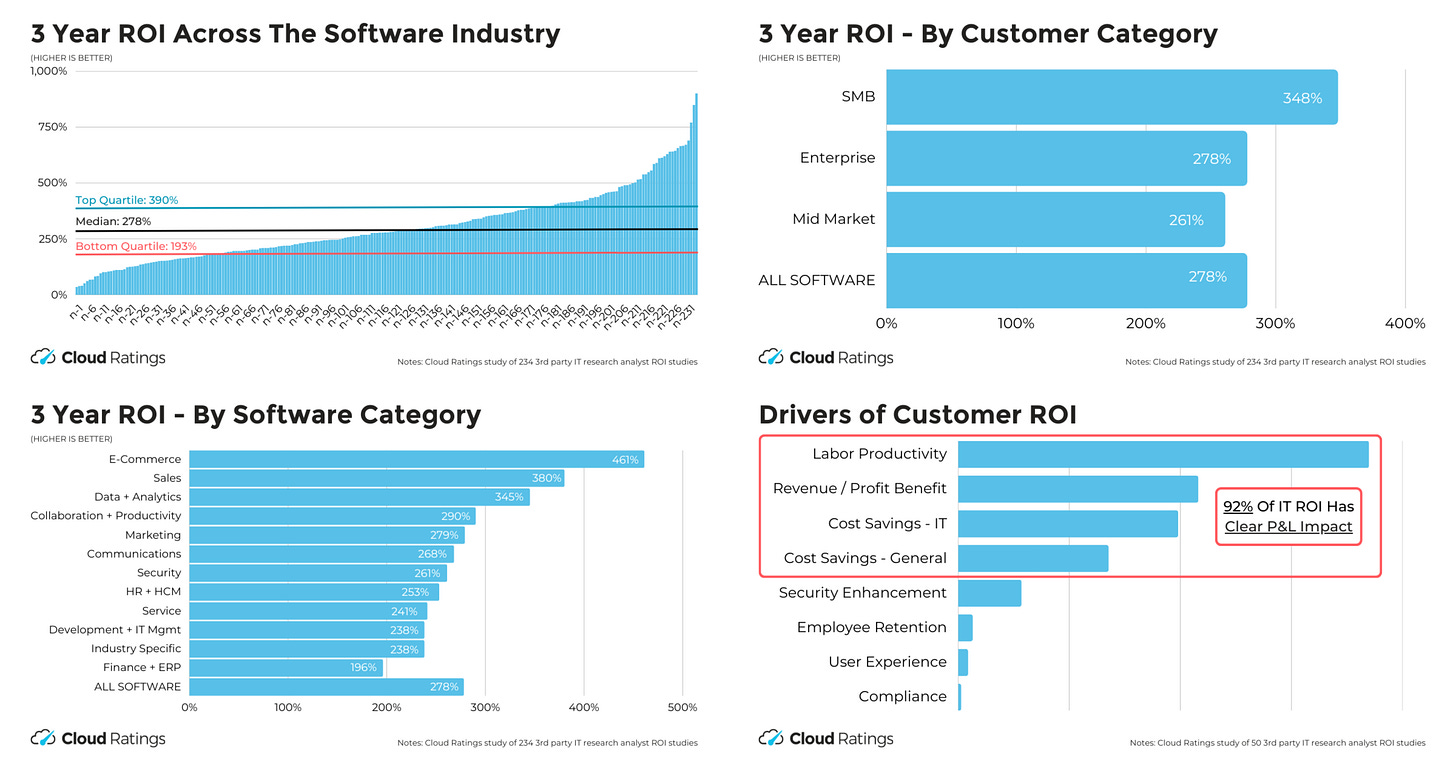

Cloud Ratings’ meta-analysis of 200+ 3rd party ROI studies is one of the only available:

“The ROI of Software + IT” - median 3-year ROI of 278%, payback of 6 months

“Drivers of Software ROI” - labor productivity is the #1 driver of customer value

The lack of ROI benchmarks makes sense:

ROI is very product and company-specific

ROI varies by customer (i.e. a larger customer gets a much bigger benefit from a fixed price suite)

A lack of metrics standardization

For mature categories, the business case is assumed to be proven with no need for doing the (not easy!) ROI homework

Generative AI requires ROI *math* due to:

Pricing: The rollout of AI features is creating price changes and challenging existing pricing models (see WSJ AI cost article below)

Skepticism Of New Technology: buyers want vendors to “show me your math” on AI productivity gains

Morgan Stanley On AI ROI

Quantified ROI is a key theme throughout Morgan Stanley’s excellent “AI Index – Mapping the $4 Trillion Enterprise Impact” (149 pages, released 10/1/2023).

Some excerpts oriented towards ROI:

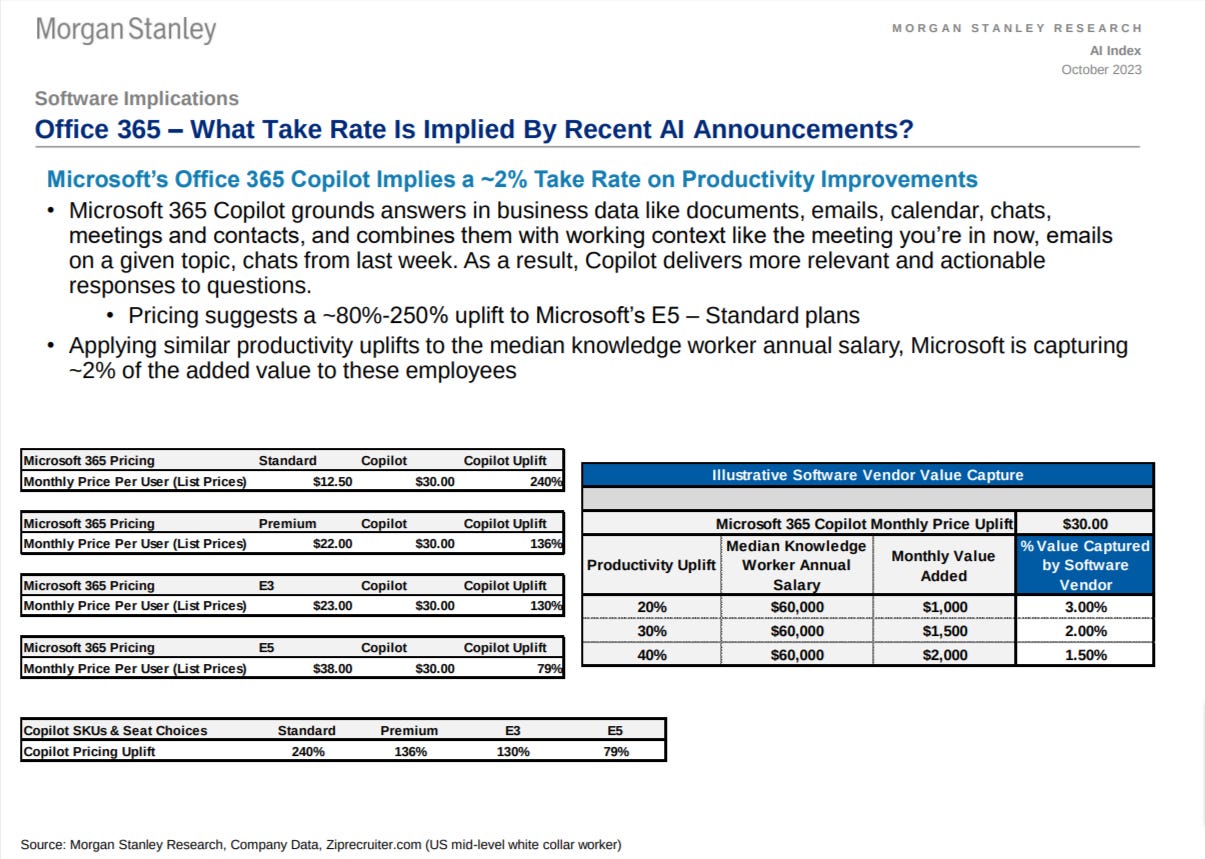

Take rates - a metrics “cousin” of ROI - makes page 1:

FYI - those adoption cases are based on precedent 3-year adoption curves: 2% for public cloud, 18% for Office 365, 28% for ServiceNow Pro

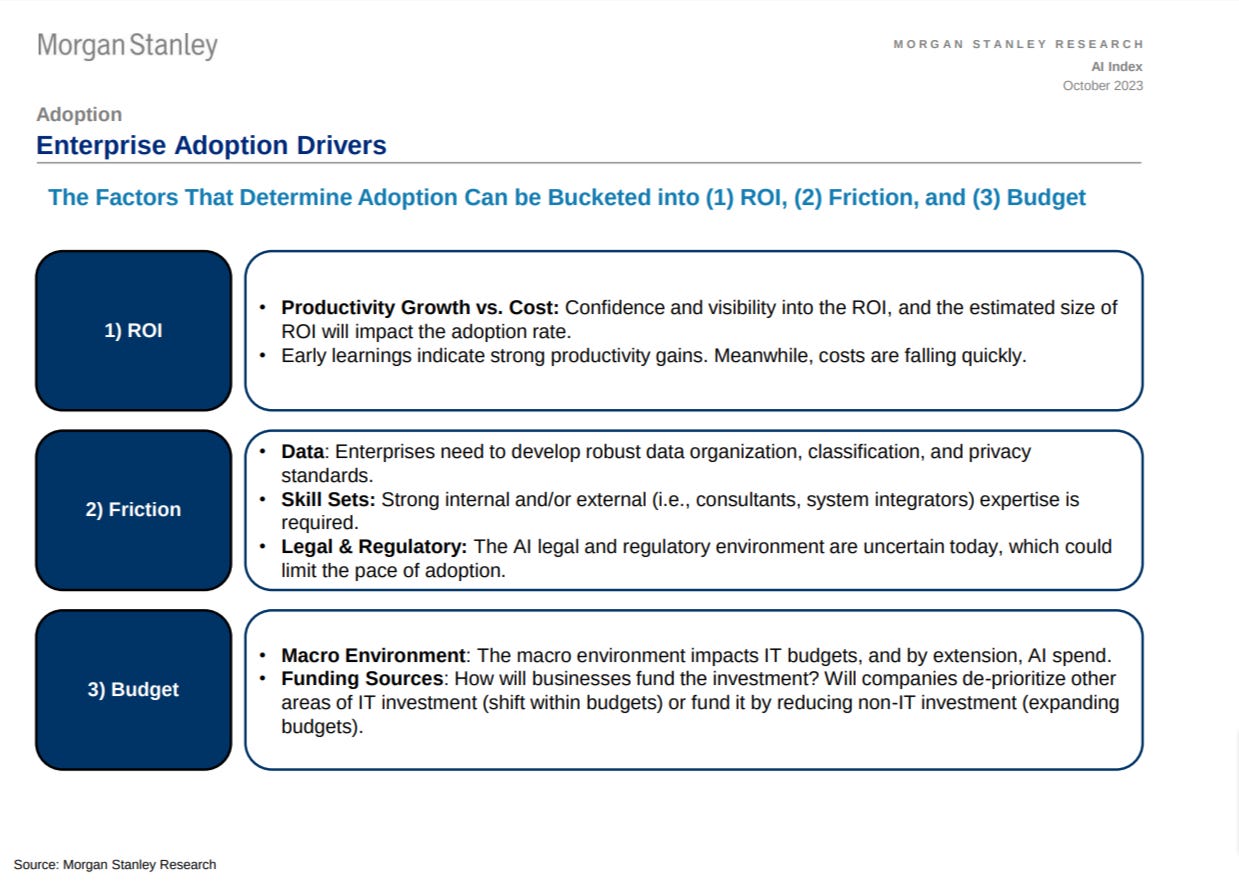

ROI is literally #1 for their enterprise adoption drivers, with “confidence” and “visibility” the operative words:

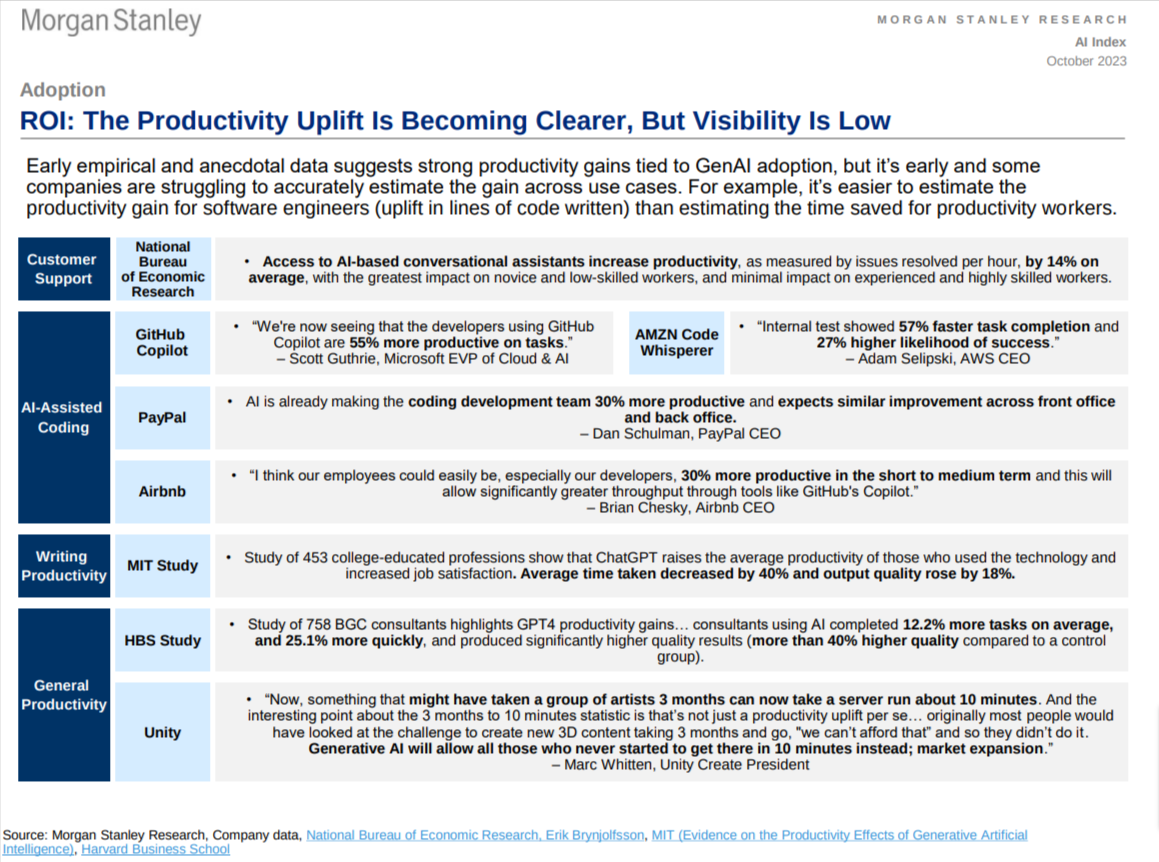

Examples to date of ROI:

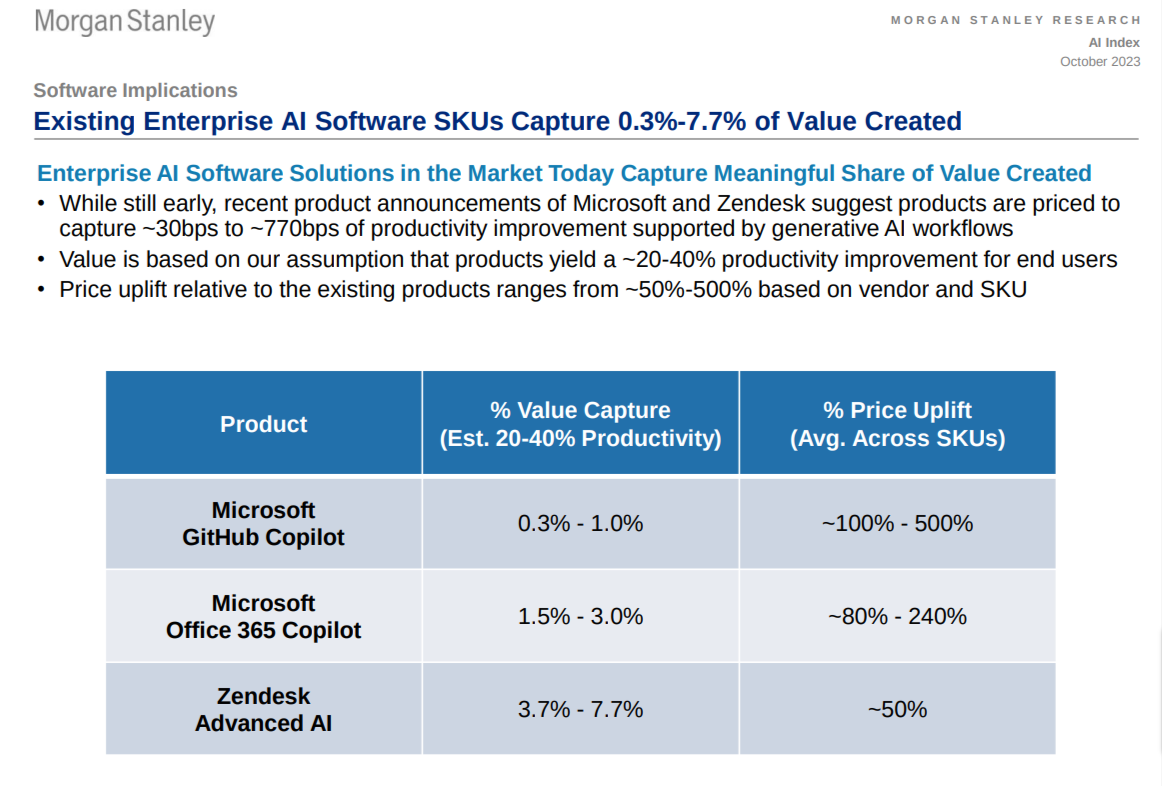

Value capture benchmarks - interestingly, the 0.3% - 1.0% value capture rate (equivalent to buyers enjoying 100x-300x annual ROIs) for GitHub CoPilot lines up with the WSJ note on its negative product gross margins → it seems very underpriced to lose money at those ROIs

Plus a sample of the granular math. Even in the initiation of coverage notes for “regular” non-AI software, this type + depth of ROI analysis is quite rare:

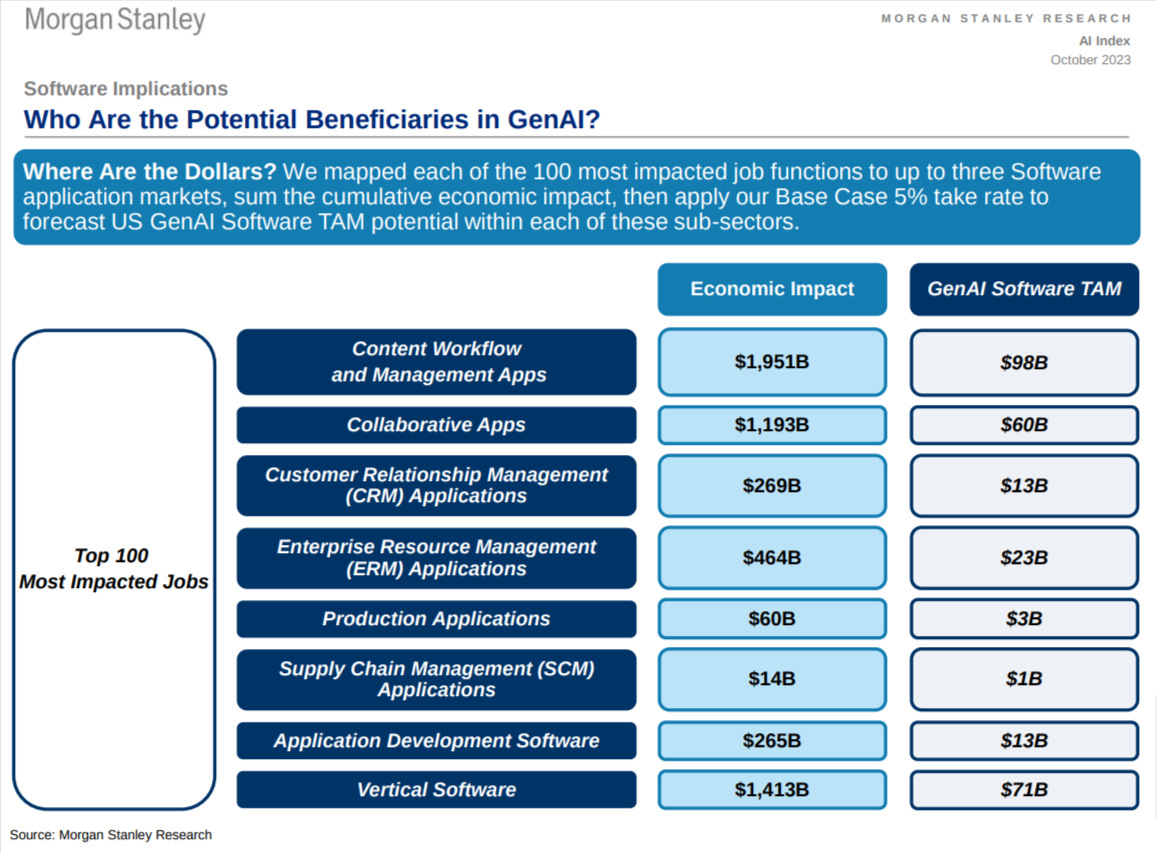

Morgan Stanley’s software TAM estimates by category. Notably, vertical software is the #2 beneficiary.

Curated Content

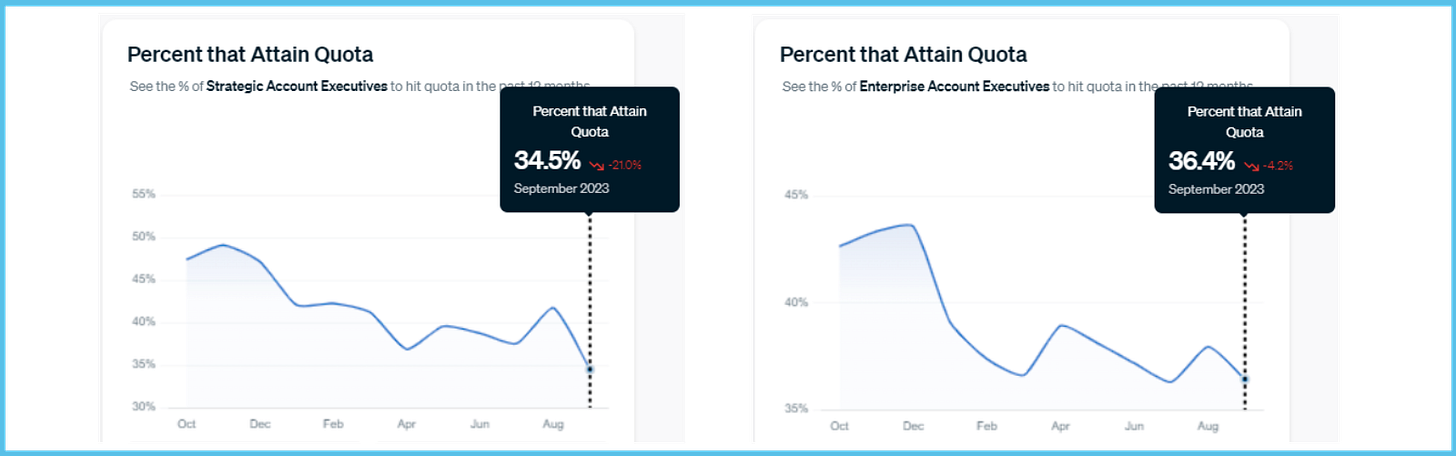

RepVue Quota Attainment Data For September 2023 = Weak - my Twitter thread; RepVue data in article format here

I enjoyed Patrick Mathieson’s “The playbook makes me nervous” on the fact many SaaS companies are run in a “paint by numbers” mentality

Reflagging my July post - “AI In Finance + Enterprise” - that had an AI ROI section

ICYMI - we aggregated SaaS benchmarks from 2009 - 2021 to create longitudinal context: Historical SaaS Benchmarks

Plus our cloud cost optimization episode with Eldar Tuvey, Founder + CEO of Vertice: