SaaSletter - Ebsta + Pavilion's 2025 GTM Benchmarks

With Our Deep Dive Podcast With Ebsta's CEO Guy Rubin

This week we cover one of our favorite recurring reports from Ebsta + Pavilion:

Ebsta + Pavilion’s 2025 GTM Benchmark Report

As always, go read the full report. Why? The report covers $48 billion of pipeline across 655,000 opportunities, analysis of 240,000 minutes of seller discovery calls, and a survey of 2,000+ CROs + Sales Leaders.

Here are key excerpts to set up our commentary:

On my first read through, I would have characterized the report as bearish for B2B software due to:

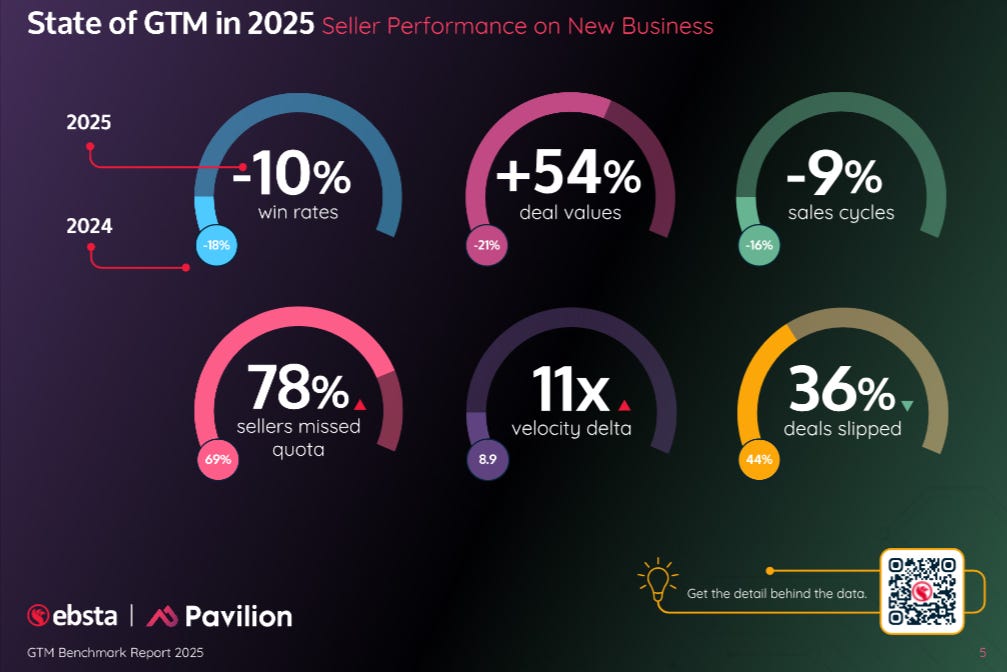

Concern #1 = Declining Win Rates: In absolute terms, the 2025 report win rate of 19% (and down from 29% in 2024) is concerning itself. Quantitatively, the implied needed 5.3x pipeline coverage is wildly expensive and in practice hard to generate. Qualitatively, at 19% win rates you start to wonder about “sellers holding on to fake deals”, buyers’ “Fear of Messing Up (FOMU)” and overly crowded categories.

Concern #2 = 11x Top Rep Velocity Gap | 14% of Sellers Generate 80% of Revenue: In our coverage of Ebsta / Pavilion’s 1H 2024 report, we termed this metric a new “check engine light” with our rationale re-quoted:

“While this model can work at times:

if teamwide quota attainment was healthy (i.e. 70%), a 10.2x top rep delta would actually be a great sign → mathematically, you would be crushing your plan

Datadog (DDOG): posting healthy growth despite quota attainment in the mid-20s per RepVue

AppFolio (APPF): per RepVue seller reviews, “leadership has restructured quotas for a target of 25% attainment"

… a 10.2x seller delta is unsustainable relative to what is “priced in” for the software industry (i.e. high revenue multiples; underwritable long-term growth).

As an analogy, a business with a customer concentration of 16% customers at 83% revenue would trade at a discounted multiple.

An investment in a software company is really an investment in a new customer acquisition machine.

Per Morgan Stanley’s X-Ray methodology, future customers represent 44% of the average public company enterprise value and ~80%+ for certain companies (like Hubspot, Samsara, and Cloudflare). For early-stage venture-backed companies, nearly all of the value (~95%+) is in future customers - there simply is no valuation / FCF support from the installed base.

If only 16% of the sales force can generate real revenue, surely the customer acquisition machine is wearing out, with check engine lights flashing. Surely, the TAM is getting saturated, making underwriting high future growth very hard.”

Positives From The Report: Stats + Tactical Solutions

When we ran the cumulative math, the above win rate and top rep concentration concerns were more than fully offset by positives like:

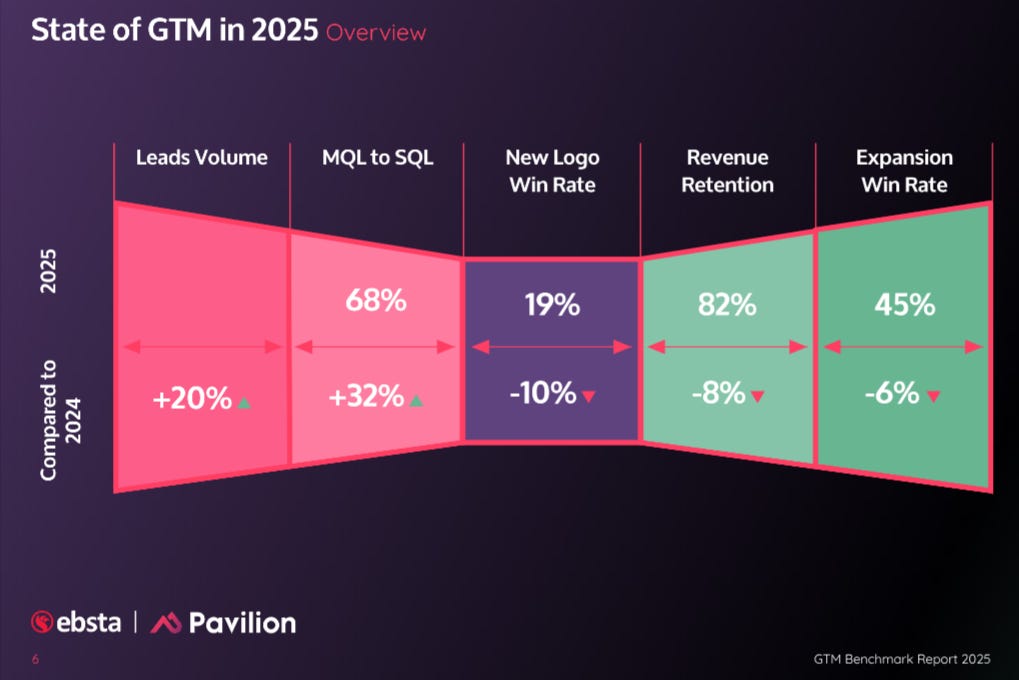

Leads Volume: +20%

MQL to SQL: 68%, up 32% from 2024. This suggests smarter top-of-the-funnel marketing investment.

Deal Values: +54%

Positively, the report also calls out solutions like:

A-Players: 55% better at discovery

Selling to the right ICP boosts quota Attainment by 90%

Top performers are 24% more likely to decline non-ICP deals early

76% of B-Player deals lack critical events

There is a *lot* more in the full report - like velocity by channel (Partnership = #1) and tactics to hardwire in your org. Go read it.

Deep Dive Podcast With Ebsta Founder + CEO

We liked the report so much, we did a deep dive with Guy Rubin:

FULL EPISODE: VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

About Cloud Ratings

In mid 2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: