SaaSletter - Martech in 2024 With Scott Brinker

Plus Employment Index + curated content

Scott Brinker Podcast Episode

Our Guest: Scott Brinker: VP of Platform Ecosystem at HubSpot and editor at chiefmartec.com (50,000 readers)

We covered:

his views on AI's impact on marketing (see also my post on McKinsey + Battery’s predictions)

the long tail of Martech apps - is this sustainable?

the trend of “composability”

and his + Frans Riemersma's excellent 89-page "Martech in 2024" report, with excerpts below:

December 2023 SaaS Employment Index

We’ve enhanced our SaaS Employment Index to include diffusion calculations.

What is diffusion? A statistical method used by the Bureau of Labor Statistics (BLS) and The Conference Board that measures the breadth and strength of employment change.

*Our* diffusion method1 applies multipliers to each “bucket” proportionate to the magnitude of change. A positive diffusion implies hiring strength; a negative implies weakness.

Why add diffusion? The outlier “buckets” (i.e. companies growing headcount 20%+) can be obscured in our stacked red-to-green charts due to scaling. When skimming the slides, you could eyeball “more red than green” and conclude the labor market is worse than it is.

For example, despite the amount of light red, the hiring conditions for 50-100 employees and 100-200 employees SaaS companies have actually been healthy. Diffusion captures the weakness for the 200+ employee buckets due to their lack of dark green strong hiring:

In fact, functions like Marketing have had stronger hiring conditions than consensus narratives - in a growth industry like software, there are companies still growing headcount:

Again, our SaaS Employment Index slides are here.

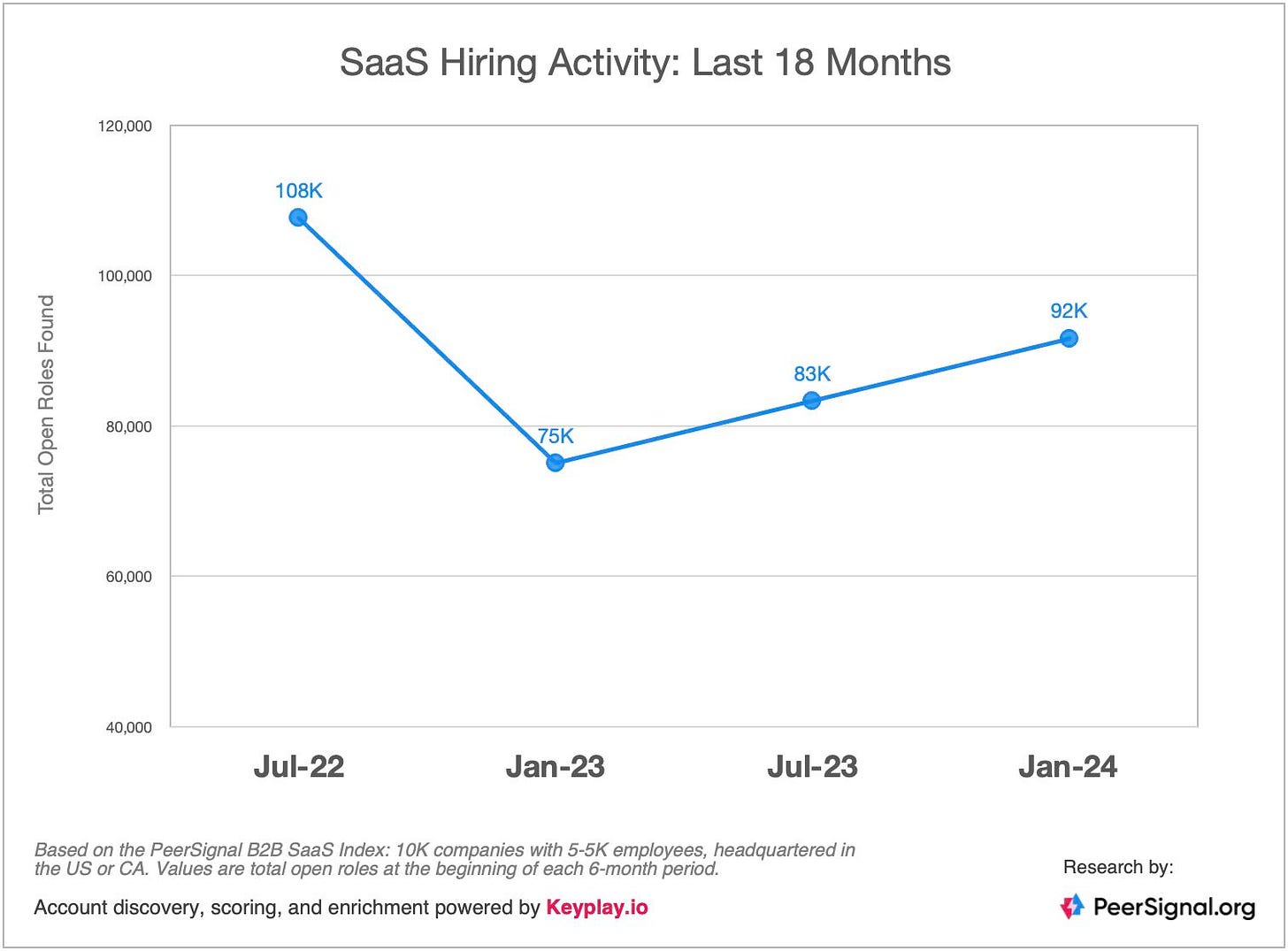

While measured on a different basis (using open roles), PeerSignal’s SaaS Hiring Activity data also captures an improving labor market:

Curated Content

Using ChartMogul’s new benchmarking tools, I looked at growth + retention trends for $1m-$3m ARR and $3m-$8m ARR companies. Why these? Past work has identified early-stage SaaS (but not micro/indie hacker) as *possible* “canaries in the coal mine” for shifts in discretionary IT spend:

$1m-$3m ARR: flat growth, slight decline in net revenue retention (NRR)

$3m-$8m ARR: increasing growth (median growth +320bps since August) and small increase in NRR

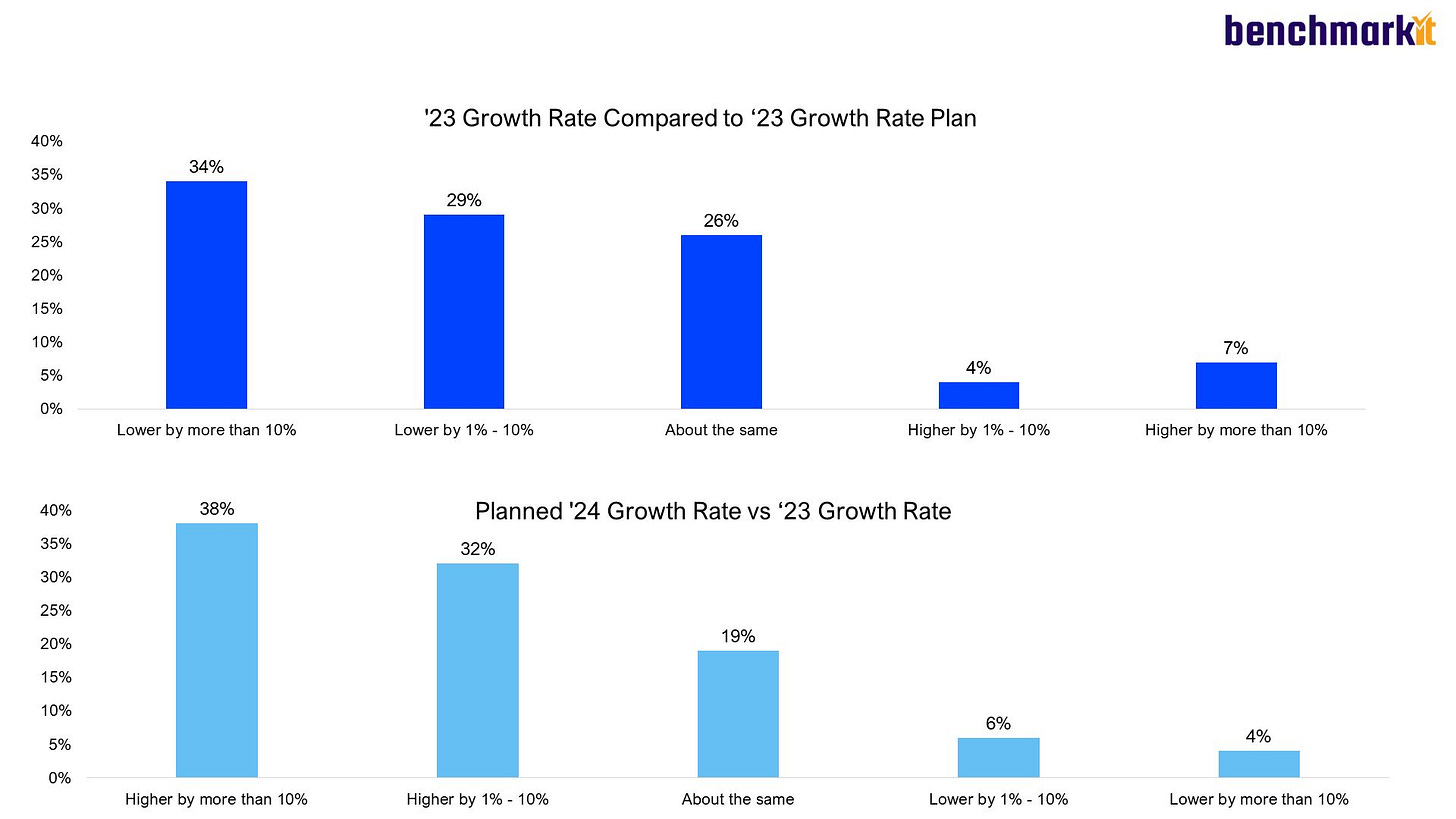

Unrealistic 2024 Budgets? Via Ray Rike and Maxio data (n = 2,000):

63% of companies missed their 2023 growth plans

but 70% are forecasting acceleration in 2024

Note: Our analysis of Pavilion member 2024 forecasts were more conservative

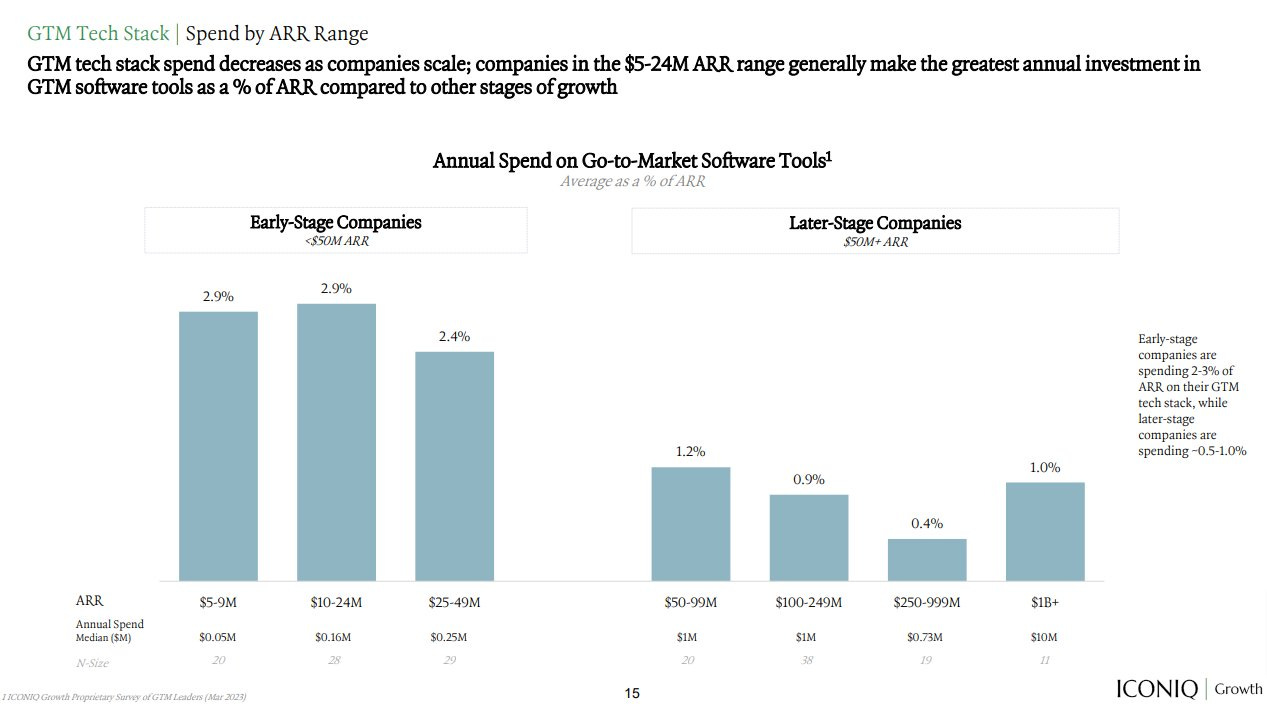

From ICONIQ Growth + G2’s “GTM Tech Stack” 75-slide report - an example of operating level - below $50m ARR, spend of 2%-3% on GTM tooling vs 0.5%-1% above $50m ARR:

A bit more evidence that we might have passed peak cloud optimization…for now:

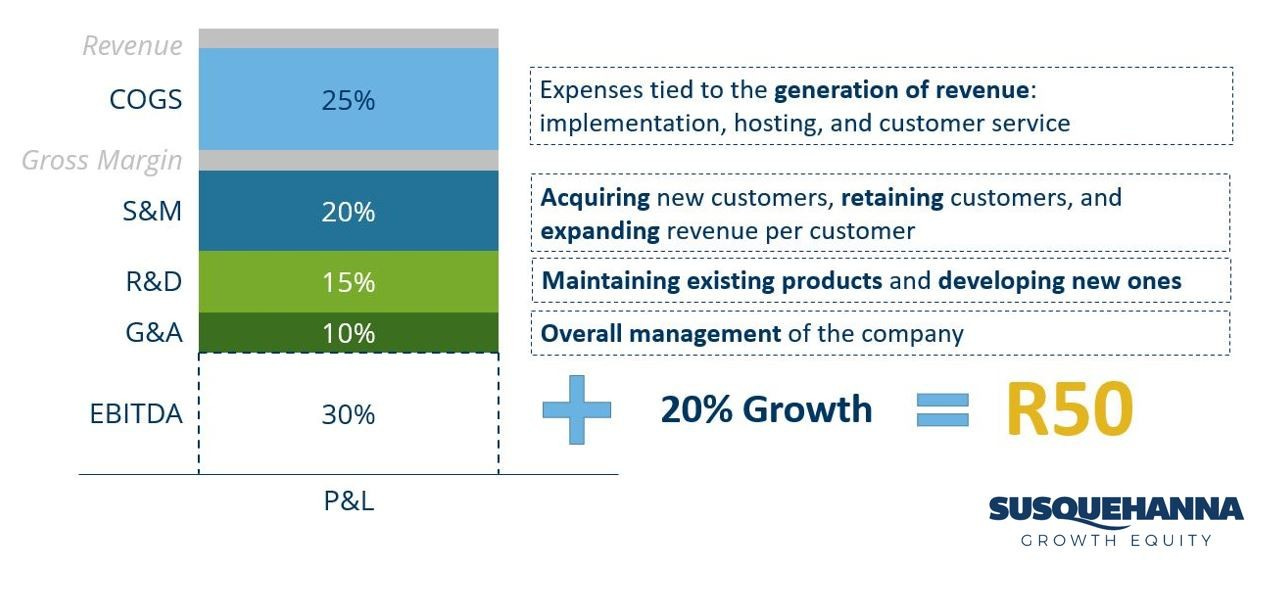

A New “Rule of”: Susquehanna Equity with a Rule of 50

“Beware the Banana Stands: Silicon Valley’s Incinerators of Capital” - by Jared Sleeper

“Kellblog Predictions for 2024” - by Dave Kellogg

“What I learned selling my company” - Harry Glaser had a thoughtful and tactical post on M&A 4 years after selling Persicope Data to SiSense

Lastly, I discussed industry trends (buyer need for ROI proof, AI demand, and employment) with Jon Russo and Meg Heuer - video here:

Our diffusion index *readings* are not comparable to others like the BLS. Importantly, ours shows negative figures to better enable skimming + visualizing positive/negative trends.