SaaSletter - Tenure Troubles

Plus more from Battery Ventures, Tidemark, + Matthew Ball

Tenure Troubles

Inspired by a particularly rocky earnings season, I wanted to look at GTM employee tenure at public SaaS companies.

I’ve seen a bit more coverage of private company tenure, like this quote from Sam Jacobs, CEO of Pavilion (a GTM leader executive network + community):

The average tenure for a PE/VC-backed GTM executive is 17 months.

At this pace, you'll work for 14 companies over a 20 year career.

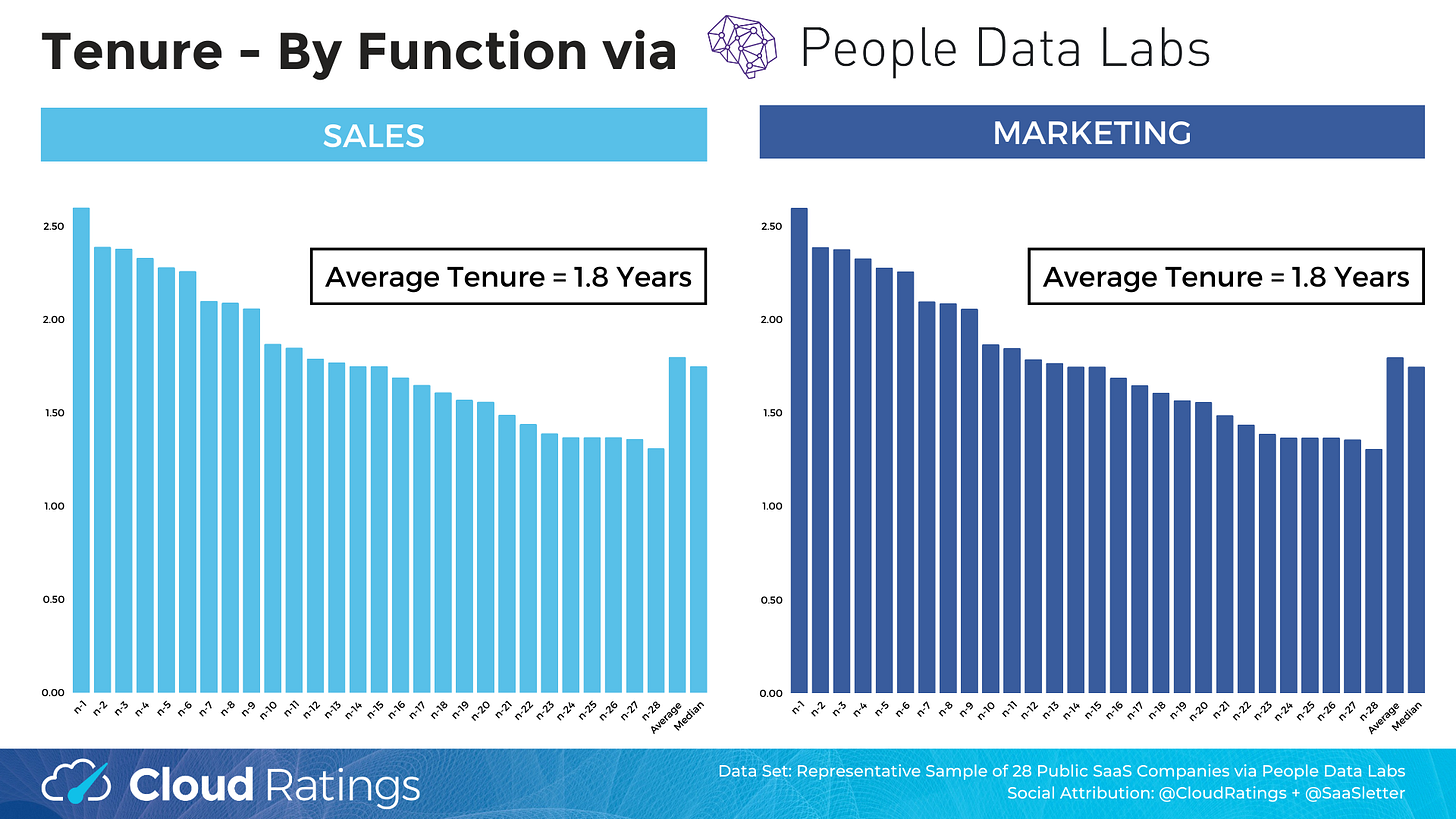

Working with People Data Labs, we mapped a representative sample of 28 public software companies:

Surprisingly, public company GTM tenure (1.8 years / 20 months) is not that much higher than PE/VC-backed tenure (1.4 years / 14 months), particularly when accounting for public company maturity, scale, and growth rates.

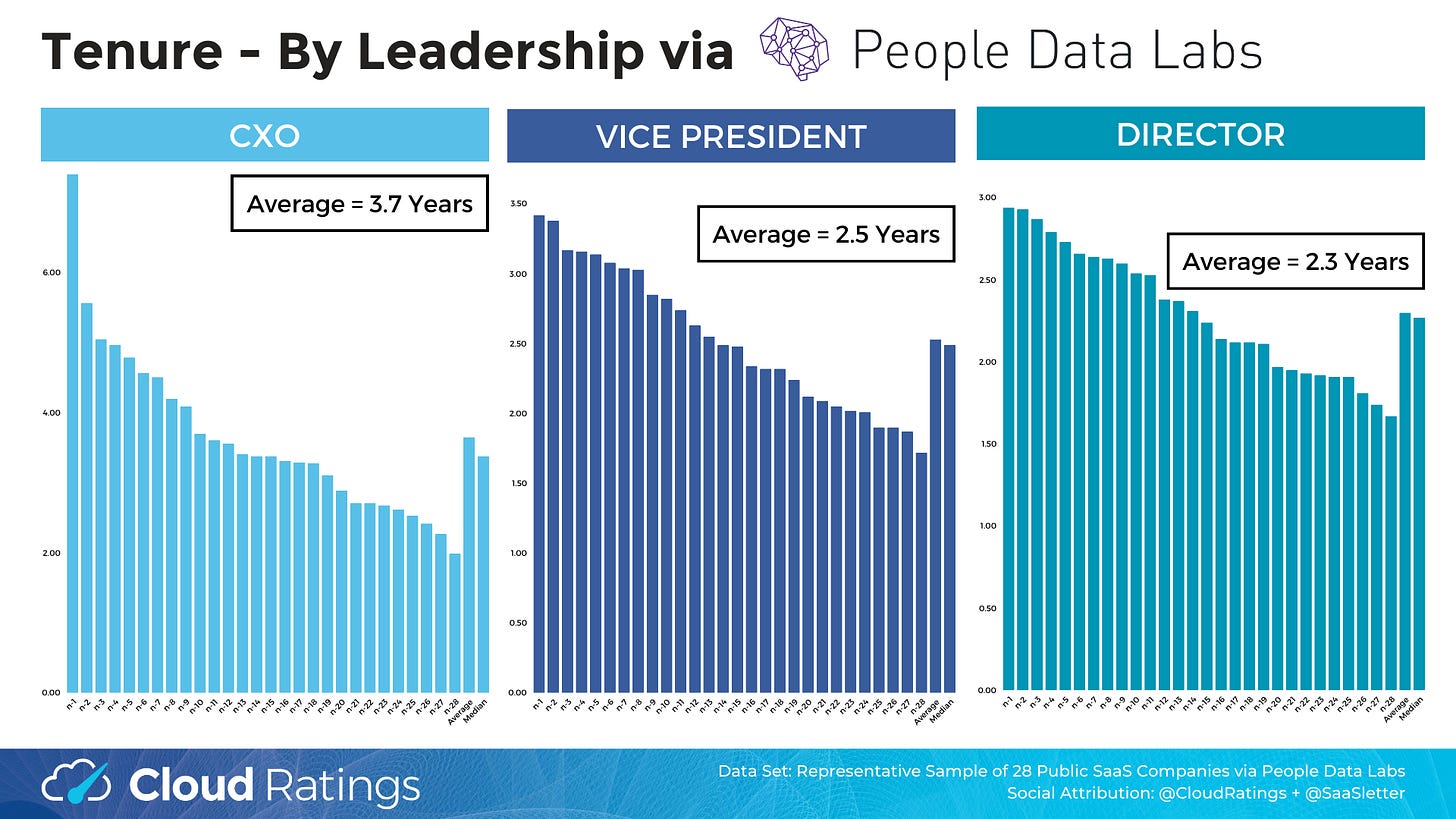

Organizational-wide leadership level tenure (defined as Director + up) is not particularly high either:

Why does this matter?

If you are a CEO or CFO forecasting based on past experiences (“we were light coming into last month of Q3 2020… and still came through” - so both anecdotes and internal data sets), given this 1.8-year tenure, your forecast will often rely on an entirely new team performing the same as the departed team.

With 17% of reps driving 81% of revenue and a rising productivity disparity (via Ebsta reports - more here and our report-focused podcast with Guy Rubin, Ebsta’s CEO), companies are more at risk from turnover → the loss of a star rep landing whales really, really hurts:

Perhaps less impactful, many of your VPs (25th percentile tenure = 2.1 years) and Directors (25th = 1.9 years) have only been ramped and owned a handful of quarters/plans.

This really matters when a 1% guidance miss can lead to a ~15%- 30% stock decline.

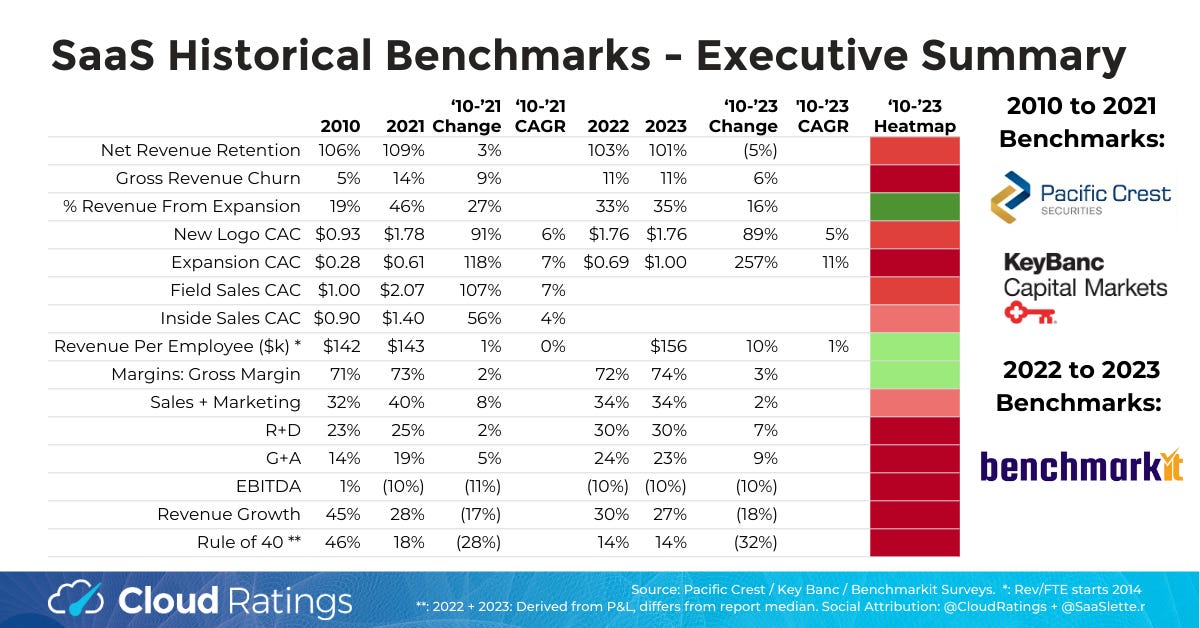

2024 Benchmarks + Historical Context

I’m re-highlighting a) Ray Rike’s new 2024 SaaS Benchmarks and b) our related historical context:

Related Event: Ray will present the report on Wednesday, June 12th, as part of a broader “SaaS Metrics & Analytics” virtual event.

Battery Ventures Enterprise Report

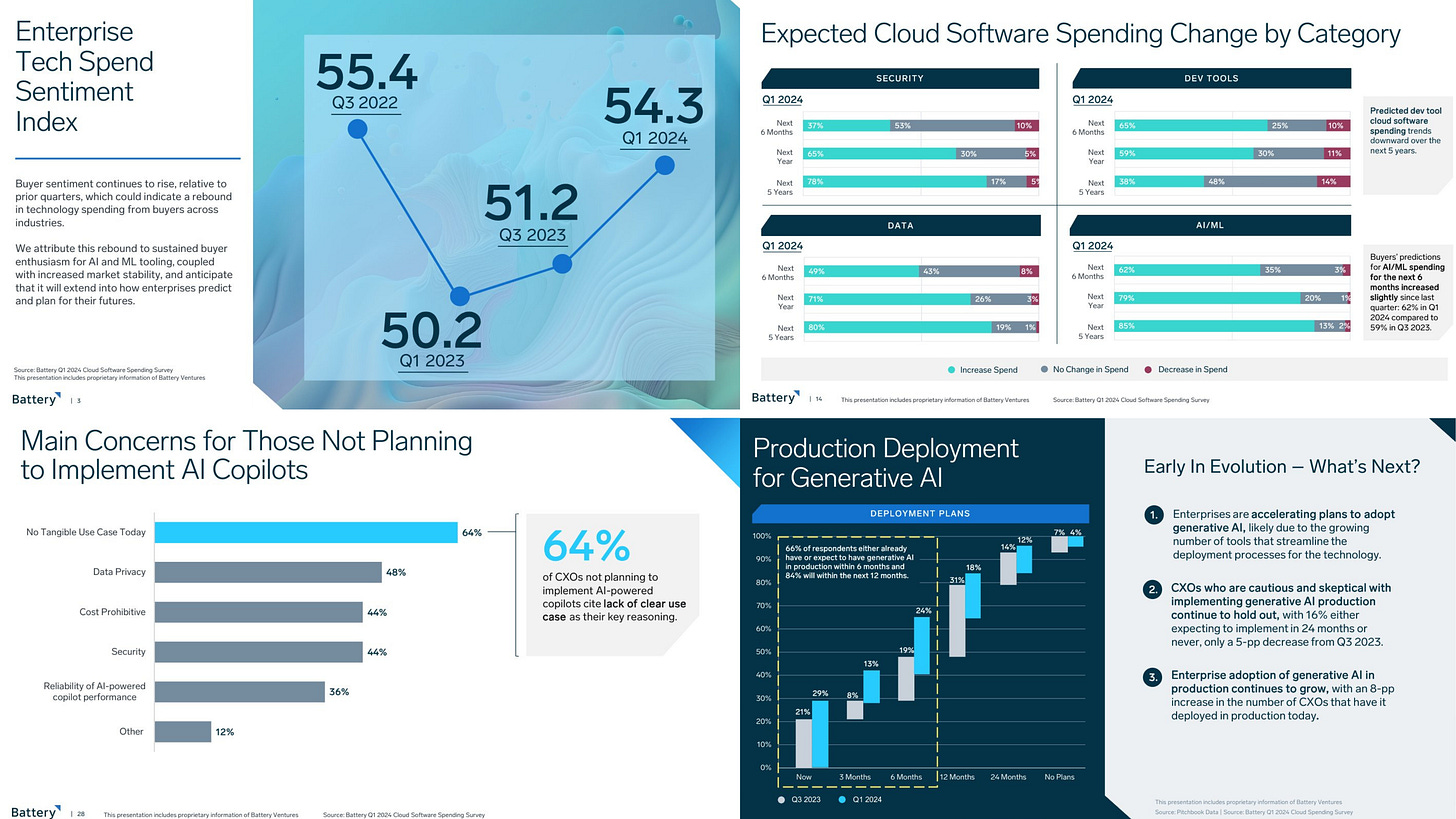

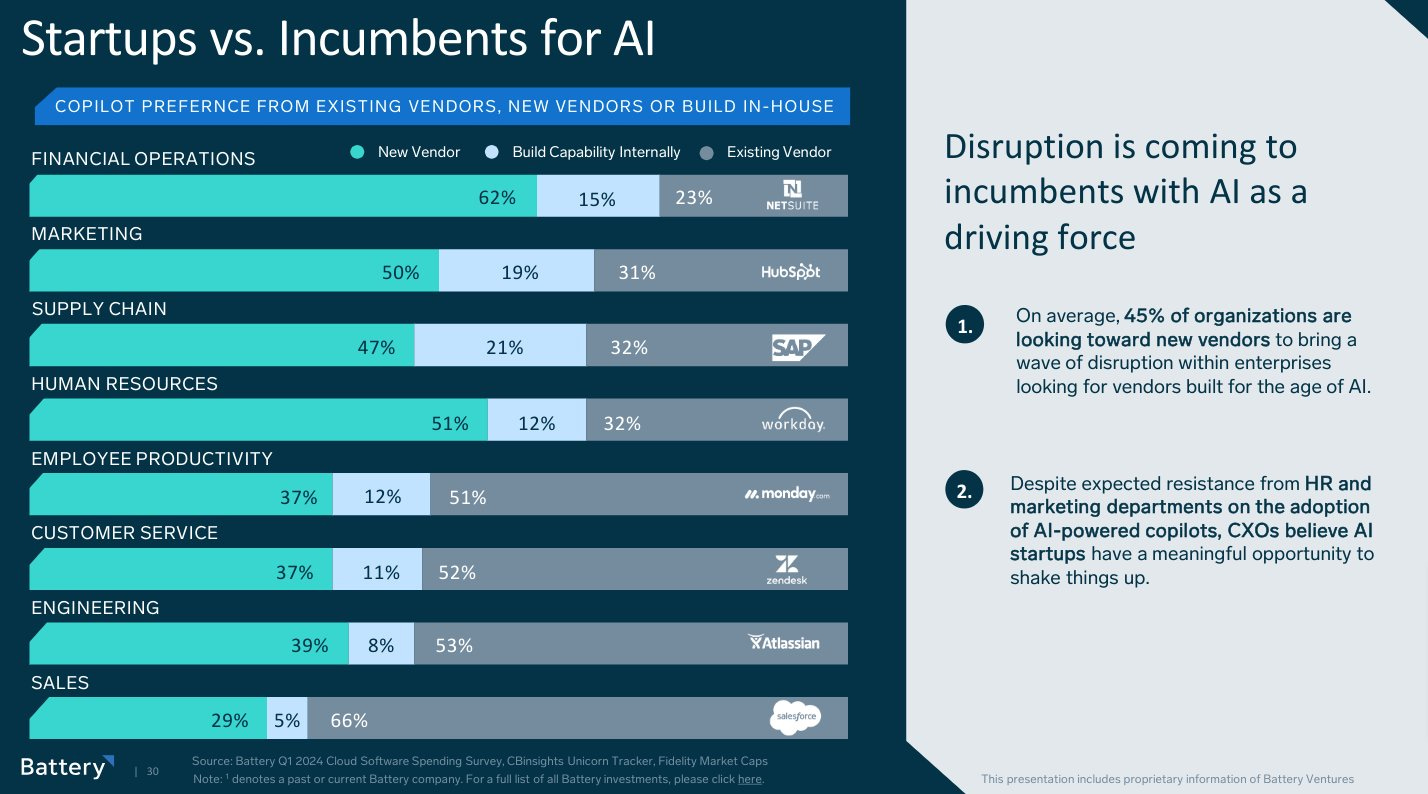

I missed Battery Ventures earlier release of its “State of Enterprise Tech Spending” report (n = 100 CIOs, $35b of tech spend)

With my full excerpts threaded here, the notable points:

An upturn in overall Tech Spend Sentiment Index (54.3 Q1 2024 vs 51.2 Q3 2023)

Non-AI trends are largely in line with consensus (i.e. vendor consolidation + licensing optimization remain a priority)

Of note, DevTools showed some weakness in long-term spending intentions → likely uncertainty created by AI

There were mildly concerning AI data points (slight downturn in intentions vs Q3 2023; non AI adopters - “64% finding no clear use case”)

My choice for the best slide - GREAT data on enterprise buyer willingness to work with AI startups versus incumbents:

Curated Content

You likely saw the “End of Software” from Pace Capital …

with these takes deserving a bit more attention:

“Investing in the Cloud: From Gold Rush to Hunger Games and Beyond” [From 2019] - re-highlighted by Rory O’Driscoll from Scale Venture Partners and

“SaaS Isn't Dying: It's Going Logarithmic” - from Jared Sleeper, and

Tren Griffin’s thread responding to “End of Software”

Thomas Reiner from Altimeter’s digest of the rocky earnings season

“The Single Product Ceiling” - Dave Yuan + Co from Tidemark

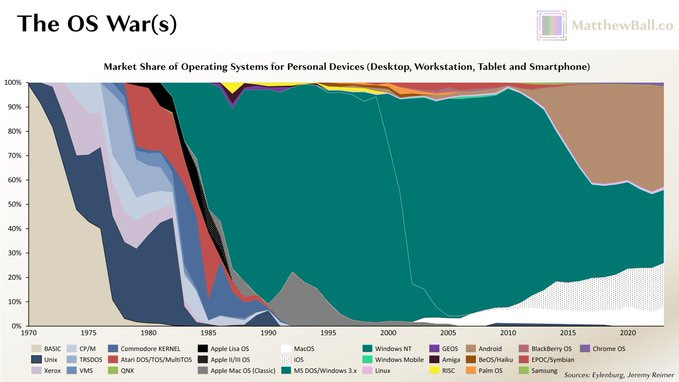

“UPDATED: Parallel Bets, Microsoft, and AI Strategies” - from Matthew Ball:

Tenure Troubles Related Podcast

The “average tenure for a PE/VC-backed GTM executive is 17 months” was a very key topic in our earlier podcast with Scott Leese. Listen for his candid takes on this topic:

Subscribe To “Cloud Radio” On: Spotify | Apple Podcasts | All Other Platforms

I am surprised that outbound growth strategy is so risky. Only 17% of reps driving 81% of revenue and when you get the right person you can't rely on it since the average sales tenure is just 1.8 years.

I’m amazed at overall tenure rates. I would have thought it was much longer.