SaaSletter - B2B AI Demand + G2's Buyer Behavior Report

Plus curated content from Dave Kellogg, Software Equity Group, + Sam Marelich

April 2025 B2B AI Interest Index from Cloud Ratings

We’ve updated our Cloud Ratings B2B AI Interest Index through April 2025 - full slides below:

B2B AI interest trends remain generally healthy.

Thematic Category Interest (n = 47 sub-categories tracked - i.e. “manufacturing AI” or “supply chain AI”) continued its steady growth trend.

Bellwether Microsoft Copilot has seen a re-acceleration. Other “Blue Chips” (i.e., Hubspot, ServiceNow) remain range-bound and small in absolute terms.

SaaS Incumbents (n=340: the same 340 vendors tracked in our top-of-the-funnel focused, forward-looking SaaS Demand Index) has seen a notable 2025 breakout relative to a very range bound 2024:

Driven mainly by PolyAI (“enterprise conversational assistants that carry on natural conversations with customers to solve their problems”), interest in AI Native B2B apps (n=50) trend line continues to be strong:

RELATED READING: Our “State of Software + AI” (21 slides) first presented at Bowery Capital’s Annual General Meeting:

G2’s 2025 Buyer Behavior Report: AI Highlights

G2 published their 2025 Buyer Behavior Report (h/t Tim Sanders). As always read the whole report… not just our excerpts below:

While G2’s AI ROI survey was encouraging on an absolute basis, the exceeded and met expectations results were below Morgan Stanley’s recent survey:

I interpreted this AI willingness to pay survey as encouraging:

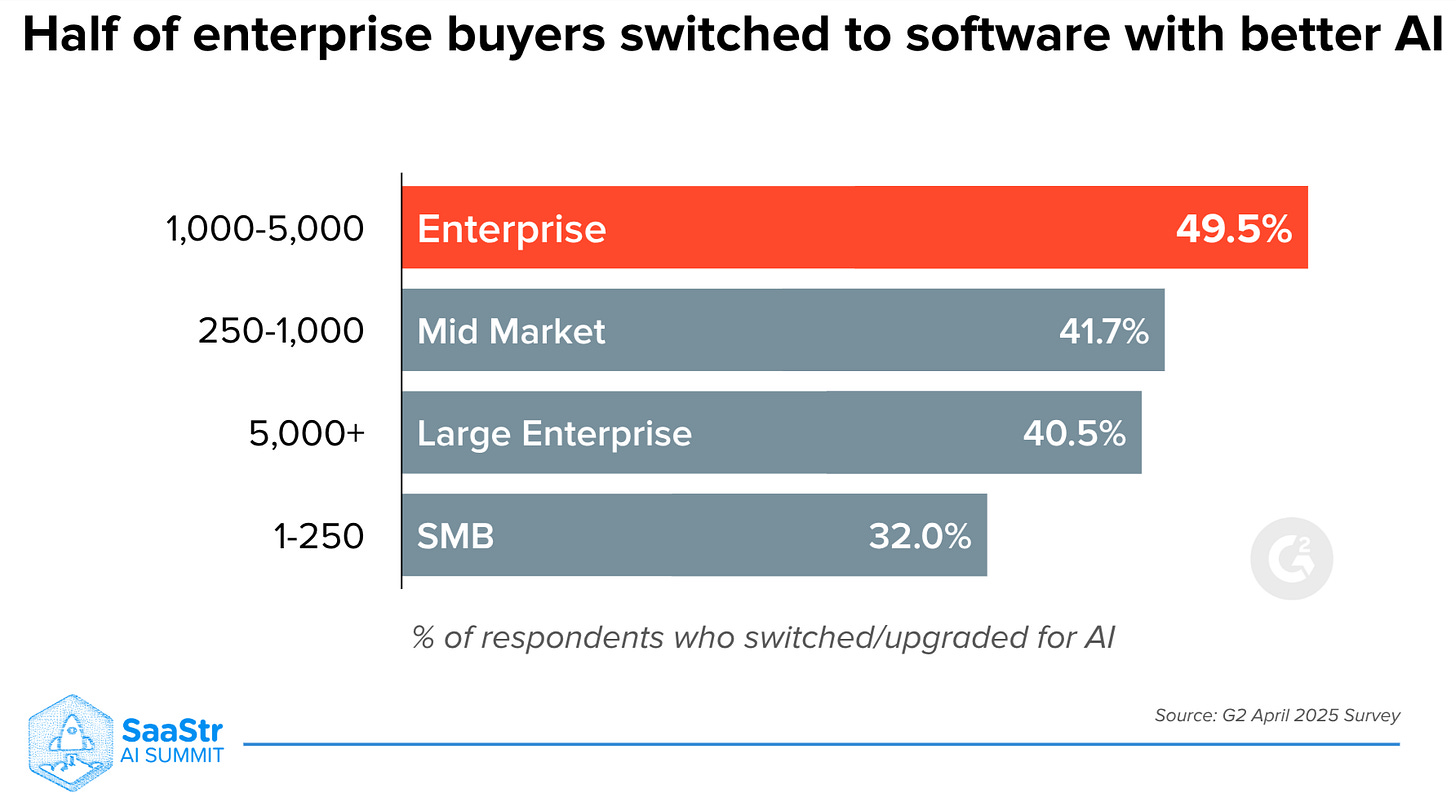

AI driving *switches* (especially enterprise) also stood out:

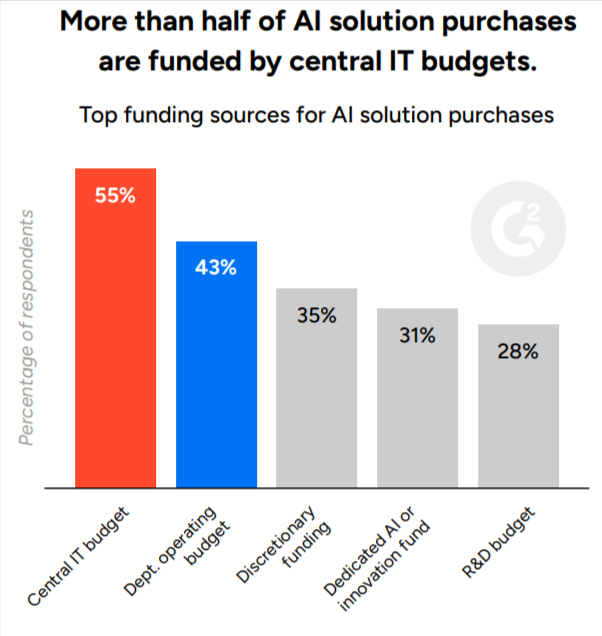

Since the funding of AI and whether it cannibalizes non-AI IT spend is a popular topic, I’m highlighting this:

G2’s 2025 Buyer Behavior Report: ~Investor Highlights

G2’s buyer shortlist size data has MASSIVE implications for both investors and operators: you really, really need to be a top 3 player in your category.

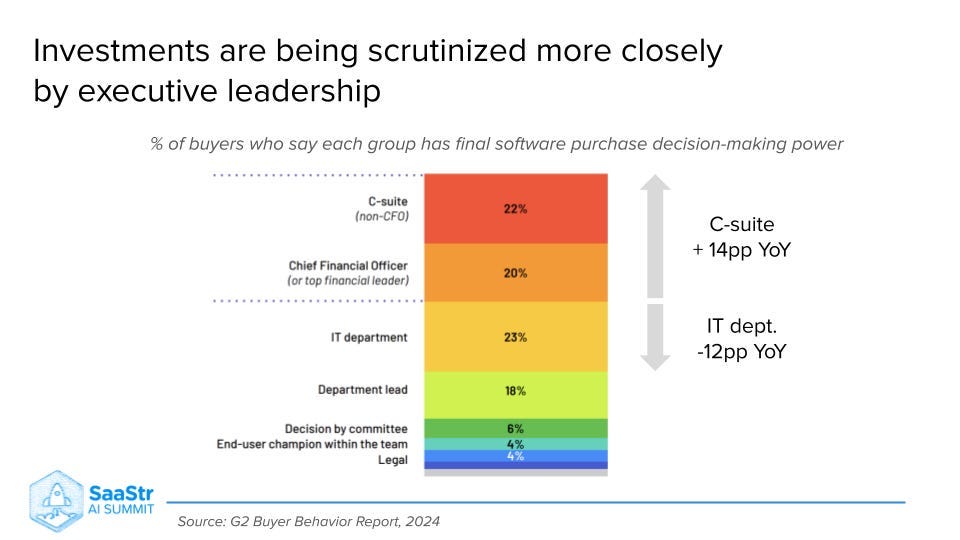

Last year, we used G2 data to cover the “FOMU (Fear of Messing Up)” trend, especially in terms of increased C-Suite and CFO participating in buying processes (see SaaStr *2024* slide):

Fortunately from a software vendors perspective, CFO involvement has stabilized in 2025 and broader C-Suite has even declined:

GenAI Chatbots as the *#1* influence on vendor shortlisting certainly was a surprise. As always, remember that buyer behaviors are idiosyncratic!

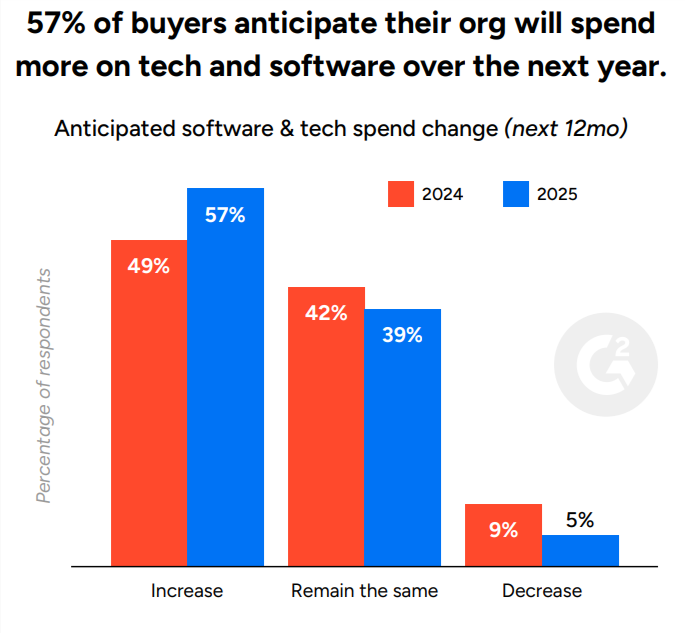

Lastly, software budgets are accelerating in 2025:

Curated Content

Dave Kellogg with:

Software Equity Group + Austin Hammer - “Q1 2025 Software M&A Report”

Sales headhunter Sam Marelich on the “You need to pay top incomes to attract top talent” mantra

SaaSholic + Gustavo Souza (h/t Rodrigo Fernandes) - “Latam AI Benchmarks 2025”

About Cloud Ratings

In mid 2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: