SaaSletter - Battery OpenCloud + Meritech AGM

It's "State of The Software Industry" Season

Battery Ventures OpenCloud 2024 → Private Valuations

Battery Ventures (h/t Dharmesh Thakker, Danel Dayan, Sudhee Chilappagari, and team) published their 43 slides from OpenCloud 2024 (no email required).

From this private versus public market ARR multiples chart, I want to expand on the “Implied ARR growth to 3x private company valuation @ a public company multiple” dialog box. Assuming a 5-year hold (fair given the likely stage of this sample and the 3x MOIC cost of capital), let’s translate these into required private company growth rates:

2021: 5.5x → 42% revenue growth

2022: 6.2x → 45% revenue growth

2023: 11.5x → 66% revenue growth

2024 YTD: 9.7x → 60% revenue growth.

Translated further: if your private company is not growing 60% year - over 5 years, not just now - investors are (arguably) better off just investing in public companies.

These public versus late-stage private multiple gap analyses always remind me of Lightspeed Venture Partners’ Nnamdi Iregbulem’s “We Don't Have Nearly Enough Startups” - a macroeconomic style study of supply and demand in venture capital:

The venture ecosystem is supply-constrained – there isn't nearly enough startup equity out there to satisfy investor demand.

Additional capital drives opportunistic company formation at the Seed stage. However, the additional capital doesn't improve survival to the later stages – it simply drives prices up for the remaining companies

With the logical investor counter-response of doing whatever it takes to get in very early with the top founders/companies - perhaps through Ed Sim style “Inception Rounds” - to avoid excessive competition, high multiples in later stage funding rounds.

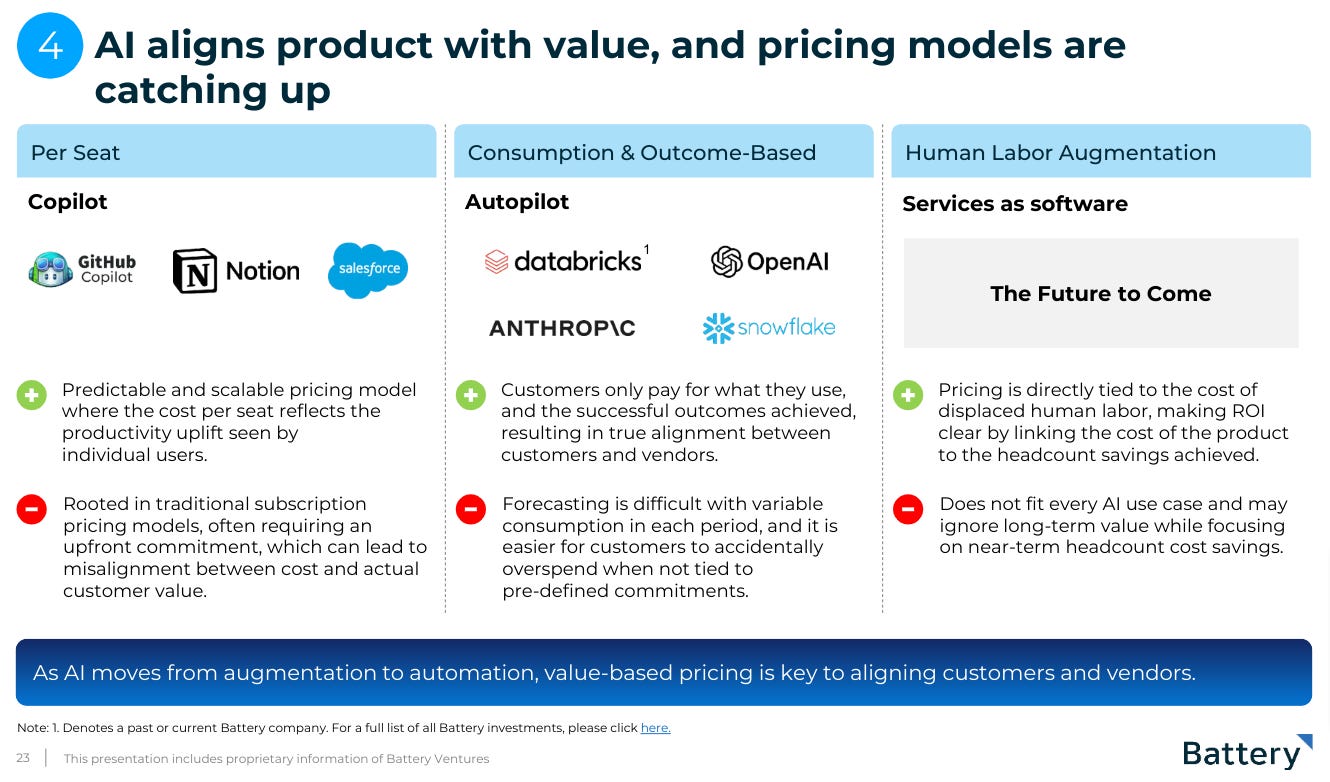

Battery Ventures OpenCloud 2024 → Value Based Pricing

I regularly write about the importance of value-based, ROI-grounded pricing - see:

… and our Cloud Ratings True ROI practice area supports private value engineering engagements as a 3rd party intermediary between vendors and software buyers.

We are currently involved in multiple $7-figure and $8-figure ACV evaluations, all of which involve very large enterprises carefully evaluating the ROI from emerging AI vendors.

If you or your portfolio companies need ROI support and validation, please email me. I lead every engagement with the support of Ivan Arizaga, a former public company CFO.

All of which made me appreciate the pricing model slide below.

But read the entire OpenCloud 2024 report - Battery covers lots of ground across AI, hyperscalers, unicorns, and the public markets.

Meritech 2024 Annual Meeting

Alex Clayton and Meritech Capital published 44 slides from their 2024 Annual Meeting.

A thoughtful way of showing how everyone is all in on AI, from YCombinator batches to Salesforce Agentforce:

My call out from the Adobe cloud transformation case study: Adobe’s market cap was below $15 billion through the fall of 2012!

The low multiples of the 2000s and 2010s in software led to phenomenal and *easy* investor returns. Those returns attracted a surplus of private AND public investor capital today.

The above SaaS funding history chart comes from my SaaS Metrics Palooza 2024 slides (h/t Ray Rike for the invite):

About Cloud Ratings

For our many new readers, we recently announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: