SaaSletter - Best Content Of 1H 2024

Curating the best of Software x AI for Operators and Investors

Industry Reports

G2 released their “2024 Buyer Behavior Report” (n = 1,900+ software buyers; 39 slides) with some excerpts above and threaded here. But go read the whole G2 report.

“SaaS Account Executive Report” - from The Bridge Group. The long-term quota trend (2012: 74% → 2024: 51%) is likely the most notable slide with other excerpts previewed above.

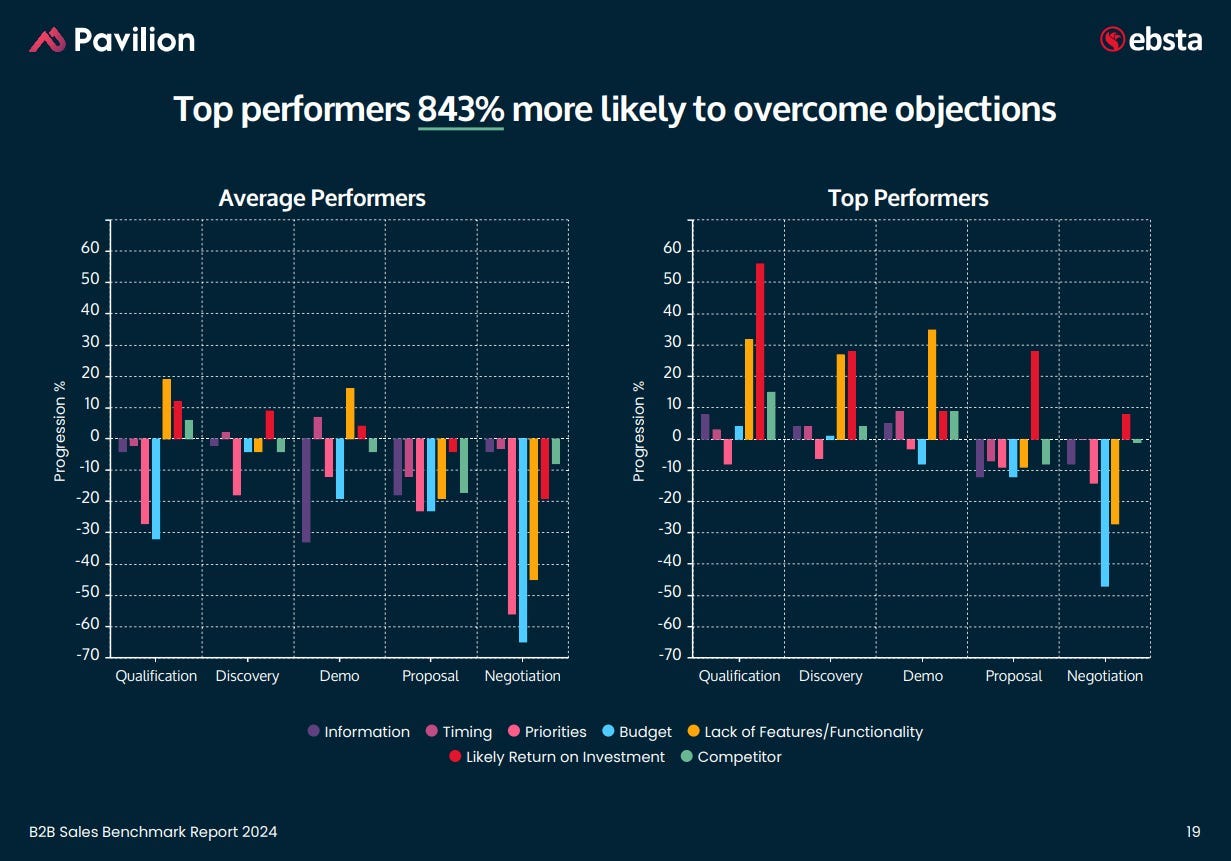

Ebsta (a revenue intelligence platform) and Pavilion published an authoritative “2024 B2B Sales Benchmarks” report (28 slides covering 530 companies across *all of B2B*, not just software, $54 billion of revenue, and 4.2 million opportunities) that was so good I set up a report deep-dive podcast with their CEO Guy Rubin. More in our “Too Little Value Selling” edition. Notable findings:

Top reps are 9x more productive today versus a 4x-6x gap earlier

61% of deals are lost to no decision

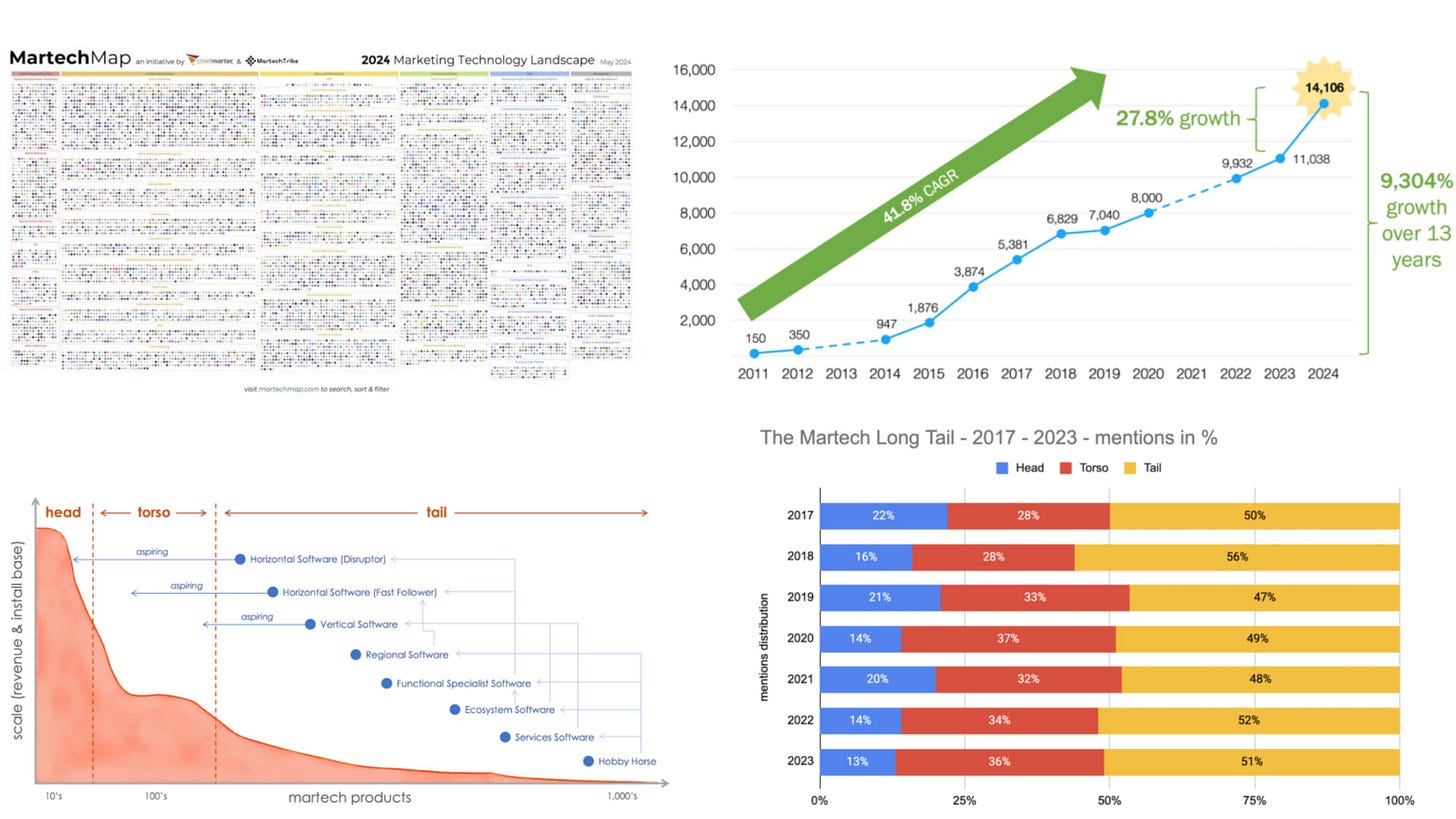

Scott Brinker (an Episode 14 podcast guest) and Frans Riemersma released their 101-slide “ State of Martech 2024” report (excerpts pictured above)

Zylo (software to manage software spending; $34 billion of spend under management) released their 2024 SaaS Management Index report (30 pages). A few highlights:

Average Spend Per Org: 2021: $60m → 2023: $45m (25% decrease in 2 years)

Average Utilization Rate: 49% → Average Waste of $18m / org

72% of SaaS spend occurs outside of IT control

Average Spend Per Employee: 2022: $4,621 → 2023: $3,916 (14% YoY decline)

From + For Investors

From Dave Yuan + team at Tidemark:

“Market Structure Drives Strategy” - Email required… but worth it

"Needles and Haystacks: Which GTM Practices are Actually Best Practice?" - a great tactical report from Insight Partners.

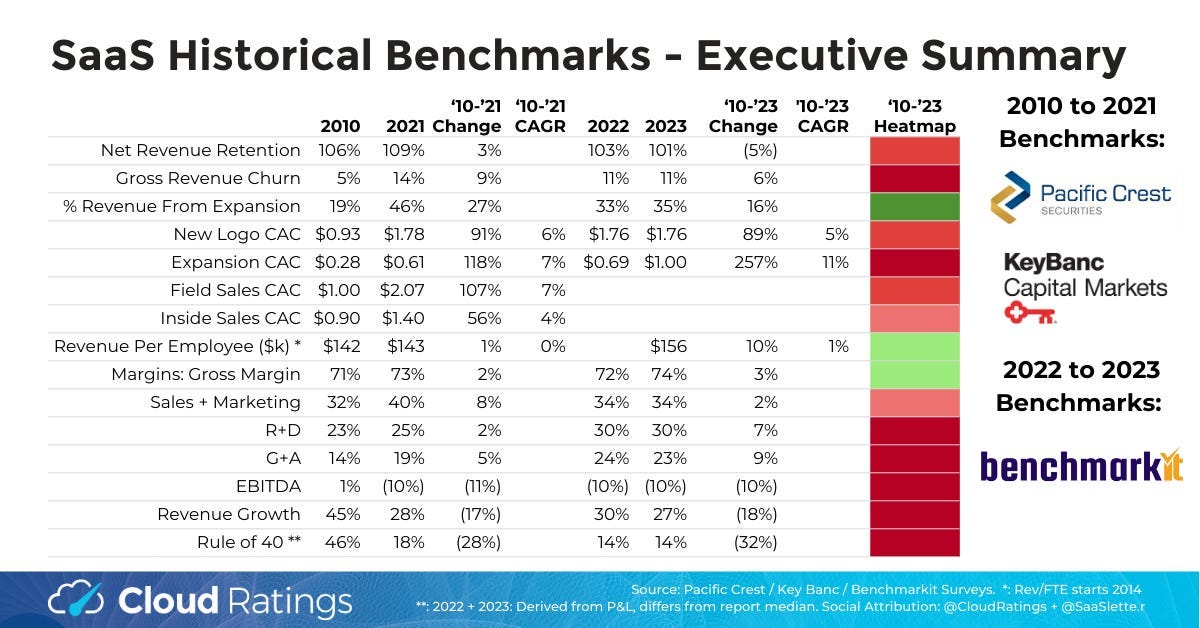

Ray Rike + Benchmarkit’s 2024 SaaS Benchmarks (n=936 companies) warranted our own update of 2010-present SaaS historical benchmarks:

Special thanks to Bowery Capital for offering me the opportunity to pontificate a few times:

“State Of The Industry” - with my slides on SaaS as a maturing growth industry that is fortunate to have AI

“SaaS Perspectives” - my Q&A with Patrick McGovern on new logos, AI, and what type of software I would recommend building today

My quick excerpts from Sapphire Ventures (Steve Abbott + team)'s very comprehensive (71 slides) "State of the SaaS Capital Markets" report

Battery Ventures’ “State of Enterprise Tech Spending” report (n = 100 CIOs, $35b of tech spend) With my full excerpts threaded here

“BVP State Of The Cloud 2024” - in terms of AI, I found the 65% gross margins notable. See my earlier coverage of gross margins in “Coatue on AI -> SaaS Read Throughs”

“InfraRed Report” - Redpoint released its annual 56-slide review of infrastructure software - my InfraRed 2024 excerpts here

“SaaS Perspectives” - via my appearance on Bowery Capital’s new blog interview series

From Jared Sleeper:

Chips Ahoy Capital’s comprehensive and must-bookmark study: “Benchmarking Multi Product Penetration in Software”

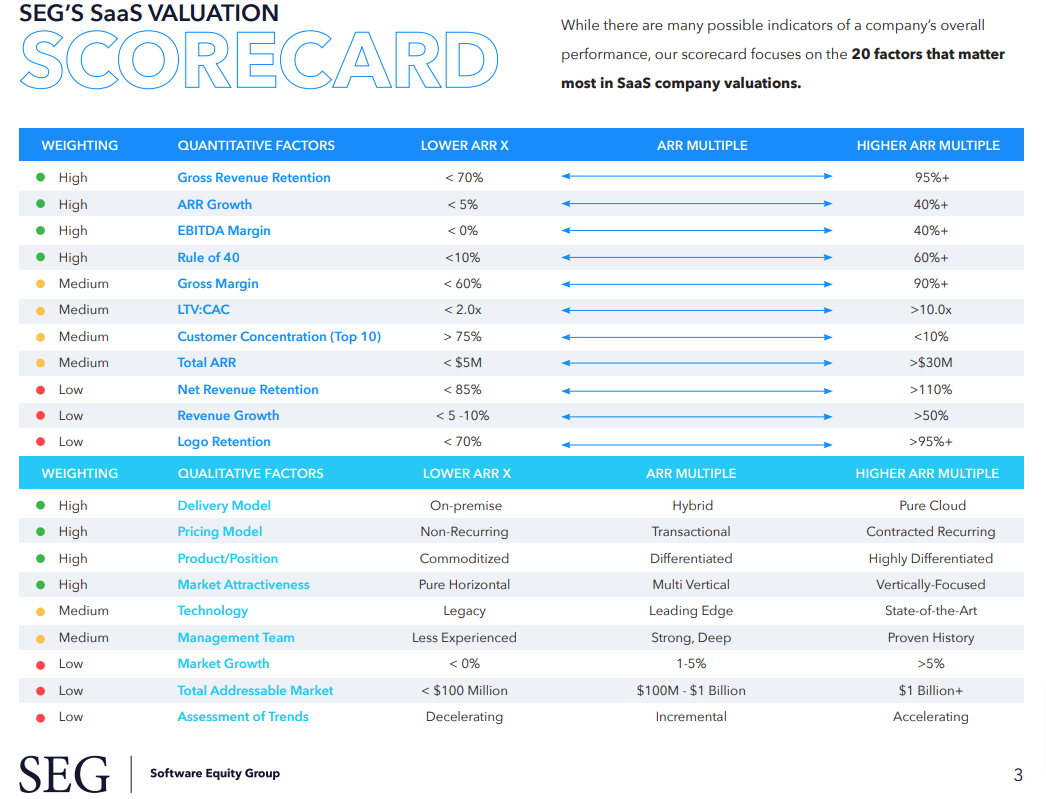

SEG’s “20 Factor Valuation Scorecard” from above deserves more attention

Our Primary Research

Special thanks to G2, Brex, and RepVue for their collaboration and data on these research deep dives:

AI-Centric Content

[NEW] “Mapping the impending impact of Vertical AI” (152 pages, email required) - from Marissa Moore and Taku Murahwi of OMERS Ventures

Buck on Software published a very thoughtful “Winds of Change” post

“AI’s $600B Question” - David Cahn from Sequoia updated his formula (table above) that addresses the “gap between the revenue expectations implied by the AI infrastructure build-out, and actual revenue growth in the AI ecosystem, which is also a proxy for end-user value.”

Meanwhile, Barclays published its own take on AI CapEx ROI

McKinsey’s AI reports have gotten *lots* of clicks:

“Navigating the generative AI disruption in software” - by Jeremy Schneider, Tejas Shah, and Joshan Cherian Abraham - my excerpts here

“In search of cloud value: Can generative AI transform cloud ROI?” - while a November 2023 report, it was covered in our January 3rd edition “McKinsey on Cloud + AI ROI”

AI investors Nathan Benaich + Alex Chalmers from Air Street Capital have had a good, sober series of essays:

“Alchemy doesn’t scale: the economics of general intelligence”

“Alchemy is all you need: On the economics of frontier models”

“Parallel Bets, Microsoft, and AI Strategies” - from Matthew Ball

Recurring Report Recommendations

Underfollowed recurring reports that you should subscribe to:

B2B SaaS Marketing & Revenue Benchmarks from HockeyStack

Operator Perspectives

A few 1H 2024 recommendations from the prodigious Dave Kellogg:

“Playing to Win vs. Playing to Make Plan: The Two Very Different Worlds of Silicon Valley”

“Six Principles to Optimize Your Results and Your Career (With Presentation Slides)”

2 picks from OnlyCFO’s 1H 2024 content:

The Deal Director (a good sales practitioner newsletter) had a good write-up on Samsara’s use of ROI in their successful GTM

Mark Roberge’s updated “Science of Scaling” (96 slides)

Thoughtful takes from CJ Gustafson on NPS: “Is Net Promoter Score the Ozempic of Metrics?”

“What I learned selling my company” - Harry Glaser had a thoughtful and tactical post on M&A 4 years after selling Periscope Data to SiSense, with video and slides from a related “SaaStr Workshop Wednesday”

Our 1H 2024 Podcasts

We are incredibly thankful for our wonderful guests. 1H 2024 episodes here:

“Sales in 2024: SaaS AE Metrics Report” - Sally Duby from The Bridge Group

“2024 B2B Sales Benchmarks” - Guy Rubin from Ebsta

“Sales AI Founder” - Matt Slotnick, a Co-Founder + CEO of Poggio

“Martech in 2024” - Scott Brinker from Hubspot

“SaaS M&A 101: Selling Your Software Company” - Diamond Innabi from Software Equity Group (SEG)

“An Operating Partner’s POV on Value Creation” - Paul Stansik of ParkerGale Capital

“Vertical SaaS Investing Playbook” - Dave Yuan from Tidemark

“AI + Software Investing in 2024” - Akash Bajwa from Earlybird Venture Capital

and I am always grateful for the opportunity to pontificate outside of our podcasts. Thanks to these folks for giving me a platform with my appearances here:

My episode with Zylo and Ben Pippenger

My episode with Jon Russo and Meg Heuer

My episode with David Dulany from TenBound

About Cloud Ratings

In case you missed it, we recently announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants, this newsletter, our podcasts, and our True ROI practice area all fit within our modern analyst firm:

Thanks for the mention! An honor

Well done Matt! Excellent aggregation and production of content. Thanks