SaaSletter - ICONIQ Growth's "State of AI"

Plus more from Cloud Ratings, Sapphire and Hubspot's Analyst Day

Upcoming AI Podcast With OMERS Ventures

Next Wednesday, we will debut our “Vertical AI Deep Dive” episode with Marissa Moore and Taku Murahwi of OMERS Ventures. We cover their 152-page vertical AI market framework (email required).

Register for the LinkedIn Live episode debut.

Subscribe to our investor-oriented “Cloud Returns” podcast.

ICONIQ Growth’s “State Of AI” Report

ICONIQ Growth released its “State of AI” report.

Importantly, the report was based on a “survey of 215 executives at enterprises with $500M+ annual revenue, including CEOs, CIOs, CTO, and functional leaders.” My excerpts:

AI ROI by type of benefit - typically in the 5%-20% range. Unsurprisingly, revenue impact is slower to appear versus more immediate cost savings.

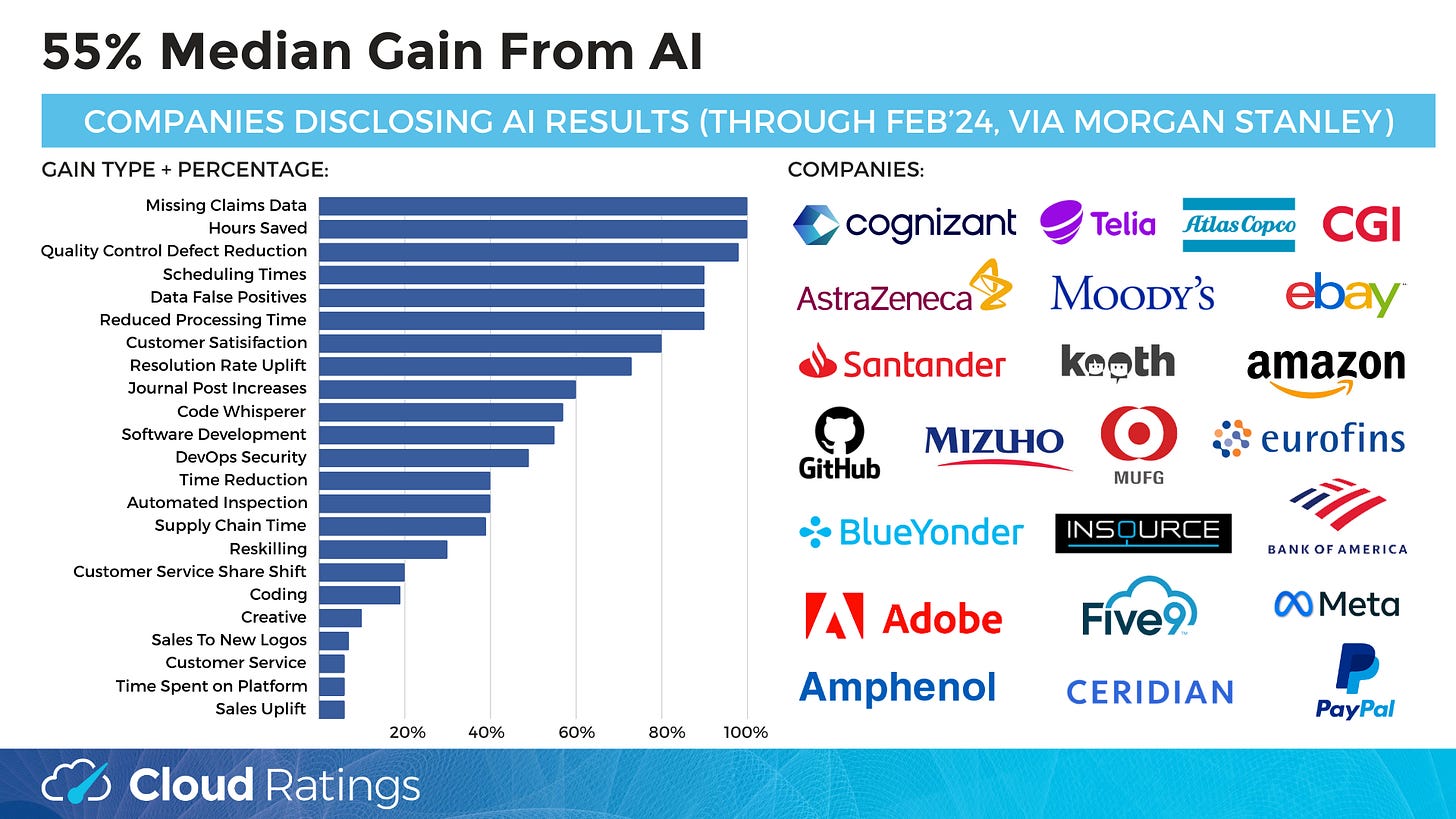

While the 5%-20% ROI results in the ICONIQ survey are well below the eye-popping but *very selection-biased* company disclosures of 55% AI gains…

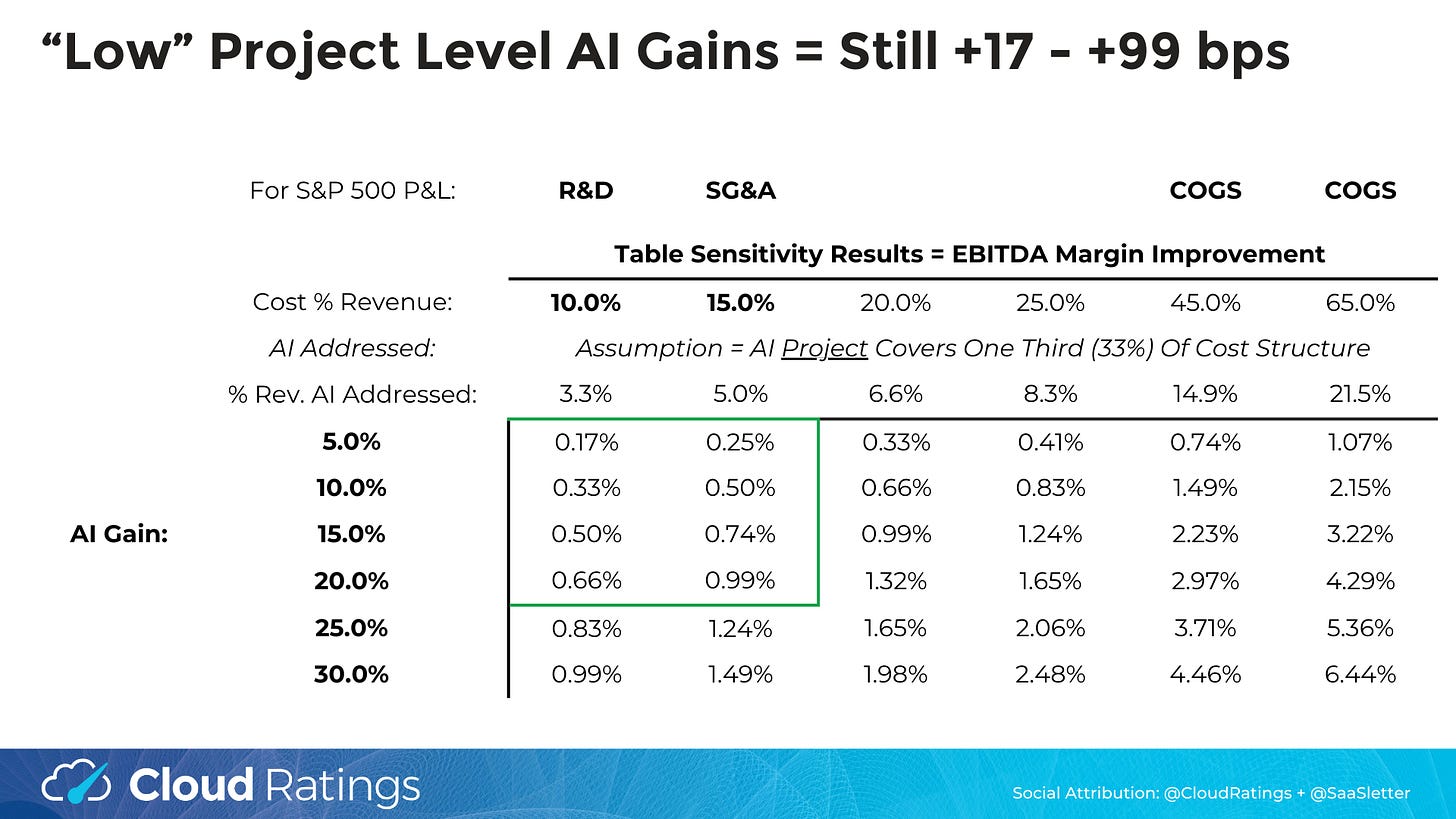

… these “low” 5%-20% AI *project-level* gains can still yield notable margin improvements on an *overall corporate* P&L. As our many public equity investor readers know, an initiative that yields 33bps to 50bps in operating margin improvement is meaningful even for S&P 500 scale companies.

Combining a few ICONIQ slides, we summarized AI ROI by function below. The callouts:

Very strong ROI across Sales, Finance, and Marketing

IT ROI results were surprisingly poor

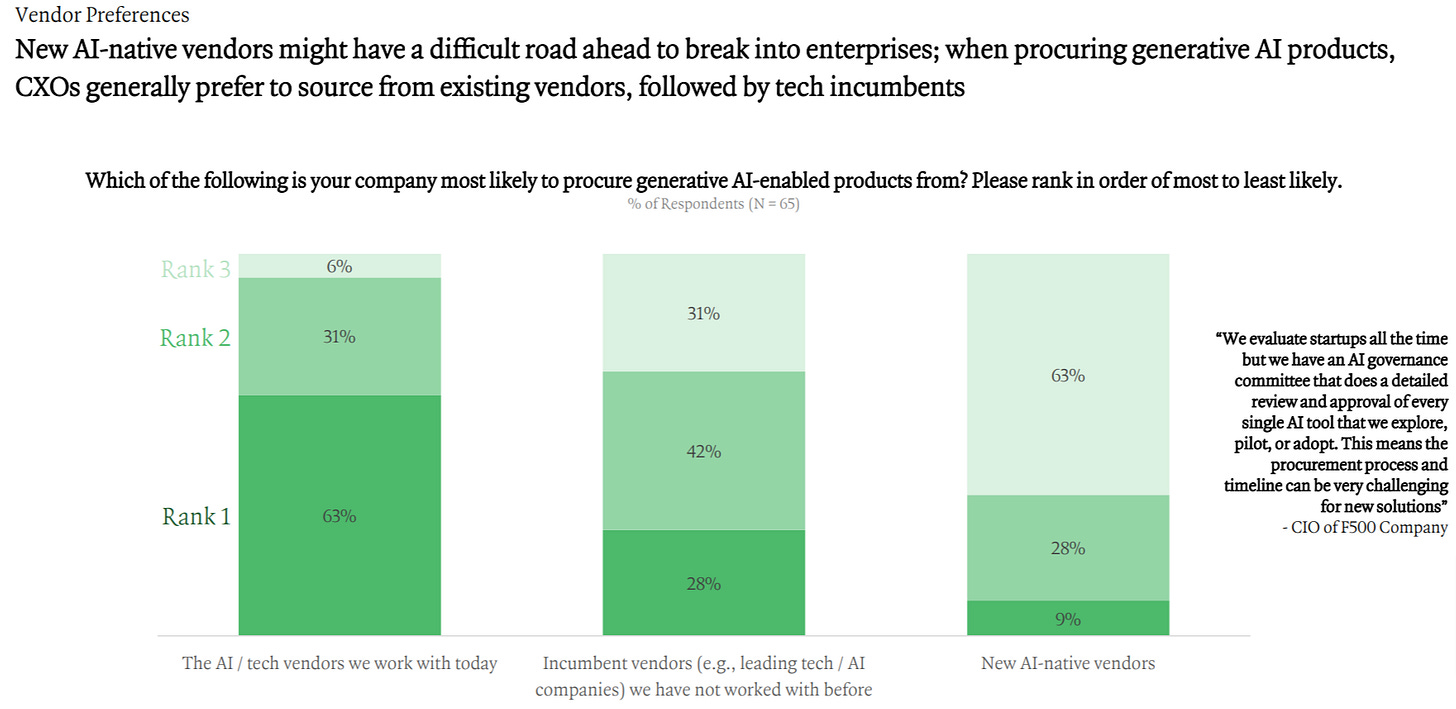

The vendor preference survey results suggest an uphill battle for AI Natives against incumbents:

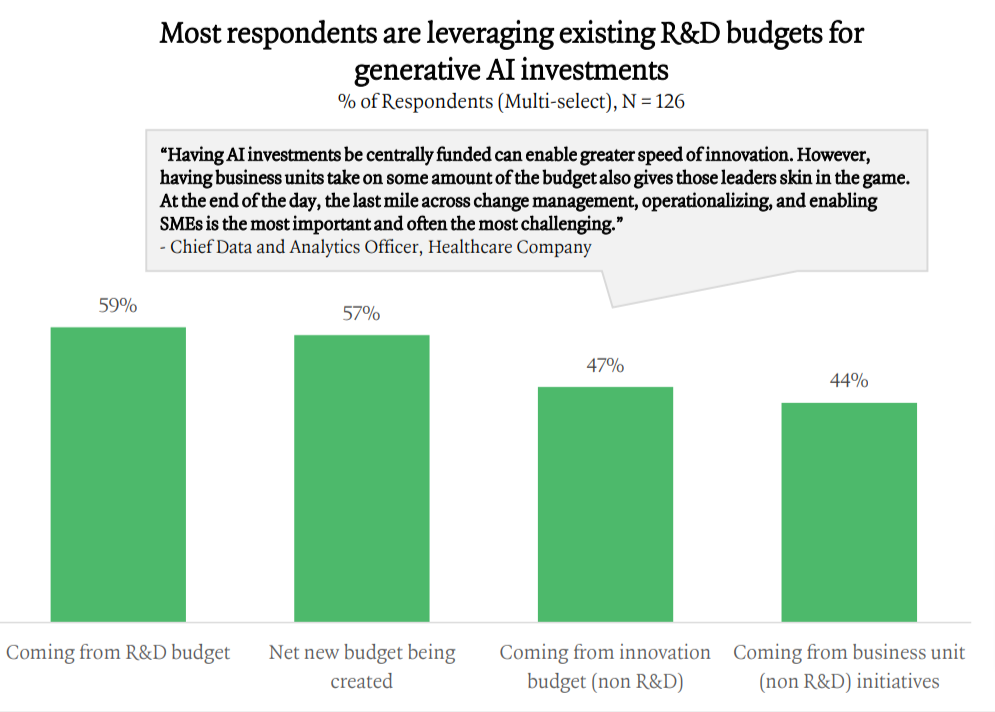

This chart on budget sources suggests AI will be a headwind to core, non-AI revenue growth near-term:

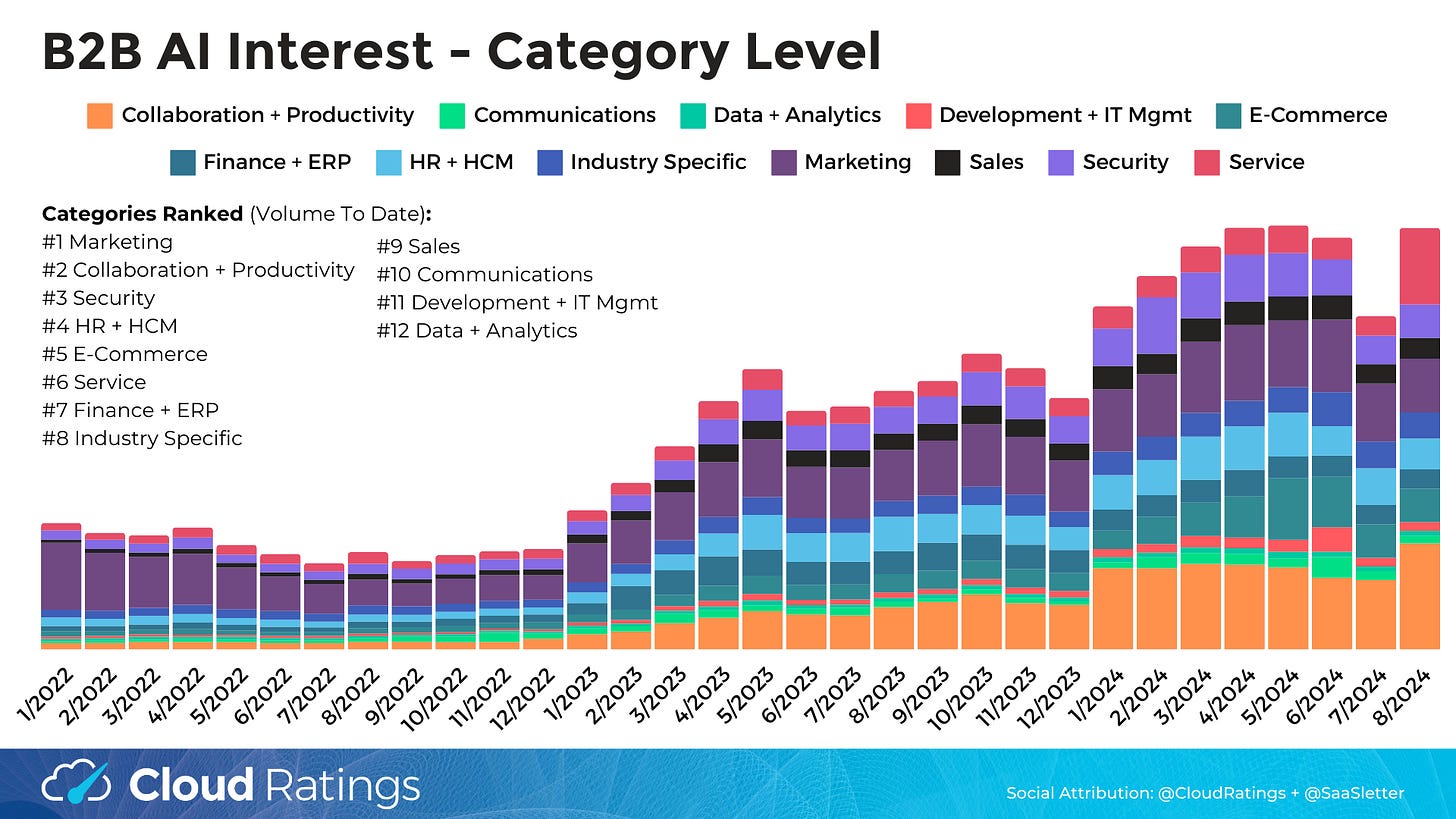

August 2024 B2B AI Interest Index from Cloud Ratings

We’ve updated our B2B AI Interest Index through August 2024 - full slides below:

August trends represent a reversal from broadly negative trends in June and July.

Thematic Category Interest (n = 47 sub-categories tracked - i.e. “supply chain AI” or “security AI”) rebounded:

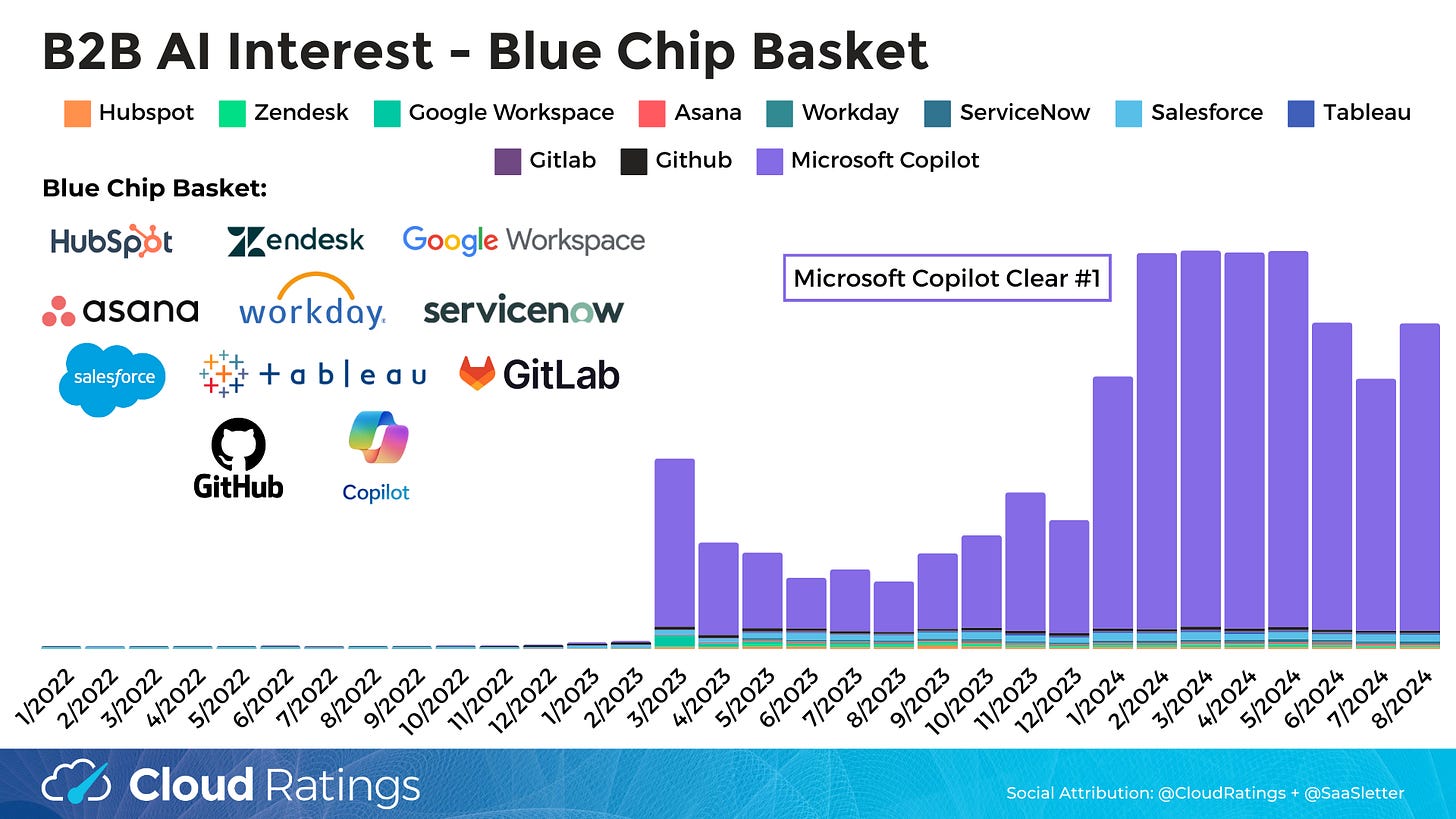

Bellwether Microsoft Copilot also rebounded… a bit, with other “Blue Chips” flat:

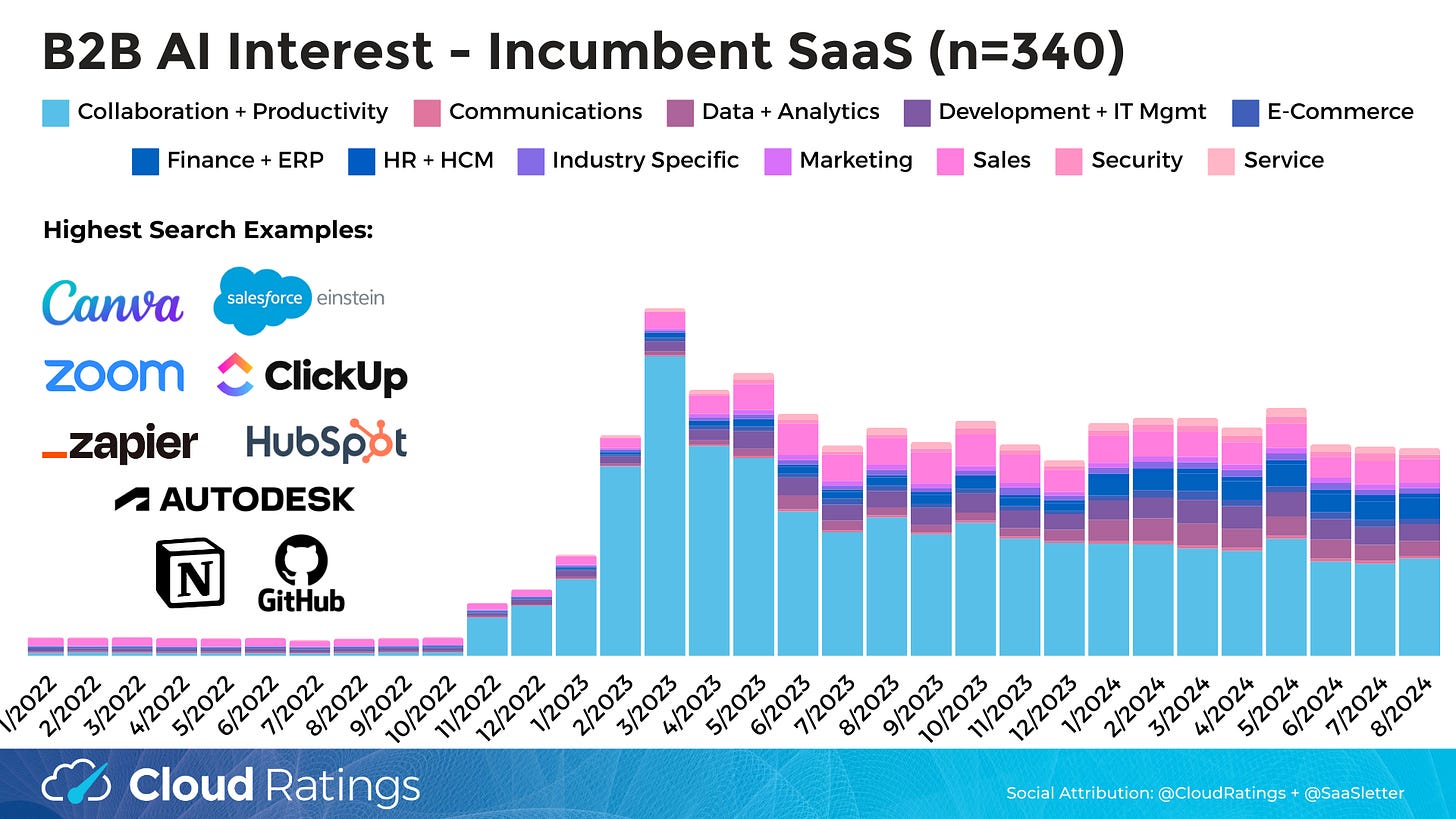

SaaS Incumbents (n=340, same 340 vendors tracked in our top-of-the-funnel focused, forward-looking SaaS Demand Index) remain flat:

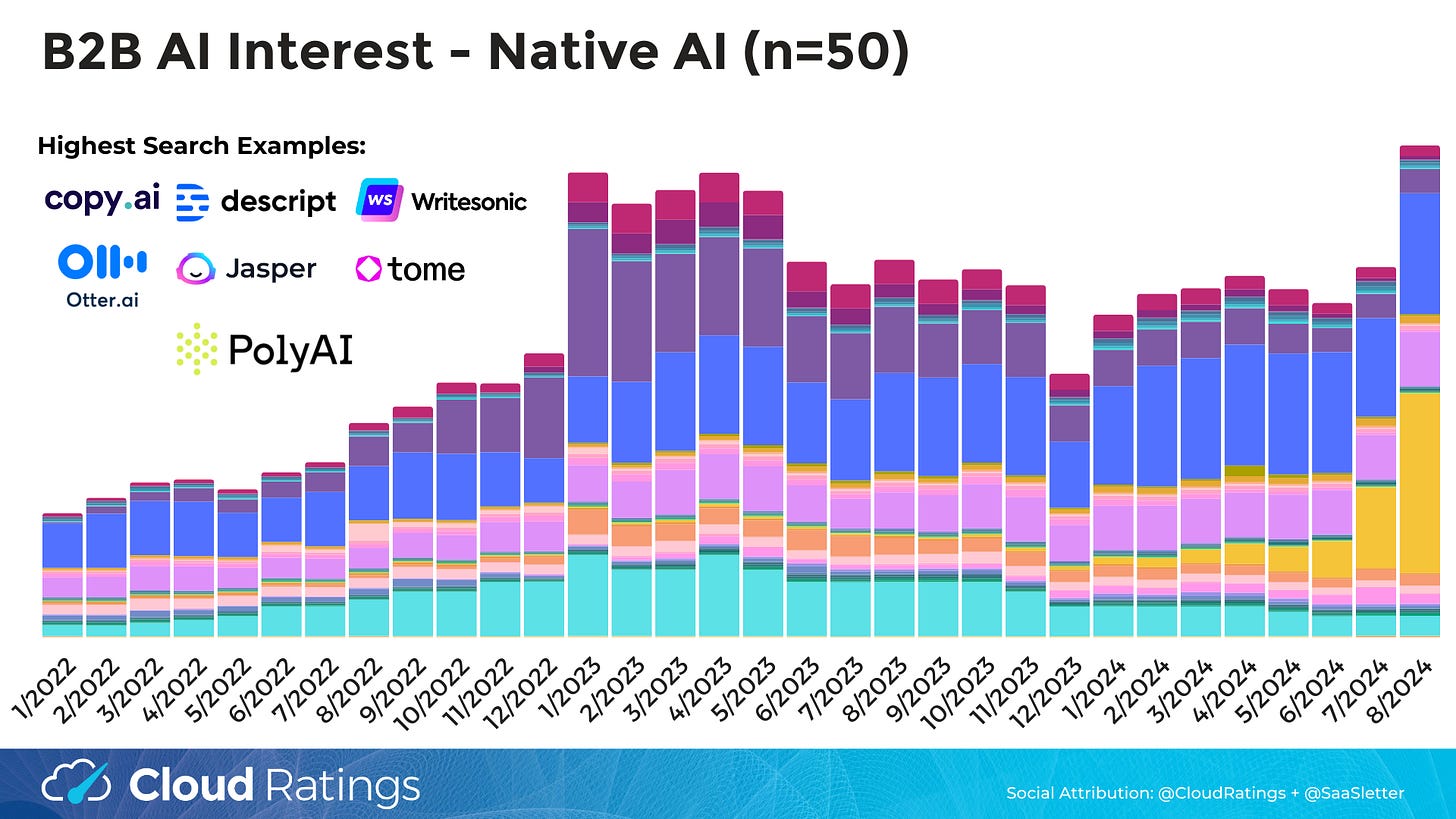

Largely driven by continued explosive growth in PolyAI (“enterprise conversational assistants that carry on natural conversations with customers to solve their problems”), interest in AI Native apps (n=50) increased:

Curated Content

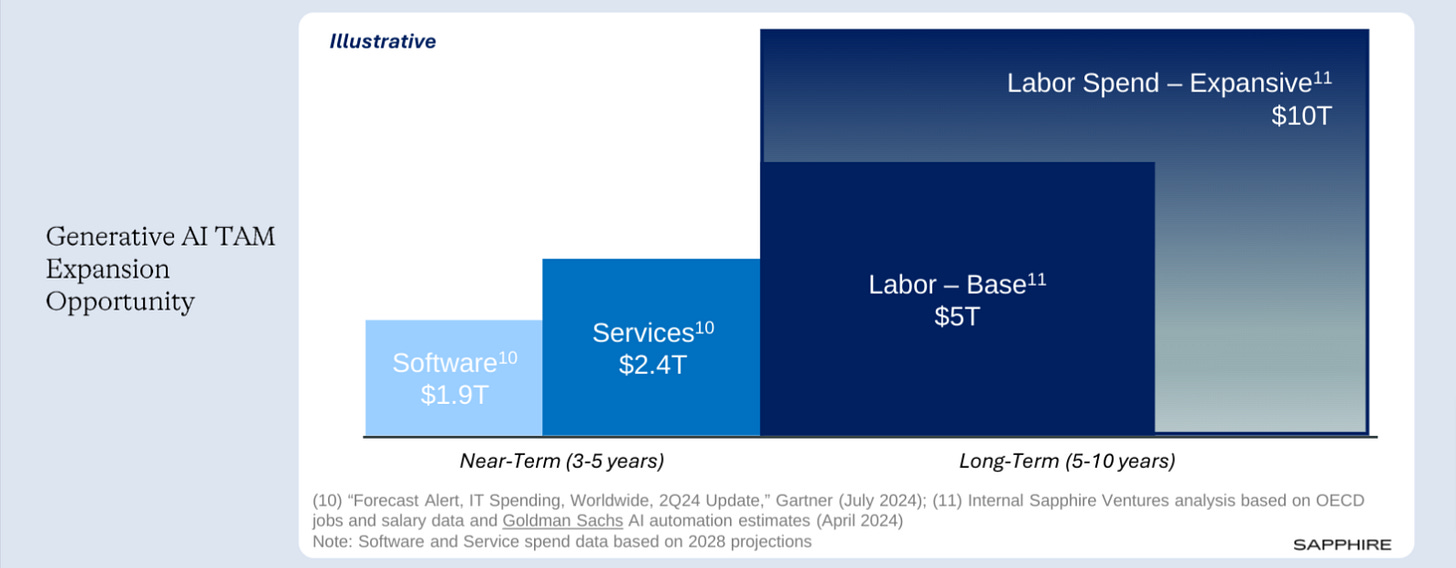

Sapphire Ventures latest “Market Memo” included a) table of private $100m ARR companies growing +30% and b) their view of Generative AI’s TAM: “shift will occur as we move from AI-powered applications, which incrementally increase worker productivity within the current paradigm, to Agentic systems that can autonomously complete not only tasks but more end-to-end user workflows. … Generative AI could theoretically be targeting an additional $7.5T to $12.5T of total spend within a decade.”

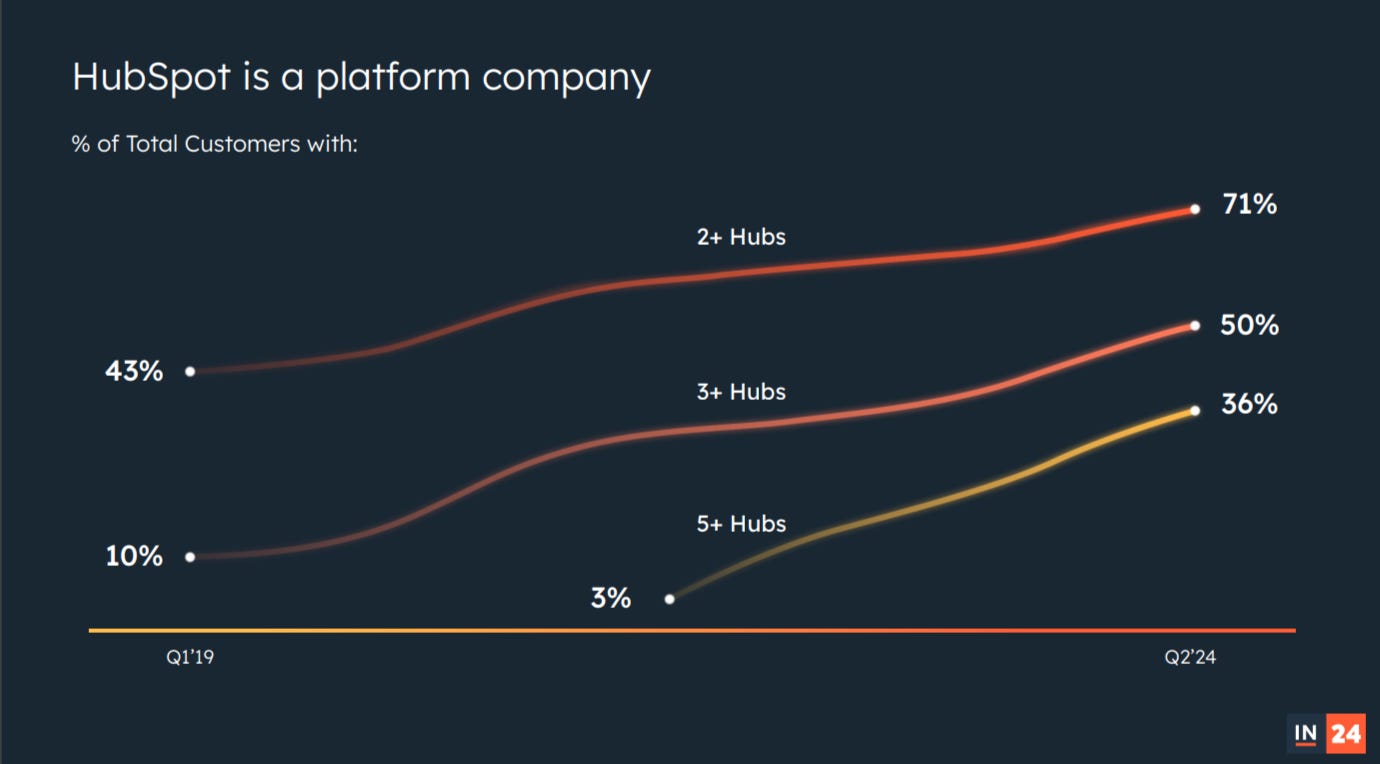

Hubspot’s Analyst Day (my excerpts) highlighted AI usage/gains, the power of a partner ecosystem, and the durability of multi-product growth:

More on this multi-product theme in our earlier platforms versus point solutions research with G2:

About Cloud Ratings

For our many new readers, we recently announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: