SaaSletter - SaaS Pricing In 2023

Plus a new SaaS Employment Index + curated content

State of B2B SaaS Pricing 2023 - Price Intelligently

Price Intelligently’s “State of B2B SaaS Pricing 2023” report featured rare + meaningful data on pricing strategies, specifically the low share of value-based pricing:

In fact, value-based pricing is the least common strategy through $99m of ARR.

Why does this matter?

Value-based pricing / selling allow software vendors to share in their products value creation at high (~80%+) incremental margins.

These incremental profits can be a critical and rare driver of capital efficiency.

The typical large scale of vendors using 3rd party ROI studies - a proxy for value selling - in their go-to-market aligns with Price Intelligently’s data - large vendors are disproportionately likely to employ value-based strategies:

Source: Cloud Ratings ROI of Software Study (n = 234 software vendors) → Cloud Ratings will be offering its own commissioned 3rd party ROI service - “True ROI” reports - click here to learn more:

A SaaS Pricing Podcast

Our recent episode with Ashley Acosta, Founder and CEO of Maca (just emerged from stealth mode; has delivered strong paybacks for Series B+ initial software customer base) is very on topic: Maca is “the first operating system for value-based pricing.”

Subscribe To “Cloud Radio” On: Spotify | Apple Podcasts | All Other Platforms

SaaS Employment Index

We recently published our September 2023 edition of the SaaS Employment Index, which covers headcount changes for 3,500+ private software companies.

Summary (vs Prior Editions):

Layoffs: significant deceleration

Hiring: no real uptick

*Sales* only (slides 6-7):

Layoffs: down (but no clear patterns by size or stage)

Hiring: strong in 500+ & Private Equity; little change elsewhere

*Marketing* only (slides 4-5):

Layoffs: deceleration in layoffs most apparent in 50+ employees

Hiring: down slightly

G2 Report Implies Negative SaaS Same Store Sales

G2’s “State of Software”1 contained a concerning but not that surprising statistic: B2B software listings are growing at 28% annually.

Gartner estimates SaaS spending will grow 18% in 2023, so we have Demand at +18%.

And G2’s data shows Supply growing at +28%

This “kind of” implies negative 10% SaaS Same Store Sales.

“Kind of” because new G2 listings (i.e. a seed stage app on their category page 3) have tiny market share + revenue. Additionally, G2’s own growth/popularity certainly contributes to this +28% Supply proxy.

Nonetheless, Supply outstripping Demand is a good Rorschach test for your views on the long-term health of the SaaS industry.

Curated Content

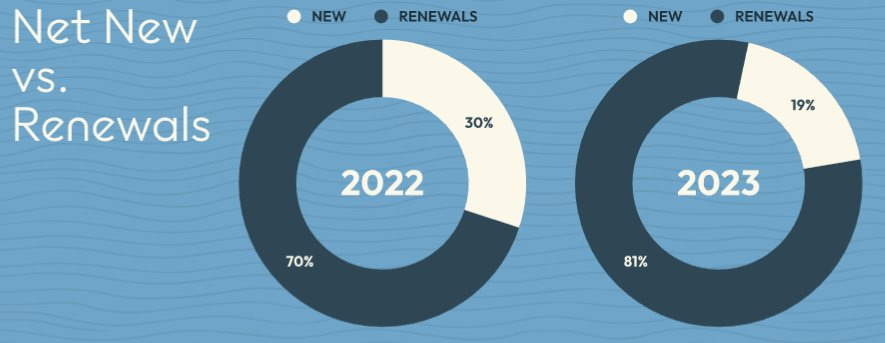

Vendr’s latest report offered yet another confirmation of the challenging net new sales environment (net new sales mix down to 19% from 30%) - my highlights threaded here, plus OnlyCFO’s report commentary + Vendr CEO interview here

I am a fan of Jared Sleeper’s new equity risk premium equivalent for SaaS - shown above + more on his methodology here

As I seemingly pivot this newsletter from SaaSletter to AIletter, flagging:

Ardent VC’s “Automating the Unstructured: The ROI of LLMs in Enterprise SaaS”

and Madrona’s Aspiring for Intelligence deep dive into Open Source Language Models

Finally, from (very under-followed!) @AmendandPretend:

Interestingly, G2’s report showed Demo Automation as their fastest-growing category by traffic. This is consistent with the outsized traffic to Cloud Ratings’ Demo Automation Software category report. The real point here = be patient → this category has been around for a while (a leading vendor, Consensus was founded in 2013) and is finally *really* inflecting upward.