SaaSletter - Redpoint 2025 Market Update

Plus Level Equity's 2025 Go To Market Report

Redpoint 2025 Market Update → Required Growth Rates

Redpoint Ventures (h/t Logan Bartlett, Adil Bhatia, Lydia Day) released their *excellent* “2025 Market Update” report (53 slides).

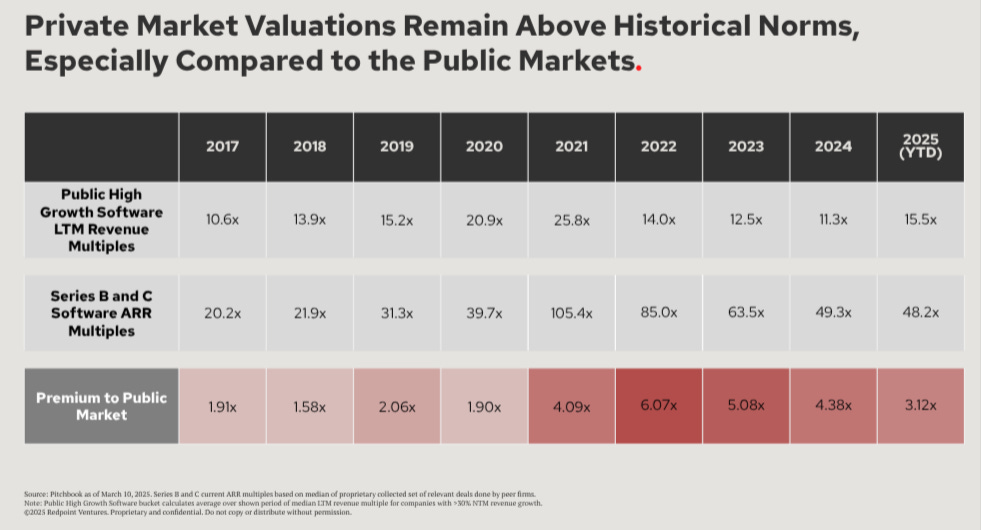

In an attempt to add value to this already excellent private vs public valuation slide, we used Meritech’s valuation dashboard to focus on Enterprise Value / Revenue / Growth (EV/R/G) trading multiples for high growth software stocks (LTM growth > 30% with NTM growth >25%)

Median: 0.35x

Mean: 0.51x (skewed by Palantir’s 1.51x)

Translating this to implied growth rate required by the 48.2x ARR multiples for Series B + C in Redpoint’s “proprietary collected set of deals done by peer firms” versus EV/R/Gs of:

Median: 0.35x → 138% growth needed

Mean: 0.51x → 95% growth needed

In plain English: if your Series B / C company is not growing 95% - 138%/year, investors are (arguably) better off just investing in public companies. Especially when accounting for liquidity discounts and less reliable IPO windows.

Required Growth Rates → Scarcity + Inception Rounds

We performed a similar required growth rate analysis from our coverage of Battery Ventures’ 2024 OpenCloud deck:

Notably, the Battery Ventures sample reflected lower multiples (23.4x), presumably by including later stage, slower growth private companies.

Regardless, when looking at the 48.2x ARR multiples for Series B + C in Redpoint’s deck, my read throughs were the same:

These public versus late-stage private multiple gap analyses always remind me of Lightspeed Venture Partners’ Nnamdi Iregbulem’s “We Don't Have Nearly Enough Startups” - a macroeconomic style study of supply and demand in venture capital:

The venture ecosystem is supply-constrained – there isn't nearly enough startup equity out there to satisfy investor demand.

Additional capital drives opportunistic company formation at the Seed stage. However, the additional capital doesn't improve survival to the later stages – it simply drives prices up for the remaining companies

With the logical investor counter-response of doing whatever it takes to get in very early with the top founders/companies - perhaps through Ed Sim style “Inception Rounds” - to avoid excessive competition, high multiples in later stage funding rounds.

Benchmarkit + Emergence 2025 Benchmarks - Now Open

Cloud Ratings is proud to partner with Benchmarkit and Emergence Capital on the 2025 edition of their B2B SaaS Performance Benchmark Report series.

This series is one of the largest in software (n = 936 in 2024 | 2024 report and our coverage here) → please submit your metrics here:

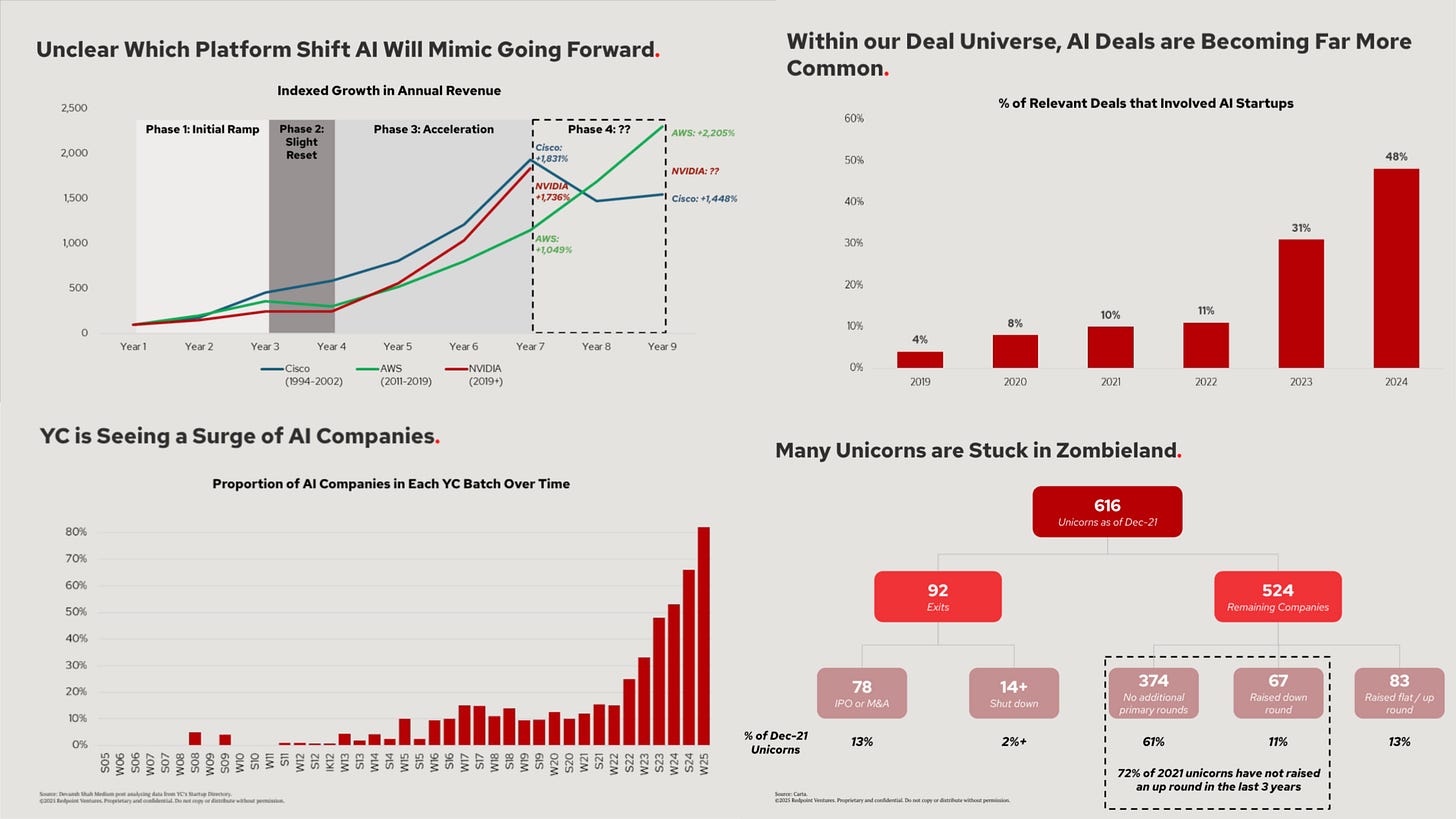

Redpoint 2025 Market Update → More Excerpts

We are intentionally placing these AI + unicorn excerpts in a smallish 4x4 to get you to read their full report:

Level Equity → More Excerpts

I wanted to flag an under-the-radar “2025 Go To Market Report” from Level Equity.

This data on number of prospects needed to book 1 sales meeting was daunting:

For ACVs over $50k, 165 prospects are needed!

Prospects required doubled versus 2023!

About Cloud Ratings

In mid 2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: