SaaSletter - Office of the CFO Software Surge

Supported by data from G2 and Cloud Ratings

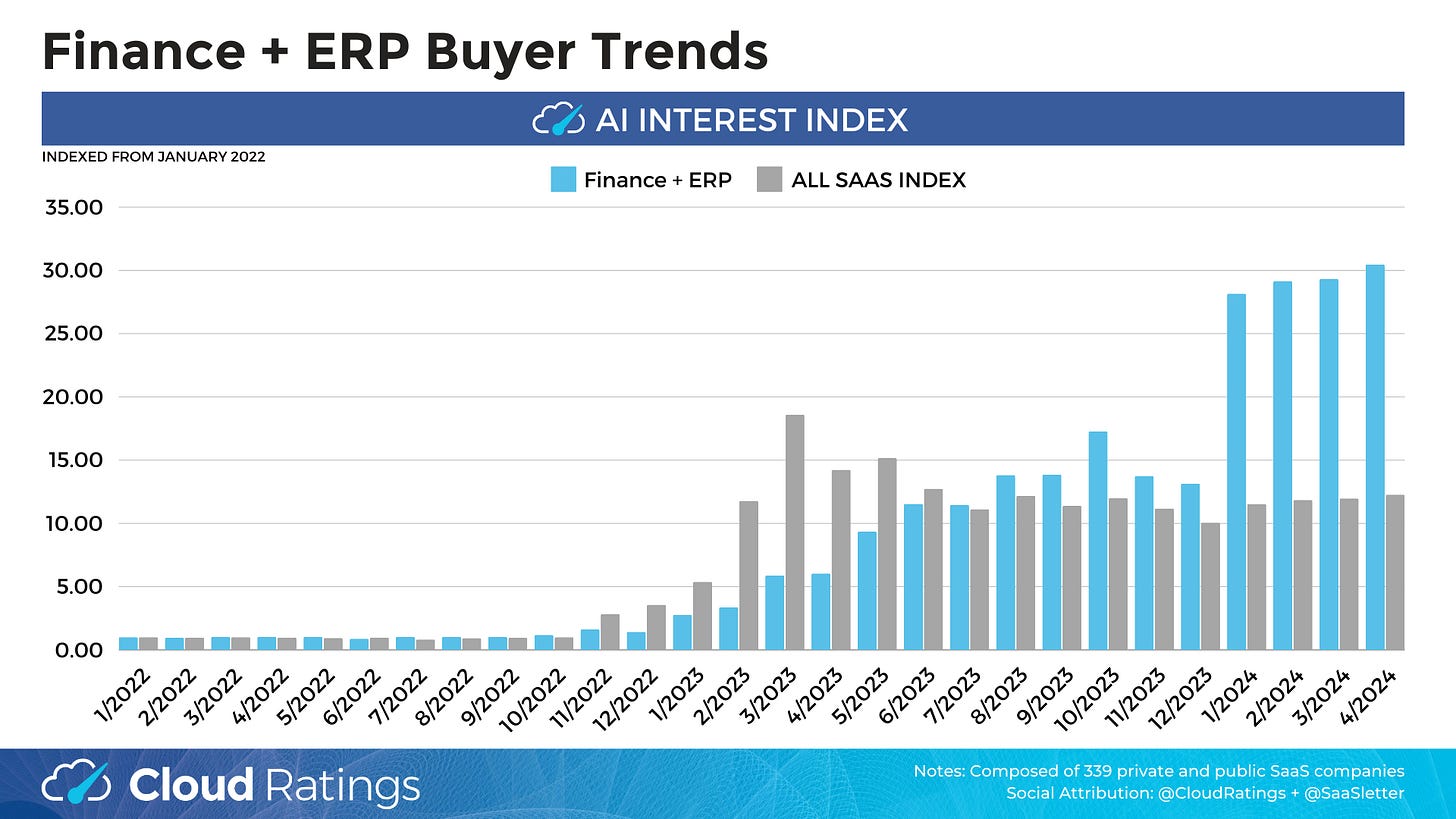

The “Finance + ERP” category has outperformed the broader software industry in our Cloud Ratings SaaS Demand Index since inception.

At least to me, the outperformance of Office Of The CFO software has been a bit surprising, enough to warrant a deeper dive.

Post SVB Failure Demand Index Surge

Built using high-intent keyword Google searches (for example, “Brex pricing”), our monthly SaaS Demand Index can quickly capture shifts in software buyer interest across 339 companies. Importantly, this approach is not impacted by sales closing cycles; search demand trends are immediate and — in our view — a useful forward indicator for the beginning of software buying journeys.

With the failure of Silicon Valley Bank (SVB) on March 10, 2023, April 2023 represented the first full month of observable “Finance + ERP” category trends in the SaaS Demand Index.

Since the failure of SVB, “Finance + ERP” software has outgrown the broader software industry every single month and by an average of +9%.

This trendline is consistent with the implications and ramifications of SVB’s failure on many companies and their finance leaders that we outlined in the “Cost Discipline Post SVB” note. Top of mind for finance leaders today:

Flexible treasury management and business operating accounts with high yields and 100% liquidity

Cash management best practices to make every dollar count amid high-cost capital markets

Tighter travel and expense controls to prevent overspending before it happens

Accounting automation products so accounting teams can do more with less

AI Demand Tailwind For Office Of The CFO Software

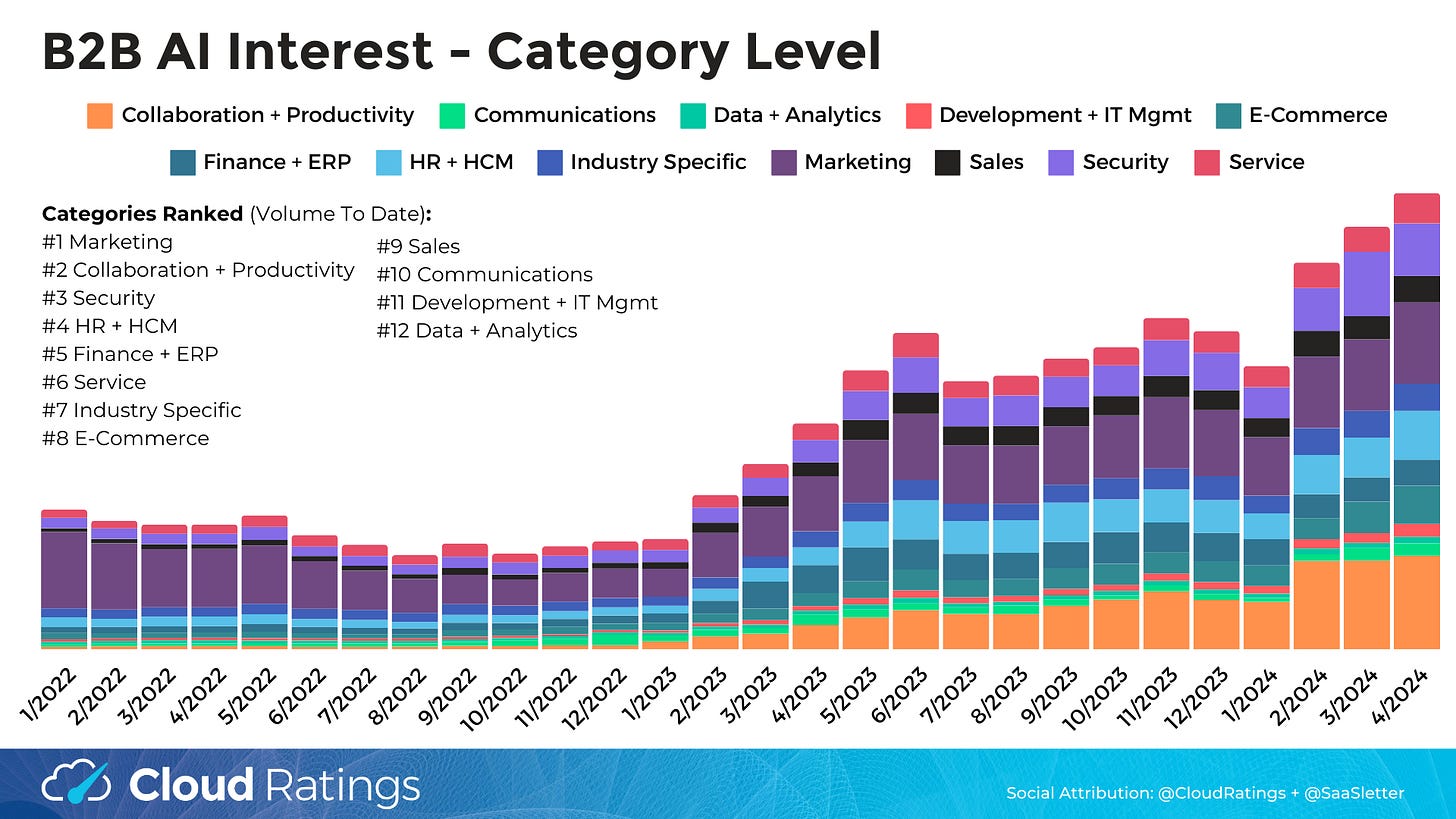

Like our SaaS Demand, Cloud Ratings B2B AI Interest Index leverages Google search data and serves as a proxy for interest in AI at the company level (for example, “Brex ai”) across 340 companies.

AI interest for Finance + ERP software has been striking at the company level: up by 30x compared to a pre-ChatGPT baseline.

While demand for AI features from other categories’ incumbent vendors is up 11x, the demand has been far less durable. Interest peaked in March 2023 during a wave of AI feature rollouts, then declined to a plateau of 36% below peak. In our AI coverage, we’ve noted concern: “if new AI features were wildly popular and generating word-of-mouth buzz from happy early adopters, volumes would be more stable, if not accelerating.”

By that logic, the consistent AI interest growth for Finance + ERP software suggests positive initial results and word-of-mouth buzz.

In addition to capturing company-level trends, the B2B AI Interest Index tracks at the thematic category level (for example, “ai expense management” and “ai in fp&a”).

Again, interest levels for “Office Of The CFO” AI have been healthy: up 4.4x (versus 1.9x for all software) against a pre-ChatGPT baseline.

Positive Adoption Trends

For better or worse, these Cloud Ratings indices only capture top-of-the-funnel interest, but not installations or adoption.

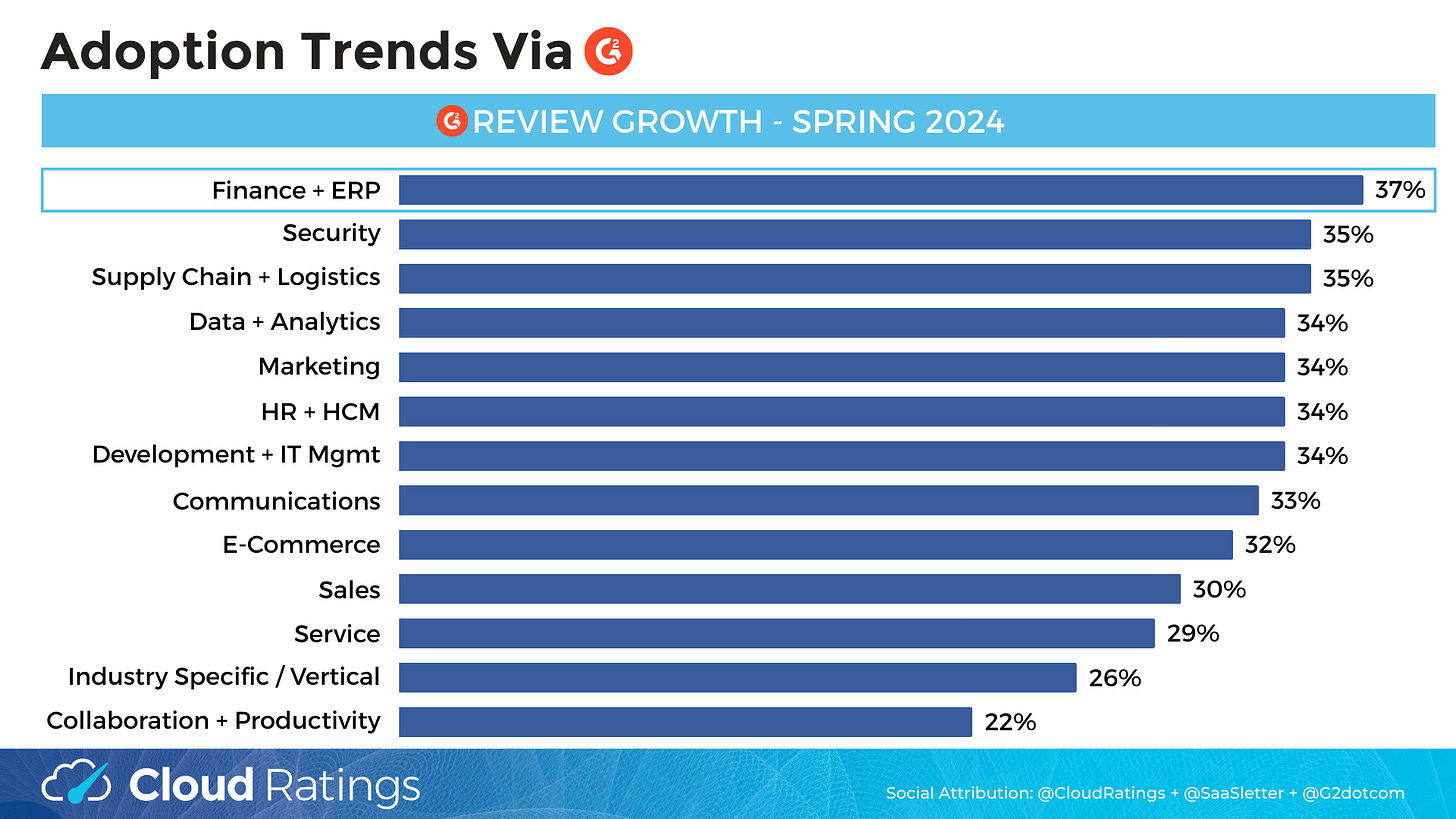

Thanks to our partners at G2, we reviewed adoption trends for Finance + ERP software by examining review growth over the past year.

In terms of adoption, Office Of The CFO software outperformed again as the #1 category:

Expert Perspectives

“Finance teams feel more empowered than ever to responsibly manage spend in today’s environment. And with efficiency in focus, leaders want better data and insight to manage spend. To accomplish this, finance teams are adding and up-leveling their tech stacks.” — OnlyCFO

“We’re already seeing that some early adopters are considering phasing out AI finance and ERP tools due to unmet expectations. It can be that the reality of some of these tools doesn’t match the sales pitch, or they are simply not offering positive ROI. The security risk of AI software is also a key concern for finance teams, as AI models need to run on proprietary data to be truly effective.

With cost reduction remaining a high priority for CFOs, we are entering a phase of ‘stack overhaul’, where CFOs are inclined to boot out the legacy solutions in favor of more cost-effective platform players with a broader span of functionality. But CFOs do need to be cautious, as consolidating now to cut costs can lead to significant price increases in a year or two as these broader suppliers become increasingly indispensable and entrenched, and therefore more difficult to replace. Balancing immediate savings with long-term flexibility is crucial.” — Nick Riley, Global Head of Purchasing at Vertice

Brex Perspective

Given the high cost of capital, finance leaders aren’t getting sucked into the “growth at all costs” mindset. Today’s marching orders are balancing costs with growth. So the Office of the CFO is leaning more on software to help, specifically AI-powered solutions, to help them rein in manual processes, better track every dollar, and do more with less — especially given the ongoing accountant shortage.

One specific area of interest is AI in accounts payable (AP). The benefits of automated document generation, expedited invoices and purchase orders, and streamlined reviews and reconciliation are wooing finance and accounts payable leaders. AP teams get more time for higher-impact work, and they also get to optimize how they fund those payments — ACH, check, wire from any bank account, and even virtual cards.

“We’re seeing tremendous adoption by AP teams in high cost of goods sold industries, where payments for product and materials as well as large AWS, UPS, and Salesforce licensing bills are made using a Brex card and funnel right into our expense management software,” said Ben Gammell, CFO at Brex. “Our customers value the bill pay automation and controls to eliminate out-of-policy AP spend, the ERP automation and reconciliation, and the rewards on such high-volume spend, which can be a meaningful revenue stream.”

This post was written in collaboration with Brex and will also be published on Brex Journal.

CFO-Centric Podcasts

For our new CFO + finance function readers, I wanted to highlight some past “Cloud Radio” episodes you might particularly enjoy:

CJ Gustafson - “A SaaS CFO’s Atomic Metrics”

Eldar Tuvey, Founder + CEO of Vertice - “Cutting Cloud Costs”

Ashley Acosta, Founder + CEO of Maca - “SaaS Pricing: Fixing The Leaks”

Ben Schaechter, Co-founder + CEO of Vantage - “Cloud Cost Optimization Explained”