SaaSletter - ICONIQ's "State Of Software 2025"

Plus our podcast with G2's CEO Godard Abel

NEW: Podcast With G2 Co-Founder + CEO Godard Abel

FULL EPISODE: VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

Titled “Software Buying In The Age of AI,” we covered AI disruption across the enterprise software stack, how AI impacts software research + buying, G2’s AI strategy, and lessons in entrepreunrship from his recent Leadville 100 race (literally 100 miles of mountain biking).

ICONIQ’s “State of Software 2025”

ICONIQ released their “State of Software 2025” (73 slides, h/t Christine Edmonds + their strong Analytics team) → go read the full report here. My *excerpts* here:

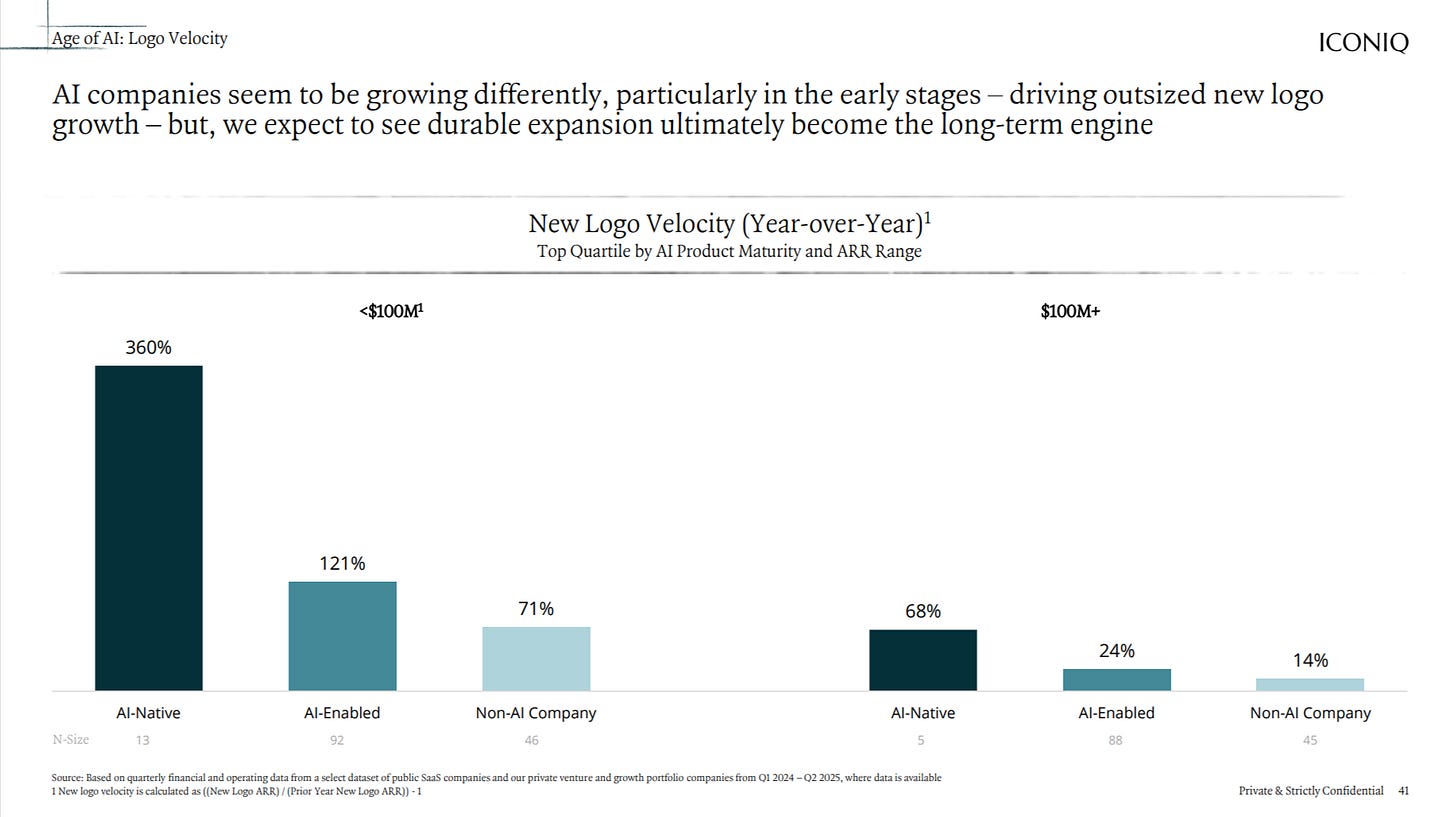

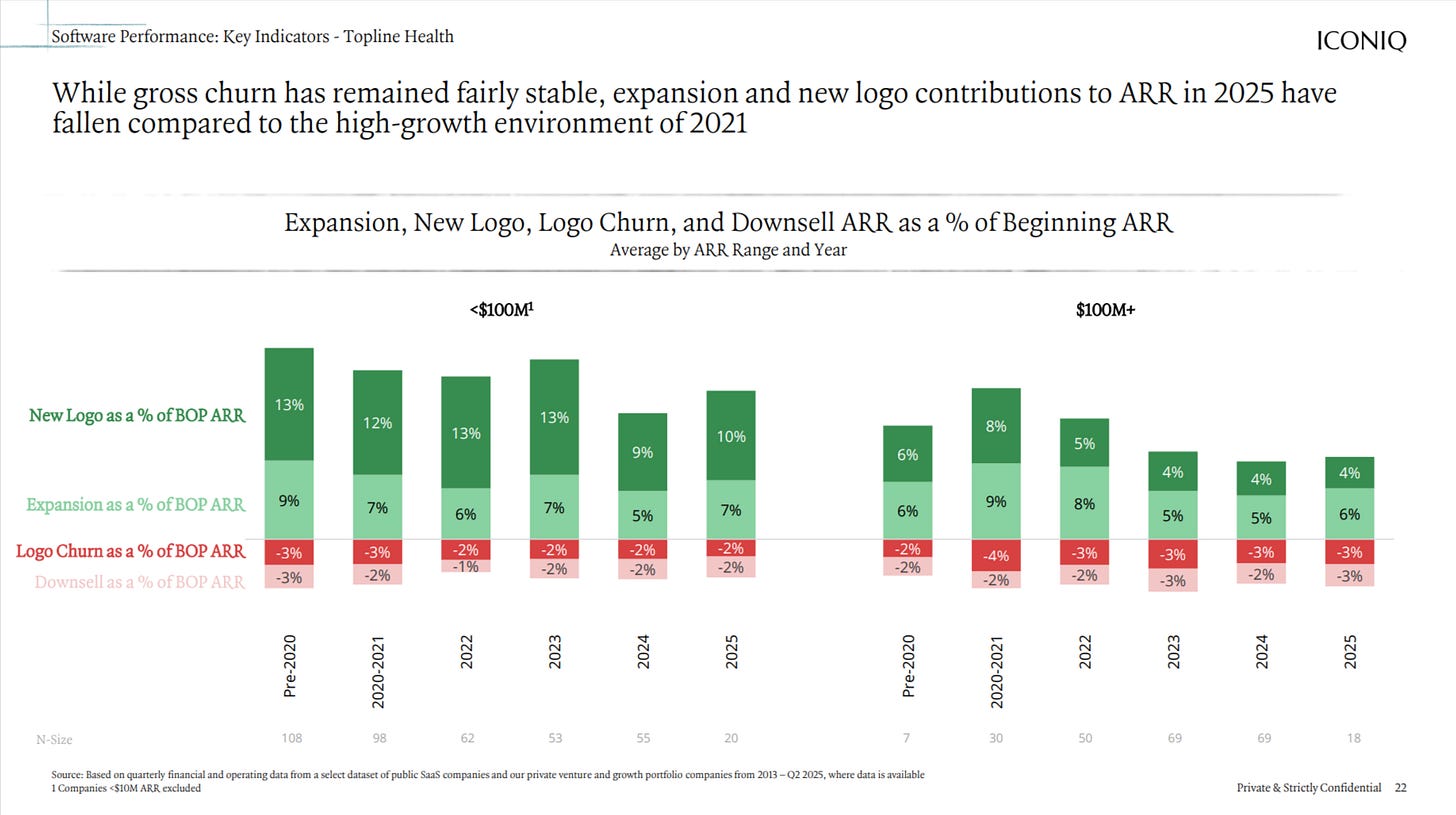

My read of the *critically important* new logo metric (with more emphasis on $100m+ where percentages are more stable/durable):

AI Natives: stunning (albeit a small sample)

AI Enabled: good

Non-AI: while not in “software is dead” territory… supportive of a “maturing growth industry” deserving of modest multiples

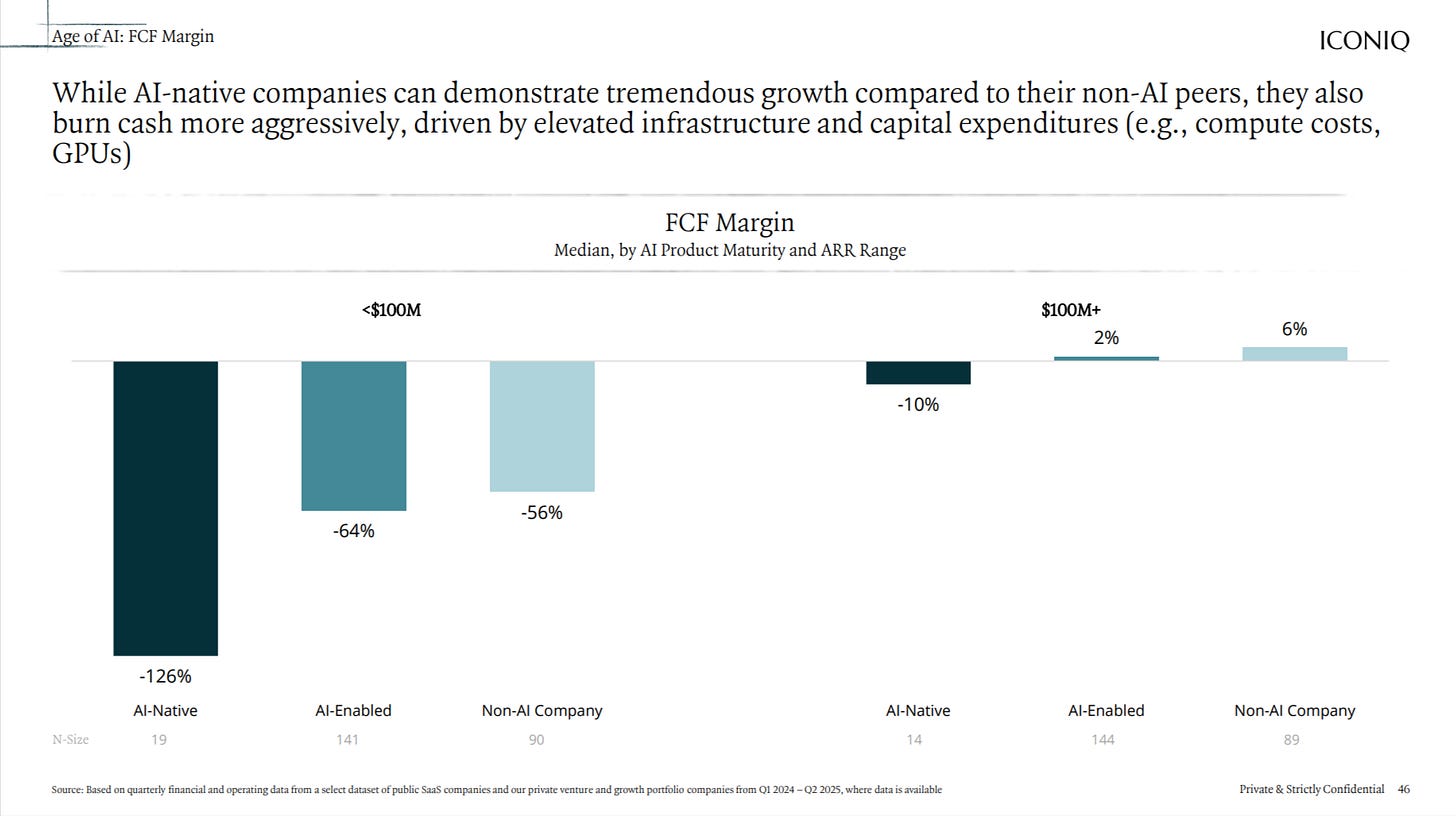

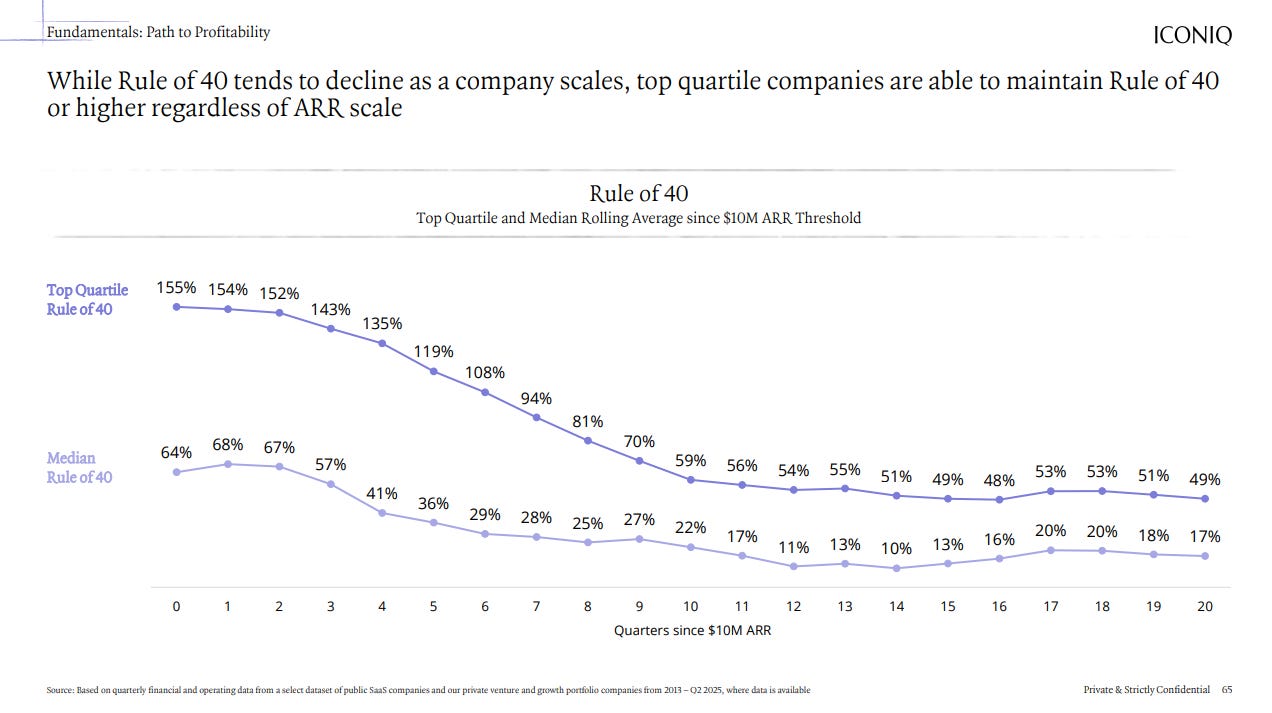

Of course, AI growth is not free. The Rule of 40 (growth + FCF%) works out to:

<$100m - AI Native: 264%

<$100m - AI Enabled: 57%

<$100m - Non-AI: 15%

$100m+ - AI Native: 58%

$100m+ - AI Enabled: 26%

$100m+ - Non-AI: 20%

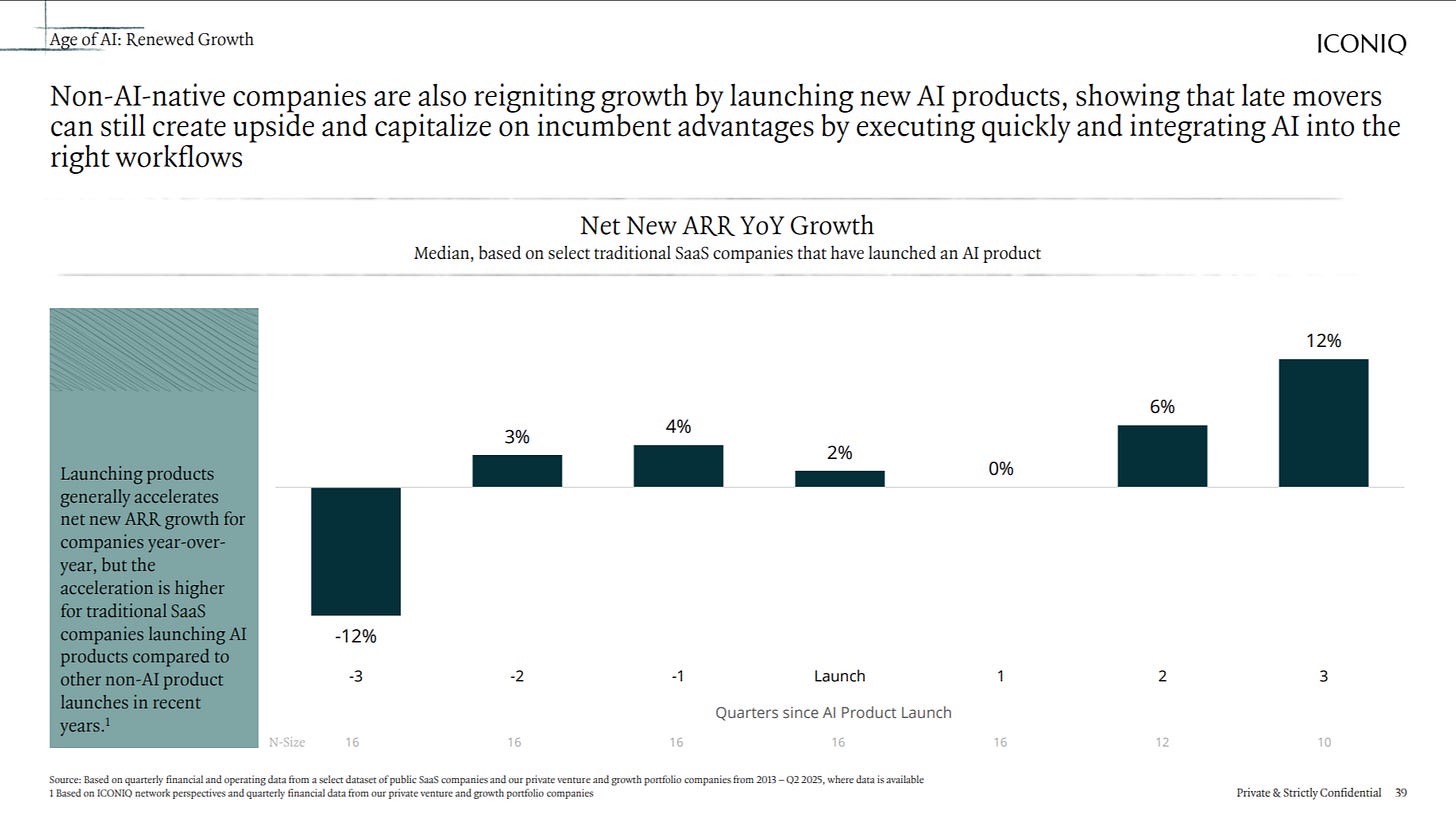

There are two ways to read this ARR growth since AI product launch data:

Encouraging: AI launches can drive a 10% acceleration within 2 quarters!

Unsaid: While the amount of AI *financial* disclosures by public software companies has been improving, we should be seeing more AI-sourced acceleration in financial results… if their launches were getting *real* traction shown in the ICONIQ data.

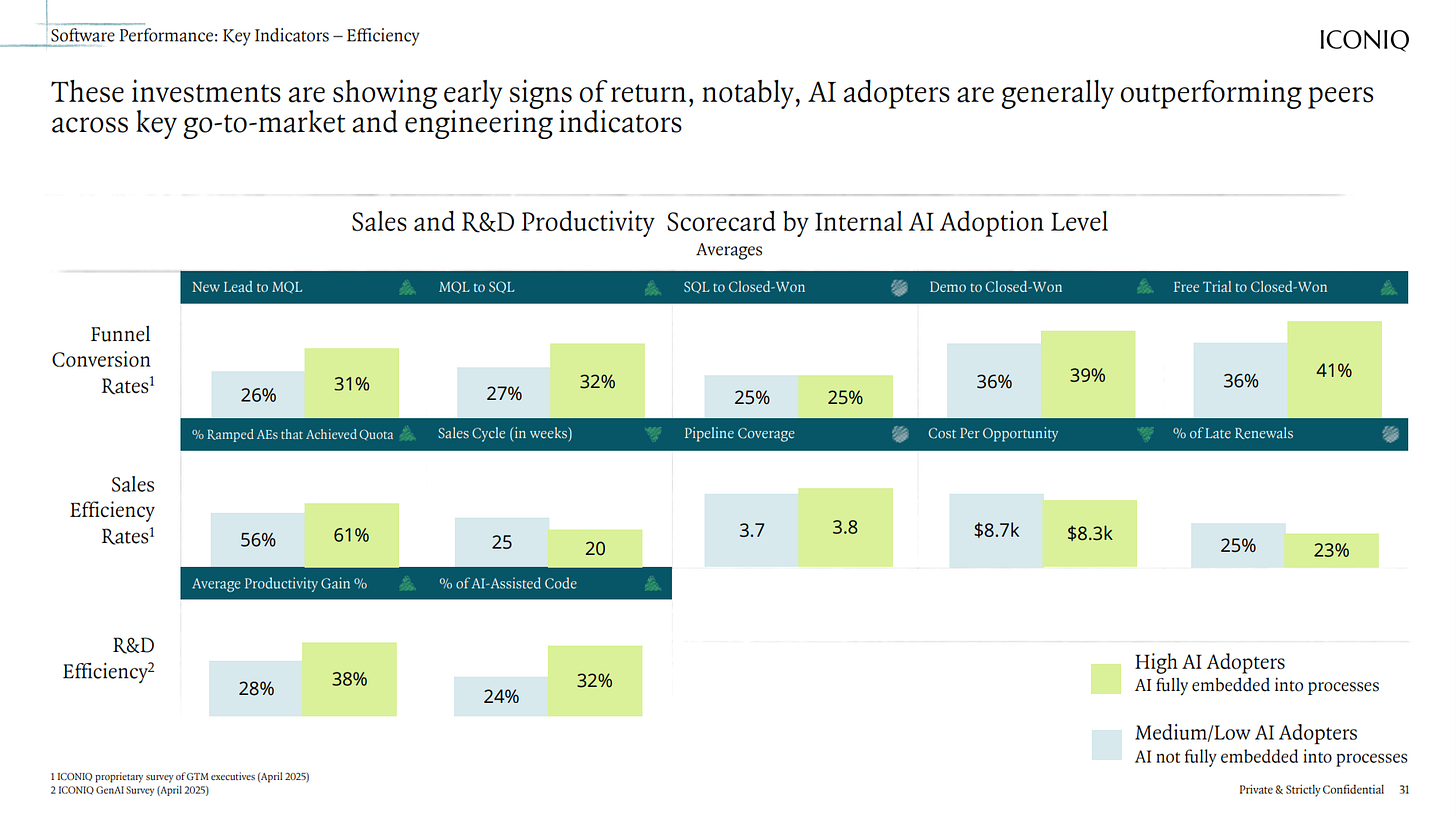

The magnitude and consistency of AI productivity gains stood out. Particularly in GTM + Sales, where I have a bit skeptical on how *AI* could move metrics like Lead→MQL or Demo → Closed Won.

ICONIQ’s “State of Software 2025” - Messy Middle Reverses?

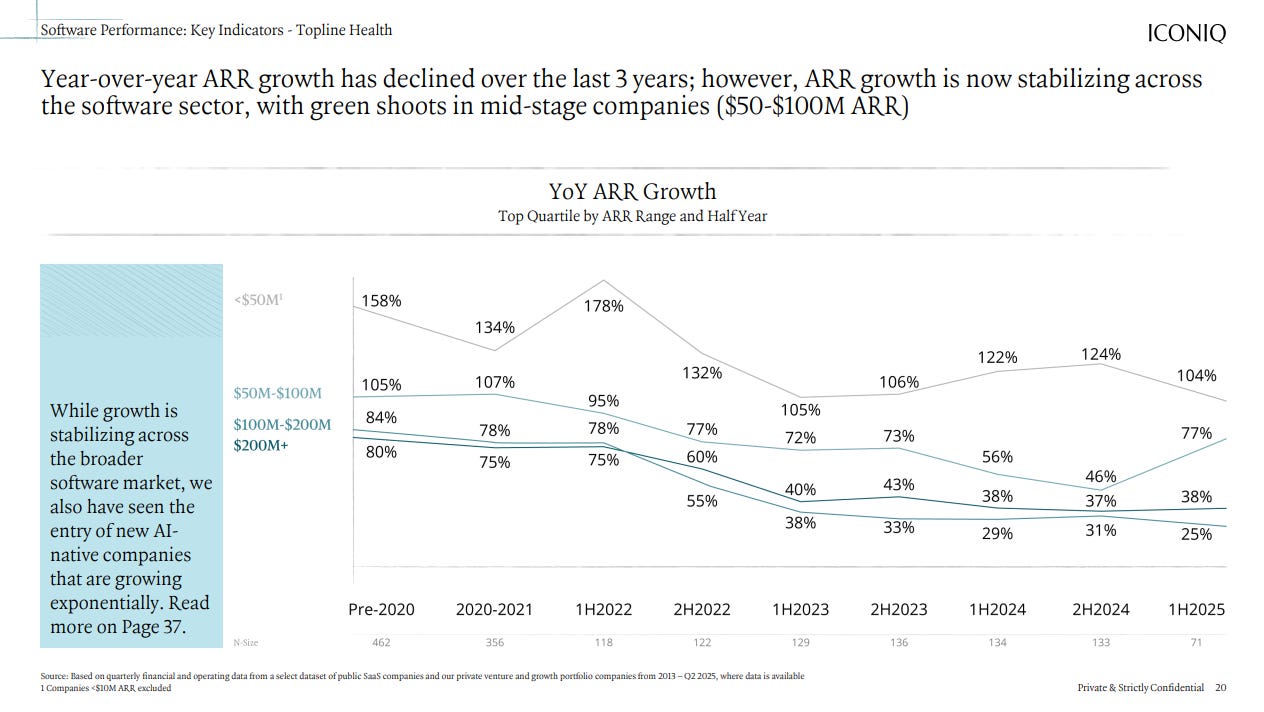

The acceleration in the $50m-$100m ARR cohort (77% in 1H’25 vs 46% 2H’24 + 56% 1H’24) represents a potential reversal of the “Messy Middle” dynamic we’ve covered:

The growth durability in the $100m-$200m cohort is also notable + encouraging.

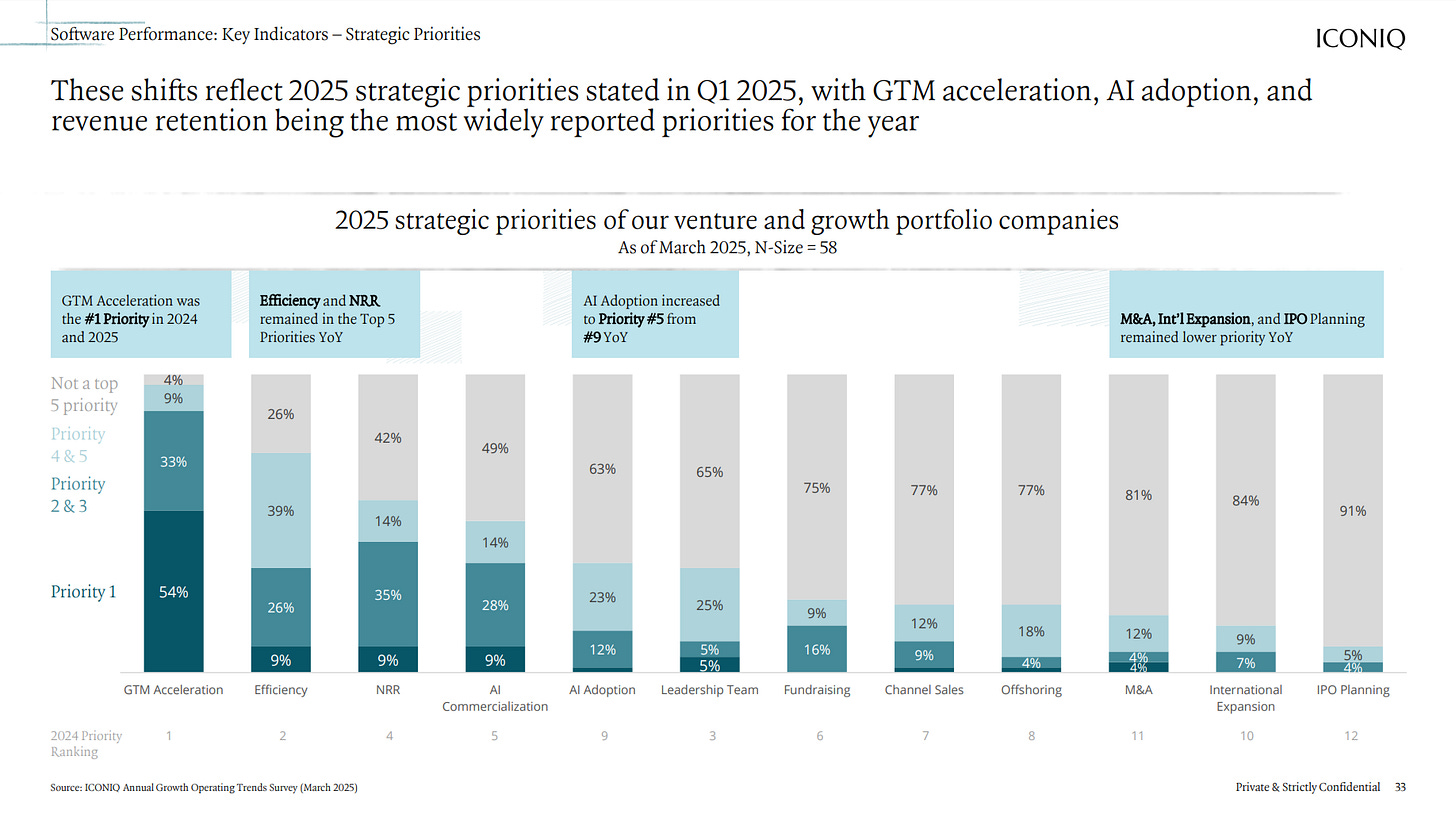

My only call out from this strategic priority chart: Channel remains underprioritized relative to ROI

To be a bit dour, 3 years of 4%+ new logo growth is quite poor. As is the “stacked” 4% growth algorithm net of churn.

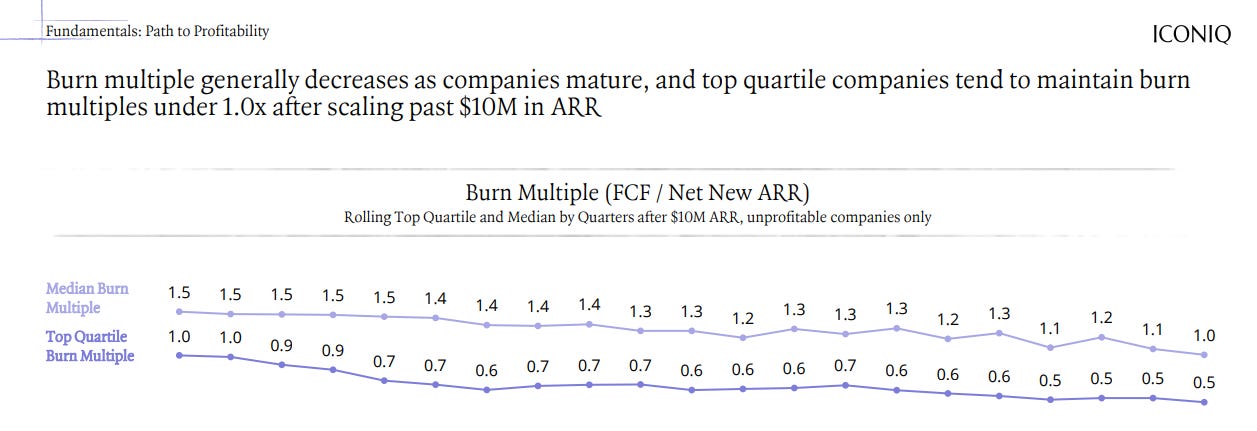

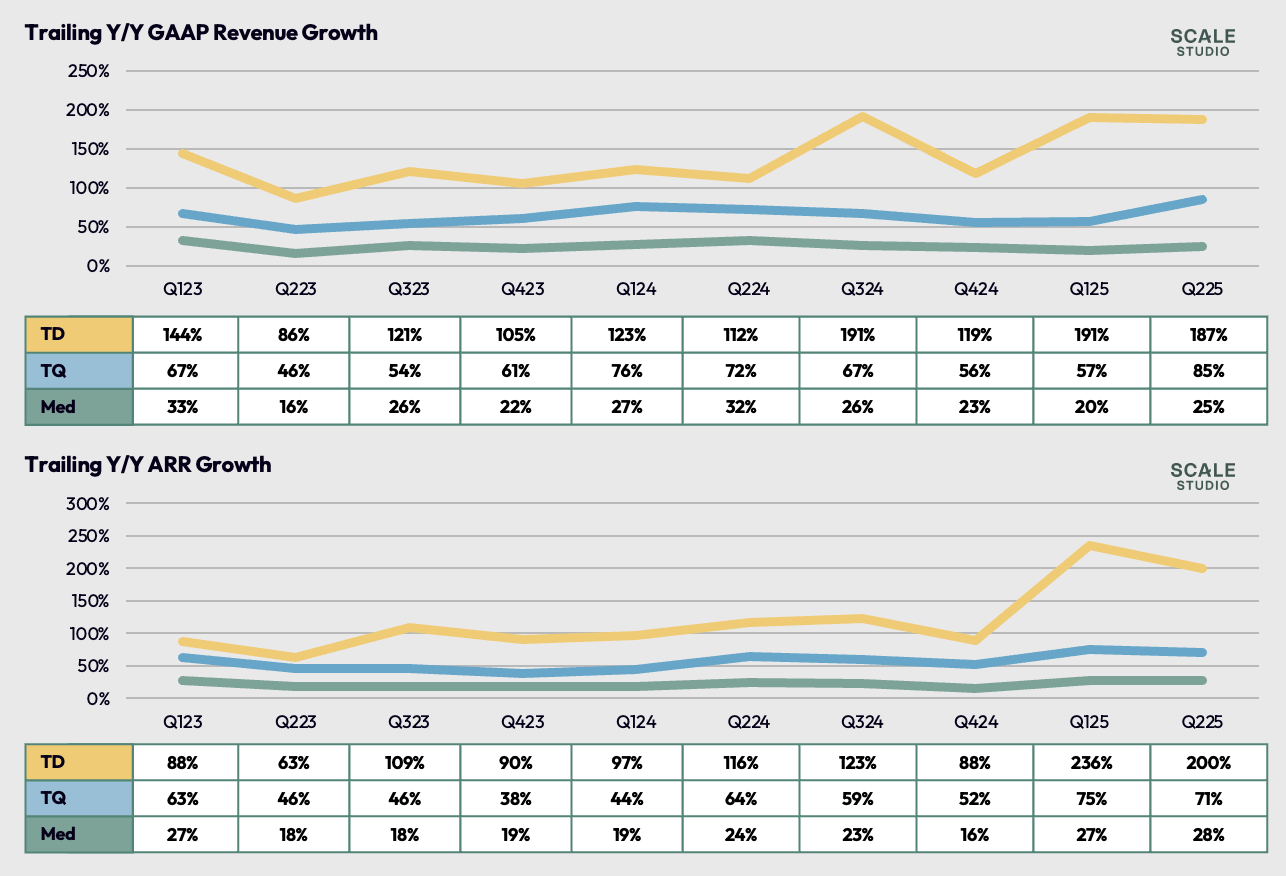

These last charts below that contrast top quartile versus median data captures a theme we see across many data sets at Cloud Ratings → the “best of the best” in software are practically different companies:

Our Value Creation Summit → Replay Available

With our written event recap here:

Curated Content

“Building Your Brand Moat In The Age of AI” (28 slides) - Sydney Sloan, CMO of G2

A postive Q2 2025 Flash Report from Scale Venture Partners (h/t Dale Chang + Eduard Danalache)

“Answering the AI Gross Margin Debate” - via OnlyCFO

… alongside “Much ado about margins: The grossly overhyped AI gross margin debate” - via Janelle Teng of Bessemer Venture Partners

“Your ICP Starts as an Aspiration and Becomes a Regression” - via Dave Kellogg

About Cloud Ratings

In mid 2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: