SaaSletter - State Of The Industry

My slides from Bowery Capital's AGM + our B2B AI Interest Index

Bowery Capital AGM Slides

I had the pleasure of pontificating on the state of the software industry at Bowery Capital’s Annual General Meeting.

Given the high proportion of private equity and growth equity subscribers, I wanted to offer an unpaid, merit-based call-out to a portfolio company I met named Incentiv - their bio = “an innovative platform designed to arm investors and talent leaders with rich data and intuitive tools they can rely on to make confident comp decisions” - led by Matt Fanelli (previously at Permira). *My* analogy = a PE/GE-oriented alternative to Aon Radford or Pave.

The full slides below are a mix of sweet (AI) and sour (maturation of SaaS):

A maturing growth industry (more in our full Pacific Crest / KeyBanc longitudinal SaaS benchmark study):

…with the impact of less open space becoming evident at the “tip of the spear” (SDRs + AEs):

From an early-stage investor/operator perspective, our drivers of software NPS study with G2 (n = 4,222 software companies) plus Scott Brinker + Frans Riemersma’s work on declining user satisfaction as software companies age/scale: opportunities exist today but require you to “be so good they can’t ignore you”:

Fundamentally, software drives ROI far in excess of corporate hurdle rates (more in our “The ROI of Software + IT” and “Drivers of Software ROI”):

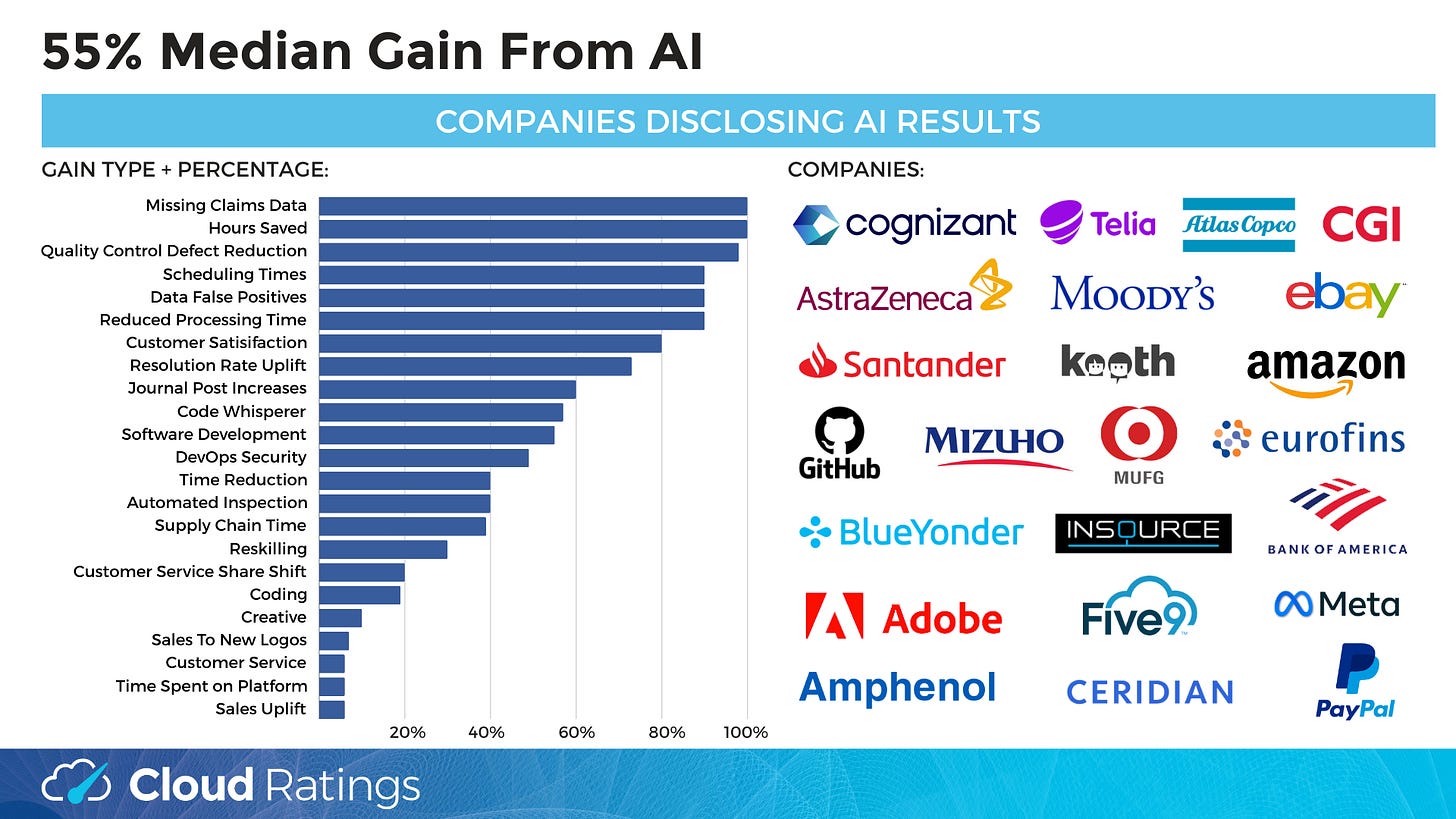

From (albeit upwardly selective) company disclosures as aggregated by Morgan Stanley Equity Research through the end of February, the median gain from AI has been 55% + encouragingly across a diverse range of *workflows* and industries:

Absent the emergence of AI as a growth vector, my positioning toward a maturing SaaS industry would be more selective and value-aware.

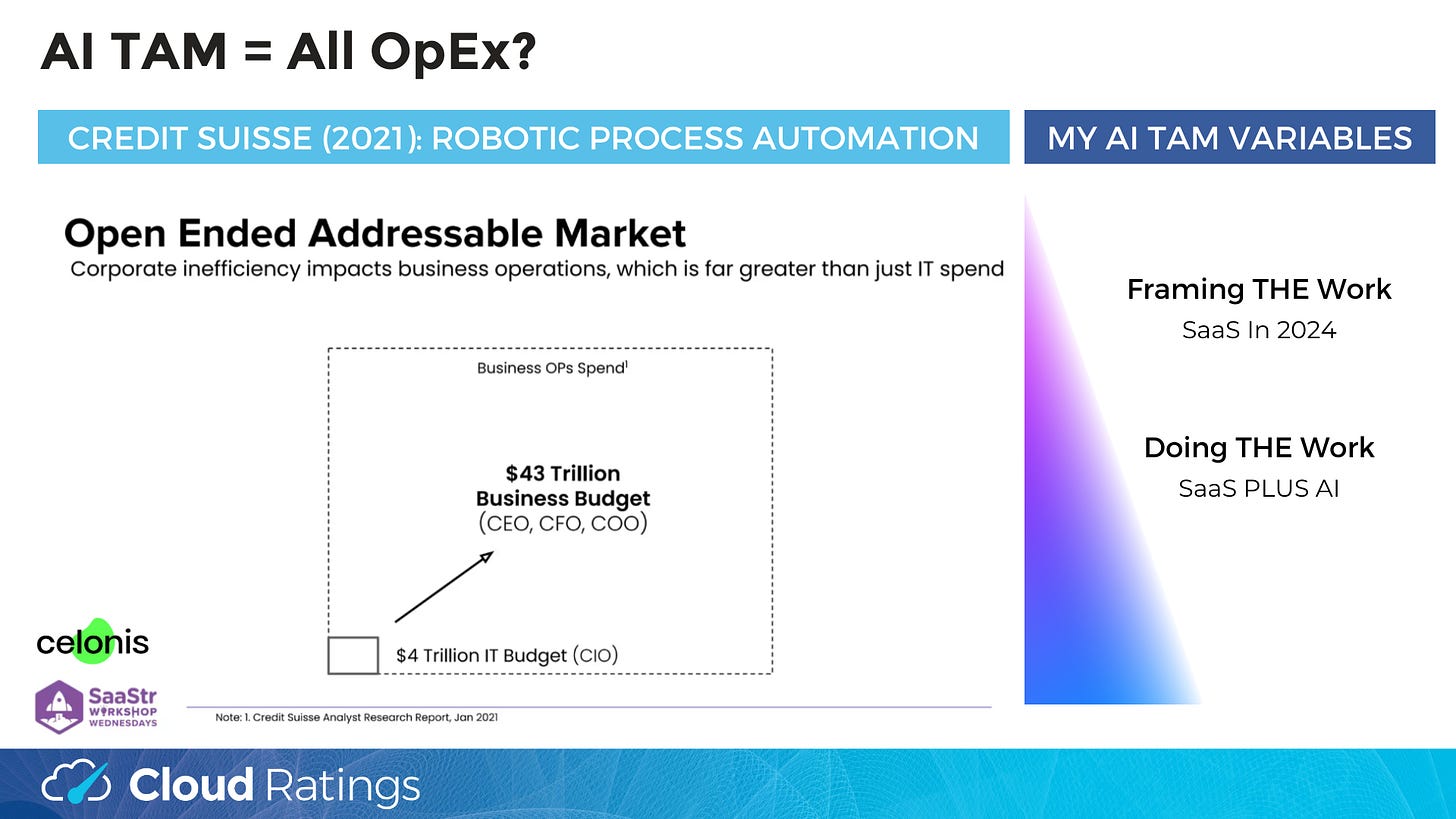

Going back to our crowded category charts above, AI opens green space for software with the exact TAM1 increase determined a) at the *workflow by workflow* level and b) the value added by SaaS Plus AI to each workflow.

After all, it all comes back to ROI.

AI Podcast: Matt Slotnick from Poggio Labs

VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

Related to the above, this clip from our podcast with Matt Slotnick, Co-Founder and CEO of AI-native Poggio Labs focuses on building AI at the workflow level and how this differs from the traditional SaaS playbook.

B2B AI Interest Index - February 2024

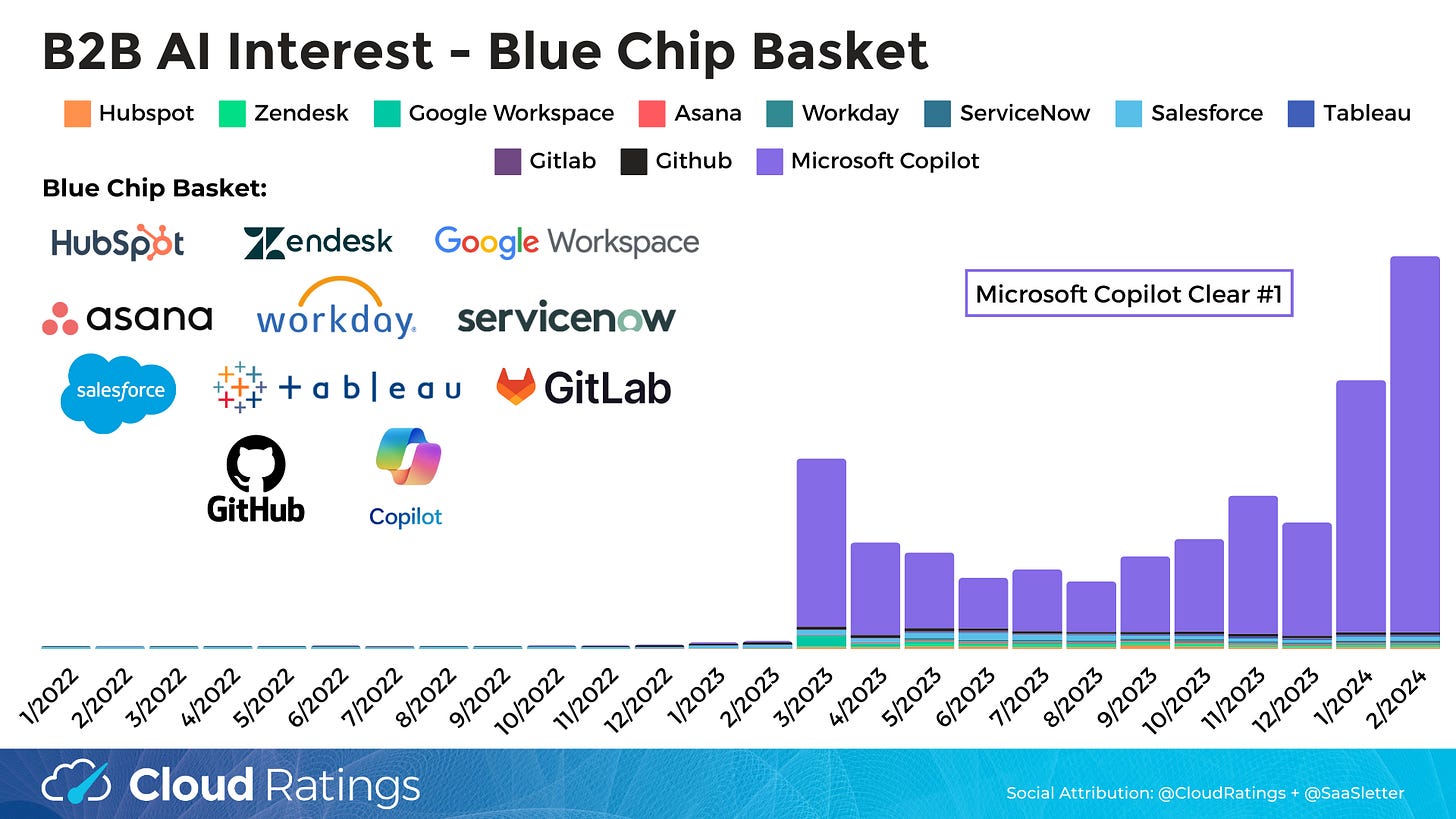

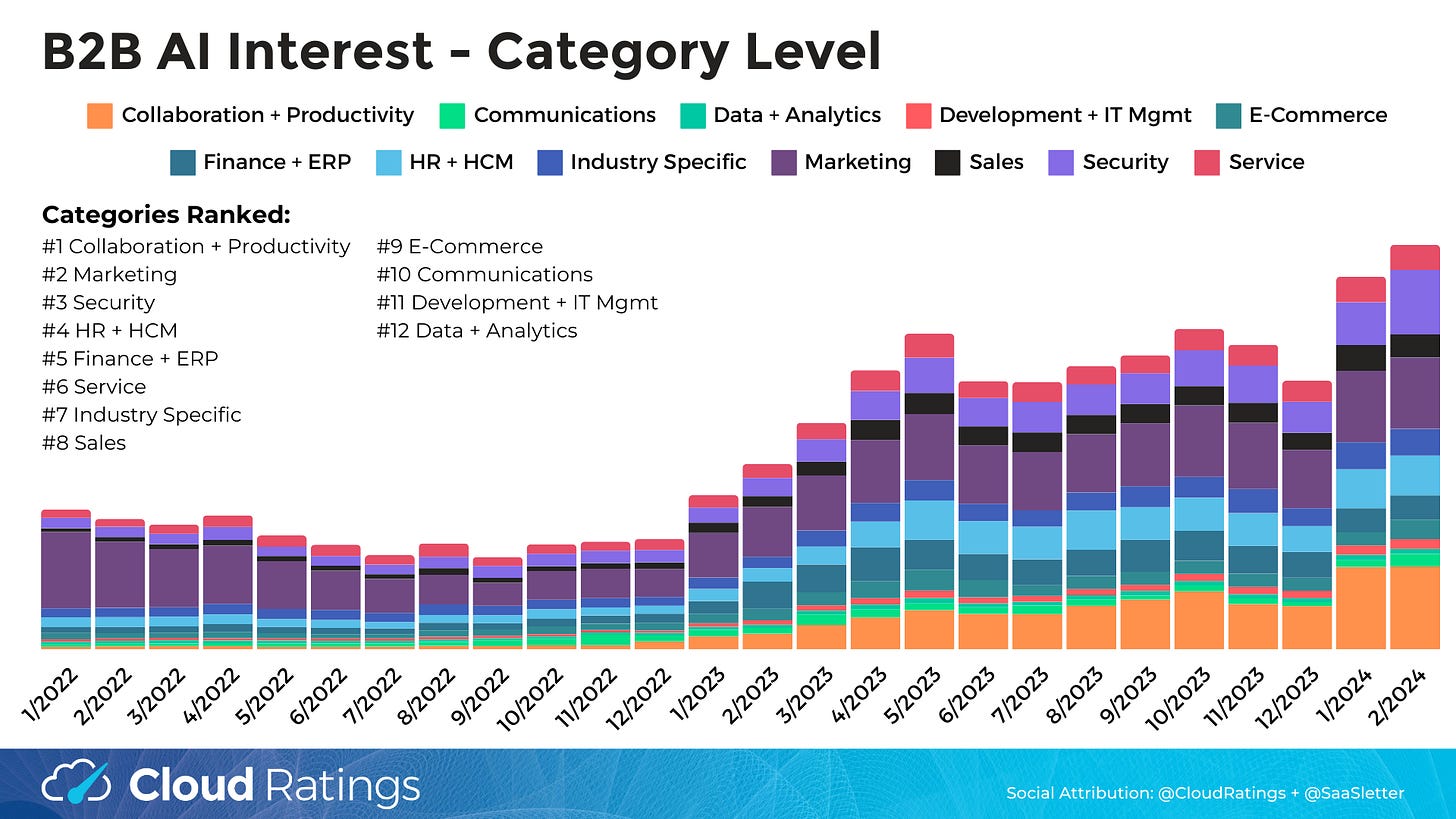

We’ve updated our B2B AI Interest Index through February 2024 - full slides below:

The callouts:

Strong “but” product rollout linked interest for Microsoft Copilot

Encouraging trends at the Category Interest (i.e. “manufacturing AI” or “security AI”) level

AI-Centric Curated Content

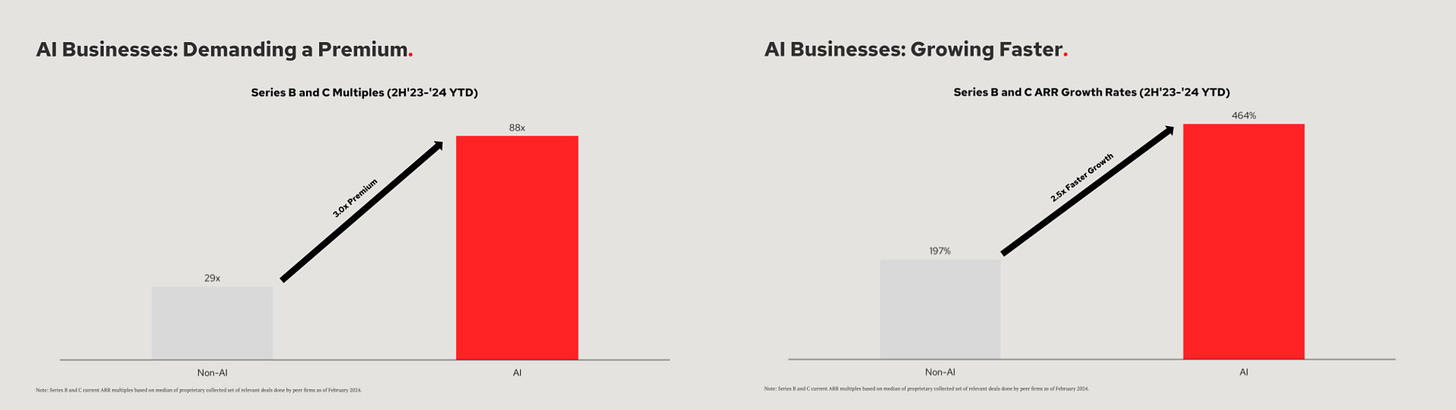

AI excerpts above from Redpoint’s Annual Meeting slides - via Logan Bartlett. My value add = From an EV/Revenue/Growth perspective:

Series B+C: AI = 0.19x + Non-AI = 0.15x (via Redpoint charts above)

Public SaaS > 25% Growth = 0.40x (via Meritech comps table)

“Why ChatGPT is the new Excel — and what it means for software” - from Natalie Sandman, a GP at Spark Capital

Tomasz Tunguz on the P&L impact of AI for classic SaaS companies

Jason Lemkin from SaaStr was bullish overall on AI throughout his recent Ask Me Anything - video here and our own AI-generated summary/transcript

While I am not an advocate of “AI TAM = All Operating Expenses” literally, I specifically chose this Credit Suisse sizing for the nice layout and the fact that a *2021* sizing of *Robotic Process Automation* - so pre-GenAI - is an intriguing comparison.