SaaSletter - Selling Satisfaction

Correlating Software Ratings + Sales Rep Outcomes: Insights from G2 + RepVue Data

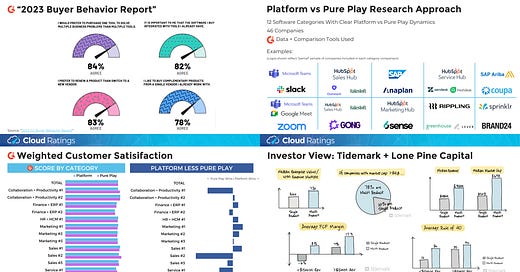

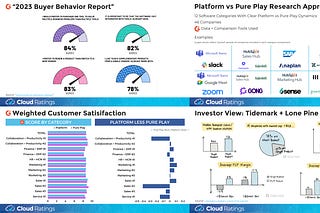

Building on our “Platforms Versus Pure Plays” and “Drivers of Customer Satisfaction + Category Leadership” primary research, we’ve partnered with G2 and RepVue to examine the relationship between software product satisfaction and seller satisfaction.

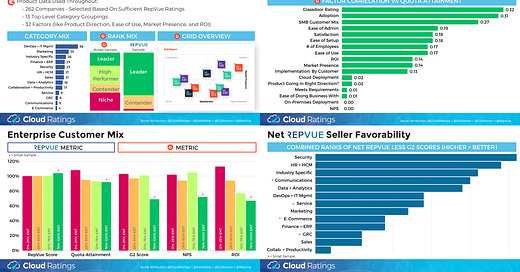

262 software companies with high volumes of seller ratings were selected from RepVue’s coverage universe and then merged with G2 review data across 32 factors.

Throughout the research, we focus on 2 key RepVue metrics, with one financially oriented (Quota Attainment) and the other a more holistic measure of the selling environment (RepVue Score):

Quota Attainment: RepVue asks each seller what percentage of *team* members typically hit their quota. Said differently, sellers leaving reviews do not provide their own individual quota results. Importantly, RepVue’s team approach multiplies the signal captured.

RepVue Score: This is a composite measure of a sales organization’s health driven by these factors: Culture and Leadership, Base Compensation, Incentive Compensation Structure, Product-Market Fit, Professional Development and Training, Inbound Lead / Opportunity Flow, and Diversity and Inclusion.

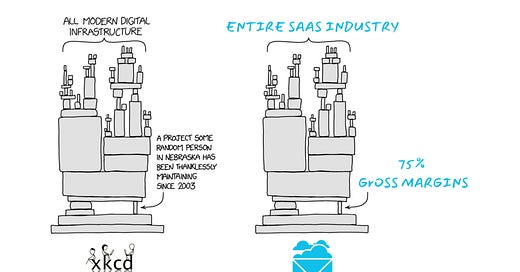

Why Does This Research Matter?

Choosing the right software company to work for is an especially important decision for sellers. While transparency has improved thanks to platforms like G2 and RepVue, deciding on a role with highly variable compensation with limited information is a real challenge.

We hope this exploratory research can provide frameworks for sellers evaluating organizations. Of course, these insights will also provide pattern recognition for our subscriber base of software investors and operators outside the sales function.

A caveat: this is exploratory research with a limited sample size. The R-squares of our regressions here (n = 262 companies) were materially lower than the “Drivers of Customer Satisfaction + Category Leadership” (n = 4,222 companies). Accordingly, these findings should be considered purely directional.

What Drives Quota Attainment?

While most of these drivers are very logical - like Ease of Admin, G2 Satisfaction Score, Ease of Setup, and Ease of Use being positively correlated with higher quota attainment - a few factors are worth noting:

Small Business (SMB) Customer Mix: a higher proportion of SMB customers correlates with better seller results.

Implementation Done By Customer: Quota attainment is higher when the software is implemented without involving professional services (either vendor professional services or a 3rd party consultant).

A few comments on negative correlations to quota attainment:

Enterprise Customer Mix: The “worst” quota correlation is a high proportion of enterprise customers.

Contract Length: Longer contracts are harder to sell.

Time To Live: Slow-deploying apps are harder to sell.

Company Age: Sellers at older companies are less likely to hit quota. Interestingly, this aligns with research findings that G2 review scores decline with vendor age.

Quality of Support: While there is a very slight negative correlation to quota achievement, this is surprising relative to our research finding that quality of support is the #1 predictor of software user NPS.

What Drives Sales Org Health?

As a reminder, the RepVue score is a more holistic measure of a sales org’s health, taking into account factors like lead flow, product-market fit, leadership, and training.

A few comments on the positive correlations:

Glassdoor Rating: It makes sense that a strong overall company culture (captured by Glassdoor) correlates to a strong culture in the sales function.

Customer Mix: With very low values, we see that customer type has far less impact on broader RepVue scores than on quota achievement.

Regarding the negative correlations to RepVue scores:

Implementation By Seller Services: Vendor-led implementations correlate with worse RepVue scores, similar to our findings on quota attainment.

ROI: While ROI was positively correlated to quota attainment, ROI has a slightly negative correlation with RepVue scores.

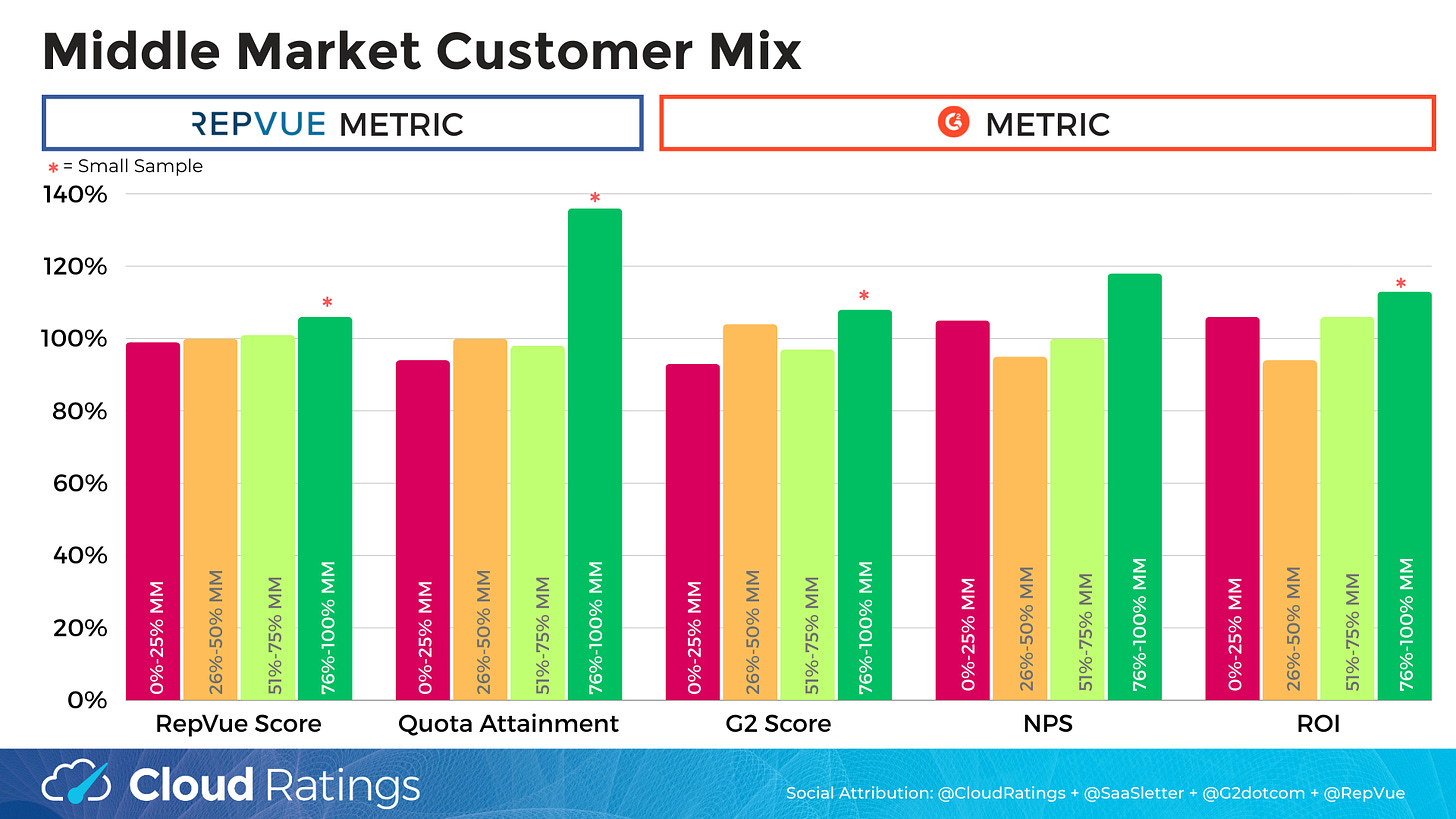

Does Customer Mix Impact Seller Outcomes?

Given the significant impacts of customer mix on quota attainment, we’ve included further detail by segment on an indexed to 100% basis. Caveat: sample sizes are understandably limited at the extremes (i.e. vendors with 76%+ Middle Market customers are rare).

ROI is the most notable factor:

ROI steadily declines as the customer base skews more toward Enterprise

ROI rises as the customer mix becomes more weighted to an SMB pure play

Does Product Category Impact Seller Outcomes?

Recognizing that software itself varies significantly across product categories, we analyzed seller satisfaction across 13 top-level groups on a indexed to 100% basis:

The diverging bars above highlight the unpredictability sellers must navigate when choosing an organization. Seller experiences can really diverge from what you would guess from looking at G2 reviews.

Summarizing the quota attainment results:

Quota Attainment > G2 Scores: Most significant for Security, HR + HCM, Industry Specific (aka Vertical), Data + Analytics

G2 Scores > Quota Attainment: This is most notably true for Collaboration + Productivity apps and, to a lesser extent, for Sales and Marketing.

The RepVue scores were generally similar:

RepVue Scores > G2 Scores: Once again most significant for Security, HR + HCM, Industry Specific (aka Vertical), Data + Analytics

G2 Scores > RepVue Scores: This is again true for Collaboration + Productivity apps and, to a lesser extent, for Finance + ERP and Sales.

When combined together, the following categories are better to sell for than their product reviews would suggest: Security, HR + HCM, Industry Specific, and Data + Analytics.

Downloadable Slides

Appendix: By G2 Grid Position

Logically, RepVue’s seller review base skews toward high market share vendors with larger sales teams.

Accordingly, the 262 company RepVue data sample was heavily weighted towards vendors with G2 Grid positions in the Leader (72% of the sample) and Contenders (22%) locations.

The findings were similar to our “Drivers of Customer Satisfaction + Category Leadership” primary research: High Performers have higher NPS, ROI, and Quota Attainment.

Note: This “Selling Satisfaction” research was first published on cloudratings.com