SaaSletter - 2024 KeyBanc / Sapphire Benchmarks

Plus RepVue's Cloud Sales Index

2024 SaaS Benchmarks from KeyBanc Capital Markets + Sapphire Ventures

KeyBanc Capital Markets and Sapphire Ventures released the *15th* edition of their SaaS benchmarks (email required).

As someone who has been reading their reports for the past 15 years - back to Pacific Crest Securities days - I created an aggregation of old reports to provide longitudinal context available here:

My quick excerpts for the 2024 KeyBanc / Sapphire benchmarks:

For *their* sample, I consider this a favorable, positive report. Specifically, the a) improving Rule of 40s, b) 70%+ quota attainment (i.e., much higher than RepVue benchmarks below), and c) sub-20 month CAC paybacks.

While a favorable report, some notes of caution.

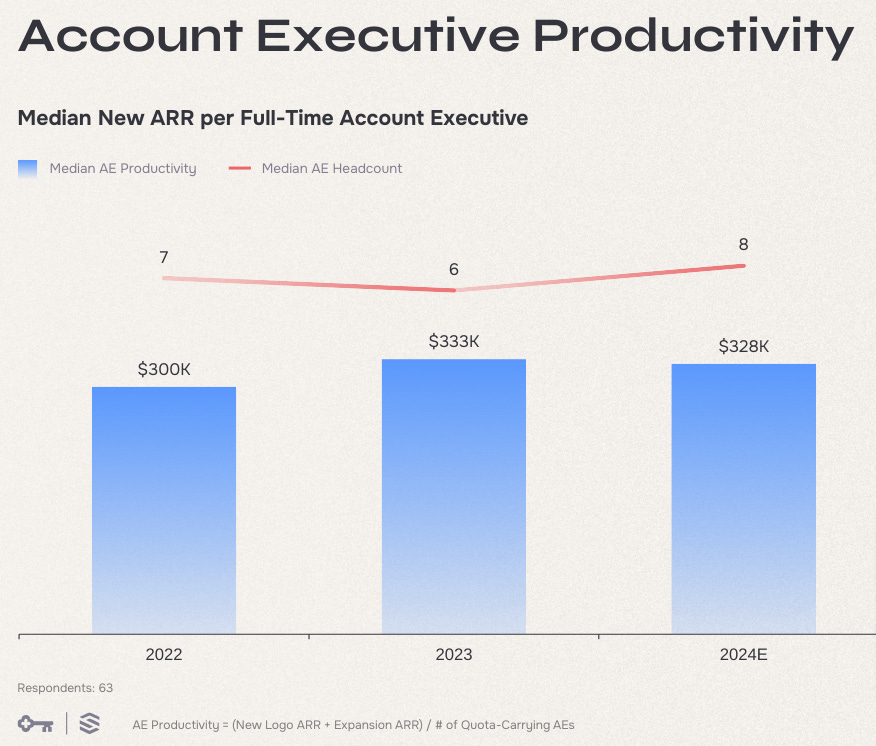

Even with healthy quota assignments (per Account Executive: $750k median, $1,085k top quartile) and well above RepVue quota attainment (RepVue: 42.9% for Q3 2024, 75%-85% here):

… the median new ARR per Account Executive levels of $328k are concerning.

Slower AE ramps - well covered by The Bridge Group (h/t Sally Duby) here - might explain some of the quota assignment to ARR $ achievement gap.

These AE productivity *medians* also reminded me of the top seller outperformance data from Ebsta (h/t past podcast guest Guy Rubin) / Pavilion 1H 2024 B2B Sales Benchmarks: 16% of reps generated 83% of revenue in 1H 2024

These $328k AE productivity *medians* should also be viewed relative to overall GTM staffing levels. Factoring in AE support (like SDRs, Sales Engineers, RevOps, and Marketing), $328k new ARR per AE might yield unacceptable fully loaded CACs. More on this in “Sapphire On Non-AE GTM Bloat”

RepVue Q3 2024 Cloud Sales Index

RepVue (h/t Adam Little and past podcast guest Ryan Walsh) released their latest Cloud Sales Index.

The core theme = stability (i.e., in quota attainment, sales cycles, deal sizes).

Excerpts below… but read the whole report (no email required):

Submit To Emergence Capital GTM Benchmarks

Building on its inaugural 2024 report, Emergence Capital is going deeper into the SaaS GTM benchmarking arena.

Their survey is differentiated → it would be a welcome source of new community knowledge → please consider participating here:

Curated Content

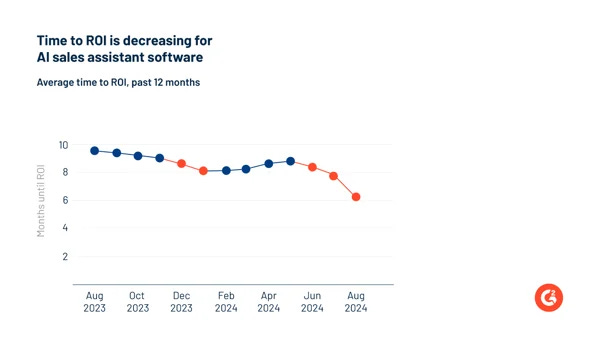

The above chart stood out from G2’s “2025 Tech Trends” report (h/t Tim Sanders + team): *user R&D* likely drives improved ROIs - a uniquely prominent dynamic for early cycle AI adoption.

The Deal Director’s case study of Lacework was particularly *juicy*.

Granular KeyBanc + Sapphire Excerpts

An interesting chart on changes to GTM priorities by channel:

Since this regularly comes up, data on accounting allocations for Customer Success and Customer Service:

About Cloud Ratings

For our many new readers, we recently announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: