SaaSletter - Be So Good They Can't Ignore You

Plus multi-product penetration data + curated content

The Software Branding Catch-22

The importance of brand stood out in a recent buyer behavior report from TrustRadius + Pavilion (n = 2,164 tech buyers):

Most short lists (63%) include two to three products and 96% include five or less. When selecting a product, 66% of buyers report leaning toward established, leading products—far outranking niche (19%) or new (11%) products.

Of buyers creating short lists, 78% reported selecting products they had heard of before even starting the research process. That number was even higher for enterprise buyers at 86%. It’s no wonder top-of-mind brands seemingly edge out niche or new products early in the selection process.

Once the short list was created, 71% of buyers reported going with the product that was their first choice; only 12% went with a different choice.

This reminded me of Dave Kellogg’s “Practical Thoughts on Branding for Software Startups”:

Do you want to build a brand? Go sell some software.

Want to improve your brand perception? Go sell some software.

Want to have a distinctive brand visual territory? Go sell some software. You see the pattern.

If software buyers need you to have a brand before purchasing + the only way to build a brand is by selling software, you are left with a gnarly Catch-22 for early stage software companies.

Be So Good They Can’t Ignore You

So, how do you break out of this branding/buying Catch-22?

Follow comedian Steve Martin’s advice: “Be So Good They Can’t Ignore You”:

In the last five minutes of the interview, Rose asks Martin his advice for aspiring performers.

“Nobody ever takes note of [my advice], because it’s not the answer they wanted to hear,” Martin said. “What they want to hear is ‘Here’s how you get an agent, here’s how you write a script,’ . . . but I always say, ‘Be so good they can’t ignore you.’ ”

In response to Rose’s trademark ambiguous grunt, Martin defended his advice: “If somebody’s thinking, ‘How can I be really good?’ people are going to come to you.”

Our primary research with G2 (n= 4,222 software companies) on the drivers of software NPS quanitifies what “being so good” requires of an early-stage software company:

Go achieve an NPS 20% better than your competitors.

The good news: this 20% NPS outperformance can be achieved by stacking smaller ~5% user experience advantages:

Even more good news: Across 50+ regressions, 6 factors showed a statistically meaningful correlation with Net Promoter Scores (NPS):

Quality of Support

Meets Requirements

Ease of Doing Business

Ease of Use

Ease of Set Up

Product Direction

Winning on these dimensions - like going “above and beyond” on customer support - is very achievable for early-stage software companies:

“Meets Requirements” was given a “Somewhat Achievable” rating due to the nature of enterprise requirements (i.e. integrations across many applications; addresses “corner cases”) that are hard for an early-stage company to solve (you can only do and build so much!).

As always, caveats apply. For example, the interests of decision makers can diverge from those of day to day users, so NPS itself might not lead to commercial success. Fun fact: SAP is currently guiding to an NPS range of 9-13… but has a ~$240b market cap.

47% Of Buyers Want More ROI Proof

Another notable stat from the TrustRadius / Pavilion buyer report:

When we segmented out buyer data for enterprise purchase prices, the wish for “calculating ROI to be easier” rose a staggering 16%, placing it in the top two things buyers wished were different about tech buying.

Enterprise purchase price top five were:

• I wish all vendors had transparent pricing: 51%

• I wish calculating ROI were easier so I could get the budget approved: 47%

• I wish vendors would stop contacting me when I’m not ready to talk: 44%

• I wish I could easily talk to people like me who have experience with the product: 42%. …

Want To Better Serve These/Your Buyers and Prove ROI?

Answer: Add third-party analyst validation of your ROI to your sales + marketing mix with Cloud Ratings True ROI:

Multi Product Penetration Rates

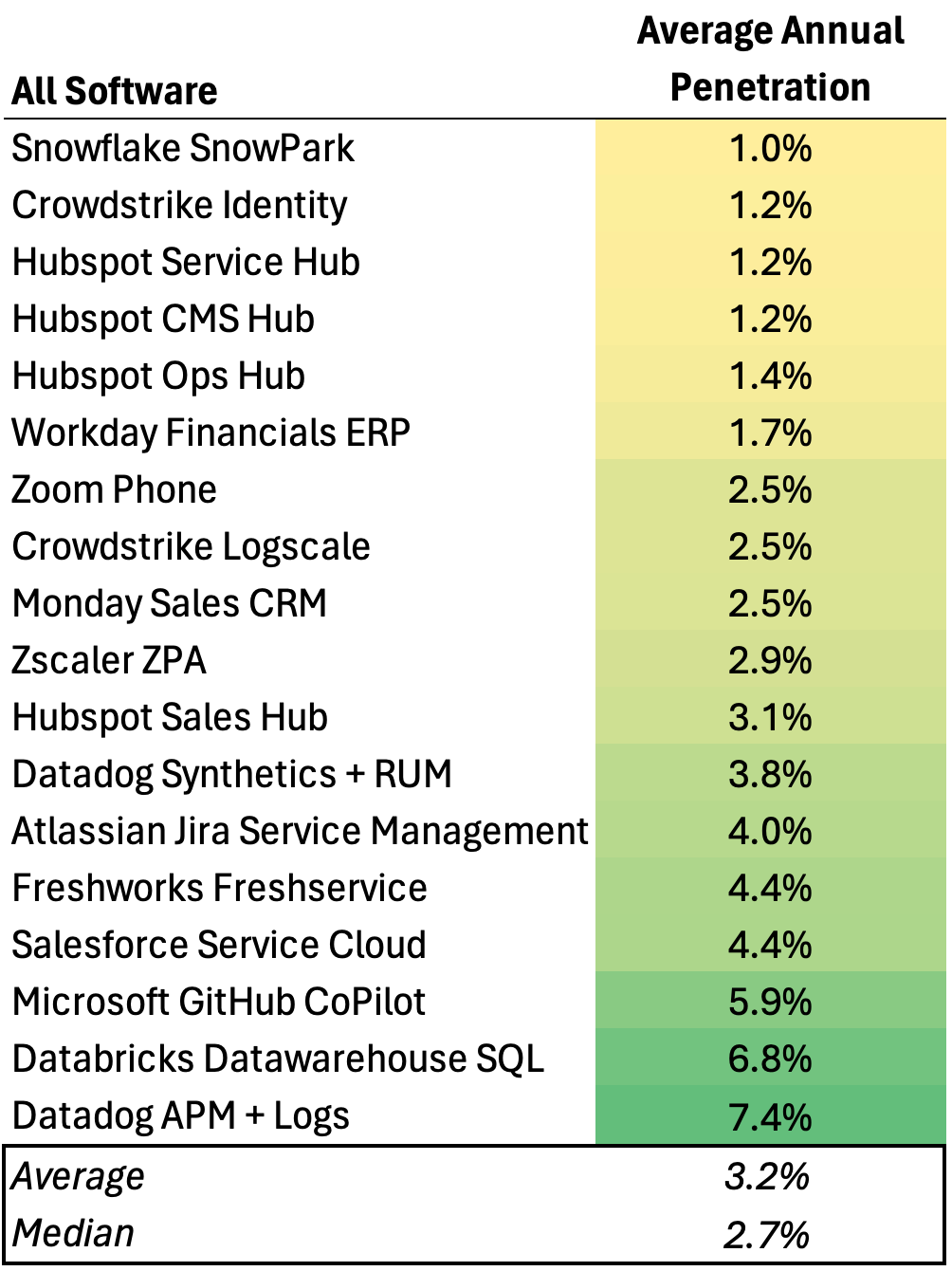

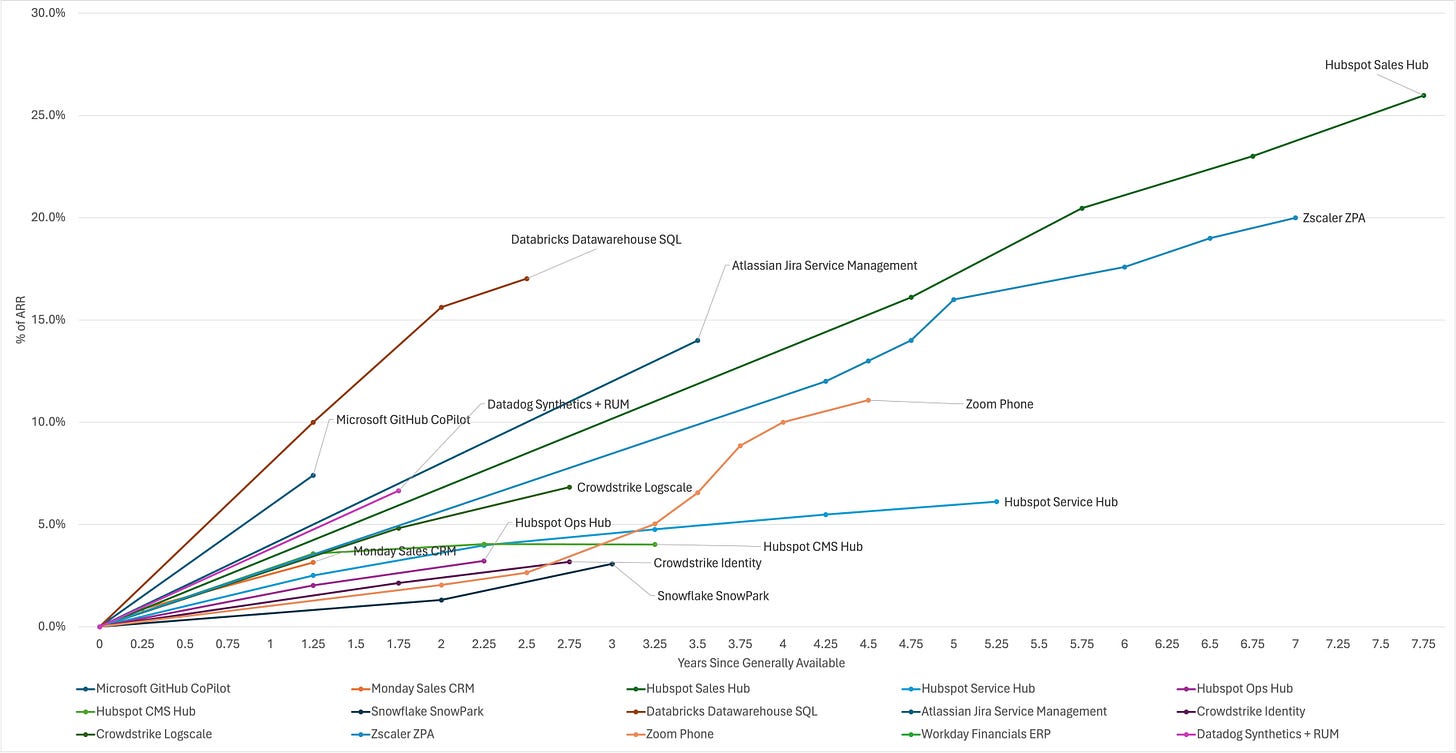

In our “Platforms vs Pure Plays” (aka platforms vs point solutions) primary research in partnership with G2, the durability and consistency of additional product penetration was a key theme:

In our accompanying research slides, we include *some* examples from public company disclosures (like Crowdstrike, Toast, and Datadog below):

Assembling these gave me a real appreciation of the *very* hard work entailed in Chips Ahoy Capital’s comprehensive and must-bookmark study: “Benchmarking Multi Product Penetration in Software”:

Curated Content

In contrast to his January 2023 “Mass Extinction” take, “It’s Time for Startups to ‘Get Responsibly Aggressive’” - via Tom Loverro, Partner at IVP:

“It’s OK to be on offense and burn again. You don’t need to be clutching your pearls and being nervous about building,” Loverro said. “People were spending like drunken sailors” during the zero-interest-rate era, he added. “It was, ‘Can we do more? Can we spend more?’…Now I think people have probably even overcorrected.”

“Winning Software Budgets in 2024” - via OnlyCFO

“The AI Plateau Is Real — How We Jump To The Next Breakthrough” - via Gordon Ritter and Wendy Lu from Emergence Capital

“SaaS Perspectives” - via my appearance on Bowery Capital’s new blog interview series

ChartMogul SaaS Benchmarks Through June 30th - via Sofia Faustino from ChartMogul

About Cloud Ratings

In case you missed it, we recently announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants, this newsletter, our podcasts, and our True ROI practice area all fit within our modern analyst firm: