SaaSletter - AI Gross Margin Drag

Plus our Cloud Ratings B2B AI Interest Index for June 2025

Gainsight CEO On AI Mistakes

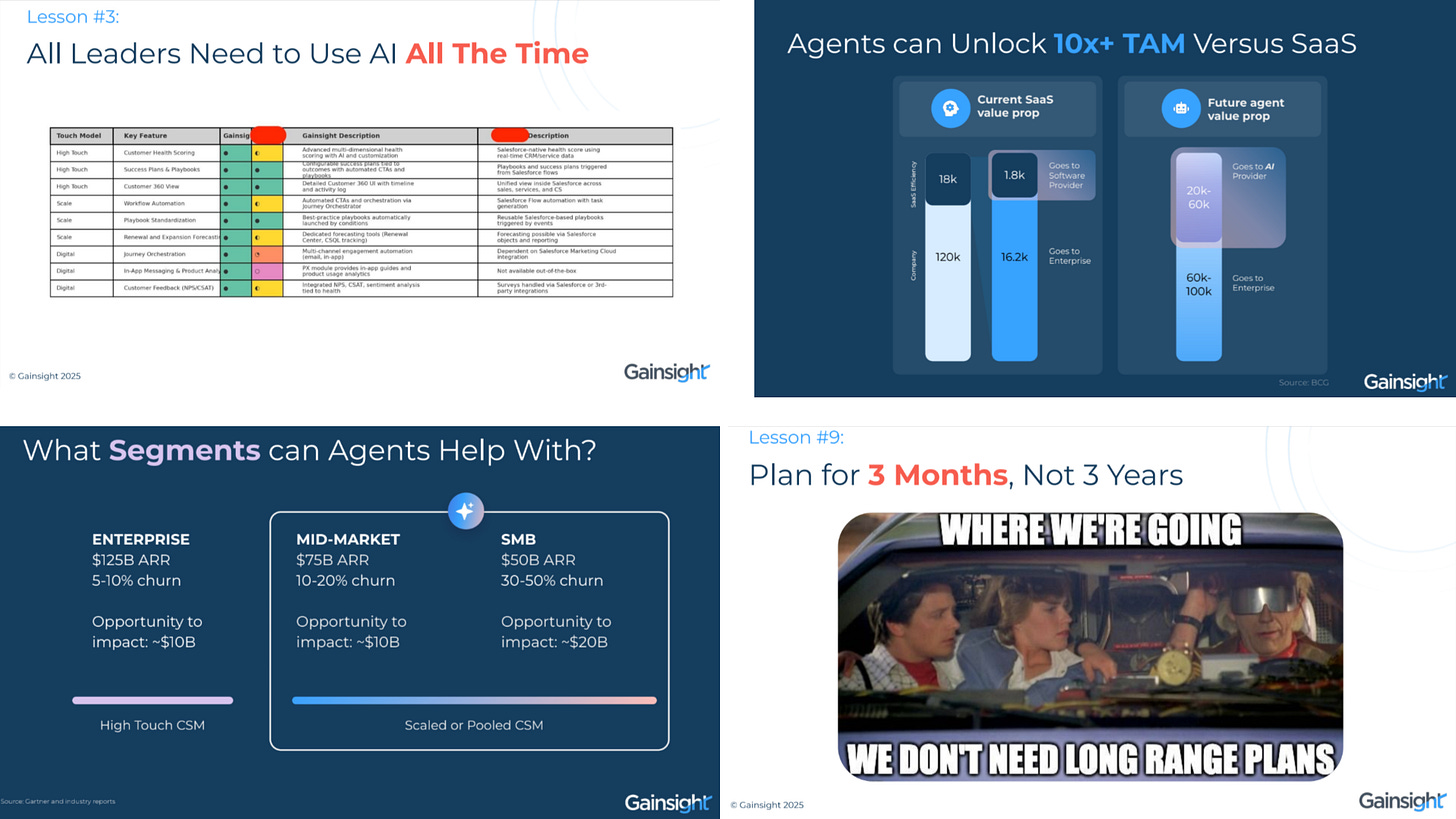

Nick Mehta, CEO of Gainsight, shared his 64-slide deck on “10+ Mistakes I’m Trying To Avoid In Making Gainsight AI First” from the GenAI Week conference.

Some key excerpts below → as always, go read the full version:

However, this particular slide captured my attention most:

…along with his slide context (bolding = mine):

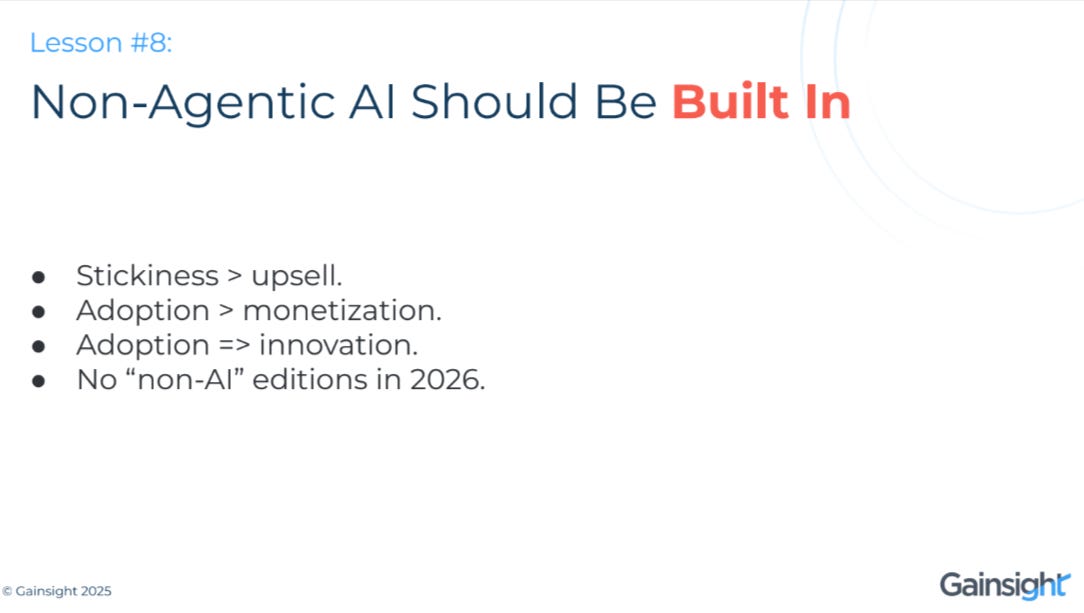

8. Charging for What’s Expected: 2 years ago, we made a very unconventional (at the time) decision within Gainsight - that our AI functionality inside our CS product should be available at no additional cost. Basic AI features are just expected now.

A Gross Margin Drag Reminder

That “no additional cost” for AI is particularly important given the higher compute (i.e. COGS) expenses from AI, well captured in the Jared Sleeper (Partner at Avenir) quote above.

This dynamic means vendors will need to better adopt value-based pricing and *value-based selling* to offset higher COGS in an AI age. I was very opinionated that *pre-AI* far too few vendors (only 33%!) adopted value-based pricing relative to their software’s customer ROI:

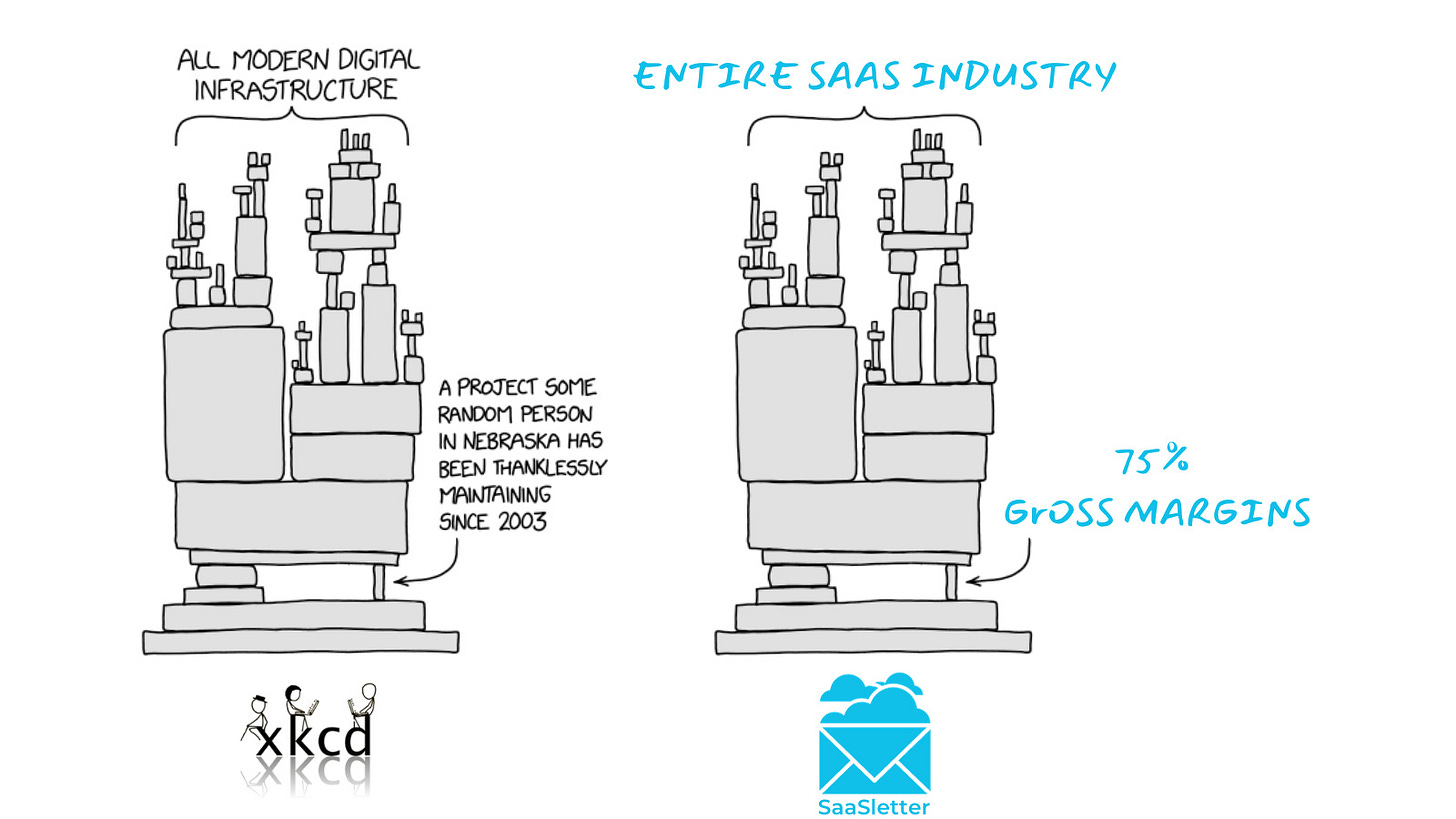

You can read my long-winded, analytical take on the importance of gross margins in my *2023* coverage of Coatue’s “AI Revolution” deck (h/t Sri Viswanath, Vibhor Khanna, and Yijia Lianghe)…

… which is more efficiently captured in my xkcd “Dependency” remake:

Our Value Creation Summit → Replay Available

With our written event recap here:

June 2025 B2B AI Interest Index from Cloud Ratings

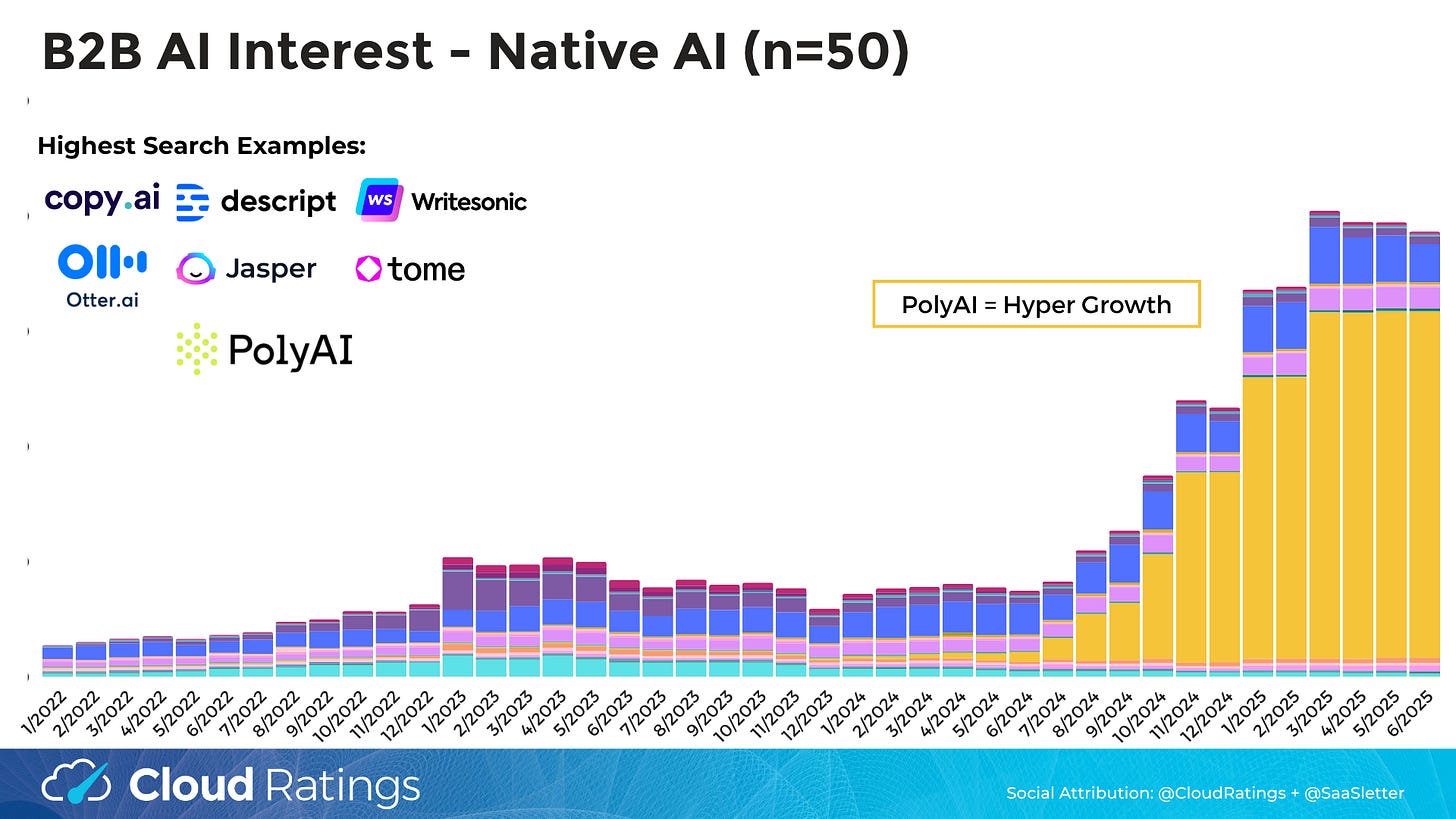

We’ve updated our Cloud Ratings B2B AI Interest Index through June 2025 - full slides below:

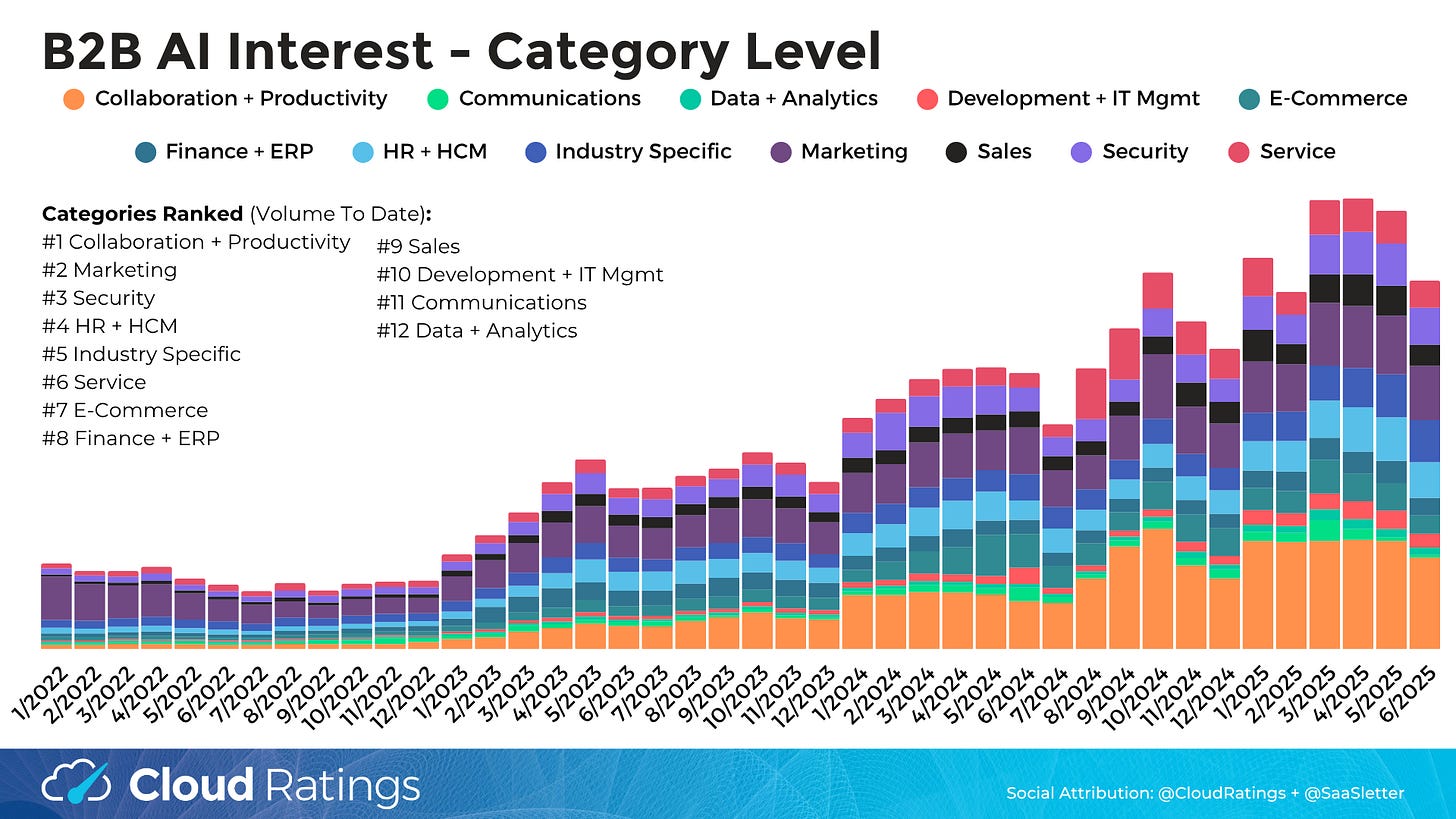

B2B AI interest trends are healthy but *moderating* in June.

Thematic Category Interest (n = 47 sub-categories tracked - i.e. “manufacturing AI” or “supply chain AI”) dipped in June.

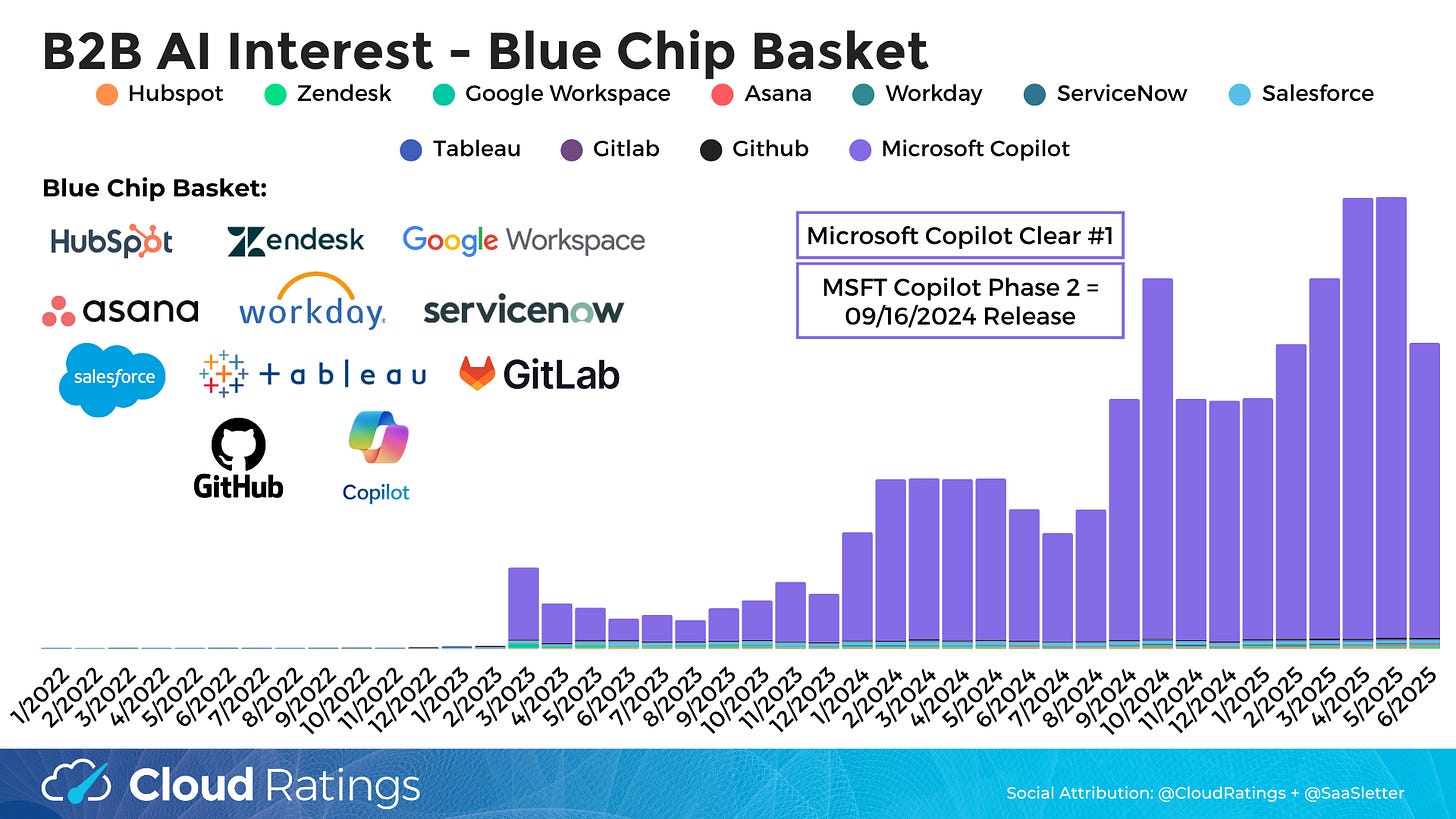

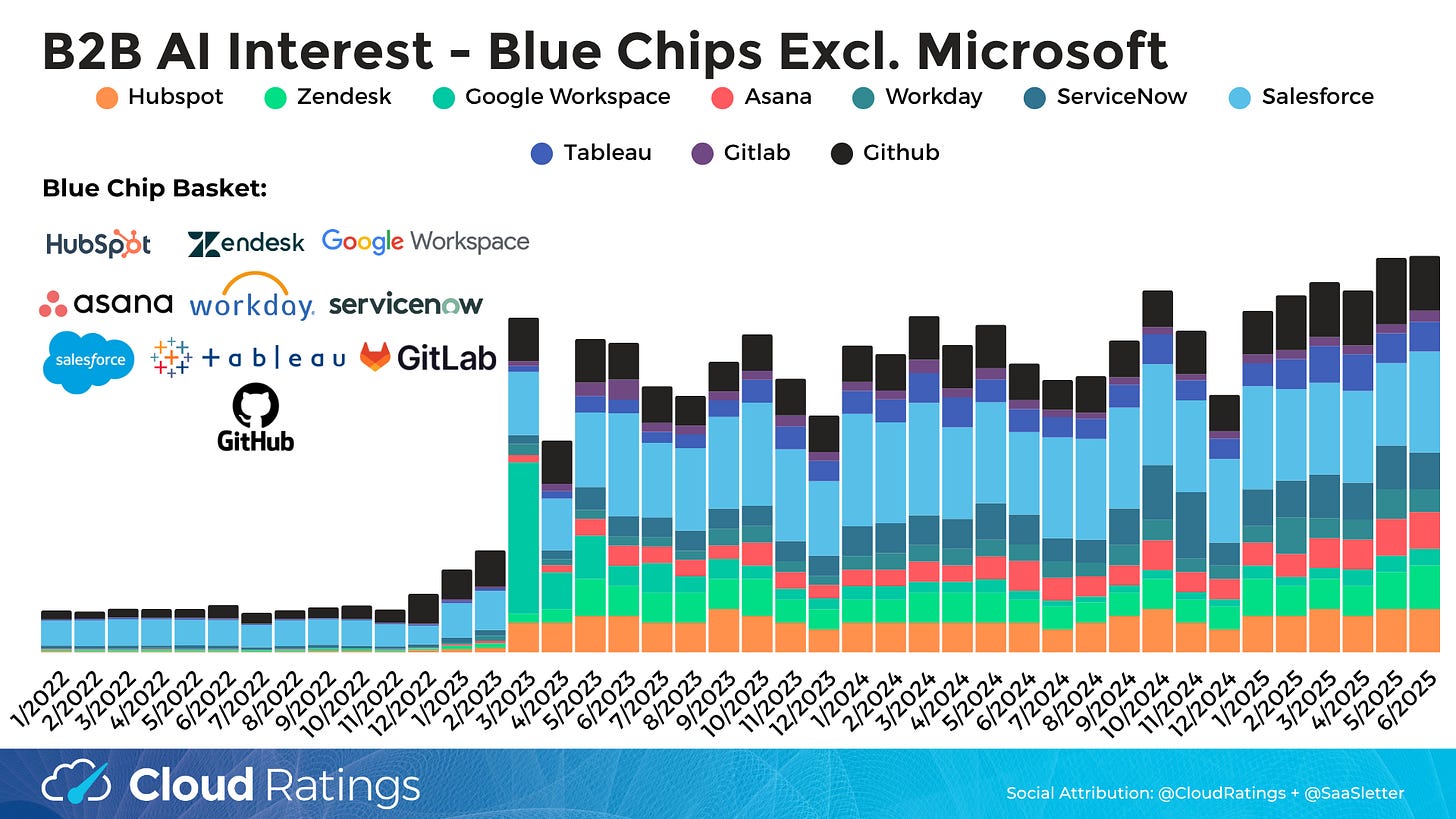

Bellwether Microsoft Copilot saw a material decline in June versus strong April + May comps. Other “Blue Chips” (i.e., Hubspot, ServiceNow) remain range-bound and small in absolute terms.

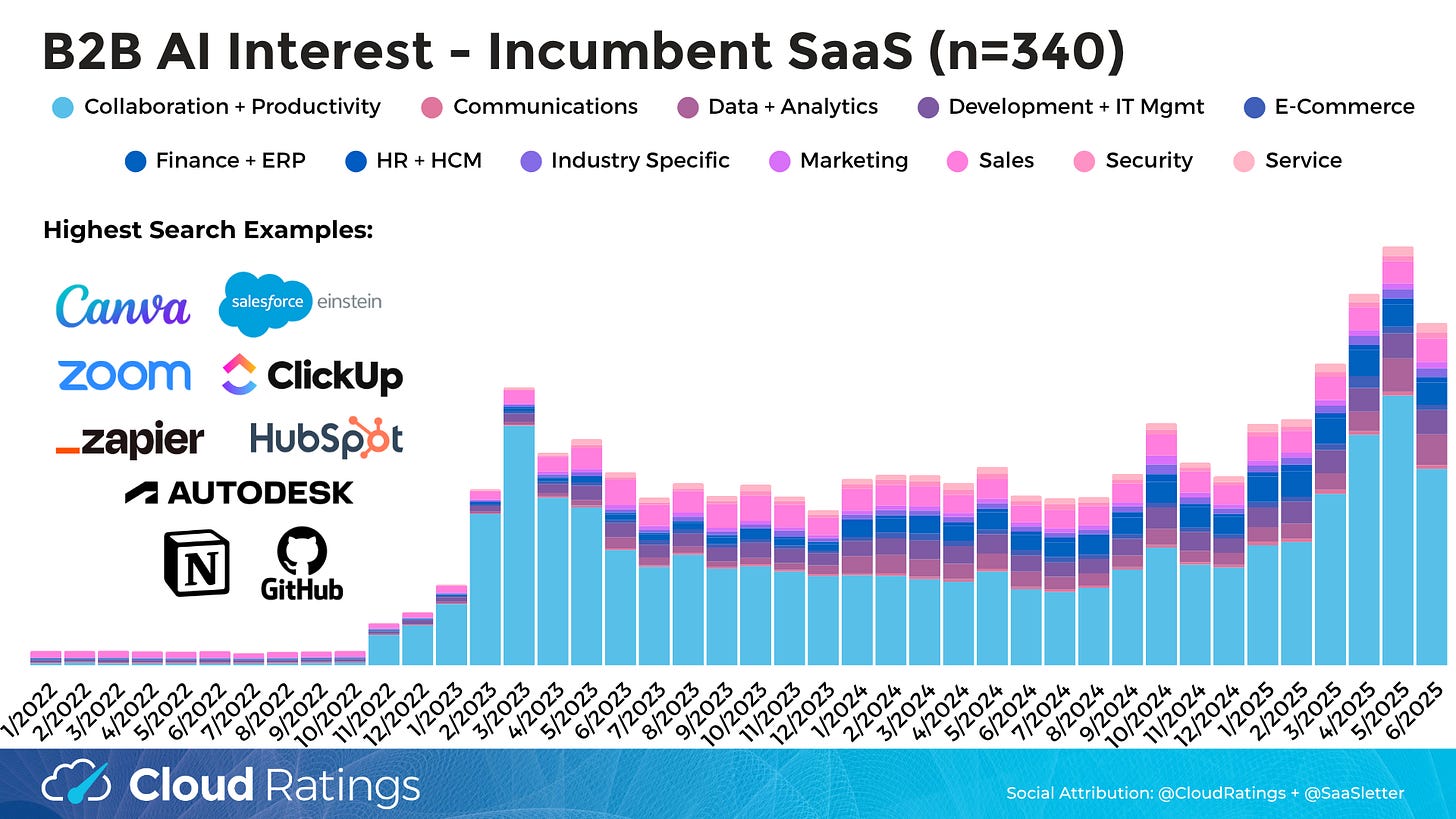

SaaS Incumbents (n=340: the same 340 vendors tracked in our top-of-the-funnel focused, forward-looking SaaS Demand Index) has seen a notable 2025 breakout relative to a very range bound 2024. That said, June showed a downward reversal:

Driven mainly by PolyAI (“enterprise conversational assistants that carry on natural conversations with customers to solve their problems”), interest in AI Native B2B apps (n=50) has shifted from strength to plateauing with June showing a sequential decline:

About Cloud Ratings

In mid 2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: