SaaSletter - Coatue on AI -> SaaS Read Throughs

How Much Will AI Hurt Gross Margins?

Coatue’s “The AI Revolution”

Coatue’s (specifically Sri Viswanath, Vibhor Khanna, and Yijia Lianghe) 115 slide deck on AI was truly excellent. And hopefully, Coatue’s work does not get lost in the Sam Altman / OpenAI palace intrigue.

Their slide deck is available on Newcomer (a great newsletter!): “The AI Revolution”

Given the 115-page length and level of depth into certain areas of AI beyond my expertise, I wanted to focus this edition on the SaaS-specific takeaways of the Coatue AI thesis while weaving in some other AI data points.

An interesting zoom out to review value creation/capture in the cloud cycle: SaaS Apps represent 40% of the revenue pool (62% when including PaaS like Snowflake + Confluent that are often treated as SaaS - i.e. public market comp sheets)

Possibly encouraging for investors and operators in SaaS incumbents, AI apps have “only” received 17% of AI investment dollars. Or 17% could (also) imply a long runway of for future investment to compete with incumbents.

Enterprise Adoption of AI: The 65%:61% ratio of “AI-powered features for existing products” vs “New AI products” should be somewhat concerning for SaaS incumbents. Somewhat due to greater adoption completion vs AI-natives largely in POC stages.

My personal reminder from these increasingly vertical AI capability trendlines → when experiencing mediocre results with an AI tool today, be wary of extrapolating to skepticism → that tool might be exponentially better in 12 or 24 months.

This customer service case AI results study: Faster (45x!) + Better + Cheaper (20x!) = a reminder AI ROIs might far outpace typical software ROIs (via Cloud Ratings ROI meta-research):

AI + Software Gross Margins: Existential Problem?

Concerns over AI’s impact on software gross margins have existed for some time. In 2020, Martin Casado and Matt Bornstein from Andreessen Horowitz wrote:

Anecdotally, we have seen a surprisingly consistent pattern in the financial data of AI companies, with gross margins often in the 50-60% range – well below the 60-80%+ benchmark for comparable SaaS businesses. Early-stage private capital can hide these inefficiencies in the short term, especially as some investors push for growth over profitability. It’s not clear, though, that any amount of long-term product or go-to-market (GTM) optimization can completely solve the issue.

Beyond Coatue, these recent data points help show the how + why of lower gross margins:

$1 per automation “rule of thumb” via Jason Lemkin:

And more granularly at the query level, the variances in Tomasz Tunguz’s graph are simultaneously:

encouraging: <$0.07 costs per query for “last” generation models like GPT-3.5 Turbo likely leads to completed automations (even assuming ten short queries) below Lemkin’s $1.00 estimate. Caveat: an 8,000 token context window might produce bad results and an incomplete automation

concerning: $0.87-$0.94 costs per query for newer AI models (OpenAI’s GPT-4 Turbo and Anthropic’s Claude 2) suggest many B2B SaaS-grade automations would cost more than Lemkin’s $1.00 estimate.

Of course, SaaS vendors are unlikely to give away new AI features for free - if priced appropriately, gross margin compression could be a non-issue. Interestingly, given the outlier customer ROIs AI can generate, if priced appropriately (i.e. value-selling methods employed), AI could generate higher gross margins.

Disruptive technologies can disrupt market structures:

Subsidized by VC dollars, will AI natives underprice?

Aided by GitHub CoPilot type developer productivity gains today - let alone “natural language programming as soon as 2024” shown above - will there be an excess supply of AI apps that force software prices down?

Will certain categories map poorly to sufficiently charging for varying compute consumption? Speculative examples:

Where outliers (but not removable by “fair use” levels) drag down gross margins?

Categories where AI pricing and packaging just don’t work - i.e. customers balking and annoyed at buying “500 AI credits” → instead, customers want a fixed price that puts vendors at risk for compute overages.

Some quick math1 on theoretical impacts of gross margin compression from 75% Pre-AI to 55% Post-AI:

LTV/CAC: 3.60x → 2.64x (27% decrease). This is meaningful with a 3.0x LTV/CAC often considered a minimum for financing.

Rule of 40: Meritech’s public SaaS comps show a mean Ro40 of 27% - and this is for the best of the best. All else equal, at a 55% gross margin, Ro40 would decrease to 7%. 7% Ro40 SaaS businesses shouldn’t be worth much. Meritech data for the sub-7% bears that out:

Median EV/Revenue: 2.1x

Median Multiple of Money Post IPO: 0.6x (down 40%)

Below 60% Gross Margin Examples: Using Meritech data, the few public SaaS companies (n = 9) with gross margins below 60% show a:

Median EV/Revenue: 3.3x

Median Multiple of Money Post IPO: 1.0x (flat)

Shopify Outlier - Shopify has returned 36x since its IPO with 50% gross margins (a function of their lower-margin payment revenue stream). It’s debatable how comparable payments and generative AI are.

At 2x-3x revenue multiples, most of the SaaS capital cycle breaks down.

There is probabilistically zero economic incentive to start, join, or invest in an early-stage software company if - after completing the arduous, long, and talent-intensive journey to a meaningful ARR level - you exit for 2x-3x revenue!

A few other implications of ~55% type gross margins: a much different + disciplined approach to operating expenses → fewer offsites, smaller event sponsorship budgets, leaner teams, lower salaries, and so on.

Copying the incomparable xkcd comic, a summarizing meme on the importance of gross margins:

AI + Software Gross Margins: Encouraging Slides

Now, back to Coatue and their AI slides that are encouraging regarding AI + gross margins.

AI revenue can/should offset AI COGS.

Massive decreases in costs are encouraging:

This is beyond my AI circle of competence… but a pruned data set (30% in size) yielding equivalent results could lead to lower model training costs = a positive for margins (TBD whether on COGS or R&D line though):

Very importantly, the strong performance of open-source models is encouraging for incumbent SaaS vendors that add AI features (more on open source in my prior note):

A SaaS Security + Modeling Bootcamp

Two friends of the newsletter - Thomas Robb + Francis Odum - are hosting a bootcamp. Here’s their pitch in their own words:

30% Off: ONE week left -- Live Cohort Starts 11/27

Thomas and Francis are hosting their THIRD cohort of the Cybersecurity x SaaS Bootcamp! Join top SaaS operators, investors, founders, and VCs to learn, engage, and network with each other.

Cybersecurity Industry Overview: In-depth analysis into cybersecurity frameworks, including cloud, endpoint, and network security. We also dive into Crowdstrike, Palo Alto Networks and many startups.

SaaS Metrics and Modeling: Dive into Key SaaS Metrics (ACV, ARR NRR), Billings vs. Bookings, and FCF margins. We provide detailed financial models of top SaaS companies and the basics of how to model them.

Top Tier Guest Speakers (Note: this cohort's guests have not been announced yet)

CISO of Google’s Deepmind, Vijay Bolinaone

CISO of Datadog, Emilio Escobar

SVP, Head of Finance and IR of Pendo.io, Stan Zlotsky. Previously at Morgan Stanley SaaS Equity Research

Networking. Join students from Goldman Sachs, Microsoft, Bank of America, Palo Alto Networks, Cowen, SVB, Scotiabank, VCs, ETF Managers, and many more!

Community. All alumni get added to a Cyber + SaaS slack group to continue learning well after the bootcamp is complete!

Curated Content

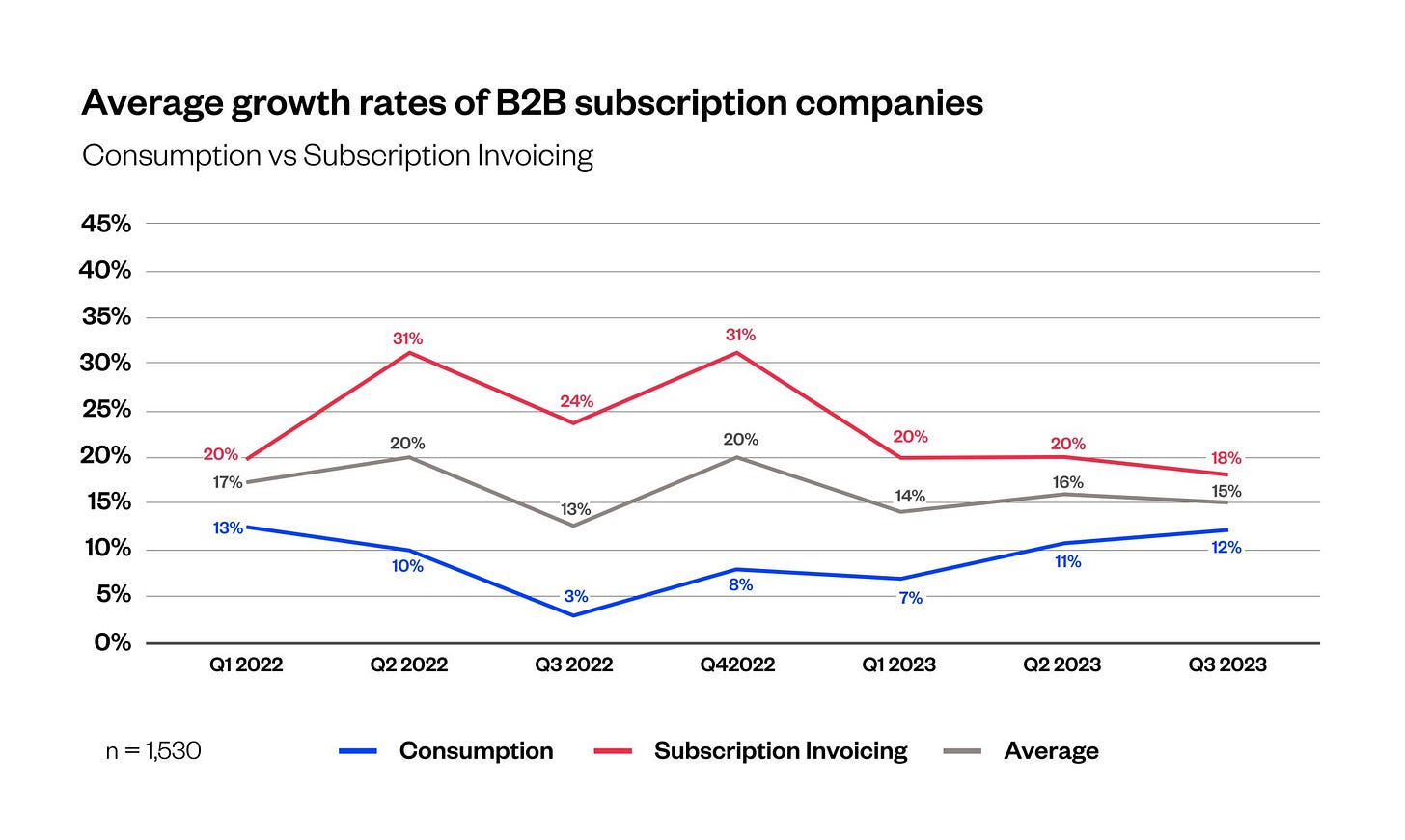

Maxio data through Q3 saw another, albeit small, uptick in consumption ARR growth:

Even more content on AI from VCs:

Menlo Ventures on “2023: The State of Generative AI in the Enterprise”

Cowboy VC on “The Emerging Vertical AI Landscape, And Our Vertical AI Market Map”

Lan Xuezhao + Basis Set released an interactive AI model predicting founder performance

Jared Sleeper with a preview of this enterprise AI survey

A thoughtful thread on AI from @atelicinvest

Lastly, our “SaaS GPT Lab” has been in heavy use - check it out here (if you have a ChatGPT Plus account):

Assumptions: 8 year customer life (in-line with logo churn benchmarks), $50,000 ACV, 105% account NRR, $60,000 CAC, 12% discount rate. Pre-AI: 75% gross margin. Post-AI: 55% gross margin.

Really enjoyed this.

Loved reading the piece from Coatue! And thanks for including us!