SaaSletter - Key New AI Data Points

Plus Curated AI Content From Felicis Ventures, Scott Brinker + SAS

Ebsta’s Revenue Insights As A Service

Having first connected thanks to their impressive benchmark data ($48 billion+ of customer pipeline under management) and hosting Guy Rubin on our podcast 2x, we are helping Ebsta connect with software private equity investment firms to launch their Revenue Insights as a Service (RIaaS) offering:

quarterly deep dives into your portco's sales machine,

using a mix of AI/software (linked into CRMs, email, and call recordings)

with a professional services element that yields this type of report (attached)

Full Ebsta RIaaS overview deck here + book a demo

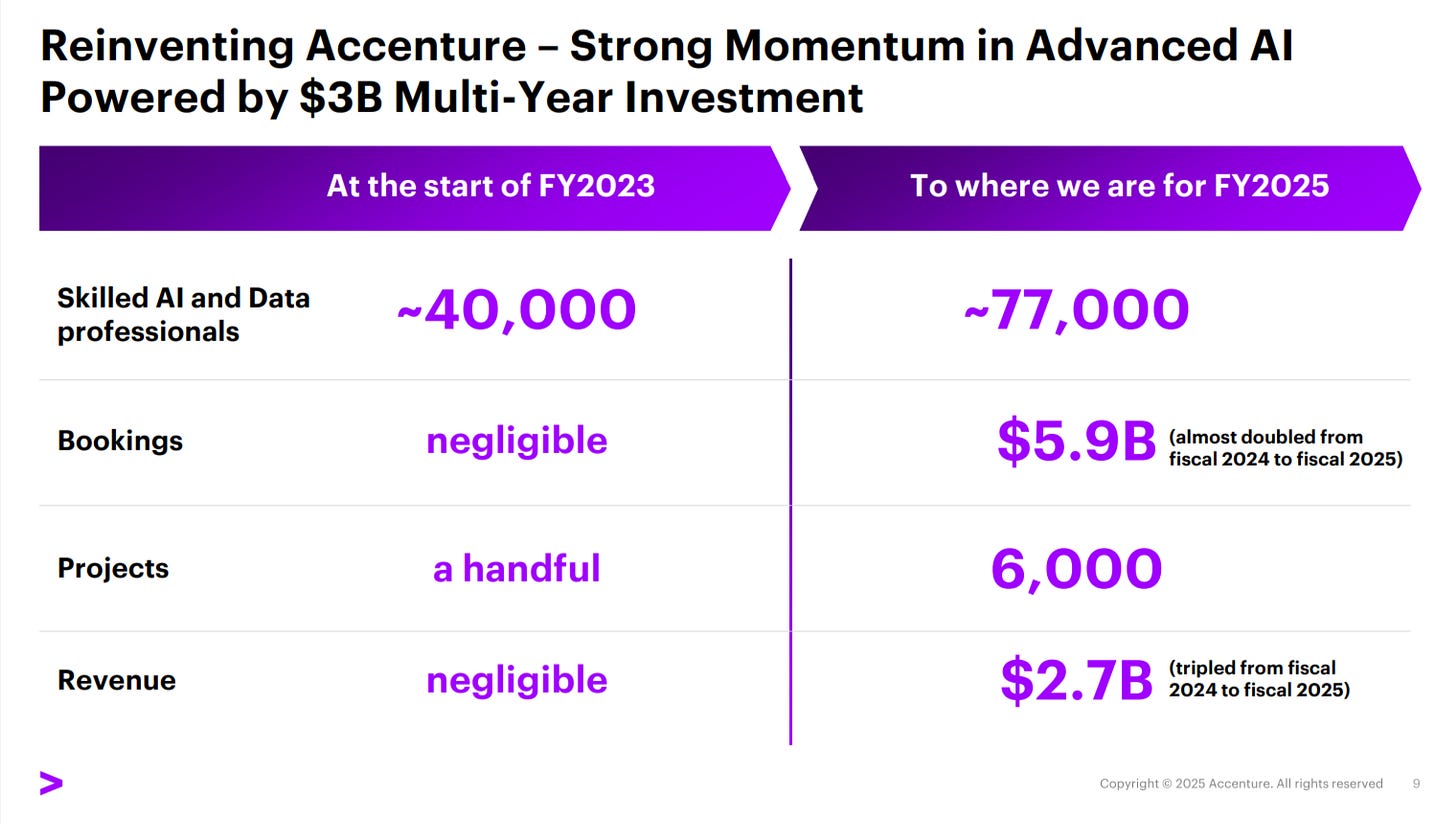

Tracking Accenture + Microsoft

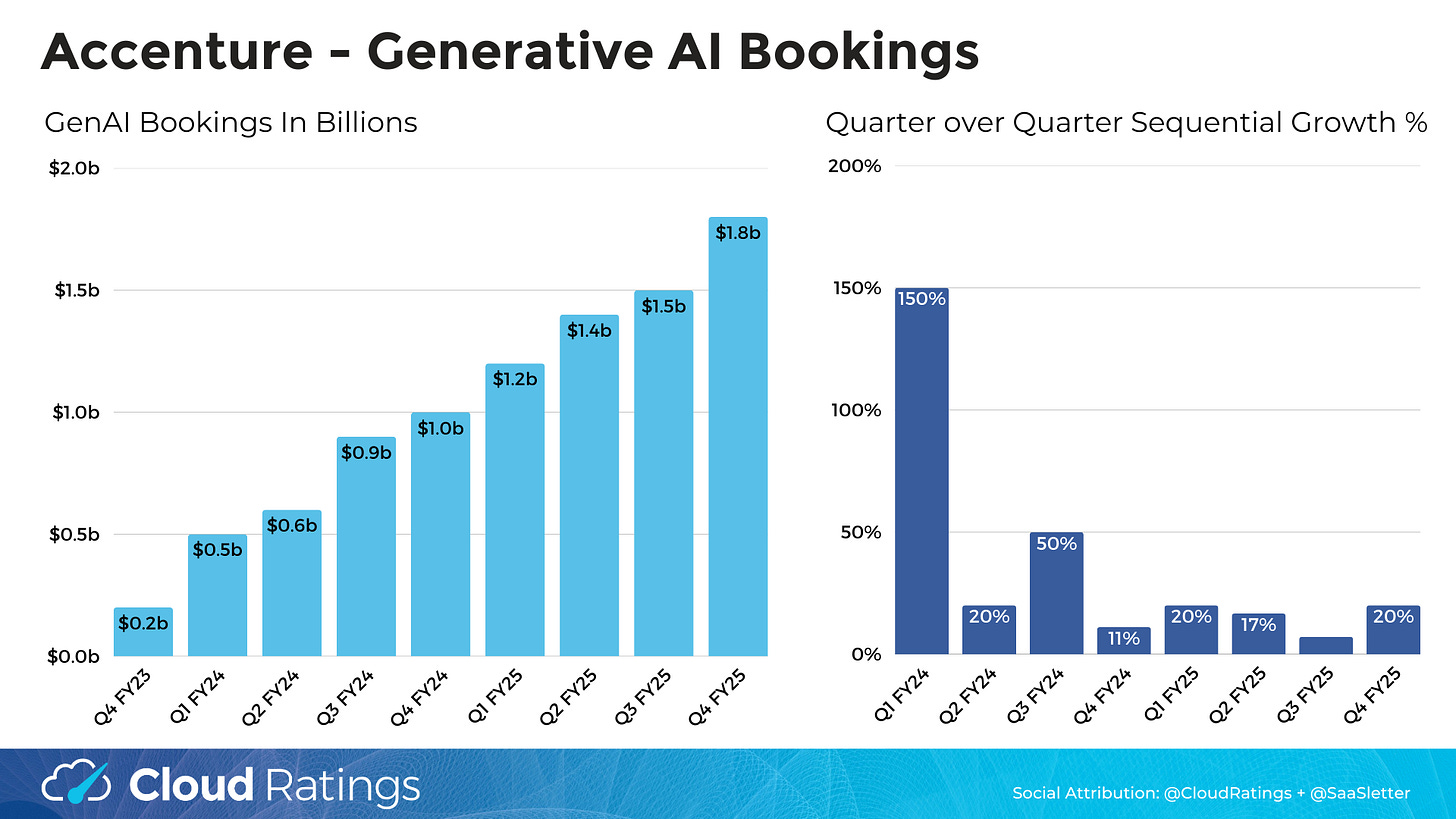

Accenture report $1.8 billion of GenAI bookings in their most recent earnings:

+80% Year over Year

+20% Quarter over Quarter (an acceleration from + 17% and +7% prior 2 quarters)

112% CAGR from Q1 FY24

~$1 million average AI project size (calculated via the above earnings slide)

Turning from Accenture *actuals* to Microsoft Copilot *forecasts*…

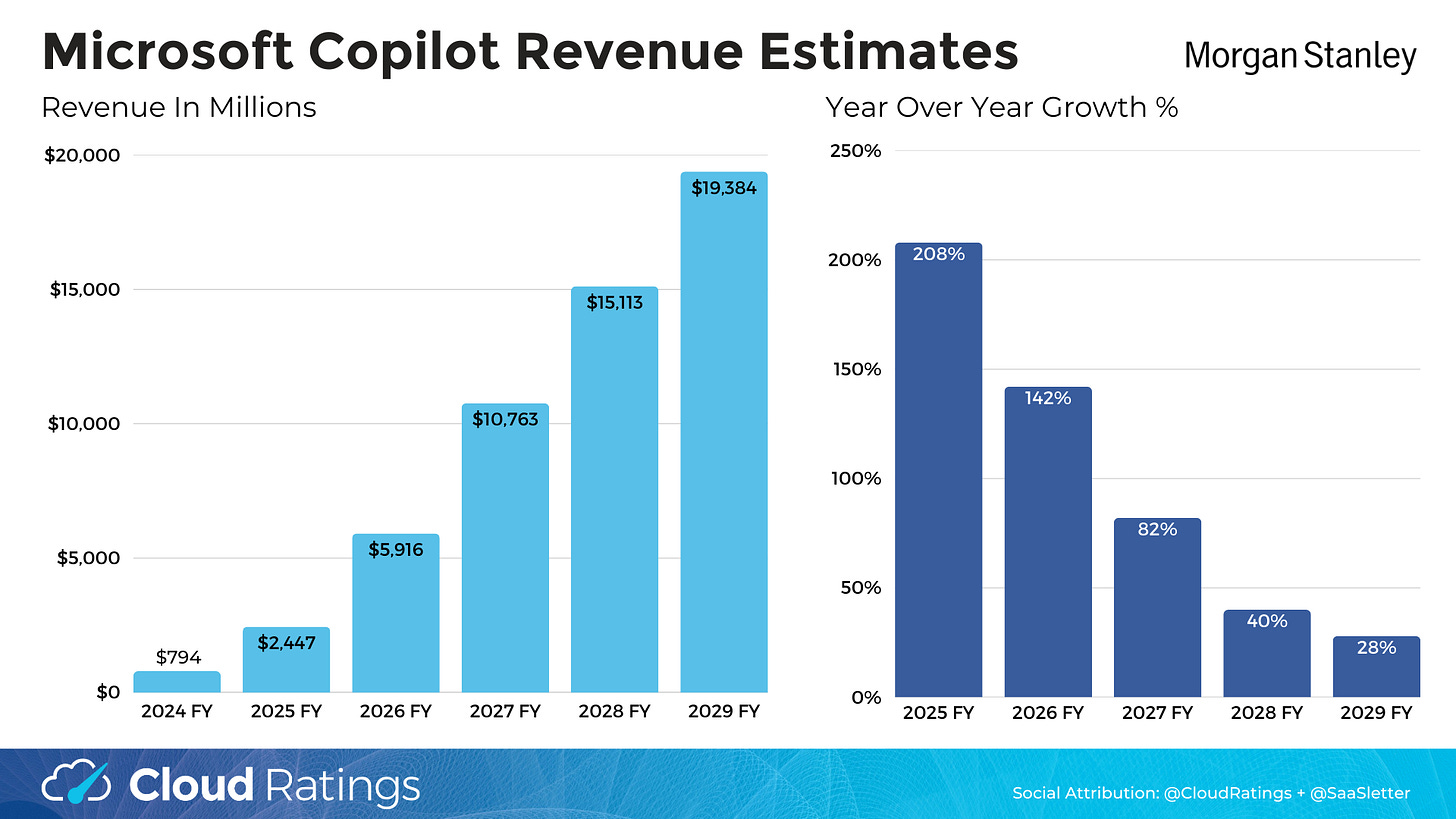

We graphed Microsoft Copilot forecasted revenue embedded within Morgan Stanley’s 9/25 MSFT upgrade note. Key points:

90% forecasted Copilot revenue CAGR through FY 2029

… despite a significant deceleration in 2028 and 2029, with “growth durability” below historical software benchmarks

That said, revenue growth from Copilot should be very frontloaded given ease of deployment within the existing Microsoft customer base

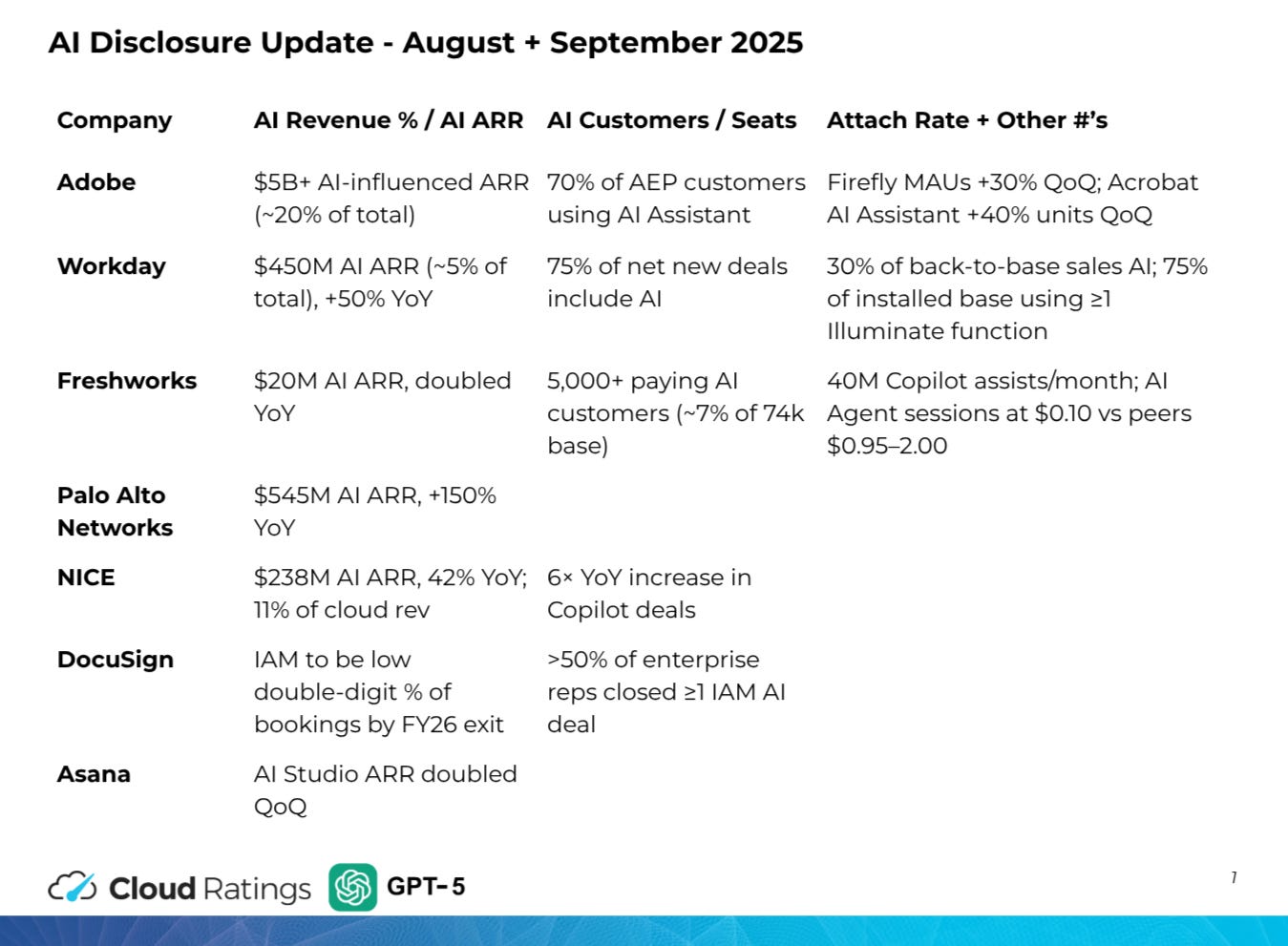

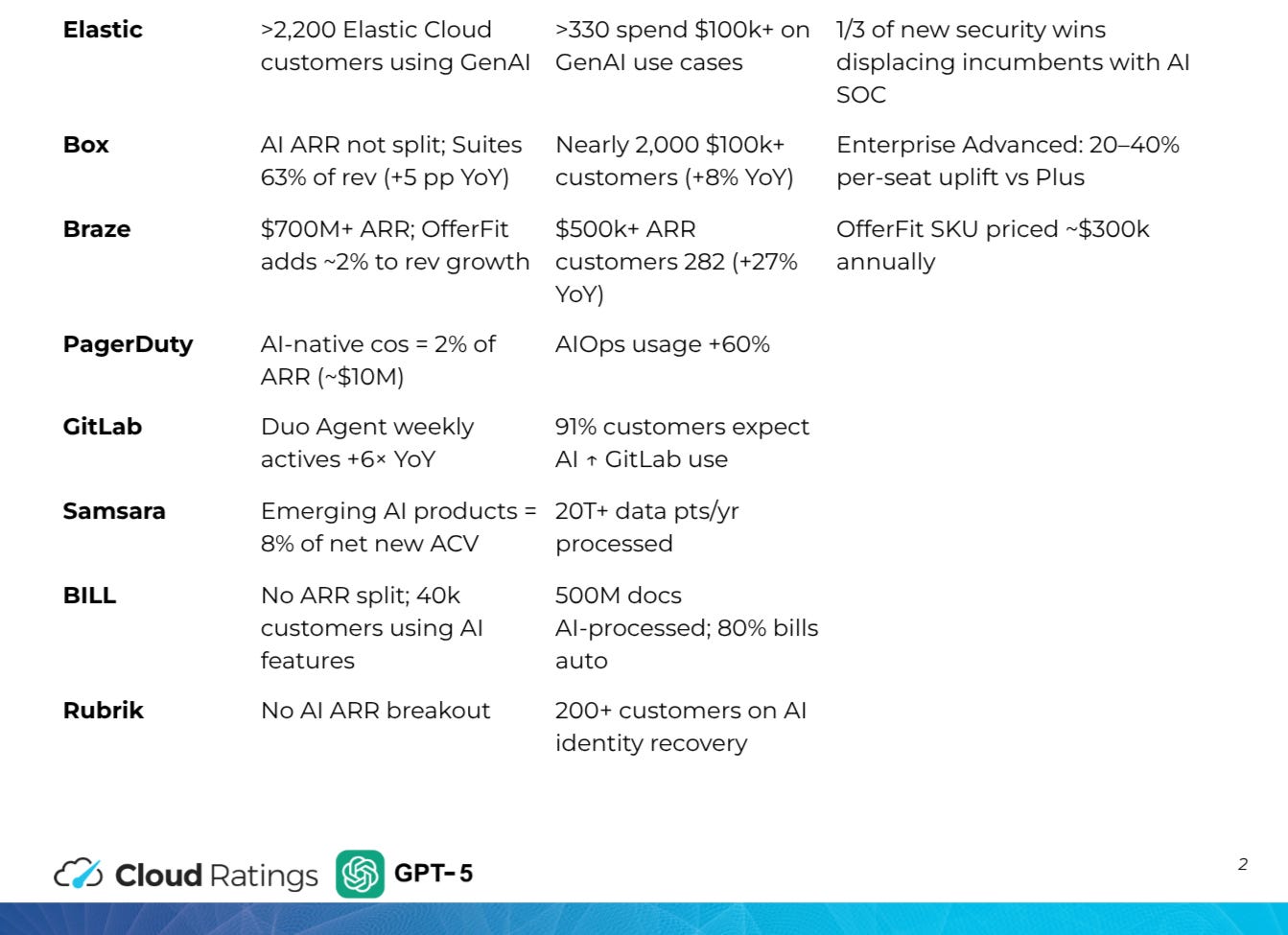

Tracking 20 Public Company AI Disclosures

The volume of public company AI disclosures has improved significantly since my aggregation in *March 2025* (see my presentation at Bowery Capital Annual Meeting):

Leveraging Quartr for recent slide decks and call transcripts across *20* public companies, I had each of Chat GPT 5 and Google Gemini 2.5 Pro *attempt* an update. *Our* content is handmade - in instances of AI-generated content, we will self disclose.

Most significant call outs:

Workday: +50% YoY AI ARR, 75% attach rate on new deals, 30% attach rate on customer renewals

Palo Alto Networks: +150% AI ARR

Asana: AI Sutido ARR doubling QoQ

NICE: +42% AI ARR, 6x increase in Copilot deals

Samsara: emerging AI products at 8% of net new ACV

DocuSign: IAM product line expected to be low double digit of new bookings

Full 14-page AI disclosure recap - including key quotes - here.

Curated AI Content

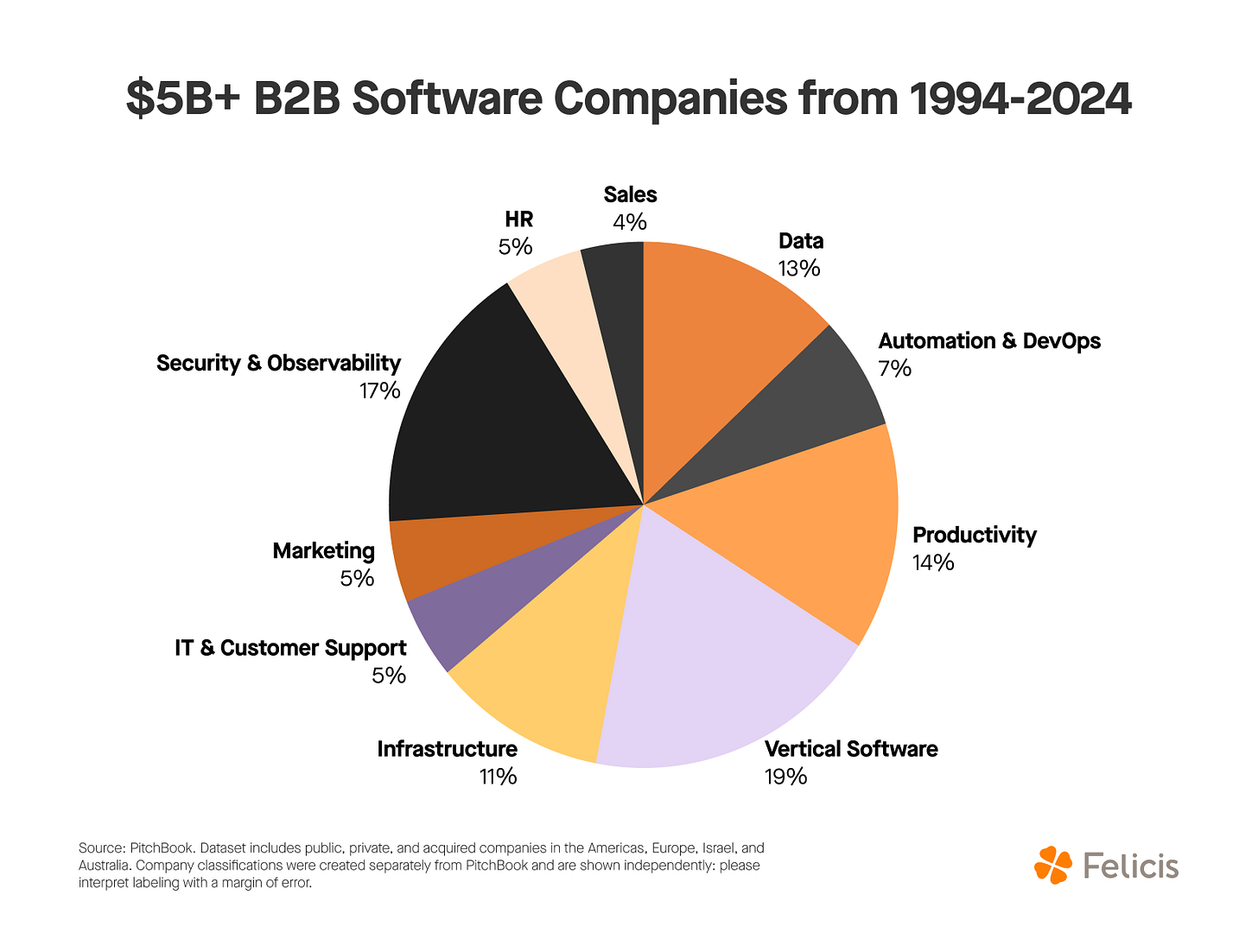

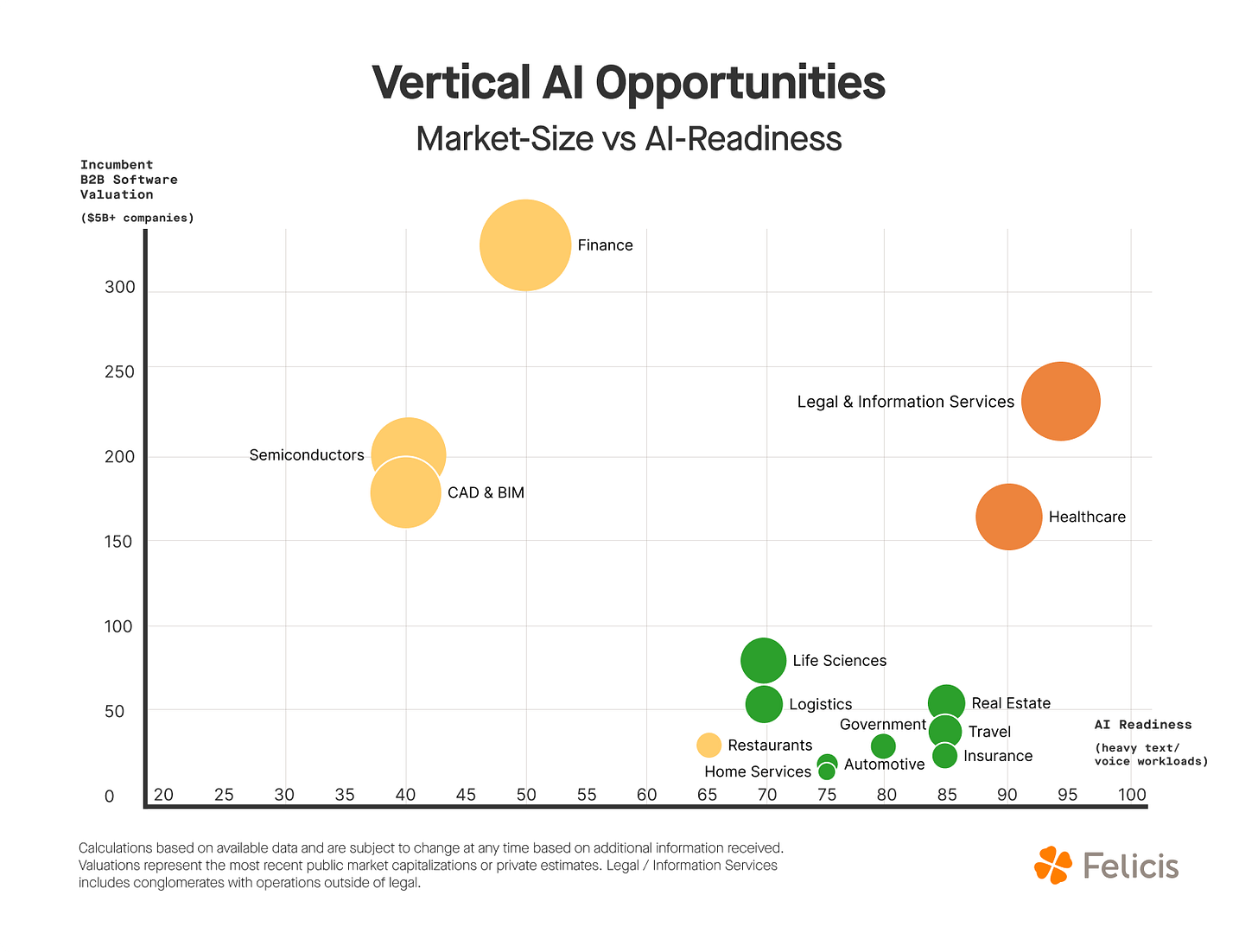

2 call outs from “How to Size the Market for Vertical AI” via Felicis Ventures (h/t Sundeep Peechu + Eric Flaningam):

The category mix of companies achieving a $5 billion valuation higlights the (surprisingly?) “many ways to win” in software.

I appreciated the framing by the incumbent B2B software valuation here:

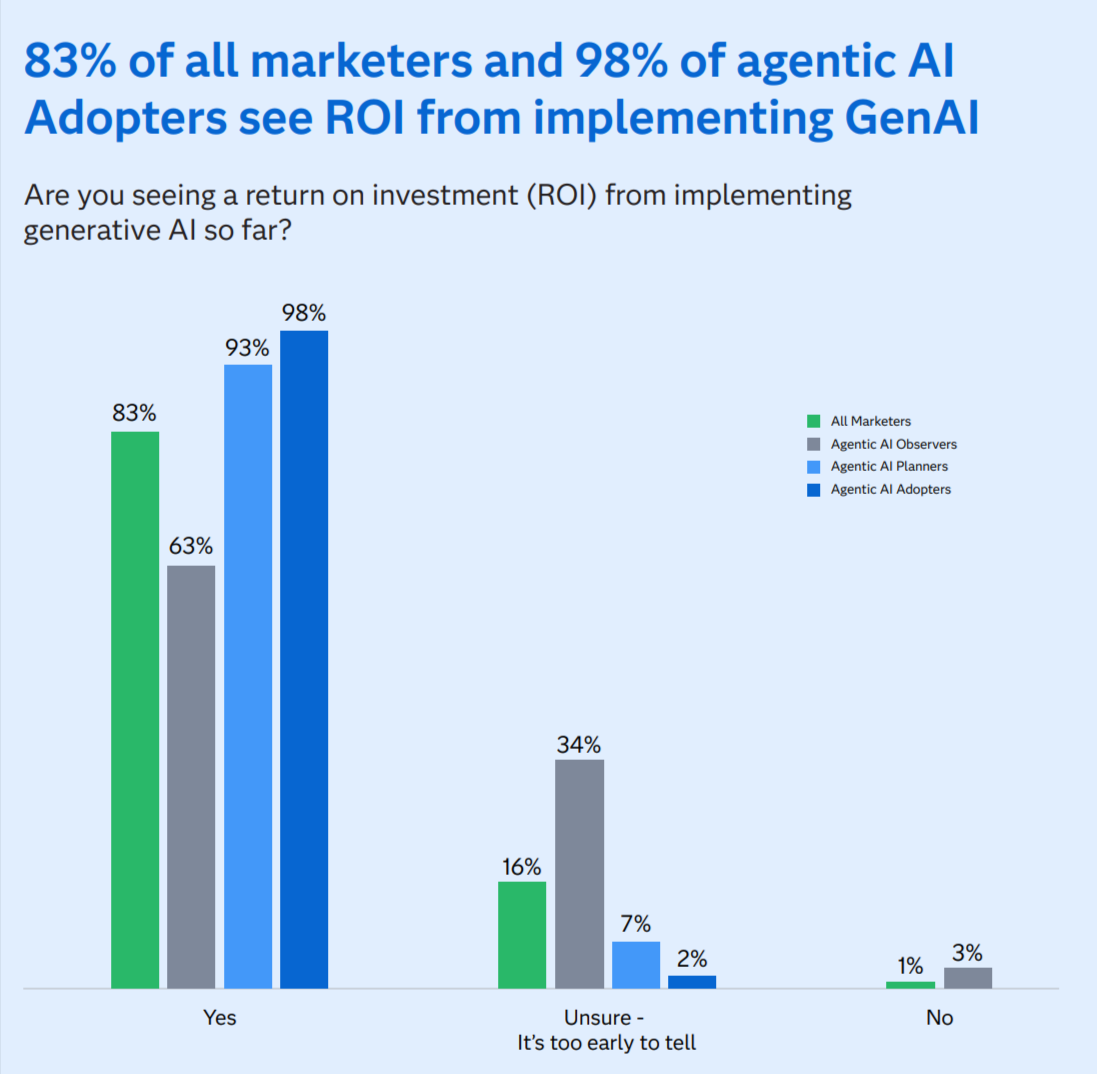

Our past podcast guest Scott Brinker’s “The first generation of gen AI use cases in marketing are streaking through the Hype Cycle” included a great Marketing AI visual…

… built upon insights from SAS’s “Marketers and AI: Navigating New Depths” (n=300 orgs), including 83% of marketers reporting ROI from AI:

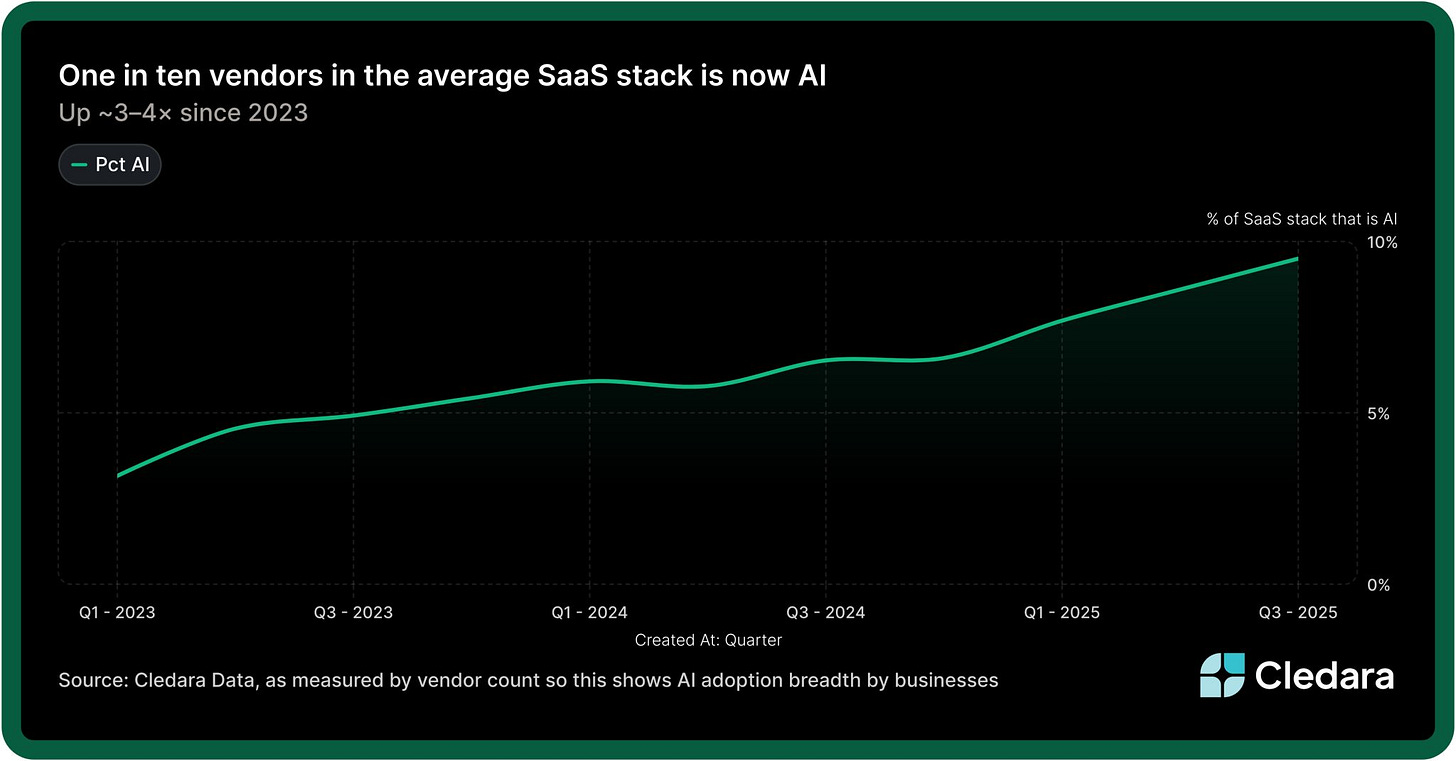

SaaS management platform Cledara (h/t Brad van Leeuwen) reported AI apps now constitute nearly 10% of the software stack (by app count)

Podcast With Godard Abel Of G2

FULL EPISODE: VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

About Cloud Ratings

In mid-2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm:

* Disclosure: Cloud Ratings has a commercial partnership agreement with Ebsta