SaaSletter - COVID Lessons For AI Beneficiaries

Plus Software Equity Group, Revealera + Vertice

Defining + Sizing AI Beneficiaries

’s Tweet on Snowflake:Snowflake reminds me a little bit of Slack in COVID. You have a trend which seems like they should be massively exposed to (AI/remote work), but their exposure is more fumes than full gas. And the trend also happens to make a competitor (Teams/Databricks) in an adjacency stronger.

… gives me an opportunity to share some SaaS Demand Index-style work examining COVID-19 Beneficiaries:

*My* COVID learnings:

understanding the durability of a demand spike is critical

many companies were included in a "digital transformation" narrative... that the underlying data did not support

COVID Read Through To AI: define, really quantify, and size AI beneficiaries wisely!

Meet At B2BMX 2024?

I will be at the B2B Marketing Exchange 2024 conference in Scottsdale, Arizona from February 26-28th. Email me if you want to meet.

2023 SaaS M&A Report From Software Equity Group

Full SEG M&A report here.

Two quick highlights:

Median M&A multiple - 3.8x revenue. With a high volume of low multiple deals (drivers like runway, debt, investors 'giving up' on underperformers)

Private equity continues to represent ~60% of software M&A:

Too Many New Features, Too Much R&D?

Over-Investing In New Features? An investor rant on too much R&D for scaled / >$100m ARR software companies:

Scaled software companies spending 20%+ of revenue on R&D is insane. Products mature and need to be run like cash cows. Kill all pet projects and new product dev projects that will never amount to anything. Public software companies should be spending 10% of revenue on R&D.

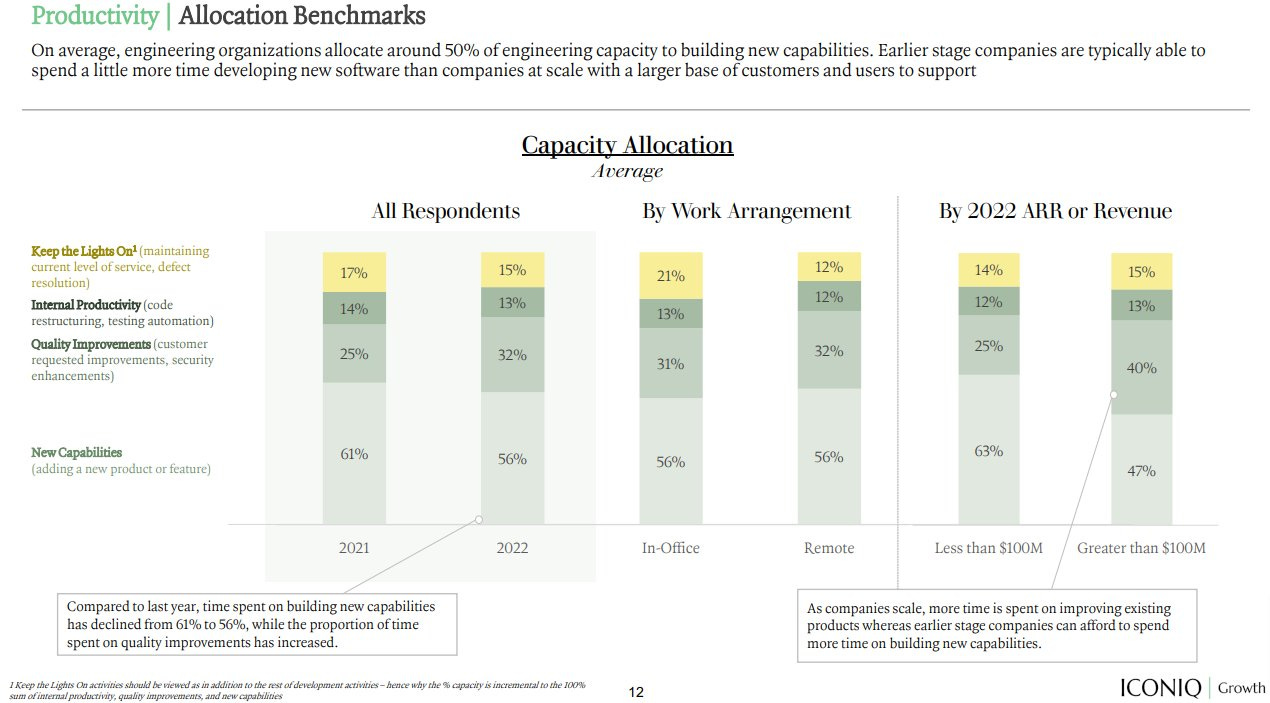

= good opportunity to call out ICONIQ Growth’s R&D mix benchmarks + *my* mechanical Rule of 40 implication:

New product capabilities should add at least 13% to your revenue growth rate; if not, growth R&D is dilutive to your Rule of 40.

More in my earlier “R&D Engineering -> Financial Engineering” post leveraging the ICONIQ R&D data.

Curated Content:

Vertice’s “2024 SaaS Inflation Index” - h/t

Revealera Job Posting Data - significant growth in sales postings by public SaaS companies → more evidence of an upturn?

“State of SaaS LatAm 2024” - 57 slides, like this CAC data (h/t Dave Kellogg)

Tidemark Vertical SaaS Benchmarks - Submit?

Tidemark and Dave Yuan are launching a vertical benchmarking series → consider taking 10 minutes to participate here: