SaaSletter - An NRR Reset + More AI ROI

Plus a podcast with Dave Yuan from Tidemark

First: A Podcast With Dave Yuan From Tidemark

VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

We cover his views on AI, Tidemark's investment criteria, qualities for vSaaS founders, product sequencing, and more.

Related Reading: I highly recommend Tidemark’s “Vertical SaaS Knowledge Project” as a library of expert content on topics like market selection, control points, and multi-product sequencing.

Our own multi-product research with G2 also heavily incorporated Tidemark’s VSKP research:

A NRR Reset + Zylo’s SaaS Management Index

Zylo (software to manage software spend; $34 billion of spend under management) recently released its 2024 SaaS Management Index report (30 pages). A few highlights:

Average Spend Per Org: 2021: $60m → 2023: $45m (25% decrease in 2 years)

Average Utilization Rate: 49% → Average Waste of $18m / org

72% of SaaS spend occurs outside of IT control

Average Spend Per Employee: 2022: $4,621 → 2023: $3,916 (14% YoY decline)

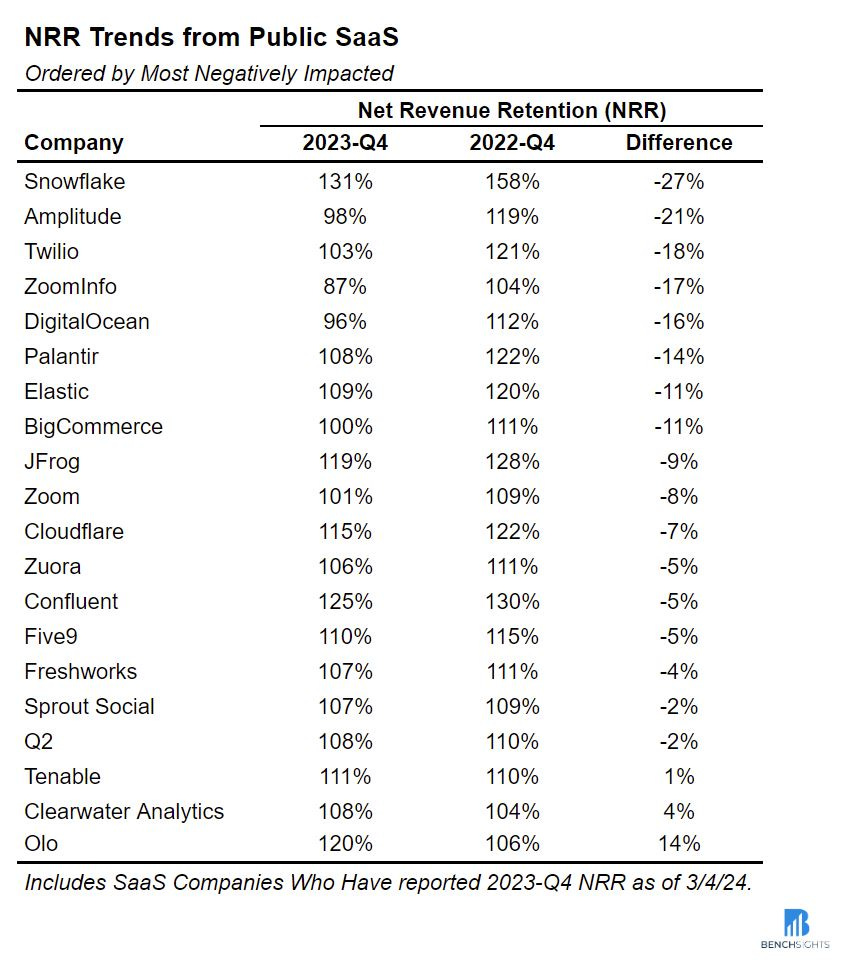

This 14% per employee reduction aligns nearly perfectly with Ed Sim’s (Founder of boldstart, a venture capital firm) observation on a reset of best-in-class NRR (112.5% / 130% = 86.5%, so down 13.5% vs Zylo’s 14%):

Meanwhile, Q4 2023 NRR is down 8% YoY (companies reporting data from David Spitz)

I will be discussing the Zylo report with their Co-Founder and Chief Strategy Officer, Ben Pippenger on Wednesday, March 6 at 2 pm EST: SIGN UP HERE

Related Reading: WSJ’s “Companies Are Juggling More Software Vendors Than Ever. It Isn’t Easy” - fits the NRR reset theme, while a bit of a Rorschach test for investors + operators (more here)

More on AI ROI: Klarna + Morgan Stanley

Huge AI-driven productivity gains reported by Klarna were noteworthy:

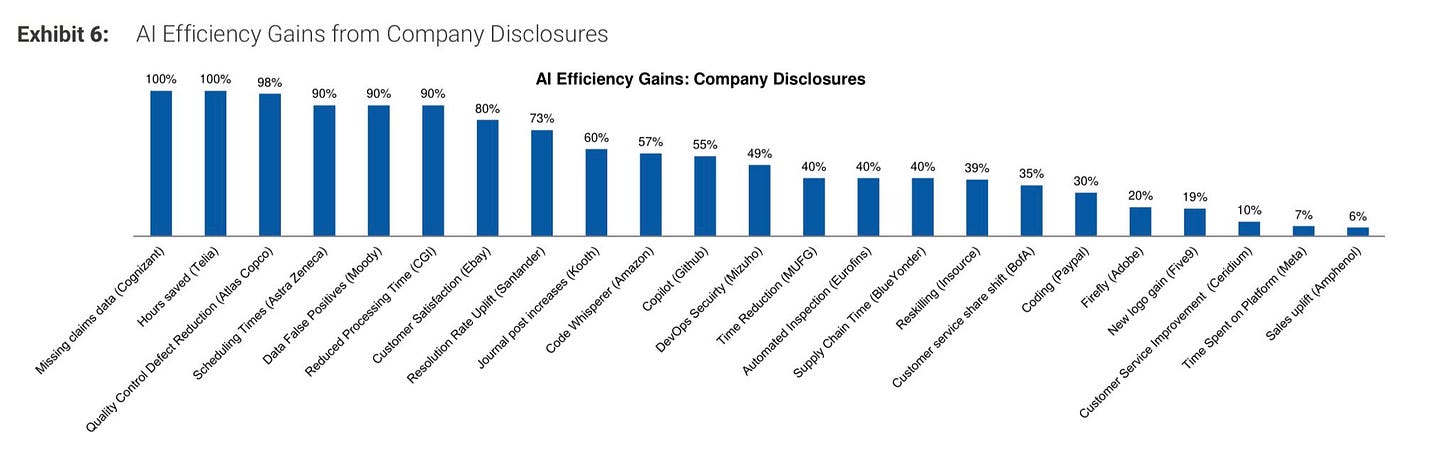

Companies disclosing AI productivity gains = 55% median improvement (via Morgan Stanley Equity Strategy’s new “Leveraging AI to Drive Efficiency” report):

Related Reading: My excerpts of Morgan Stanley on impact by industry (similar to McKinsey on AI ROI) and a summary of academic research on AI gains (34% median)

2024 Benchmark Participation

Cloud Ratings + this newsletter are serving as a partner to drive submissions for Ray Rike + Benchmarkit’s 2024 SaaS Benchmark report (for 2023, n = 1,800+):

Curated Content

Pavilion’s most recent member “Pulse Report” showed encouraging trends (improving actual vs plan as shown above; generally positive executive outlooks on 2024). More in this LinkedIn Live webinar recording with Josh Carter and Jon Russo.

Drivers of NPS + Market Share - Research With G2

Lastly, I’m re-highlighting our deep dive (n = 4,222 software companies using 135,000 G2 data points) into the “Drivers of Customer Satisfaction + Category Leadership”:

… with regression results a good bit different from our polling before releasing the report: