SaaSletter - Thin Pipeline Coverage

Our Coverage of ICONIQ Growth's "State of GTM 2025"

Red Flags From ICONIQ Growth: “The State of Go-to-Market in 2025”

ICONIQ Growth recently released their “The State of Go-to-Market in 2025” report (45 slides) → as always, go read the full report. Now for our excerpts + takes:

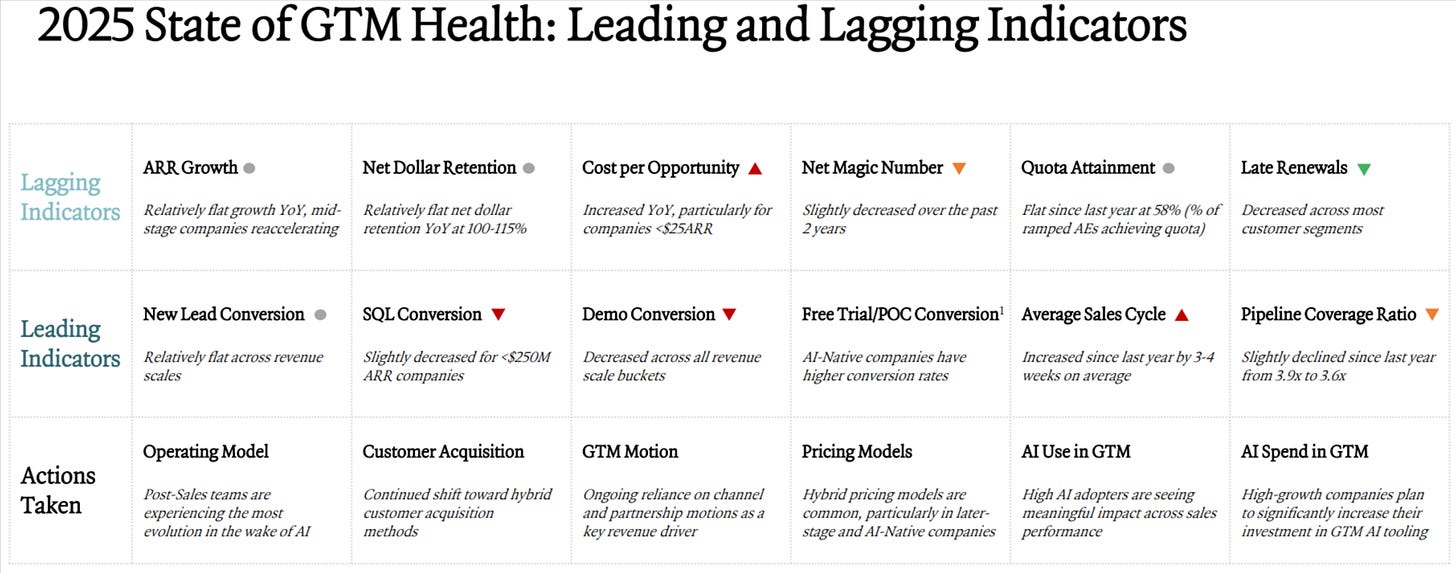

This all-in-one GTM recap paints a concerning picture with 55% down (6 of 11) and only 9% up (1 of 11) :

Lagging Indicators: 1 up, 2 down, and 3 neutral

Leading Indicators: 0 up, 4 down, and 1 neutral

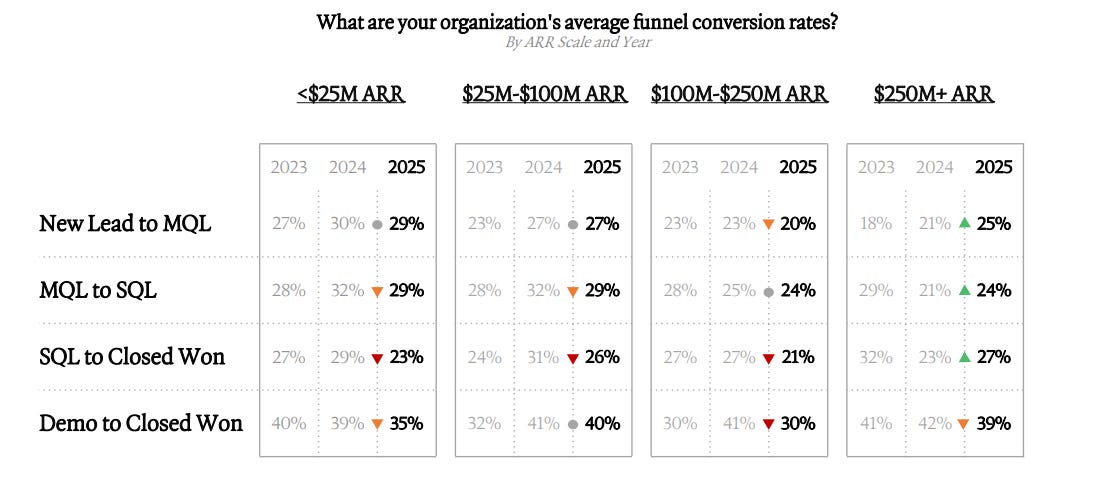

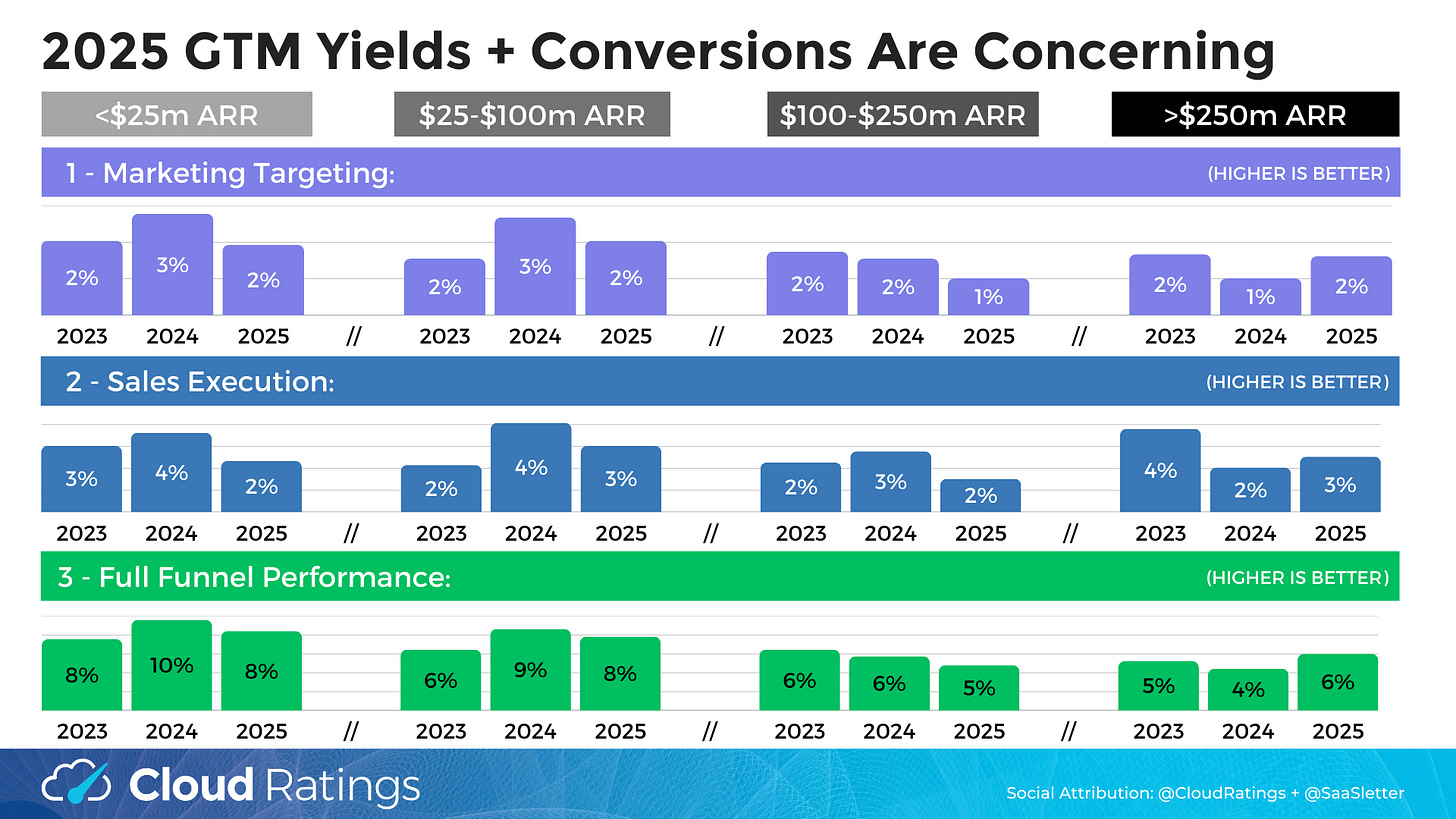

When segmented by ARR cohort, the trends are particularly concerning except for >$250m ARR, which is trending well versus 2024:

Our analysis of the data helps further call out the negative 2025 trends below $250m ARR, which represents a reversal from favorable 2024 vs 2023 trends:

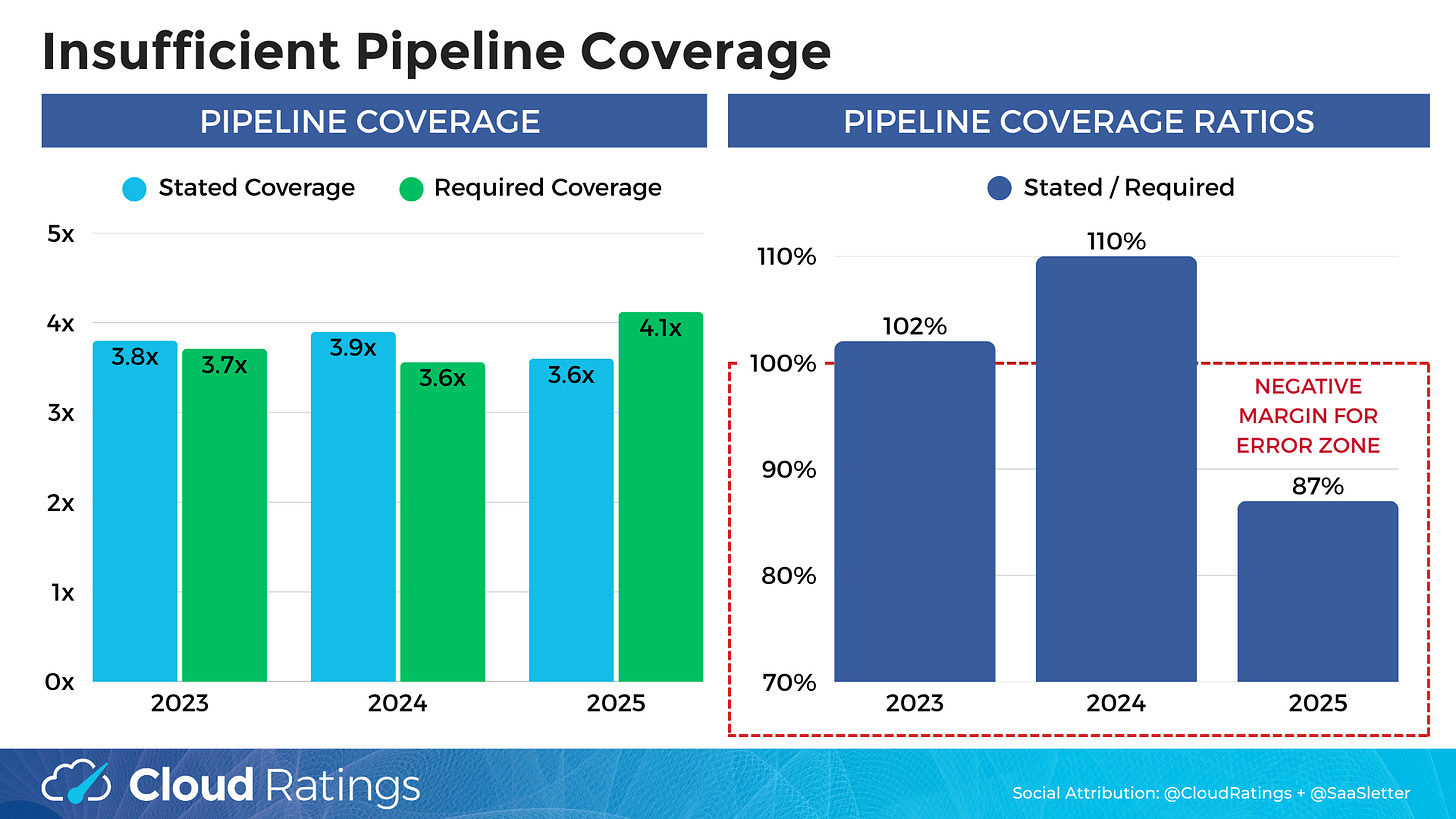

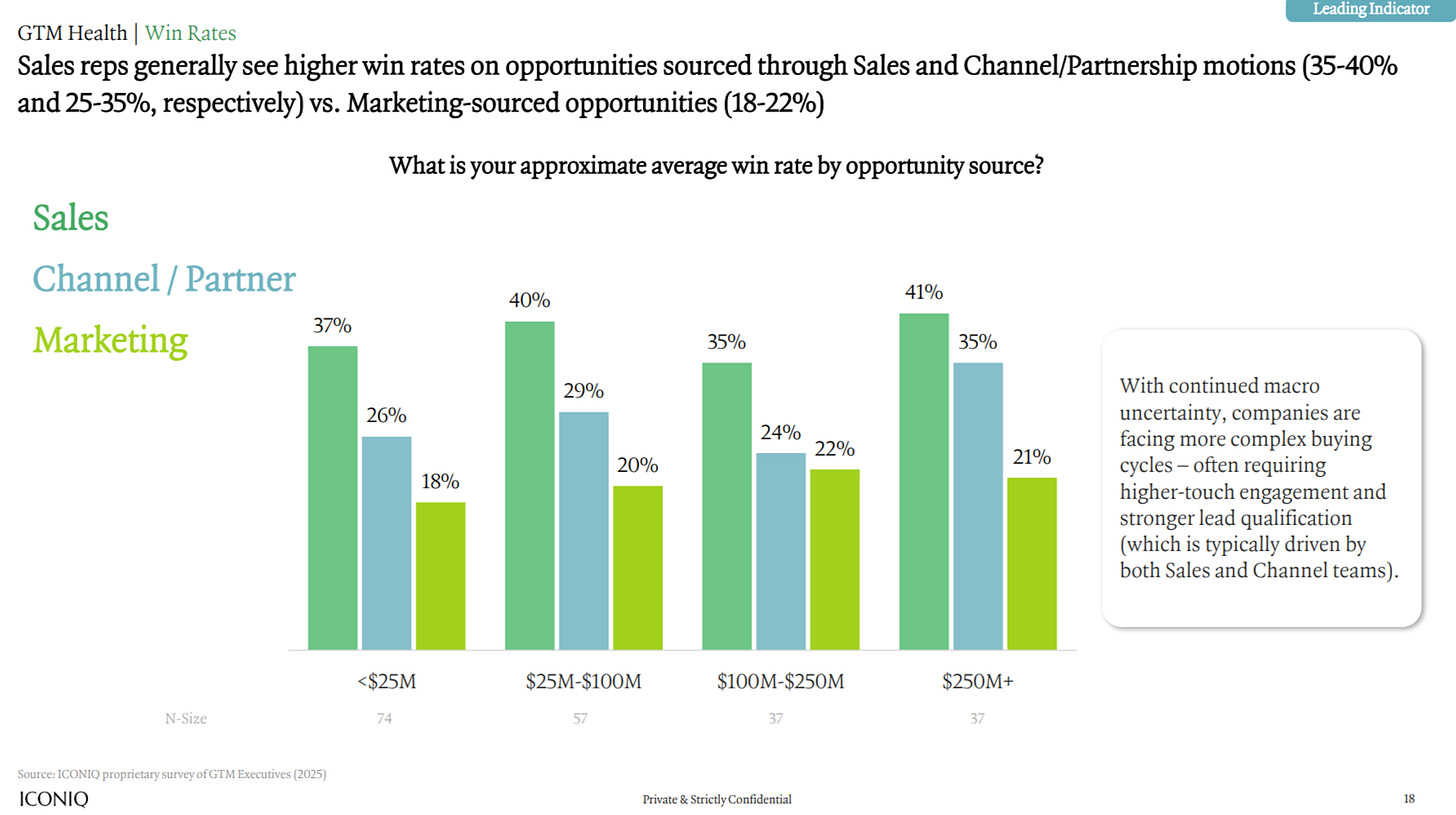

Declining win rates - which we have corroborated with private data sources besides ICONIQ - mean seemingly OK pipelines at 3.6x will not be sufficient to hit forecasts:

Missed forecasts are a recurring theme in this newsletter,1 and for tomorrow’s Weds, July 16th virtual event → register now to learn advanced tactical, data-driven solutions:

More ICONIQ Growth Excerpts

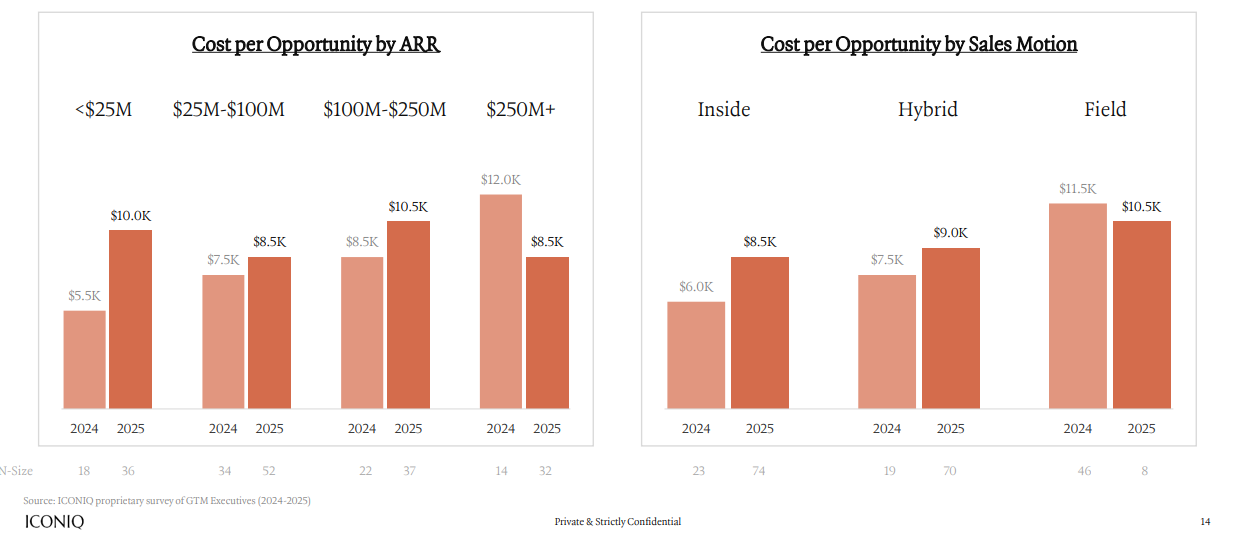

At the risk of being dour, we will call out the rising Cost Per Opportunity:

<$25m ARR: +82%!

$25m-$100m ARR: +13%

$100m-$250m ARR: +18%

>$250m ARR: -13% - yet again, >$250m is outperforming

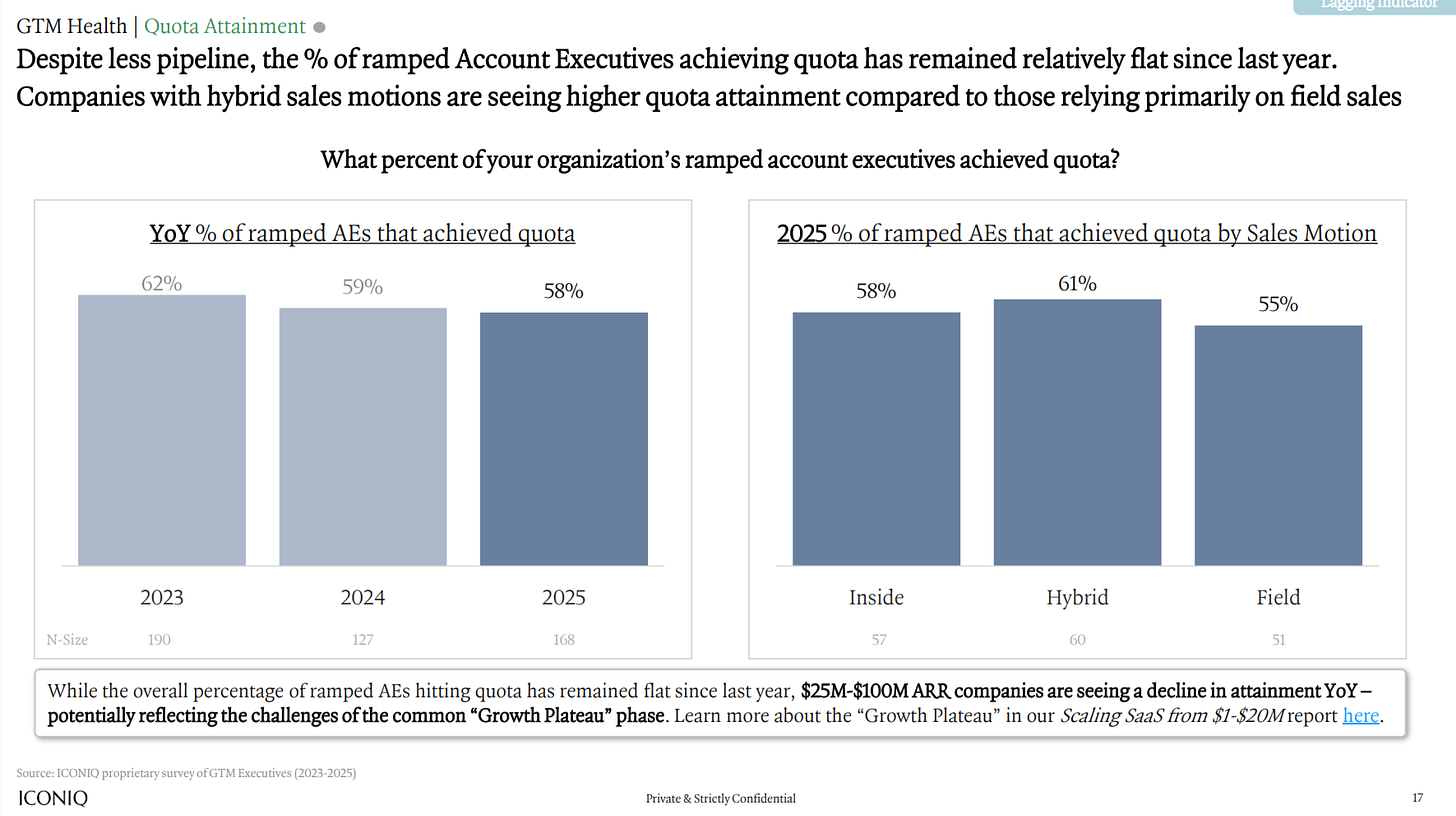

Whether a reflection of the typical higher quality company mix in ICONIQ’s reports, or a positive sign for the industry, quota attainment presented was above RepVue quota attainment benchmarks:

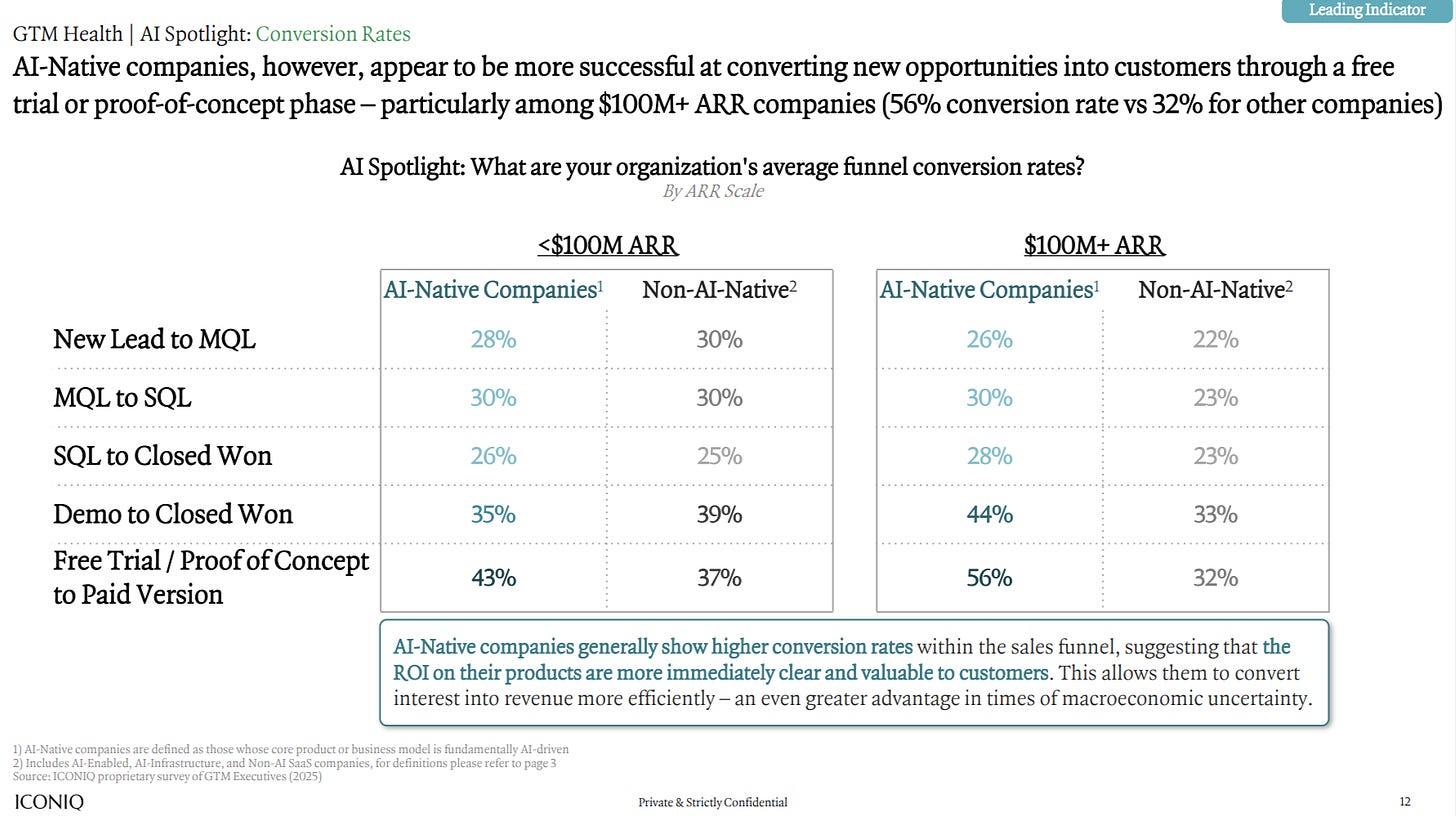

The remaining excerpts a) speak for themselves and b) should motivate you to go read the full ICONIQ report:

Curated Content

Tidemark Capital - “Vertical SaaS AI Playbook”

Matt Slotnick - “Data Rules Everything Around Me: The Future Of Enterprise Applications”

Multiple posts from Dave Kellogg:

About Cloud Ratings

In mid-2024, we announced a research partnership with G2 - more here:

With this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: