SaaSletter - State of Software + AI

First Presented At Bowery Capital's Annual Meeting

Before diving into my slides, flagging an emerging vendor for our many marketing executive subscribers that I met at Bowery Capital’s Annual Meeting = Singulate

We're building the next gen AI marketing automation platform called Singulate. Singulate provides the easiest way to do audience segmentation and better relevance-personalization at scale for marketers — results of 3-7X higher CTRs and 4X response rates.

Based on Founder Dave Schools talk, I like their vision / road map and CTR proof points enough to *organically* say this is a “get in early” tactical opportunity. Waiting list here:

State of Software + AI (As Of March 2025)

Here are the full “State of Software + AI (March 2025)” slides:

with more context and call outs below:

To paraphrase Gavin Baker and Eric Vishria, LLMs are some of the fastest depreciating assets in history. With costs decreasing 10x every year.

For software vendors and the broader universe of AI users, this is very positive, particularly with open source models (from Meta) leading the quality/cost frontier.

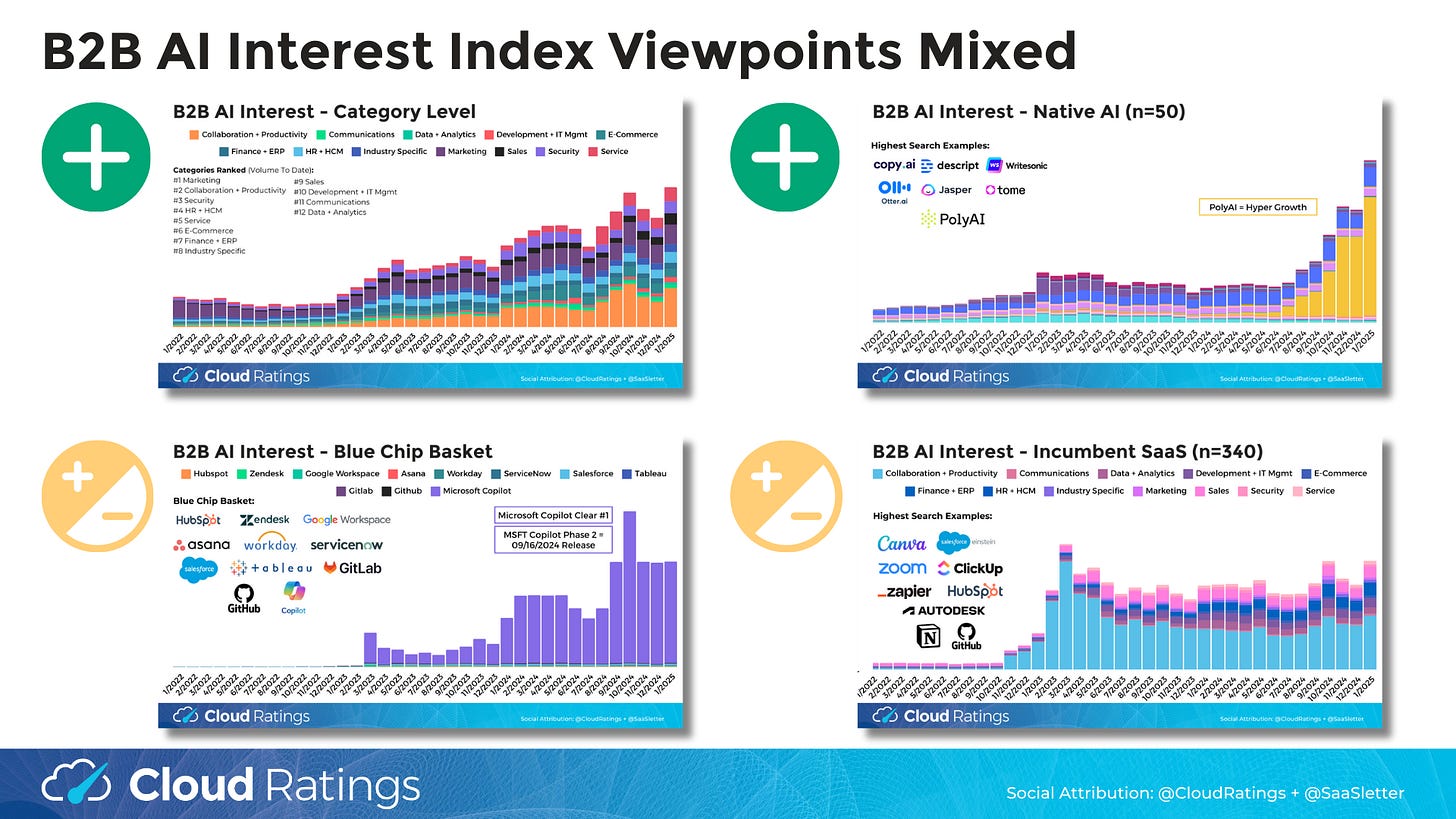

Our ongoing B2B AI Interest Index series is more mixed (when judged versus what is “priced in”):

Positive: Category Level thematic interest (like “supply chain AI” or “security AI”)

Positive: AI Native interest - our basket of 50 B2B AI natives captures the explosive growth possible with Product Market Fit (PMF)

Neutral: Our Blue Chip Basket of mega SaaS brands has been range bound and is dominated by ~decently growing Microsoft Copilot (that said, Microsoft has achieved 75%-85% Fortune 500 penetration for Copilot!) At this point, I would want to see more word of mouth driven acceleration.

Neutral: Our universe of Incumbent SaaS (n=340) is similarly range bound and lacking a word of mouth break out.

Focusing on public company disclosures on AI progress, this slide would have been far more negative prior to this last earnings cycle. Simply, too few companies were quantifying AI results.

This slide tries to highlight how monetization is very early (i.e. “cleanest disclosures” from ZoomInfo showing a 5% AI revenue contribution) and lagging forward indicators like customer adoption and attach rates. Of course, disclosures are very selective - attach rates can be 100% with your own criteria (i.e. top ten deals for Salesforce, $1m ACV new deals for Five9) and more normalized range in the ~30%-50% context.

In terms of the “AI Bubble Math: Revenue / CapEx” debate, the absolute dollars are a concern: AI revenue from mega vendors like ServiceNow ($200m) and Adobe ($125m) barely register relative to the billions + billions of hyperscaler capital expenditures.

For most traditional software vendors without a very clear AI winner story, AI contributes to uncertainty, as evident in data from Zylo on declining multi-year contracts.

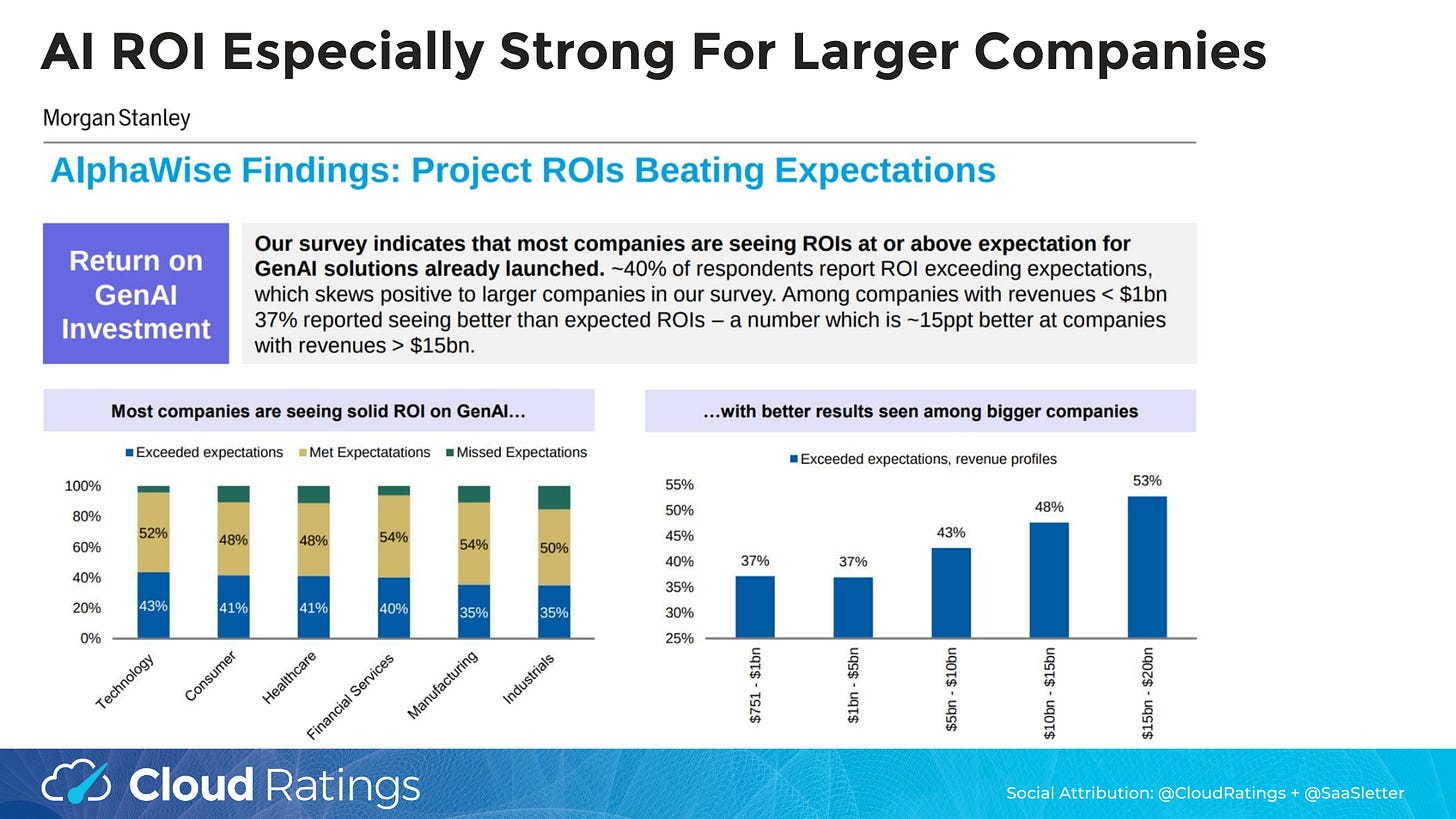

A fundamental framework of Cloud Ratings is that the business of software is driven by customer ROI. A Menlo Ventures study (covered here) showed “easily quantifiable ROI” is the #1 selection criteria for AI tools.

Surveys of AI outcomes are showing positive ROI results, generally in the ~15% context for productivity gains. See our coverage of reports from ICONIQ Growth here and Bain here.

Importantly, these AI ROI survey results from Morgan Stanley that show larger companies exceeding expectations transitions into our review of AI usage data.

Quite surprisingly, the US Census Bureau tracks AI usage and adoption plans as part of their ~bi-weekly Business Trends and Outlook Survey, with our mapping of their data through March 9, 2025.

Larger companies (250+ employees) are using AI a good bit more than their smaller peers.

Adoption rates by sector probably line up with your expectations, with sectors like Information leading.

When we look at adoption data, what is the right standard?

Is AI Adoption Too Narrow? Data from Anthropic, shows 75% of *task volume* is concentrated in 4% of occupations, like software development. By now, should adoption be more broad based? Are knowledge workers broadly using “general” AI tools like Microsoft Copilot or Google Gemini enough?

Is AI Adoption Fast Enough? In a post Internet world and with the digital nature of AI, should the adoption curve be steeper?

Building on a study from the Federal Reserve Bank of St. Louis (Alexander Bick, Adam Blandin, David Deming), we mapped the Census Bureau AI usage data relative to the adoption curves of the Internet (1995 onward) and Personal Computers (1981 onward):

What do the (rudimentary!) trend lines say?

If 250+ employee trends hold, we are on an Internet adoption path

If below 250 headcount trends hold, AI is following a good-but-slower 1980s PC adoption curve.

The same mixed story holds looking at the Sector Level:

Early adopting industries like Information and Professional/Scientfic/Technical Services are on nearly Internet trend lines…

while sectors like Healthcare are following the PC slope.

A framework of “Unbounded Task TAMs” outlined by Buck on Software in “Winds of Change” provides a reason to be bullish on AI, particularly in the software industry.

We examined Unbounded Task TAMs through the lens of economy-wide software data from 1987 onward. The value-add per developer has been consistently rising.

Especially so on a price to quality basis - see the gap between real and nominal above developed using CPI-style adjustments. For example, a Microsoft Office suite retailed for ~$895 in 1989, or ~$2,270 in 2024 dollars. Given the transition to a SaaS model, the equivalent 4-year price for today’s Office 365 is $400. So a radically better software costs 82% less in real quality-adjusted terms.

Concerns around AI leading to an explosion in the supply of software are legitimate. See the enduring popularity of Chris Paik’s “The End of Software” or “vibe coding” as a buzzword.

AI enabling *better software* is overlooked. When crafted properly, AI will raise the ceiling on what software can deliver.

Said differently, software that allows you to chat with your data, set up automations with natural language instructions, or automatically log + summarize sales activities should be a fundamentally better and higher user ROI product. Just like 2024’s Office 365 versus 1989’s Microsoft Office.

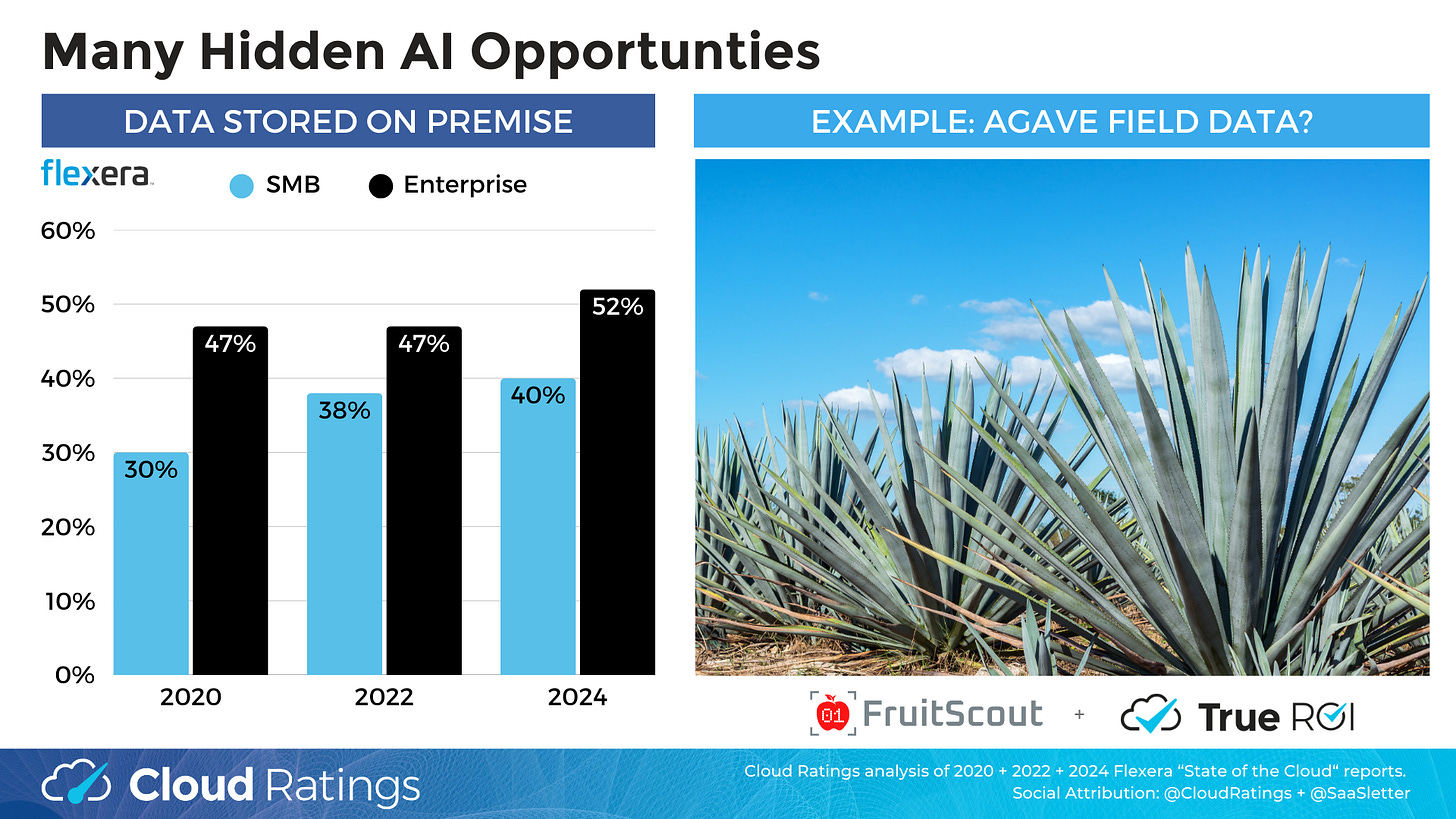

The amount of data on-premise can cause AI use cases to be under-appreciated. While vendors like Dell cite that 83% of all data resides in on-prem data centers, for purposes of conservatism and trending, we mapped 3 historical Flexera “State of the Cloud” reports. Surprisingly, the share of data on-premise is rising despite cloud migrations.

On-premise data and deeply embedded business processes (more on the agave field slide below) are inherently less visible.

The above slide was included more for the Founders in the audience, with a podcast quote from Matt Slotnick (Founder of sales AI workspace Poggio) reminding to focus on the market-leading Winners who will *actually* buy AI.

This “AI = Winning The Next Game” message can frame the entire talk:

If you believe in the early adopters (250+ Employees; Information sector) are playing the next game, we are in the *1997 equivalent* of an Internet adoption trend line. Based on the AI ~laggards, we are on a PC adoption curve.

The ultimate AI adoption curve will come back to workflow-level ROI… that needs to broaden beyond AI’s current concentration in workflows like software development.

AI enabling fundamentally *better software* will be key.

Full Slides From Bowery Capital’s Annual Meeting

Special thanks to Bowery Capital (h/t Michael Brown, Loren Straub, Patrick McGovern + team) for inviting me to pontificate and HSBC Innovation Banking (h/t Andrew Oddo) for a beautiful venue at Hudson Yards.

Full copy of the slides are available here:

Our True ROI Practice Area

Less visible relative to our public-facing ROI reports (example report with RELAYTO), Cloud Ratings True ROI practice area supports private value engineering engagements as a 3rd party intermediary between vendors and software buyers.

We are currently involved in multiple $7-figure ACV evaluations, all of which involve very large enterprises carefully evaluating the ROI from emerging AI vendors (like Fruit Scout in the agave field example from my slides).

If you or your portfolio companies need ROI support and validation, please email me. I lead every engagement with the support of a former CFO.

About Cloud Ratings

In mid 2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: