SaaSletter - FOMU: Fear Of Messing Up

Plus Our August 2024 SaaS Demand Index

Sydney Sloan at SaaStr 2024

I first heard the acronym “FOMU: Fear Of Messing Up” from Matt Mitchell of MonetizeNow at SaaStr 2024.

FOMU seems to apply to parts of G2 CMO Sydney Sloan’s talk at SaaStr 2024.

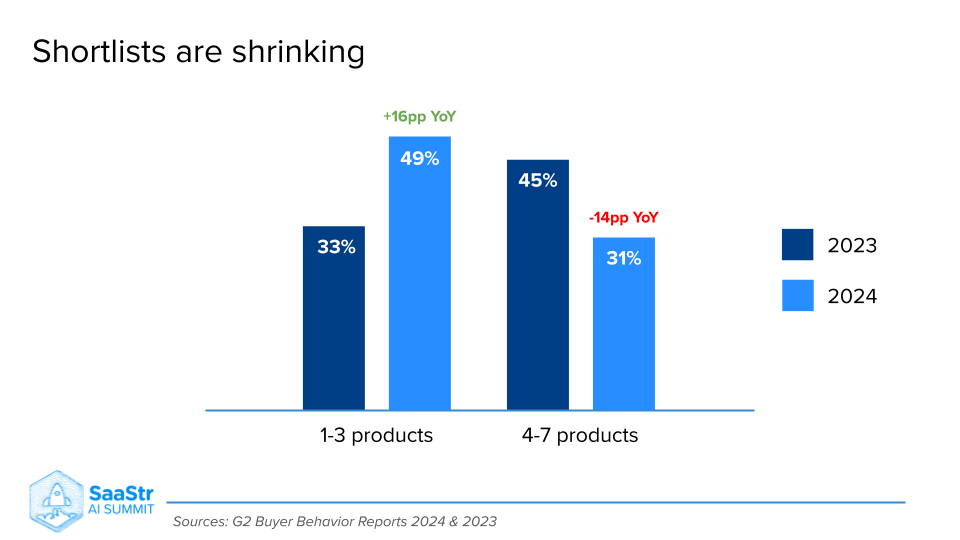

In a more risk-averse environment, FOMU leads to shorter shortlists (+16% 1-3 product lists per G2’s Buyer Behavior Report)

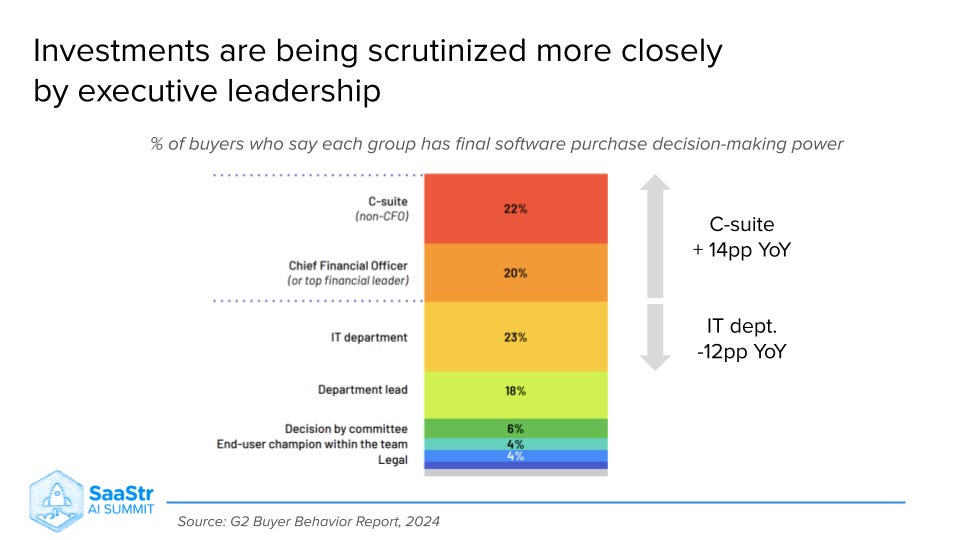

More C-Suite involvement in purchasing decisions (+14% YoY) likely contributes to FOMU and risk aversion:

A FOMO (Fear Of Missing Out) buyer mindset works in a spending boom - chasing the latest hot app - regardless of risk - makes sense with far less C-Suite purchasing scrutiny AND when you are likely to move to the next hot role before any bad choices become apparent (more on SaaS employee tenure using People Data Labs data here).

The Deal Director captured the lack of focus on outcomes well here:

A big part of the tech sales bull run between 2010 and 2022 was driven by customers being tricked into glossing over these outcome details. Most companies tried to pretend like services or getting to an outcome quickly was either not relevant or "probable".

ROI Cures FOMU?

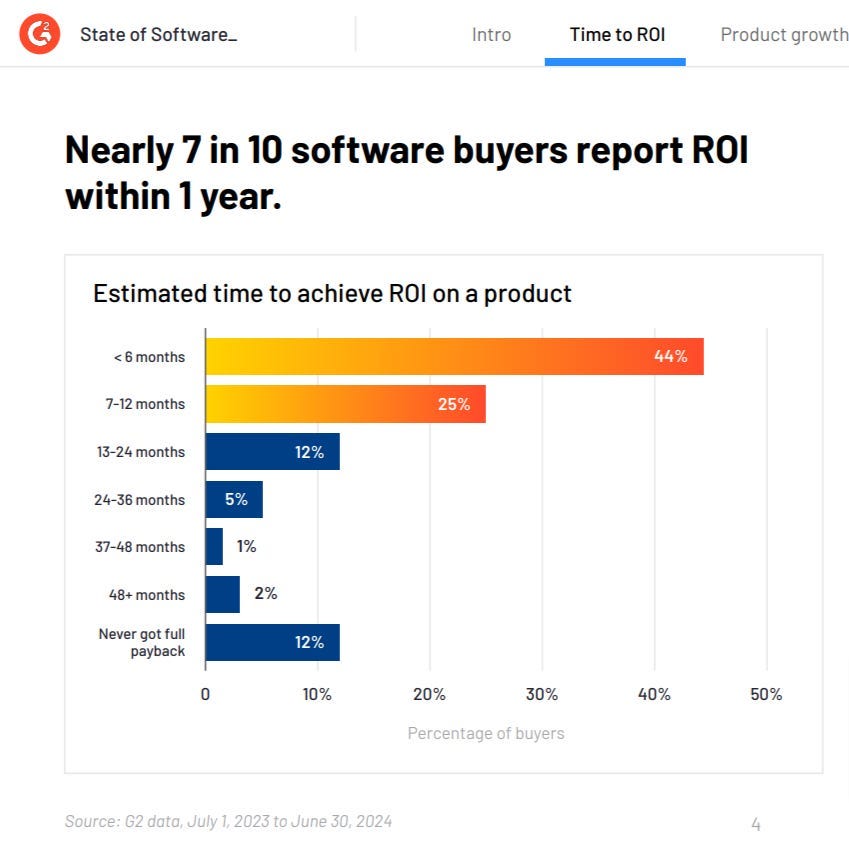

Note the “getting to an outcome quickly was either not relevant or ‘probable’” phrase → from Sydney Sloan’s SaaStr talk, buyer expectations for a fast payback are very, very high:

This chart from G2’s recent State of Software breaks down actual payback periods - applying mid-points + assumptions to “never”, the actual average payback period is ~18 to ~24 months:

Tying ROI back to the FOMU trend:

No Vendor ROI Support = More *Perceived* Messing Up Risk: Surprisingly, few vendors arm their buyers and internal champions with quantitative ROI support. Only 10% of 300+ private-equity-backed software vendors have an ROI calculator on their websites.

Another notable stat from a recent TrustRadius / Pavilion buyer report - 47% of buyers want ROI support to secure budget:

When we segmented out buyer data for enterprise purchase prices, the wish for “calculating ROI to be easier” rose a staggering 16%, placing it in the top two things buyers wished were different about tech buying.

Enterprise purchase price top five were:

• I wish all vendors had transparent pricing: 51%

• I wish calculating ROI were easier so I could get the budget approved: 47%

There is a business value gap that vendors should be filling in their GTM. Otherwise, your buyers must risk their reputations without support in a risk-averse environment.

Want To Serve These/Your Buyers Better and Prove ROI While Fighting FOMU?

Answer: Add third-party analyst validation of your ROI to your sales + marketing mix with Cloud Ratings True ROI.

Our True ROI practice area can also provide 1-to-1 financial sales engineering. We are currently supporting a seed-stage AI vendor and 2 of their enterprise buyers overcome FOMU on $1m-$2m ACV purchases.

August 2024 Demand Index

We’re excited to update the SaaS Demand Index with data through August 2024.

Due to an ongoing, partial shift in Google’s methodology, this month’s sample consists of 83 companies (versus our usual 340) covering 100,000+ high-intent searches. However, all graphs are pro forma on a historical basis (i.e., apples to apples).

Reminder: this is a directional, free, and ever-evolving* analysis → always do your own due diligence. Moreover, the data captured here is best characterized as top-of-funnel or dark funnel → factoring in sales cycle length, do NOT use this Demand Index as a predictor of near-term financial results and/or financial guidance.

High-intent search volumes were up +5% year-over-year while down -3% month-over-month. While noting the volatility of monthly data samples, the poor August reading is a concerning deceleration from the +15% readings of February through July 2024:

Curated Content

Dave Kellogg’s “Why Great Marketers Look at Pipeline Coverage, Not Just Pipeline Generation”:

Tomasz Tunguz from Theory Ventures SaaStr talk included a 2024 GTM Survey showing quotas increasing by 14%:

For more about ROI and FOMU, I covered this topic extensively on recent podcasts with Craig Rosenberg, Matt Amundson, and David Dulany

About Cloud Ratings

In case you missed it, we recently announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants, this newsletter, our podcasts, and our growing True ROI practice area (see Ivan Arizaga’s appointment as a Principal Analyst) all fit within our modern analyst firm: