SaaSletter - SaaS Metrics Palooza 2024

Plus more from ICONIQ Growth, Tidemark, + Emergence

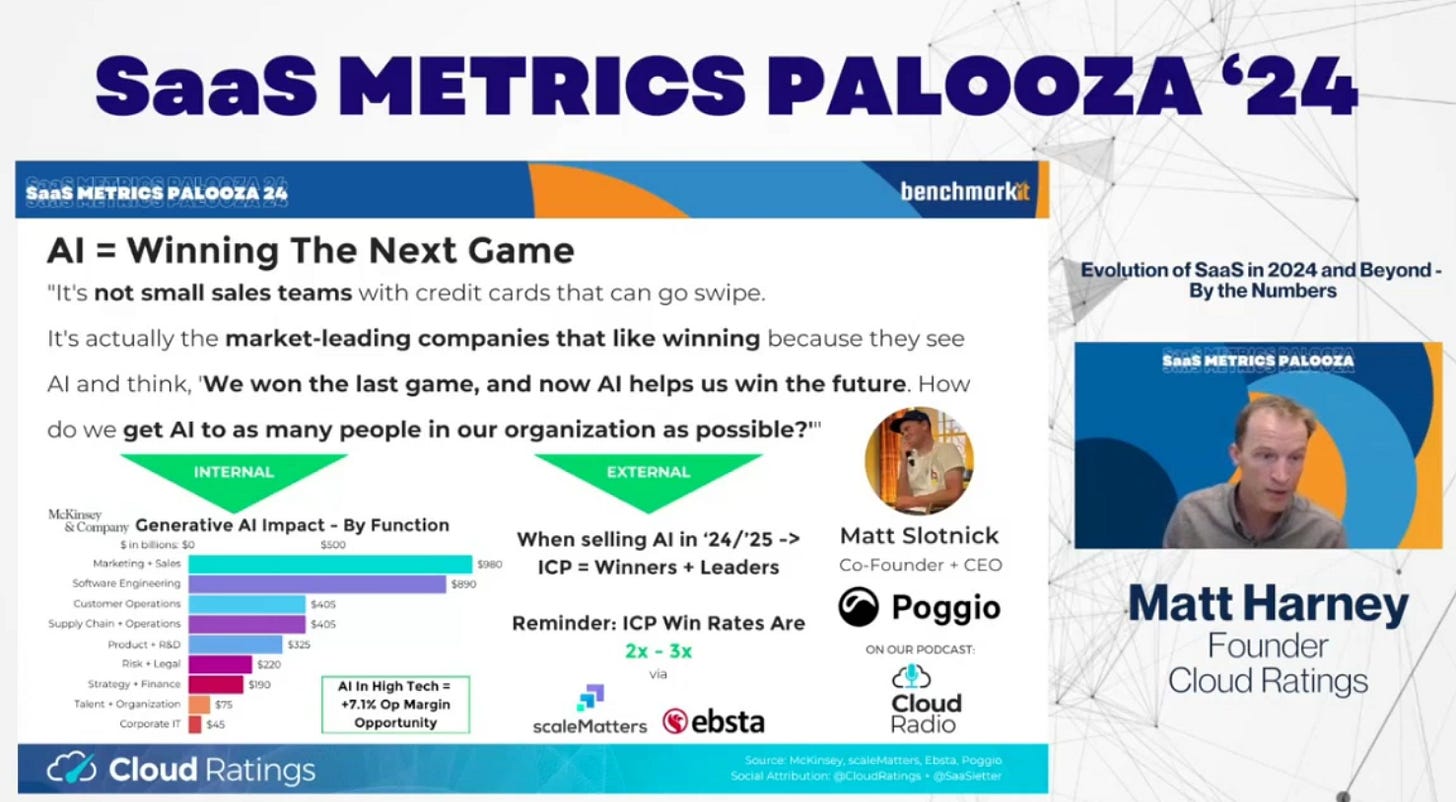

SaaS Metrics Palooza 2024

With special thanks to Ray Rike + Benchmarkit for the invite, here are my slides from SaaS Metrics Palooza 2024:

Some excerpts:

Poor forecasting will be a key upcoming theme of ours.

I included Dave Kellogg’s translation of a 90% confidence level into real-world terms (i.e., you can miss once every 2.5 years). Based on YTD 2024 results (63% of companies missed plan in Q2 per Pavilion Pulse Report, h/t Josh Carter), forecasting falls below that margin of error.

With GTM overhiring in 2022 (h/t Sean Saint + People Data Labs for the underlying data) another example of poor planning:

Focusing your resources on your Ideal Customer Profile (ICP) was a key theme throughout: Whether Ebsta’s shocking stat (ICP = 18% of pipeline + flat)…

… or more positively, how ICP deals have a 2x - 3x higher win rate (via scaleMatters and Ebsta). With past podcast guest Matt Slotnick’s quote serving as a reminder to focus on your ICP when selling *AI* too:

While not excerpted, my session was only possible thanks to citing excellent work from:

G2 - our primary research collaboration on the drivers of NPS in software, their recent SaaStr 2024 talk with great data on shrinking shortlists and more C-Suite involvement, and ROI data,

and The Bridge Group (h/t Sally Duby), ICONIQ Growth, Battery Ventures

Watch the SaaS Metrics Palooza 2024 event replays here.

Curated Content

ICONIQ Growth (h/t Claire Davis) released a $1m-$20m ARR journey benchmark report - while deserving of future newsletter coverage, I hope this excerpt piques your interest in reading their report:

Brian Halligan’s “A Startup Founder To Scaleup CEO’s Journey from $0 to $25billion (Halliganism’s)”

Dave Yuan + Tidemark’s “The Franchise: An Archetype for Vertical SaaS”

From Emergence Capital’s “Adapt or Die: Five New Go-To-Market Rules for SaaS Survival” - I support this ROI focus quoted below. Reply to this newsletter if you need help with ROI proof.

“This shift has forced SaaS companies to refine their GTM messaging, delivering sharp, ROI-driven narratives that directly address buyer concerns and show near-instant benefits.

“Customers are not just looking for value anymore,” Callaway added. “They are looking for value that can be quantified in a way that justifies the investment almost immediately. Purchases from 2020 to 2022 were often seen as long-term bets, but now, the expectation is a much quicker ROI. Buyers are under more pressure to make every dollar count.”

Vertical AI Deep Dive With OMERS Ventures

Building on their 152-page(!) vertical AI framework report (email required), we recently debuted our episode with Marissa Moore and Taku Murahwi of OMERS Ventures

VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

About Cloud Ratings

In case you missed it, we recently announced a research partnership with G2 with this slide showing how our G2-enhanced Quadrants, this newsletter, our podcasts, and our growing True ROI practice area (see Ivan Arizaga’s appointment as a Principal Analyst) all fit within our modern analyst firm: