SaaSletter - Menlo Ventures On AI

Plus Cloud Ratings B2B AI Interest Index

Menlo Ventures - “2024: The State of Generative AI in the Enterprise”

Menlo Ventures (h/t Tim Tully, Joff Redfern, Derek Xiao) released their “2024: The State of Generative AI in the Enterprise” report (n=600 IT decision makers with 50+ employees).

Some quick excerpts (which skip over good data + coverage of topics like foundation models) here:

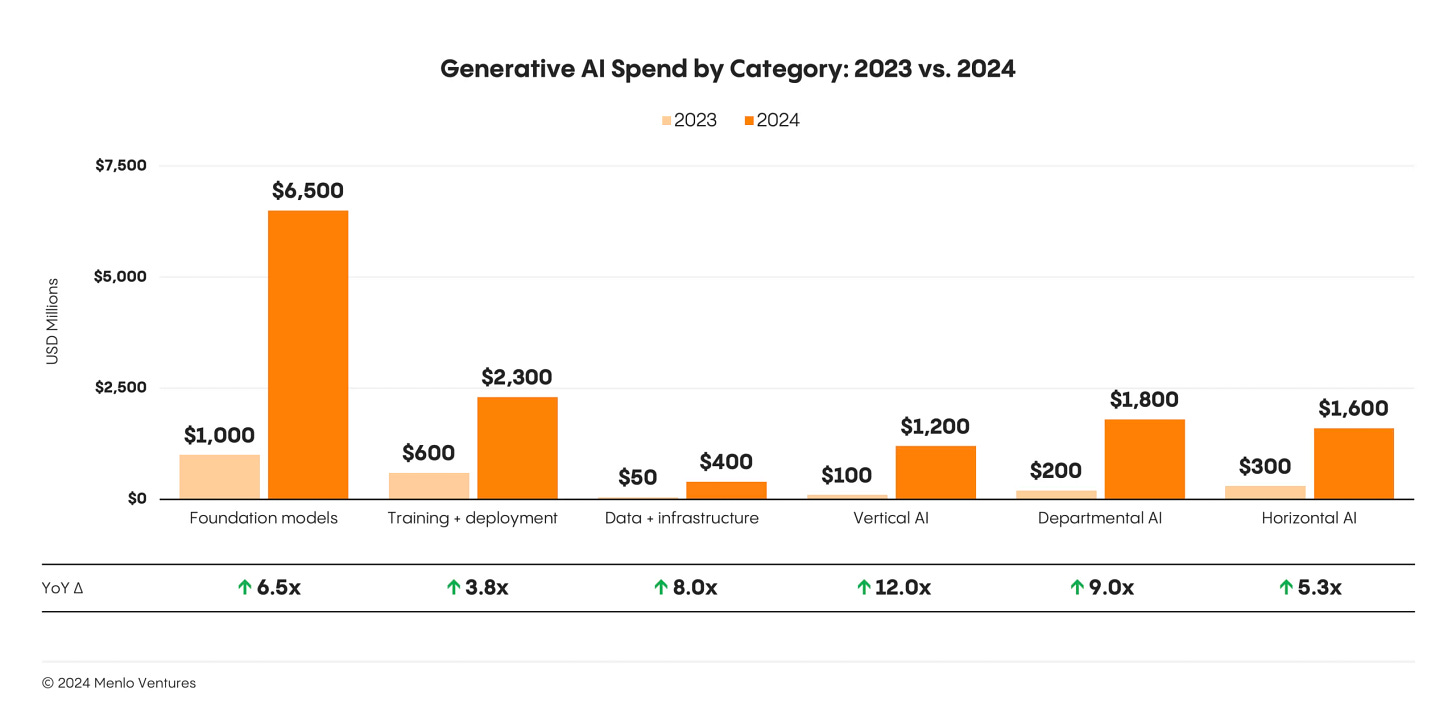

In my view, certain increases in spend are particularly bullish since they signal tangible, real-world use cases + ROI:

Vertical AI: 12x

Departmental AI: 9x

Horizontal AI: 5.3x

Said differently, further “upstream” categories (like Foundation Models, Training + Development, Data + Infrastructure) are correlated but less definitively linked to a tangible line of business ROI (i.e., you can spend money training a model… that fails in the real world).

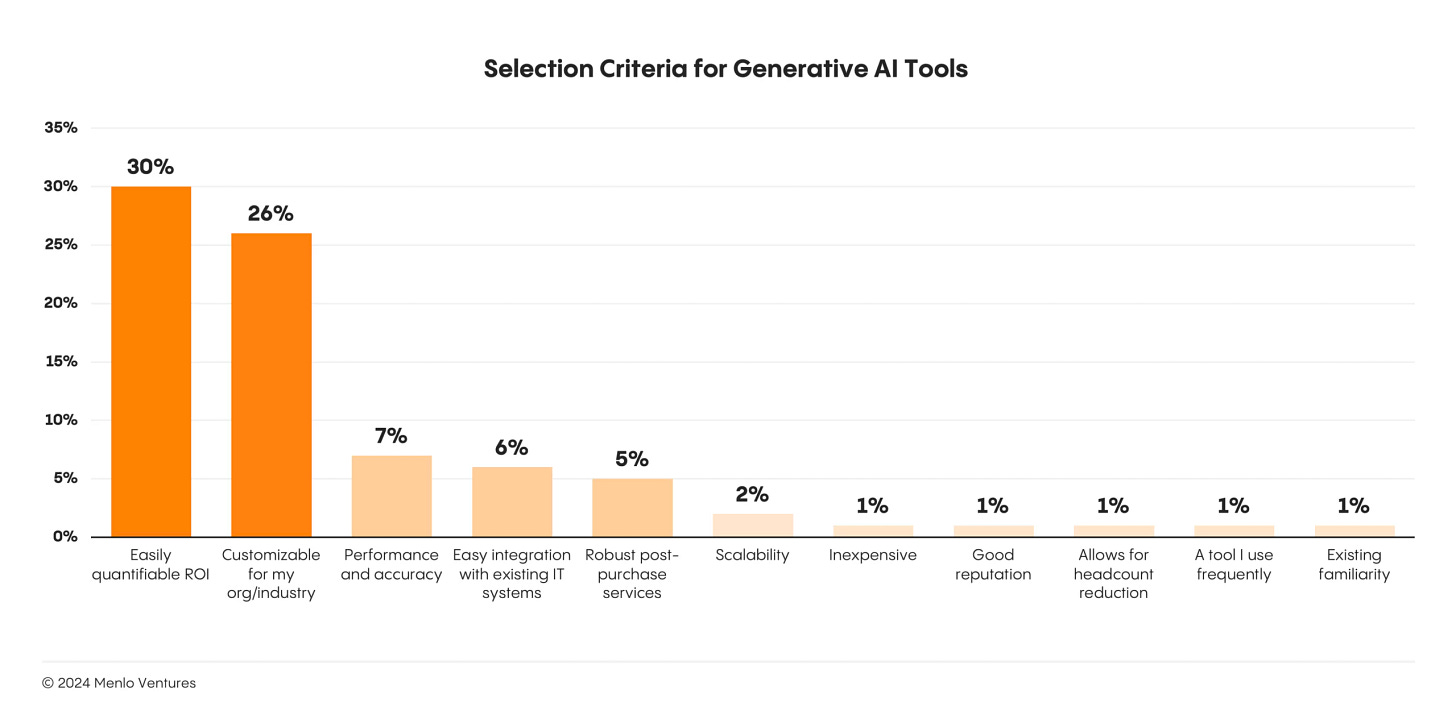

Speaking of ROI: Quantifying AI ROI is a top buyer priority:

Less visible relative to our public-facing ROI reports (example report with RELAYTO), Cloud Ratings True ROI practice area supports private value engineering engagements as a 3rd party intermediary between vendors and software buyers.

We are currently involved in multiple $7-figure ACV evaluations, all of which involve very large enterprises carefully evaluating the ROI from emerging AI vendors.

If you or your portfolio companies need ROI support and validation, please email me. I lead every engagement with the support of a former CFO.

G2’s “Reach” Conference On Dec 10th

Our partners at G2 are hosting their annual “Reach” conference on Tues, Dec 10th.

October 2024 B2B AI Interest Index from Cloud Ratings

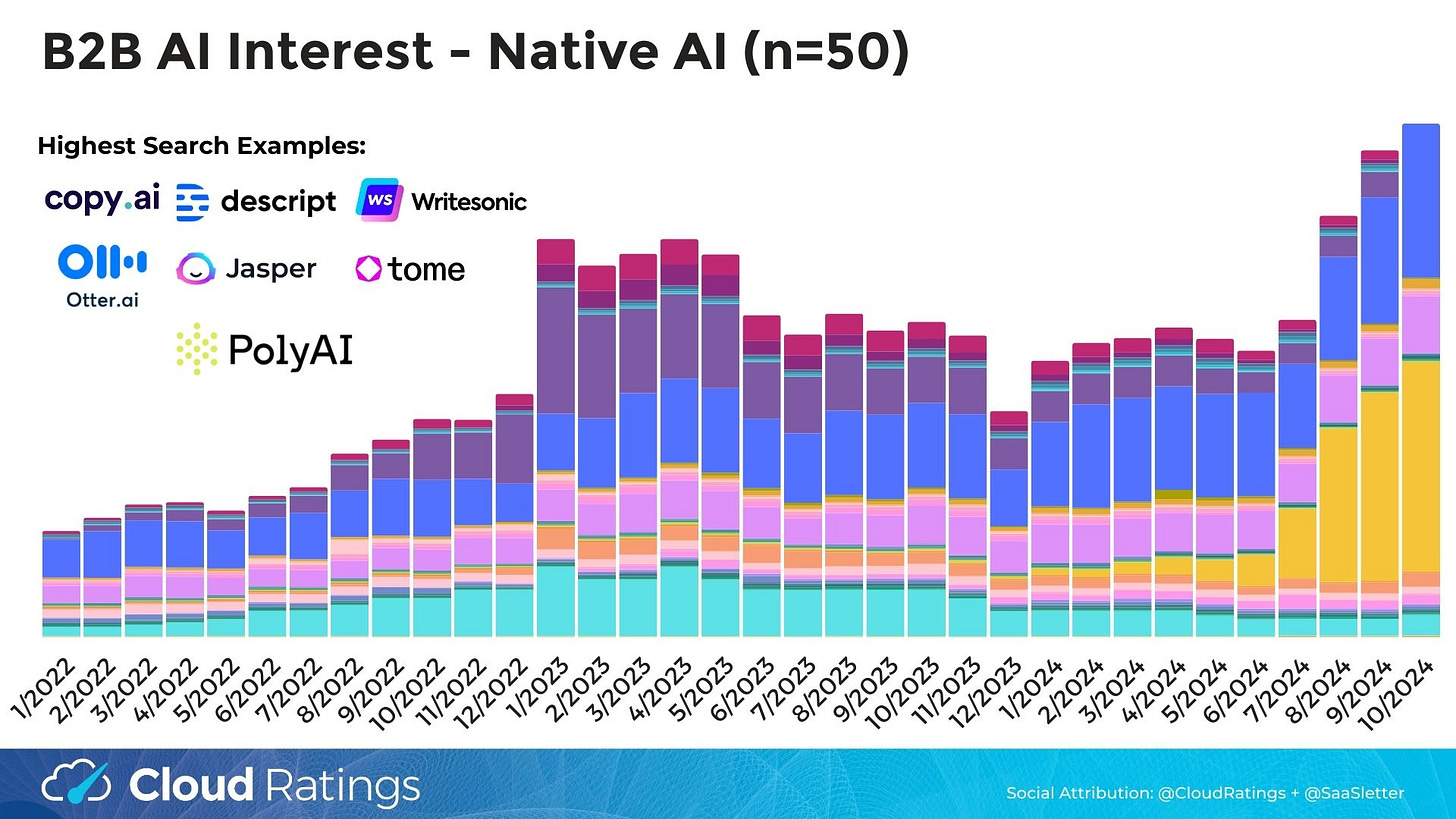

We’ve updated our B2B AI Interest Index through October 2024 - full slides below:

October marks the third consecutive month with positive B2B AI interest trends.

Thematic Category Interest (n = 47 sub-categories tracked - i.e. “manufacturing AI” or “security AI”) continued to accelerate off of a July low:

Bellwether Microsoft Copilot’s acceleration due to a Phase 2 Copilot release announcement in mid-September (ZDNet’s recap of enhancements here) continued. Other “Blue Chips” (i.e., Hubspot, ServiceNow) increased again but remained range-bound and small in absolute terms.

SaaS Incumbents (n=340, same 340 vendors tracked in our top-of-the-funnel focused, forward-looking SaaS Demand Index) had a uniquely strong month relative to their plateau-like trend:

Largely driven by continued explosive growth in PolyAI (“enterprise conversational assistants that carry on natural conversations with customers to solve their problems”; consider October PolyAI data *highly* provisional + presented on an adjusted basis for conservatism), interest in AI Native apps (n=50) increased again:

Curated AI Content

Rob Litterst and PricingSaaS.com’s “AI Pricing Benchmarks” showed AI monetization rising… though with a fair portion of AI still free.

Sapphire Ventures’ (h/t Kevin Burke + team) “AI Native Applications” included a great stat:

"By our count, there are now at least 47 AI-native applications in the market generating $25M+ in ARR vs. 34 at the beginning of the year, and we believe we will likely see an equivalent number north of $50M ARR by this time next year."

Janelle Teng - “AI's reasoning quandary” - excerpt: “As debates swirl around plateauing LLM performance, "reasoning" paradigms are hailed as the next frontier for technological & commercial growth. How much of this is genuine progress vs excessive hype?”

Recent AI Podcast With OMERS Ventures

Building on their 152-page(!) vertical AI framework report (email required), we recently debuted our episode with Marissa Moore and Taku Murahwi of OMERS Ventures

VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

About Cloud Ratings

For our many new readers, we recently announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: