SaaSletter - Big VCs + MIT on AI

Plus our Cloud Ratings B2B AI Interest Index for July 2025

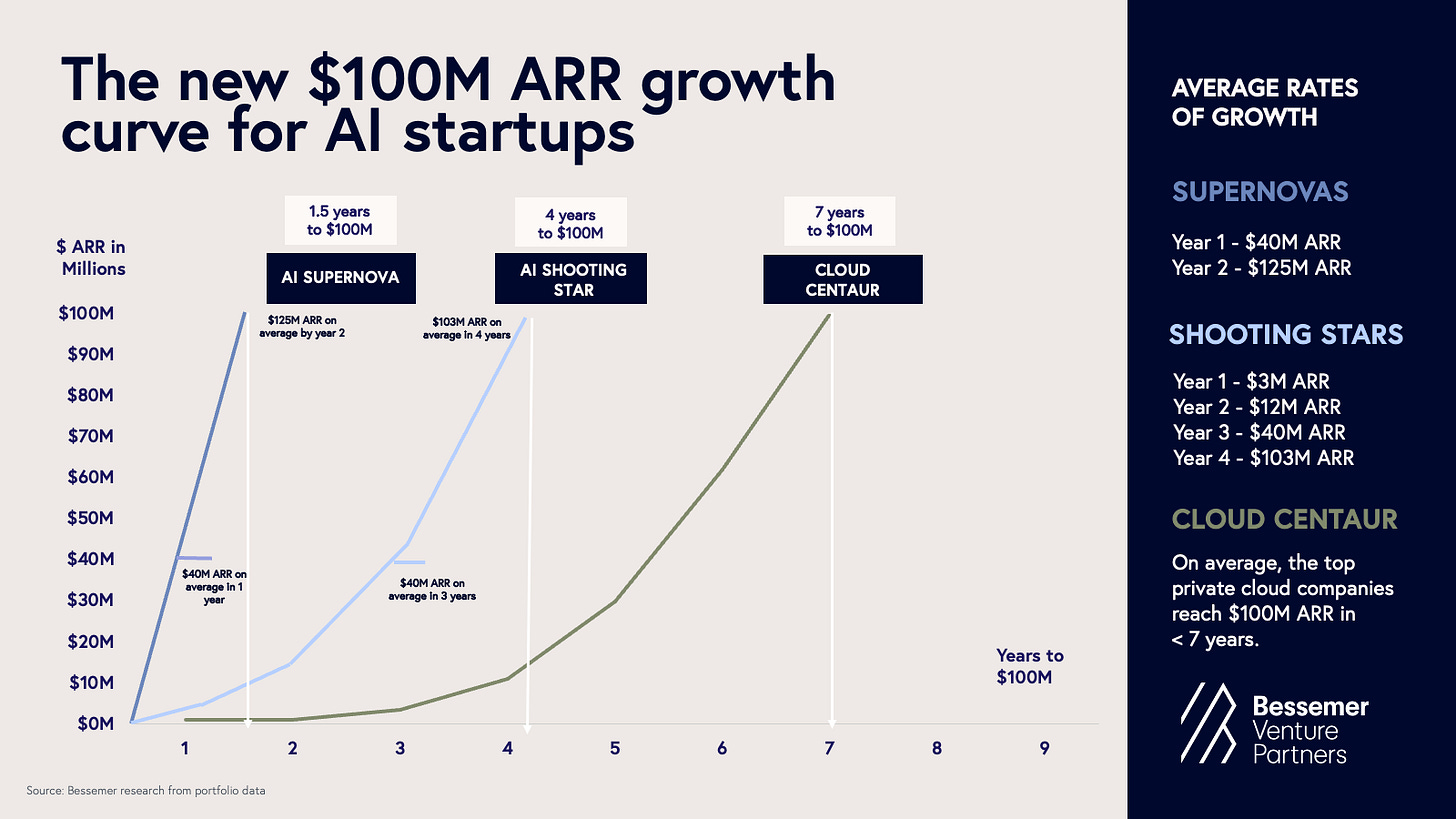

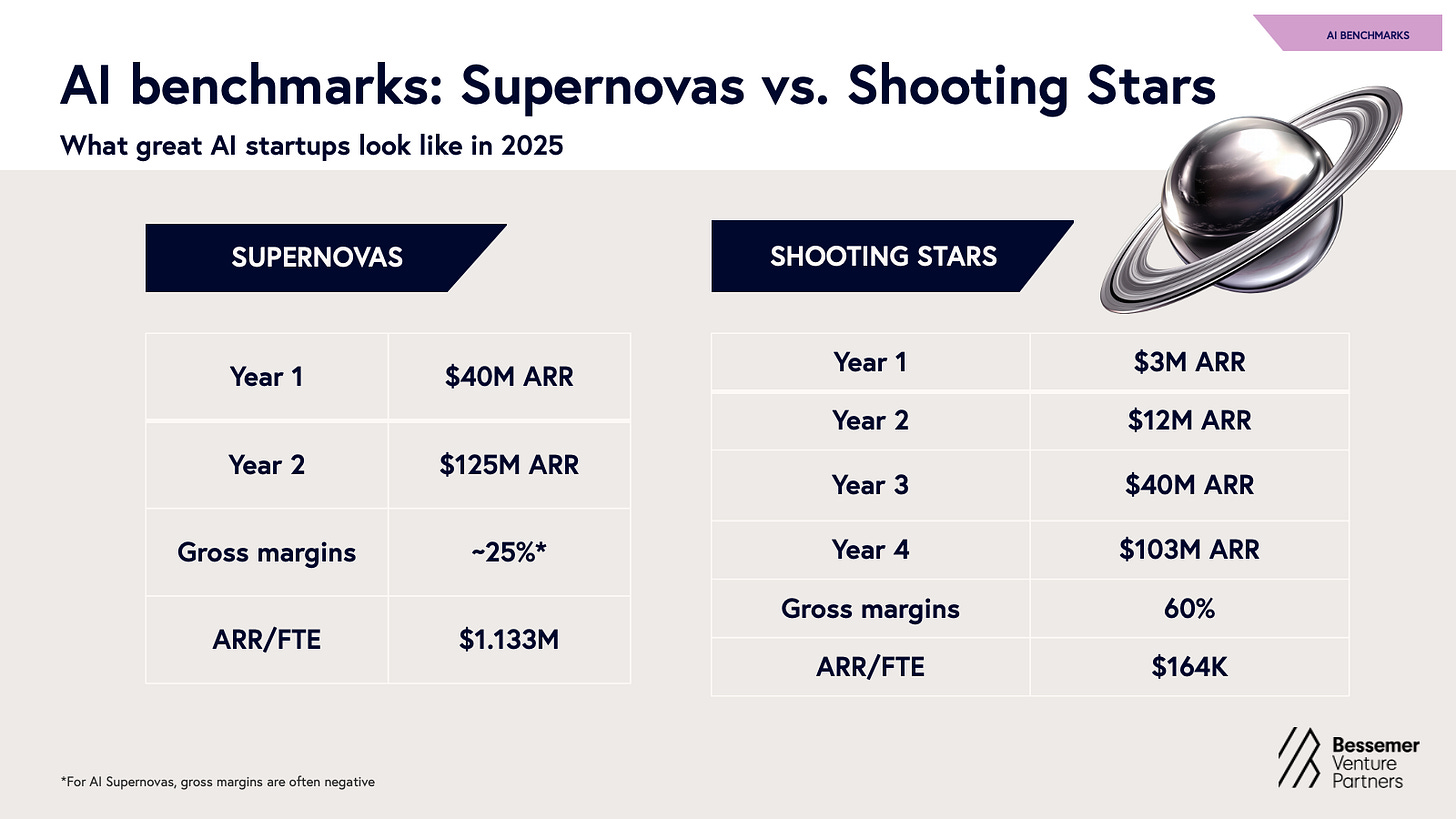

BVP State of AI 2025

Bessemer Venture Partners published their “State of AI 2025” → quick excerpts:

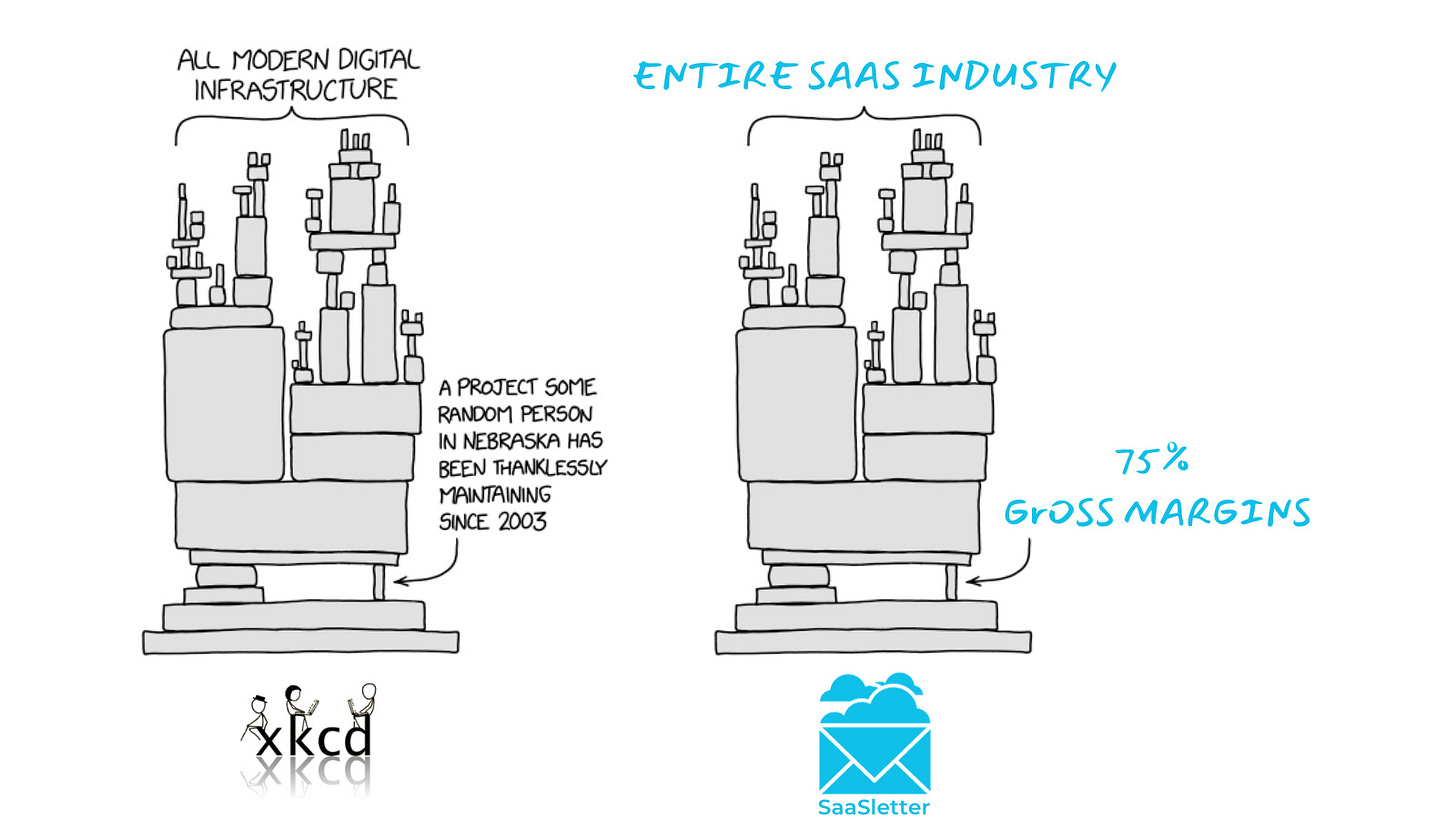

Focusing on gross margins - see our earlier “AI Gross Margin Drag” - two key call-outs:

AI Supernovas (1.5 yrs to $100m): The asterisk “* For AI Supernovas, gross margins are often negative” is worth calling out. *If* AI turns out to be a bubble, negative gross margins would be an obvious signal in retrospect.

AI Shooting Stars (4 years to $100m): If this cohort is a more representative view of “software-ish AI” going forward, 60% gross margins probably work (i.e., AI unlocks bigger workflow TAMs and gross profit absolute dollars per customer) … at the correct valuation, of course.

The BVP State of AI also included interesting predictions (I agree on the importance of browsers) and takes, like:

“Memory and context are the new moats … Persistent memory … creates emotional and functional lock-in.”

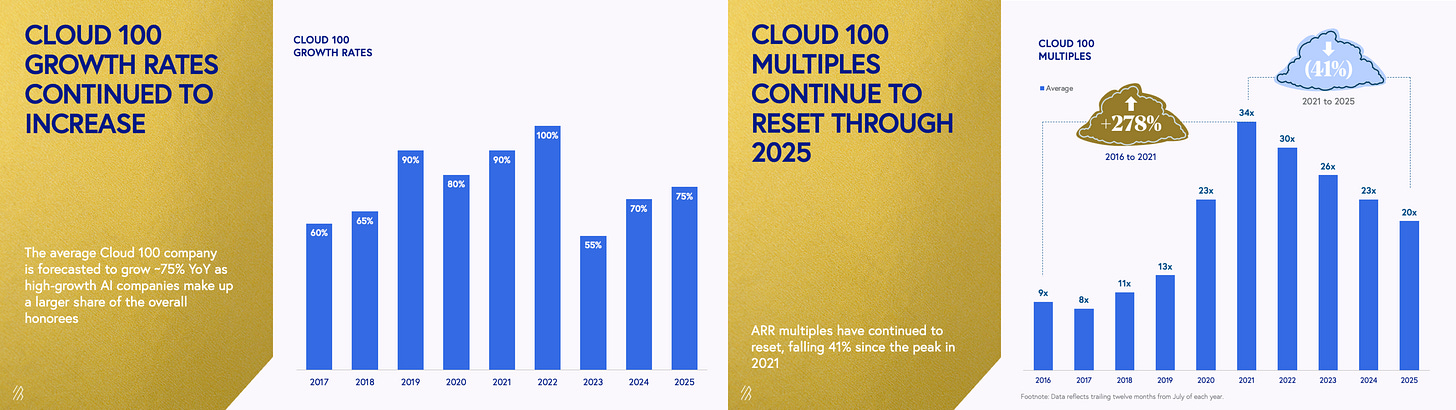

Related Reading: BVP’s “The Cloud 100 Benchmarks Report 2025”

Ebsta’s Revenue Insights As A Service

Having first connected thanks to their impressive benchmark data ($48 billion+ of customer pipeline under management) and hosting Guy Rubin on our podcast 2x, we are helping Ebsta connect with software private equity investment firms to launch their Revenue Insights as a Service (RIaaS) offering:

quarterly deep dives into your portco's sales machine,

using a mix of AI/software (linked into CRMs, email, and call recordings)

with a professional services element that yields this type of report (attached)

Full Ebsta RIaaS overview deck here:

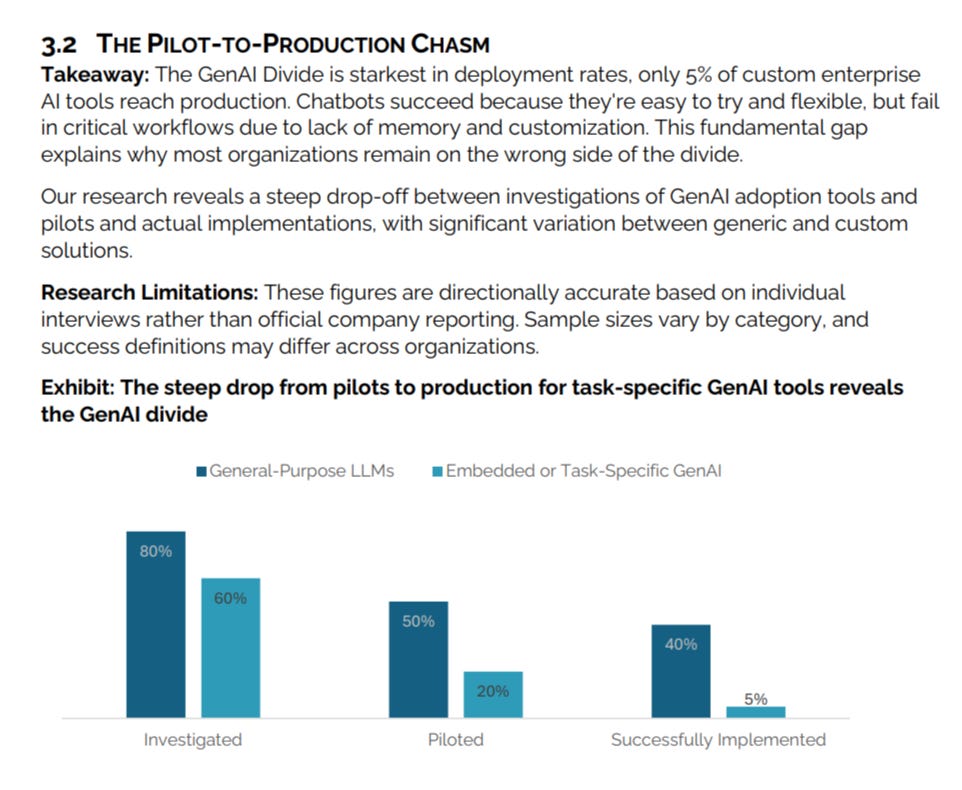

MIT On AI’s 95% Failure Rate

This report from MIT received significant attention for the 95% failure rate for *” embedded or task-specific GenAI”* (versus a 60% failure rate for General Purpose LLMs). Given the outlier nature here (relative to other AI ROI studies), reading the MIT report and methodology itself is advisable.

Menlo Ventures On AI

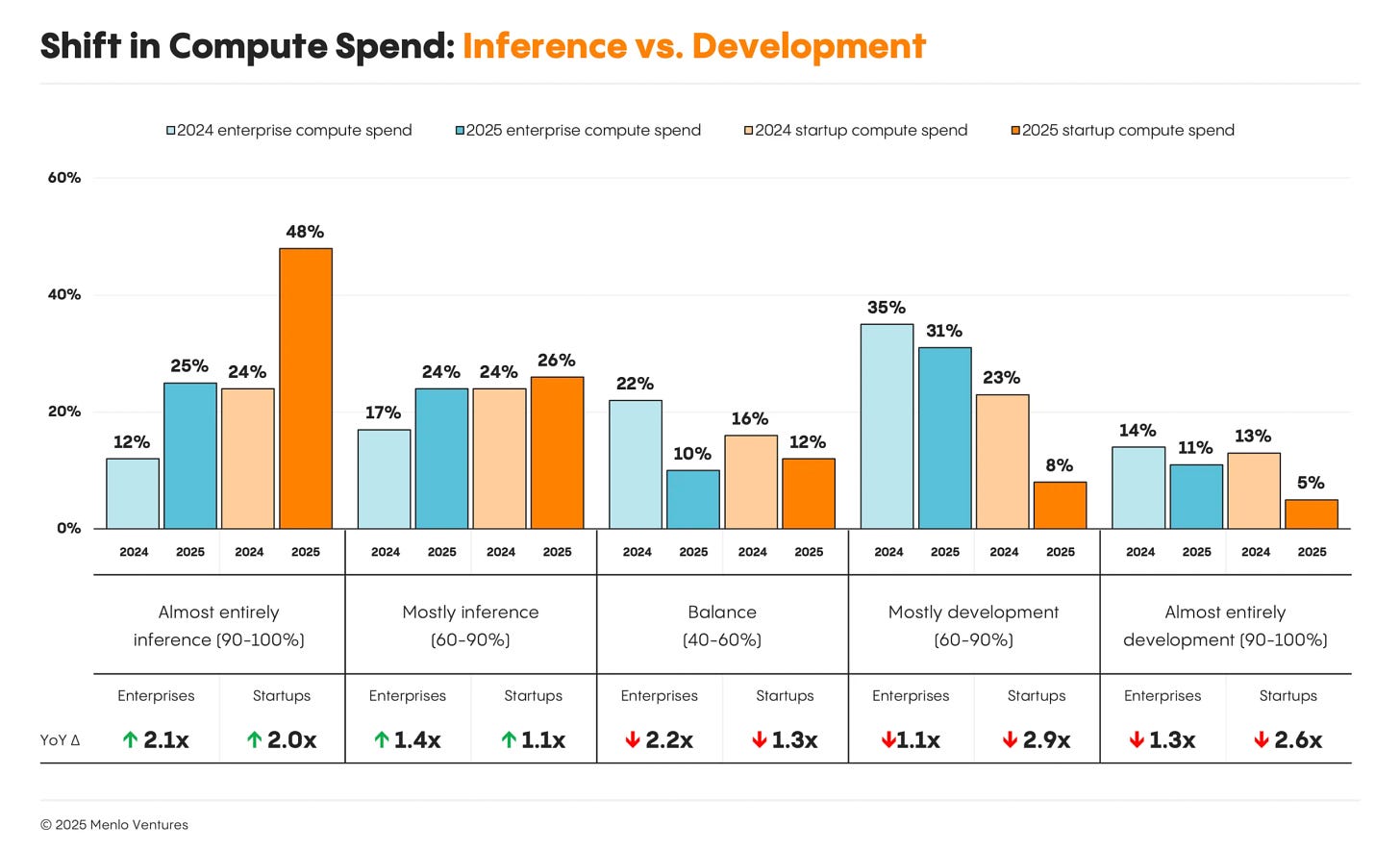

My #1 comment from Menlo Ventures’ “LLM Market Update” = the strong growth in inference is supportive of AI having ROI. Said differently, if AI was not working well enough, more spend would be concentrated in fixing models.

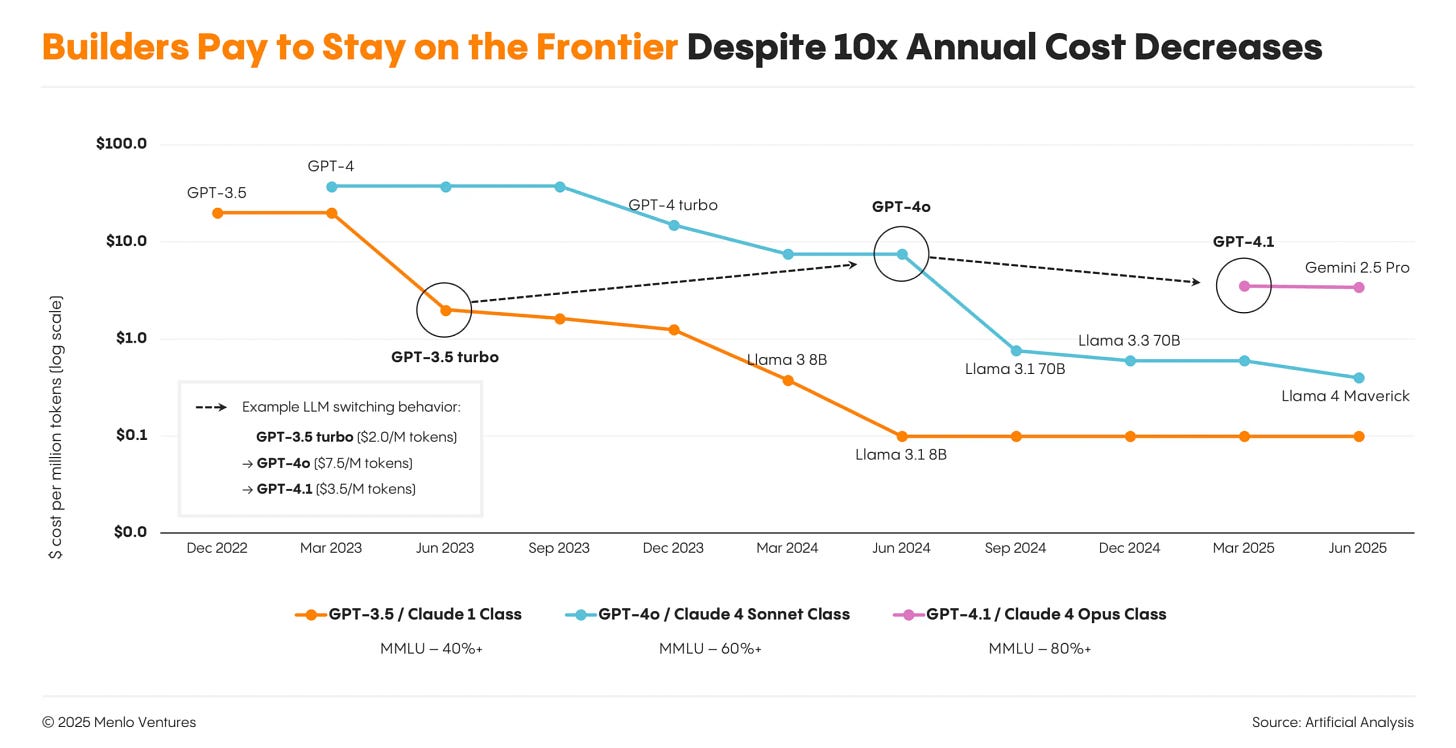

Model costs declining 90% per year will also help any ROI math!

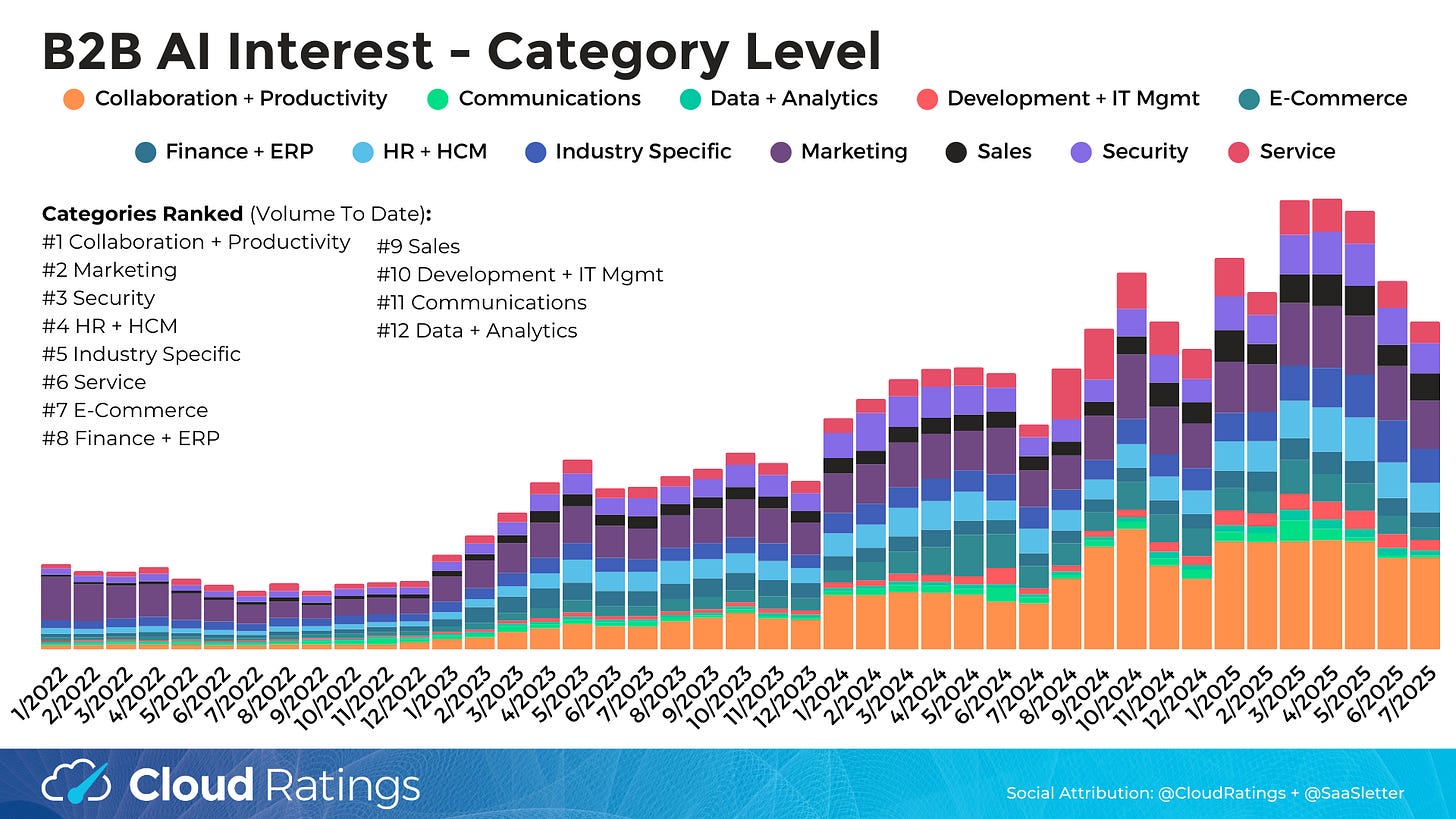

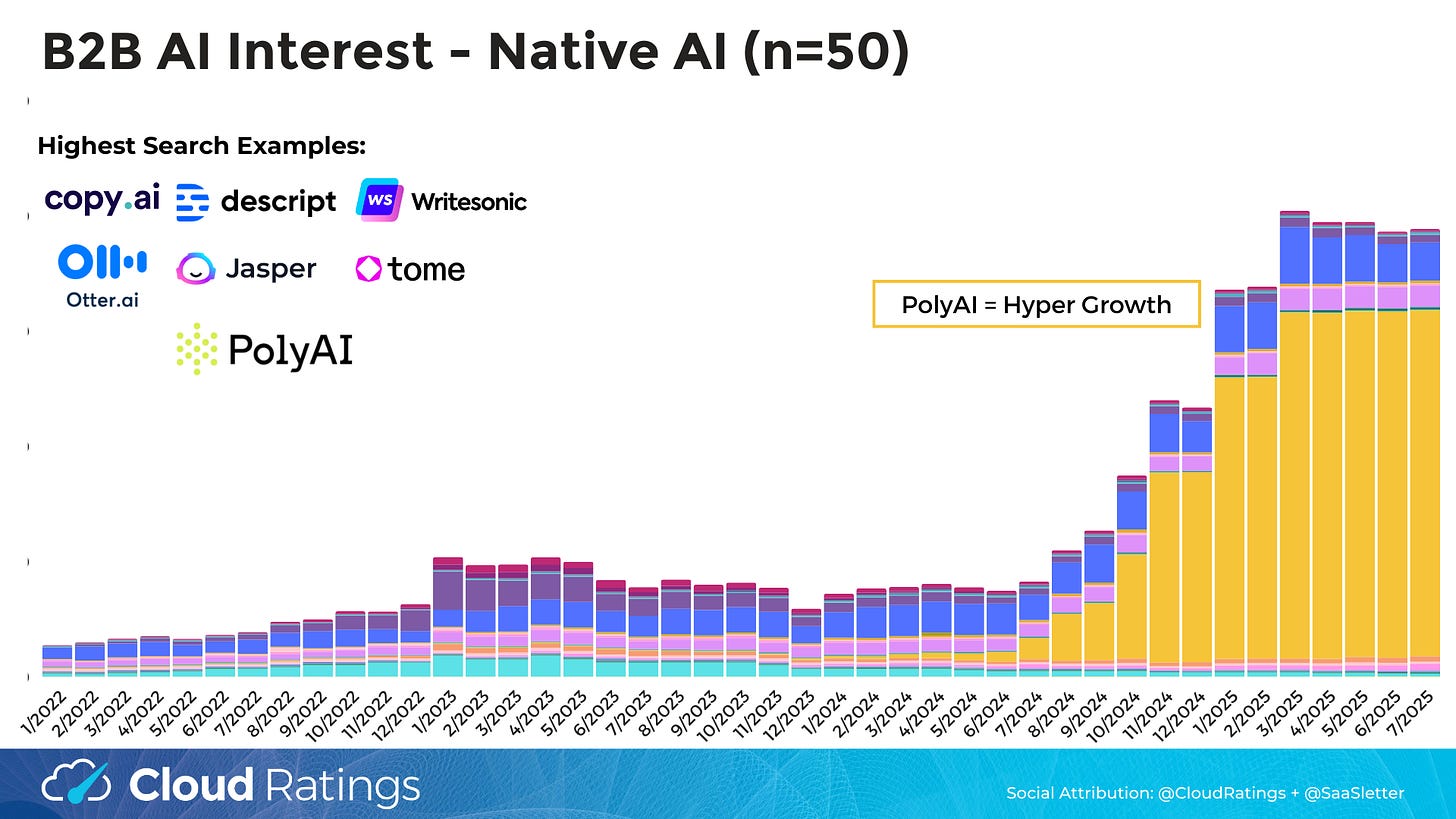

July 2025 B2B AI Interest Index from Cloud Ratings

We’ve updated our Cloud Ratings B2B AI Interest Index through July 2025 - full slides below:

B2B AI interest trends are showing some signs of *moderate weakness*.

Thematic Category Interest (n = 47 sub-categories tracked - i.e. “manufacturing AI” or “supply chain AI”) declined for the 4th straight month. Albeit with substantial year-over-year growth versus July 2024.

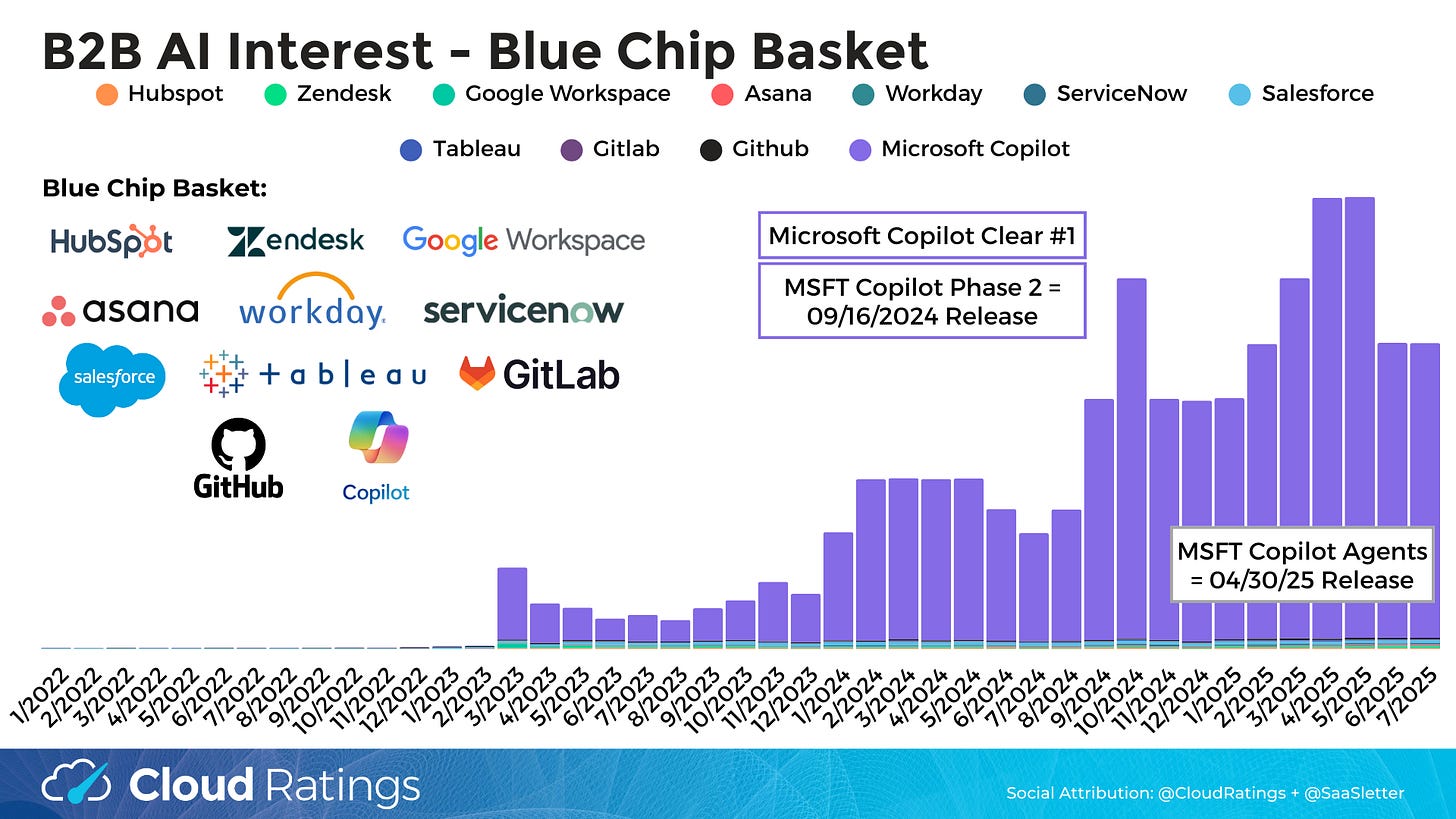

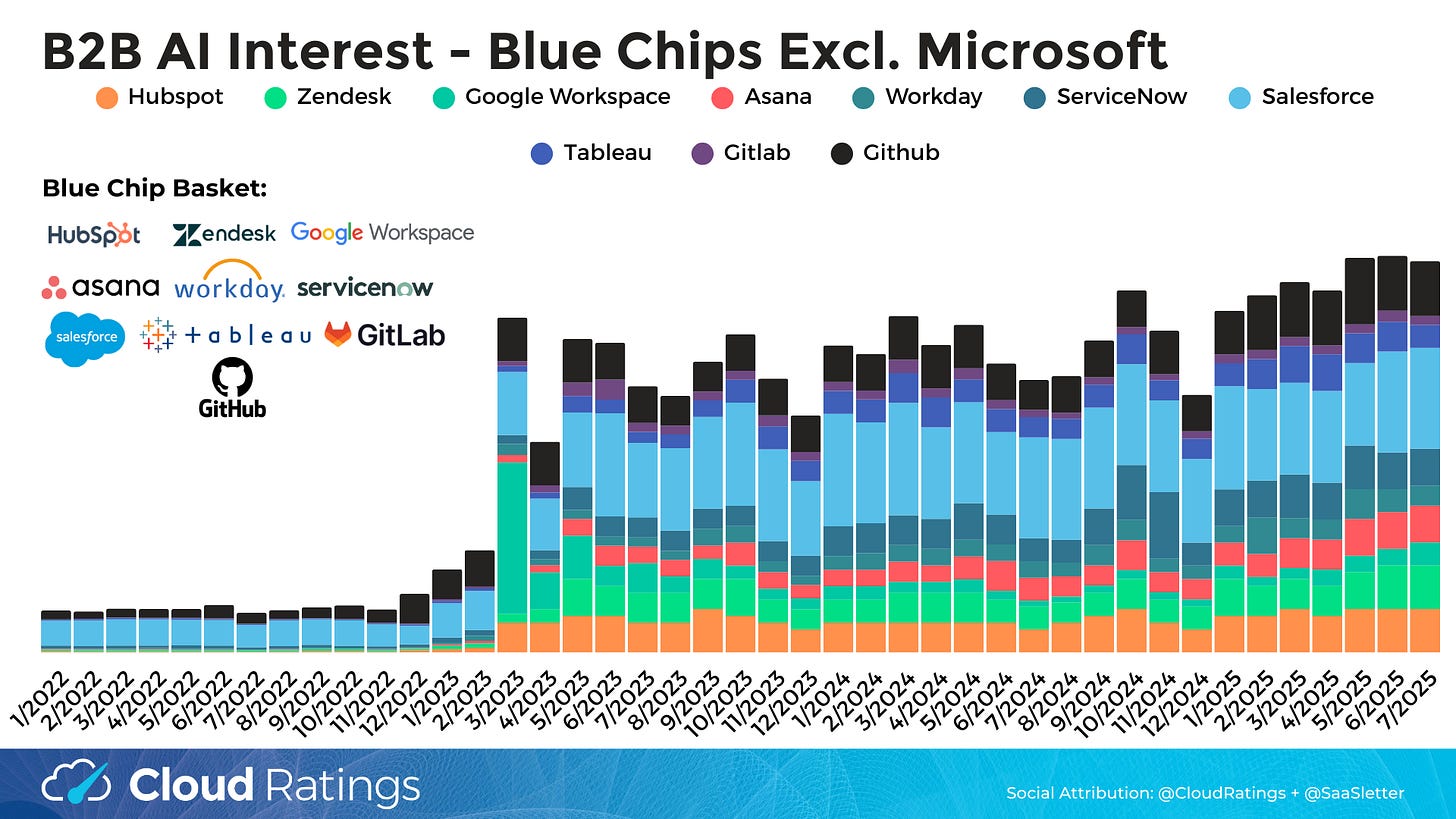

Bellwether Microsoft Copilot has plateaued after an Agent product release drove interest in the spring. Other “Blue Chips” (i.e., Hubspot, ServiceNow) remain range-bound and small in absolute terms.

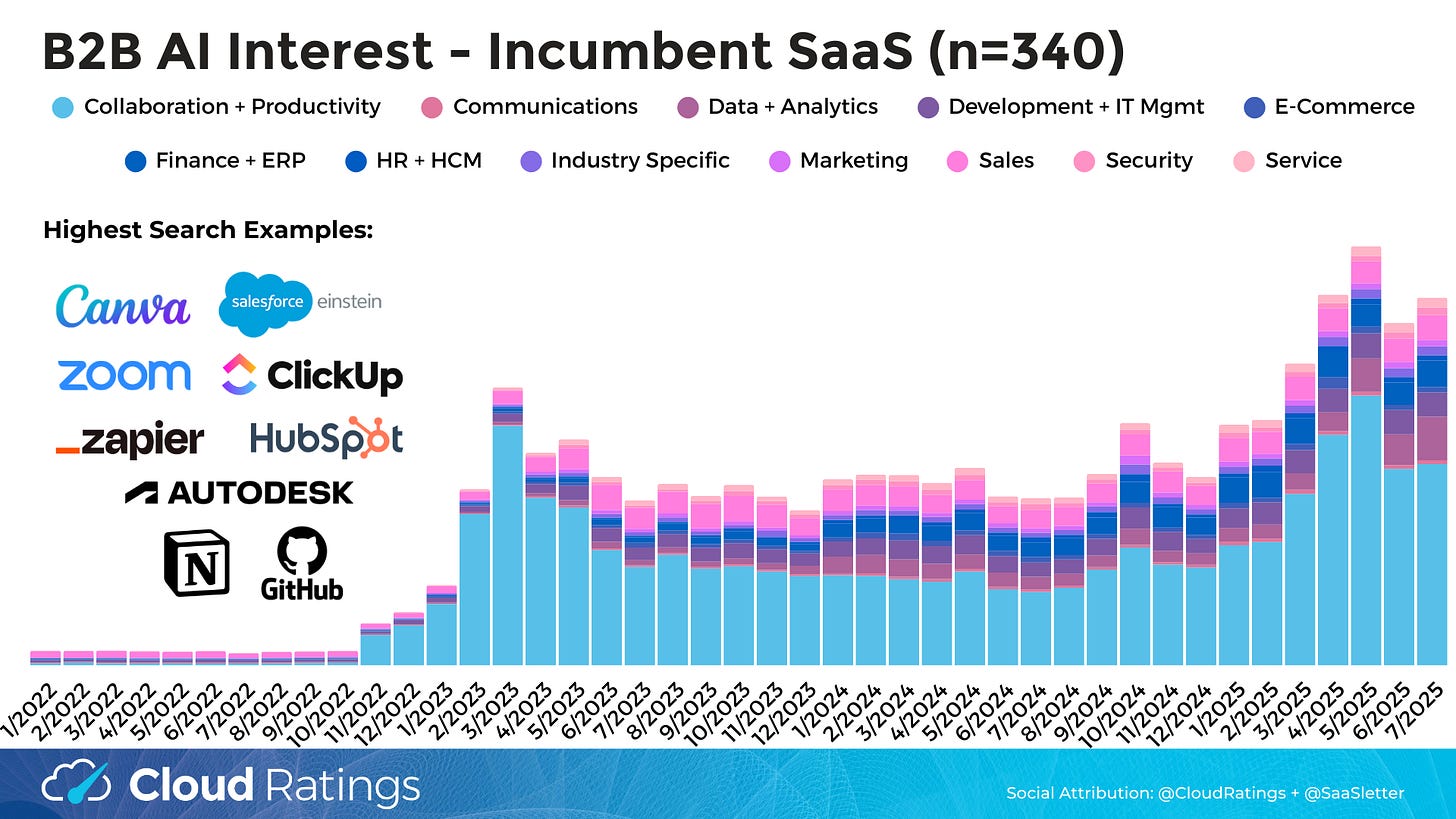

SaaS Incumbents (n=340: the same 340 vendors tracked in our top-of-the-funnel focused, forward-looking SaaS Demand Index) have seen a notable 2025 breakout relative to a very range-bound 2024. That said, interest is ~flat past quarter:

Driven mainly by PolyAI (“enterprise conversational assistants that carry on natural conversations with customers to solve their problems”), interest in AI Native B2B apps (n=50) has shifted from strength to plateauing:

About Cloud Ratings

In mid-2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm:

* Disclosure: Cloud Ratings has a commercial partnership agreement with Ebsta