SaaSletter - ICONIQ + Maxio + ChartMogul Reports

Plus Our New Sales Compensation Software Quadrant

2024 Sales Compensation Software Quadrant

We released our Sales Compensation Software Quadrant for 2024.

Through Cloud Ratings research partnership with G2, the Sales Compensation Software Quadrant has been enhanced with ROI, implementation timelines, and customer mix data from G2.

ICONIQ Growth’s “Scaling SaaS” Report

ICONIQ Growth released a phenomenal report (71 slides). As always, go read the full report. My excerpts:

I will cite this graph again + again: ARR per customer steadily grows for *top-quartile* companies at each revenue threshold.

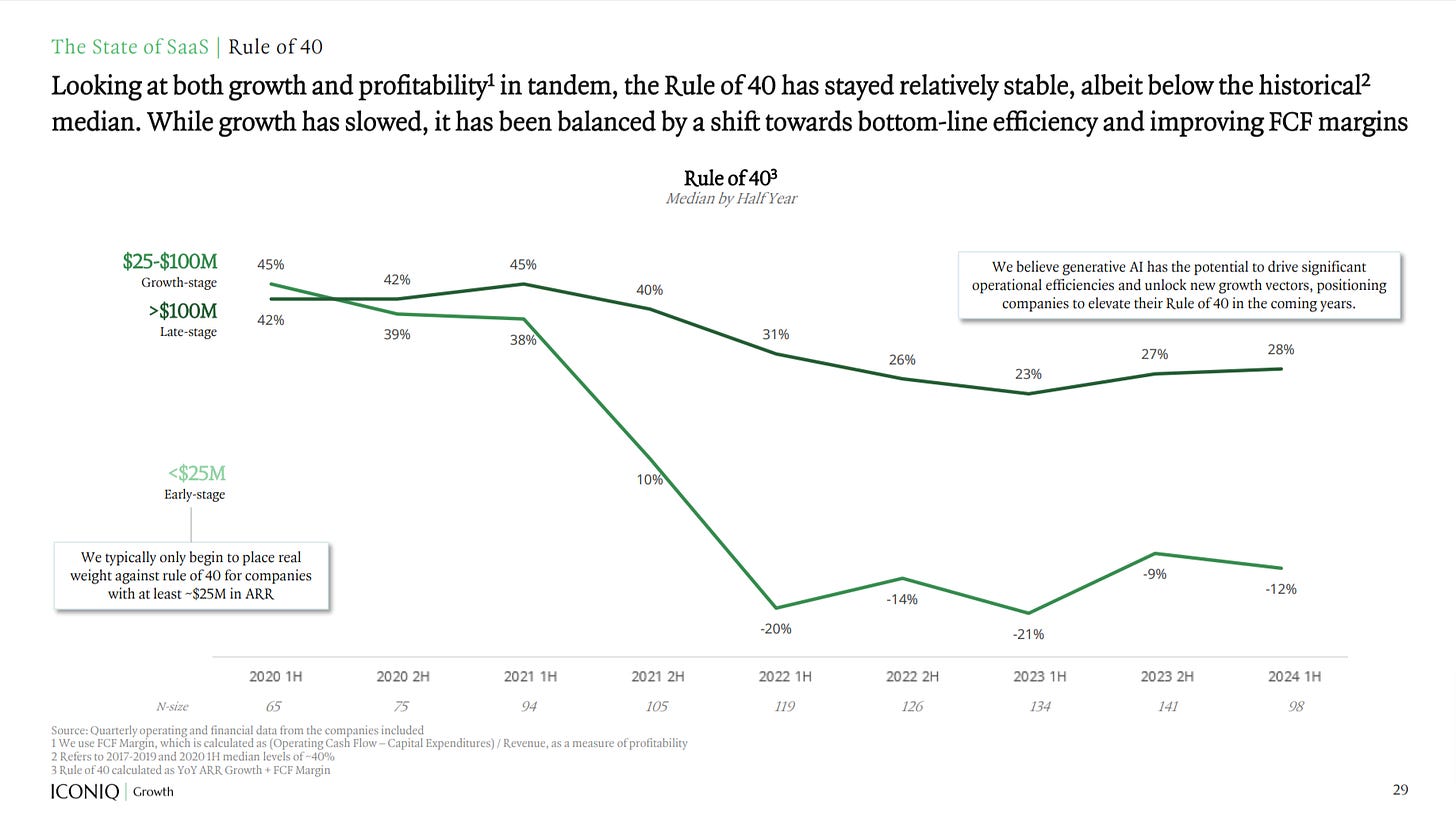

This Rule of 40 Chart is consistent with our “Messy Middle” theme - the *median* $25m-$100m cohort has not recovered from the 2021 peak with unacceptable Rule of 40 ratios (negative 12% to -21% since 1H 2022!).

Similarly, for Burn Multiples, the top quartile versus median gap widens most between $24m - $74m. The very best are able to avoid the “Messy Middle.”

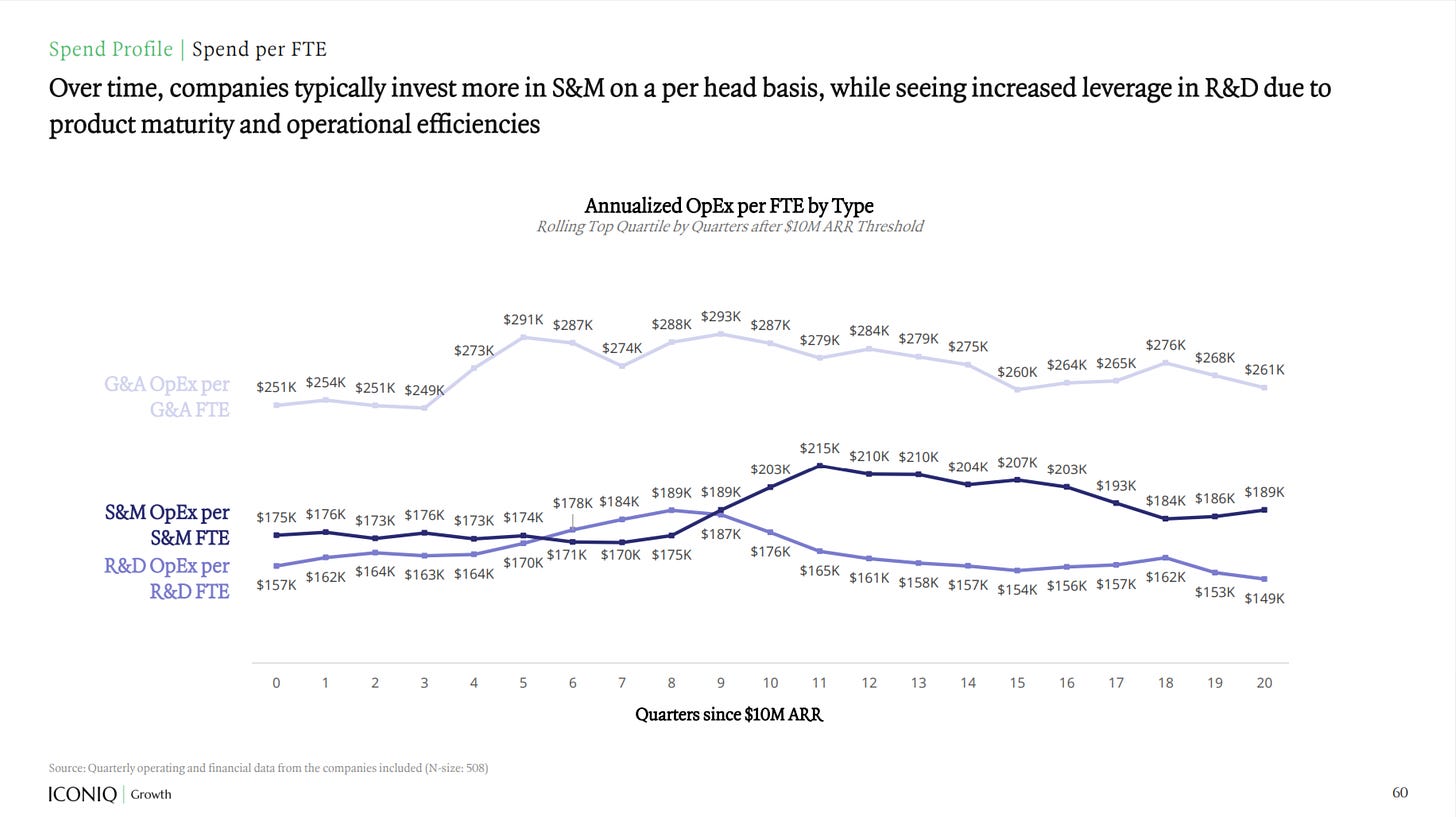

I can see this chart getting cited again: Engineering is consistently the lowest-paid P&L grouping.

Additionally, the G&A OpEx absolute dollar levels are also striking (even when accounting for growth, talent needed, and absolute valuations even at a $10m ARR level).

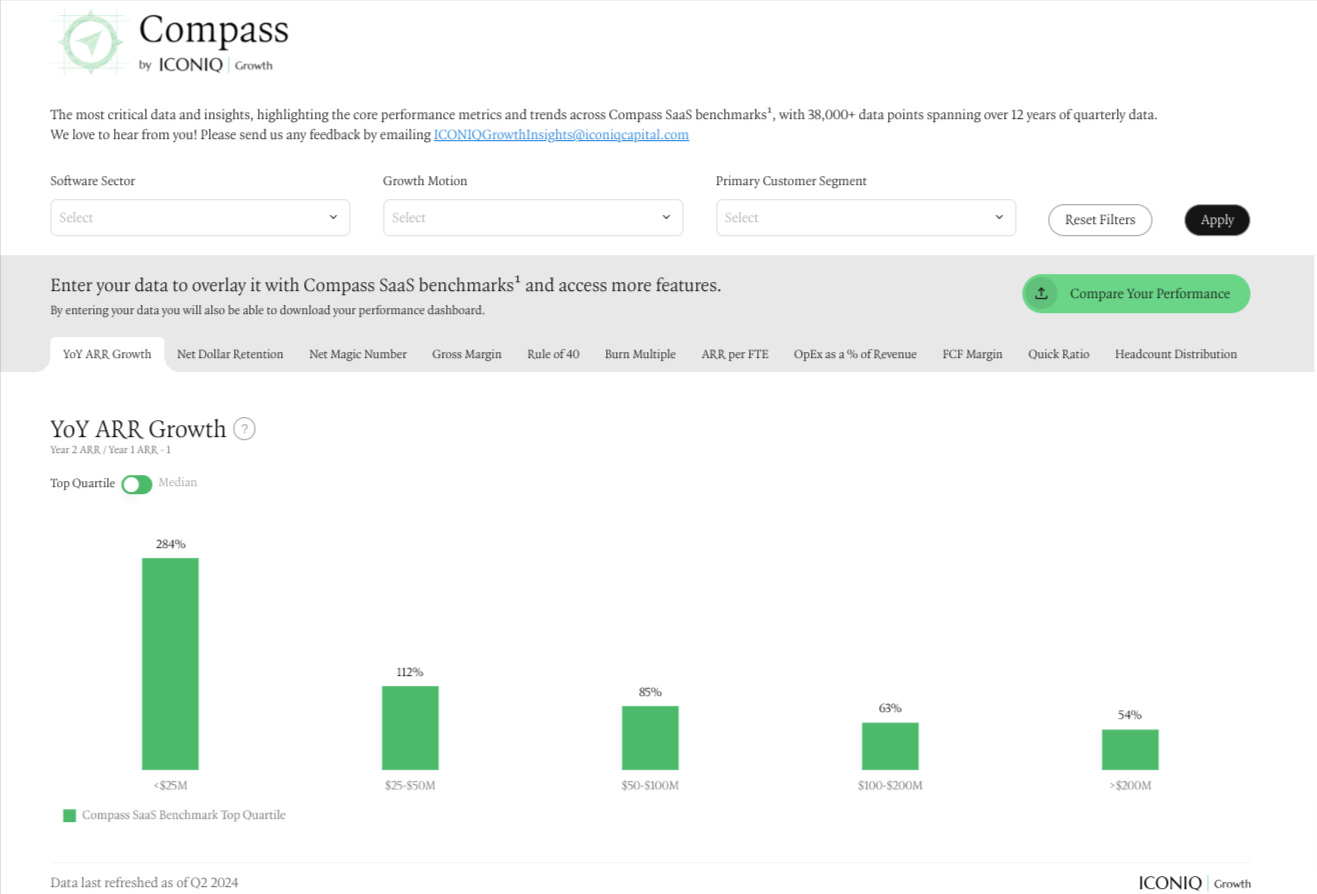

ICONIQ also debuted a new interactive benchmarking portal called Compass:

ChartMogul’s “The New Normal For SaaS”

A quick excerpt from ChartMogul’s new report (n = 2,500 SaaS companies) - go read the report for granular NRR and ARPA-type data.

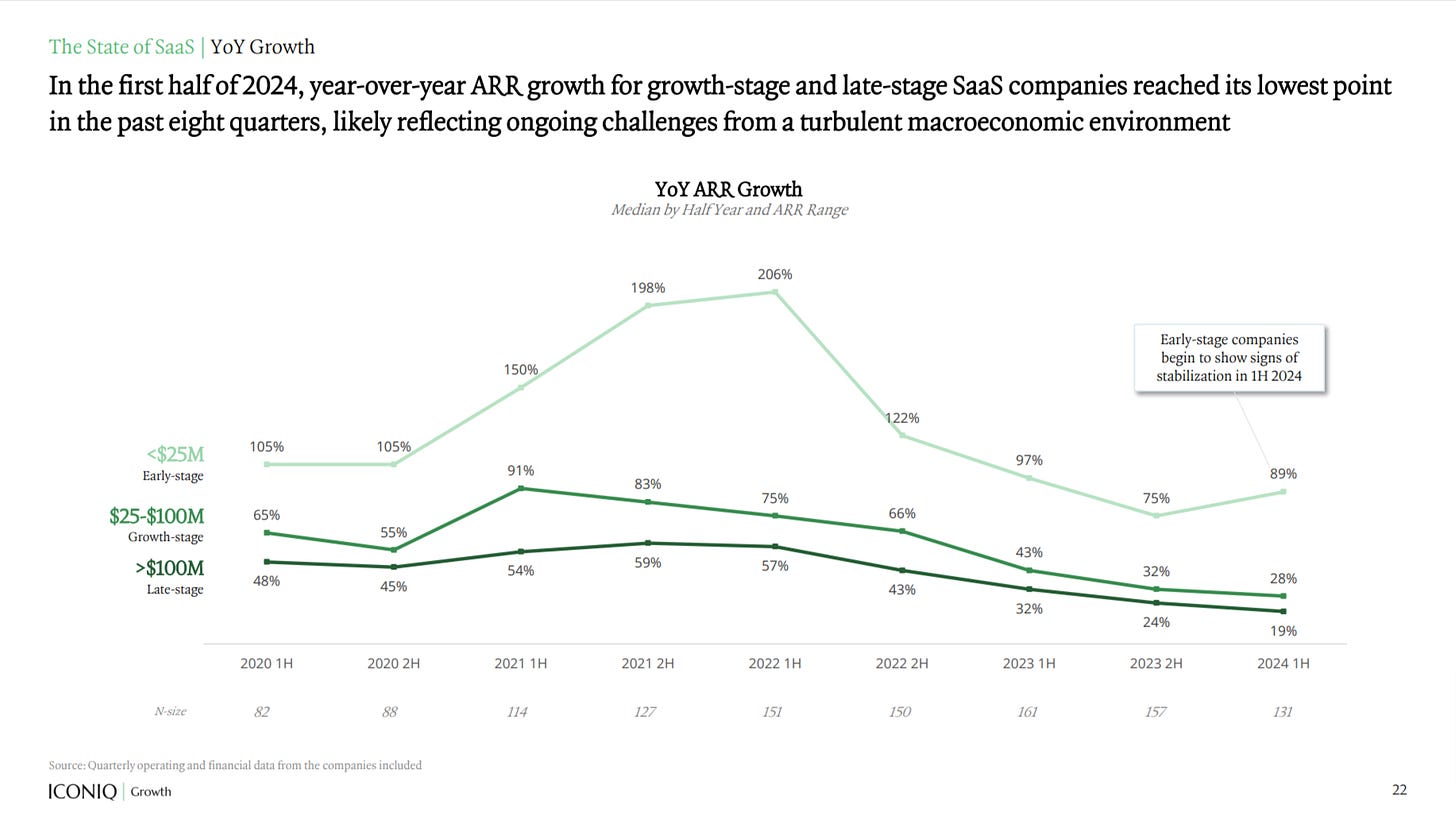

Early-stage companies - whether <$1m ARR or $1m-$30m ARR - can serve as a “canary in the coal mine” for the broader industry: note the peaks in 1H 2021 ahead of the broader downturn.

With this “early stage = early indicator” dynamic supported by data in the ICONIQ Growth report:

Maxio’s “B2B Growth Report” → Forecasting Volatility

Maxio released the Q2 2024 edition of their B2B Growth Report (n = their ~2,400 customers, largely <$100m ARR). The report includes great coverage of fixed-rate versus usage-based pricing models. Again, go read the full report.

Given the upcoming budget + forecasting season facing our many CEO/CFO/CRO readers, we analyzed the standard deviation of Maxio’s end-market growth rate dataset for Q1 2022 to Q2 2024. To state the obvious, keep volatility in mind when setting your 2025 plan!

Bigfoot Capital “Capital Provider Survey”

Brian Parks - a guest for our SaaS private debt podcast episode (AUDIO | VIDEO) - and Bigfoot Capital released their annual Capital Provider Survey. Excerpts above.

Curated Content

A quick recap of Friday’s LinkedIn-only “Tenure Troubles” note:

The tech buying bull run of 2010 to 2022 allowed *software buyers* to under-focus on buying outcomes

I argue that short tenures contribute to poor software purchase outcomes. Within GTM roles, tenures average 14 to 20 months (more here, h/t People Data Labs for public company data):

Taking into account sales cycles, implementation timelines, and the fact that very few software purchases are made simultaneously with an employee start date, your median employee will only "live" with a new software for a handful of months!

Combine this with incentive structures that are amplified by short tenures.

New initiatives and big projects are a path to promotion. I've heard my share of "The whole team knows we purchased XYZTool as part of Chad's promotion from Director to VP. Of course, he left 4 months later."

Said differently, with short tenures incentives are weighted to the near-term "buy" and NOT the project's long-term outcomes.

Jon Russo, Founder of B2B Fusion, added a thoughtful note to our post:

Great post. Adding to your under discussed topics - it makes sense for SaaS providers to extend contract terms over multiple years to ensure deployment and adoption success so there is less annual variability in retention KPIs. That means their product has to be sticky beyond the personality that championed the concept. As sellers, the short tenure points to the reason as to why there is a more talked about trend lately to target as many buyers on the committee as possible.

Building on our podcast with Scott Stouffer, Founder + CEO of ScaleMatters, we also coverered how short GTM tenures negatively impact the effectiveness of GTM tech stacks → more here.

About Cloud Ratings

In case you missed it, we recently announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants, this newsletter, our podcasts, our True ROI practice area, and our Indices + Data Science practice area (see our recent hire of Genki Hirayama, formerly of Azora Capital and Piper Sandler) all fit within our modern analyst firm: