SaaSletter - Coatue On An AI Bubble?

Plus our Cloud Ratings B2B AI Interest Index for September 2025

Coatue’s October 2025 Public Markets Update

Coatue recently released their Public Markets Update (SLIDES | VIDEO) - our excerpts + takes below:

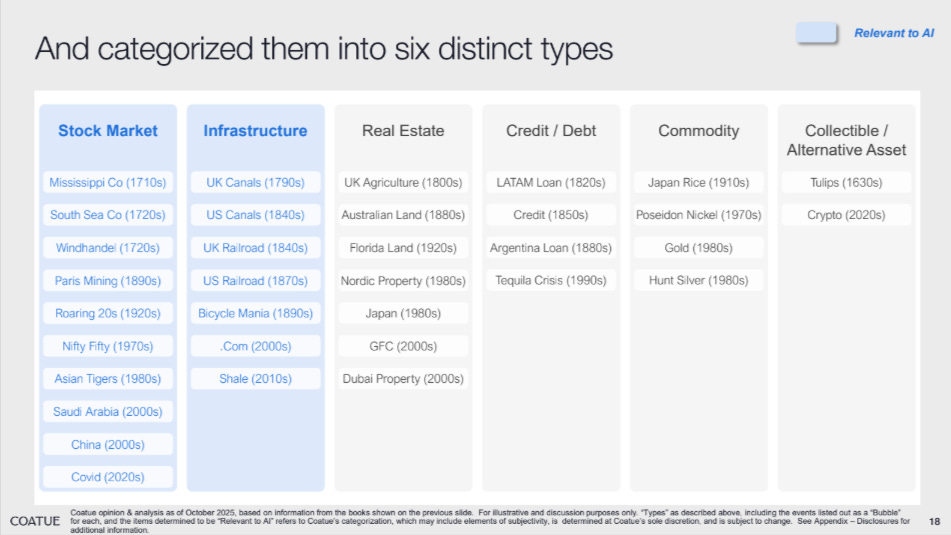

Much of the deck covered the “AI Bubble?” debate, framed against 30 bubbles dating back 400 years:

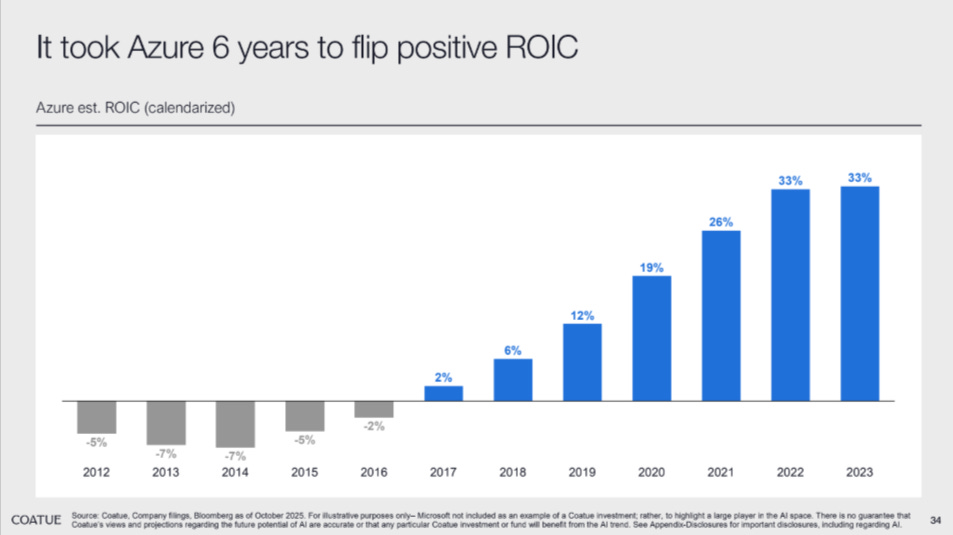

Recognizing that Return On Invested Capital (ROIC) is a crucial metric for the sustainability of any capex cycle, I found Coatue’s Microsoft Azure ROIC history slide powerful:

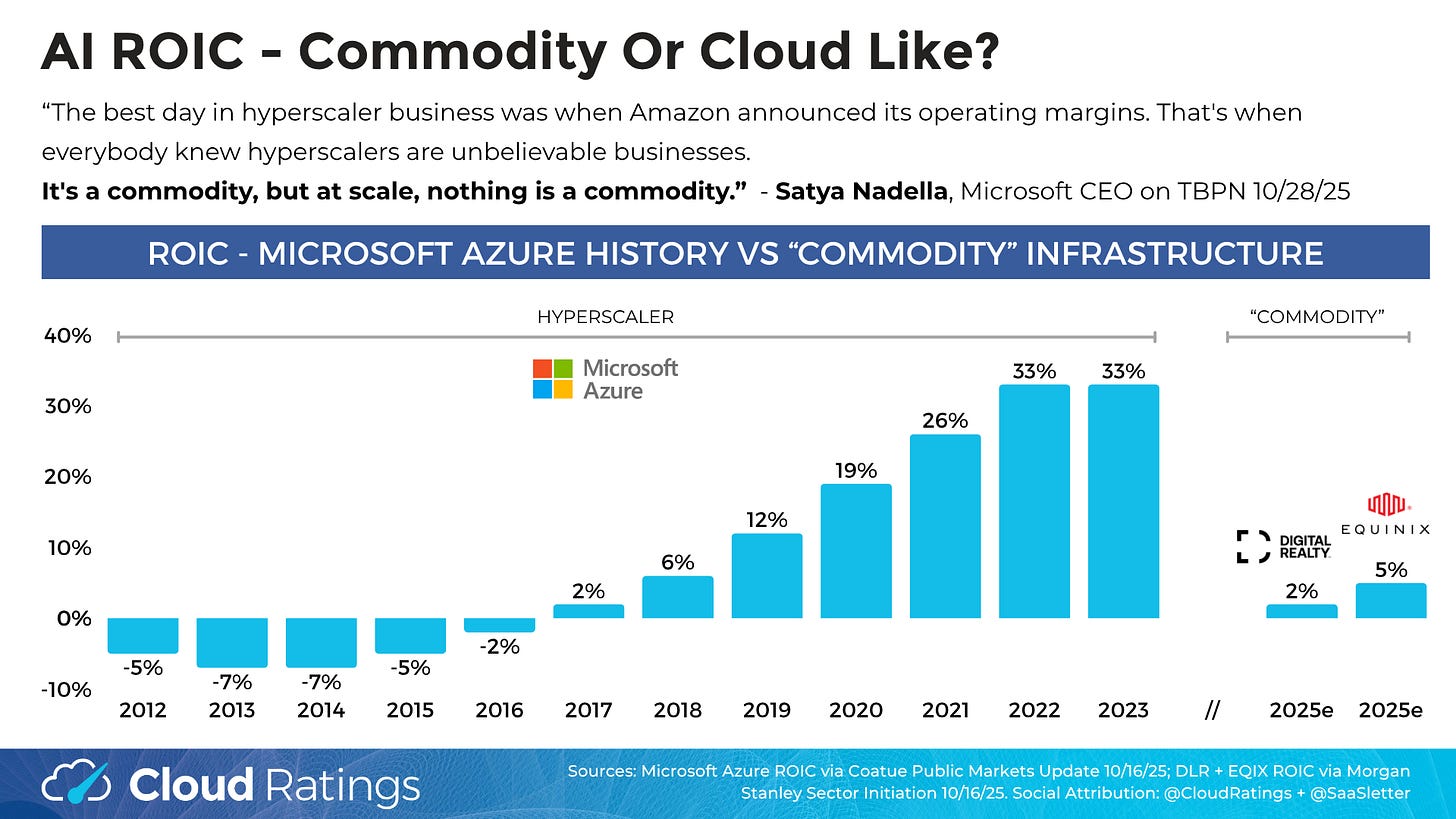

“Renting GPUs is a bad business” has been a common bear argument. “Commodity” infrastructure can yield 2%-5% ROICs (examples include data center REIT Digital Realty and colocation provider Equinix, as shown below).

Supported by the AI TAM scale and integrated value-add offerings (i.e., Google’s Vertex AI), my view is that this generation of AI Hyperscalers achieves more Cloud-like ROICs than Data Center REIT returns.

Or I can quote Satya Nadella from a recent TBPN appearance:

“The best day in hyperscaler business was when Amazon announced its operating margins. That’s when everybody knew hyperscalers are unbelievable businesses.

It’s a commodity, but at scale, nothing is a commodity.” - Satya Nadella, Microsoft CEO on TBPN 10/28/25

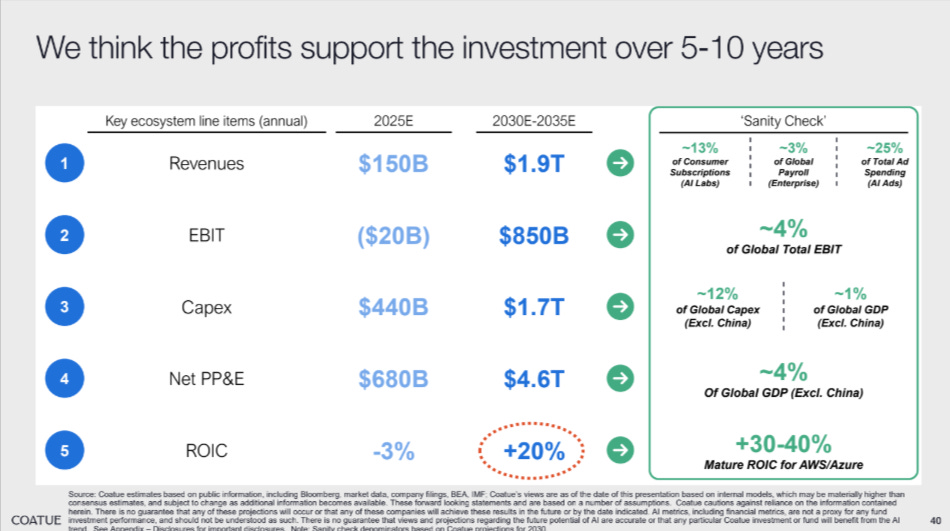

Related callout: Coatue’s ‘30e-35e forecast reflects a 20+% ROIC:

More From Coatue On An AI Bubble?

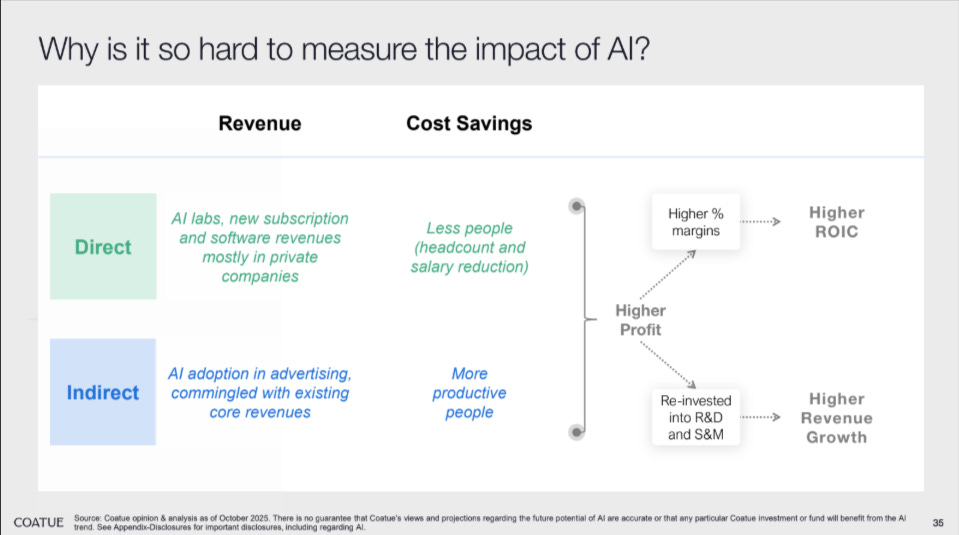

My call out from this slide: in the “AI Bubble Math” debates (like the Substack from David Cahn from Sequoia - see here and here; even more “AI Bubble Math” coverage here + here), I’ve found internal use capex to be consistently overlooked.

The Coatue slide does a good job capturing internal use AI capex with “Indirect: AI adoption in advertising, commingled with existing core revenues.” To tease internal use further here, try to picture what fully developing + *iterating* AI features for these scaled platforms would cost?

Amazon: Adding GenAI to their core retail business (scale = $588 *billion* 2025e) and Advertising offering (scale = $75 *billion*). Let alone any undisclosed AI projects (strong competitive reasons to hide).

Google + Facebook: At consumer scale (i.e., multiple apps at 1 *billion+* user bases), you need a lot of GPUs + datacenters to add always-on GenAI! Let alone whatever “secret moonshots” either is working on.

Microsoft: A similar dynamic has to exist with adding GenAI to their global installed base. That said, Morgan Stanley (09/26 report with model) *only* estimates 2025e capex directly for M365 Copilot at $630 million + “Internal AI Training” at $1 billion → this example hints my internal use focus might be closer to a rounding error in a Bubble/No Bubble calculation.

Back to more meaningful AI Bubble topics:

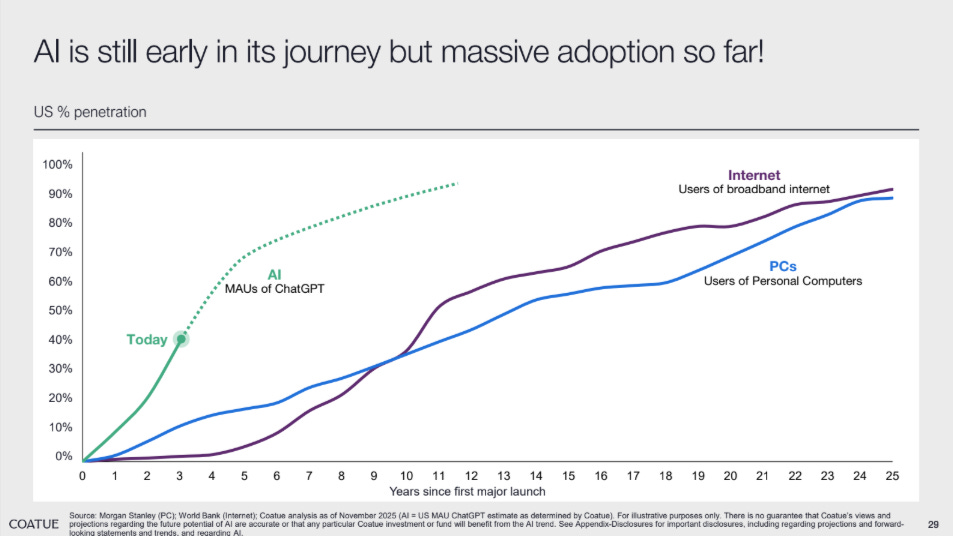

The ChatGPT adoption curve is running way ahead of the PC and Internet cycles…

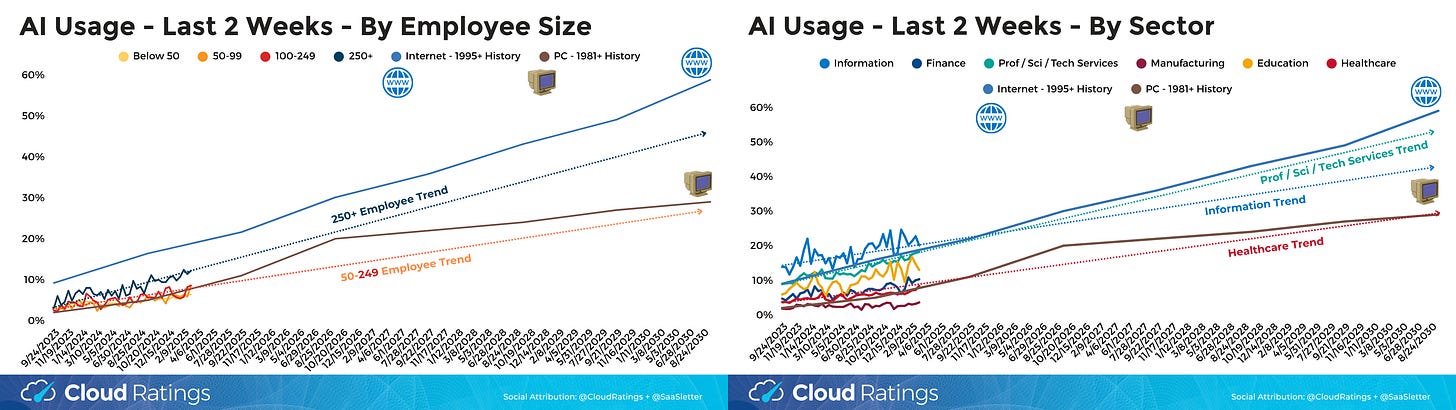

… but when using US Census Bureau data, *business AI* adoption is on an Internet / PC historical trendline. Relative to what is “priced in” for equity valuations, is that good enough?

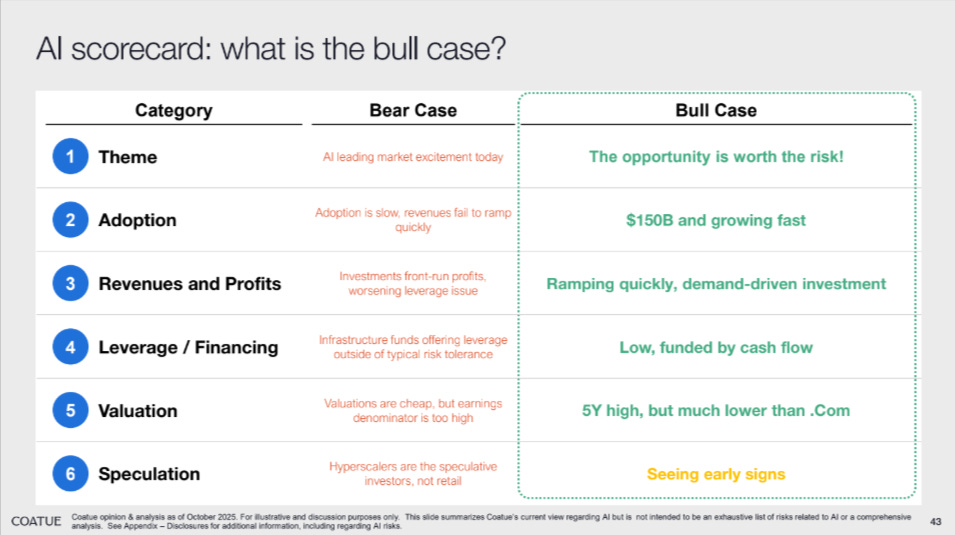

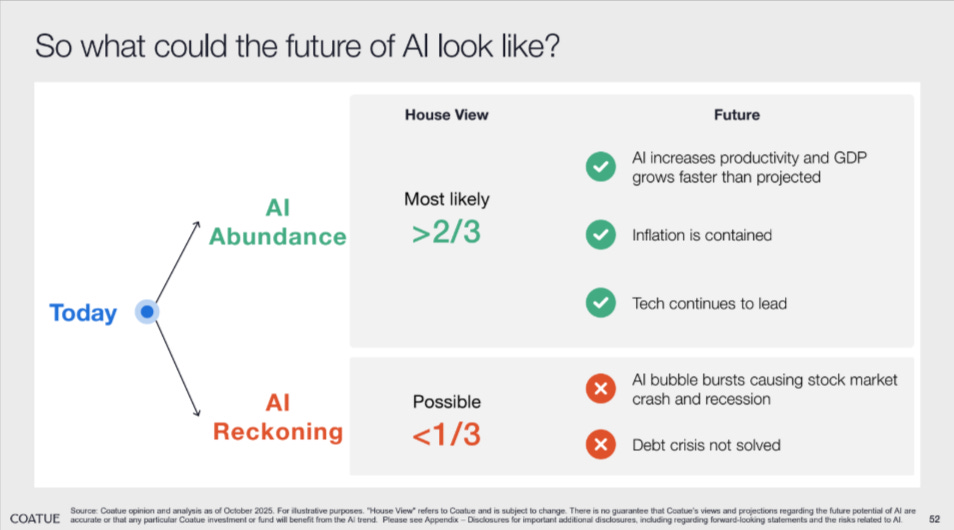

These Coatue slides should speak for themselves:

As always, do your own work and go read the full Coatue report.

September 2025 B2B AI Interest Index from Cloud Ratings

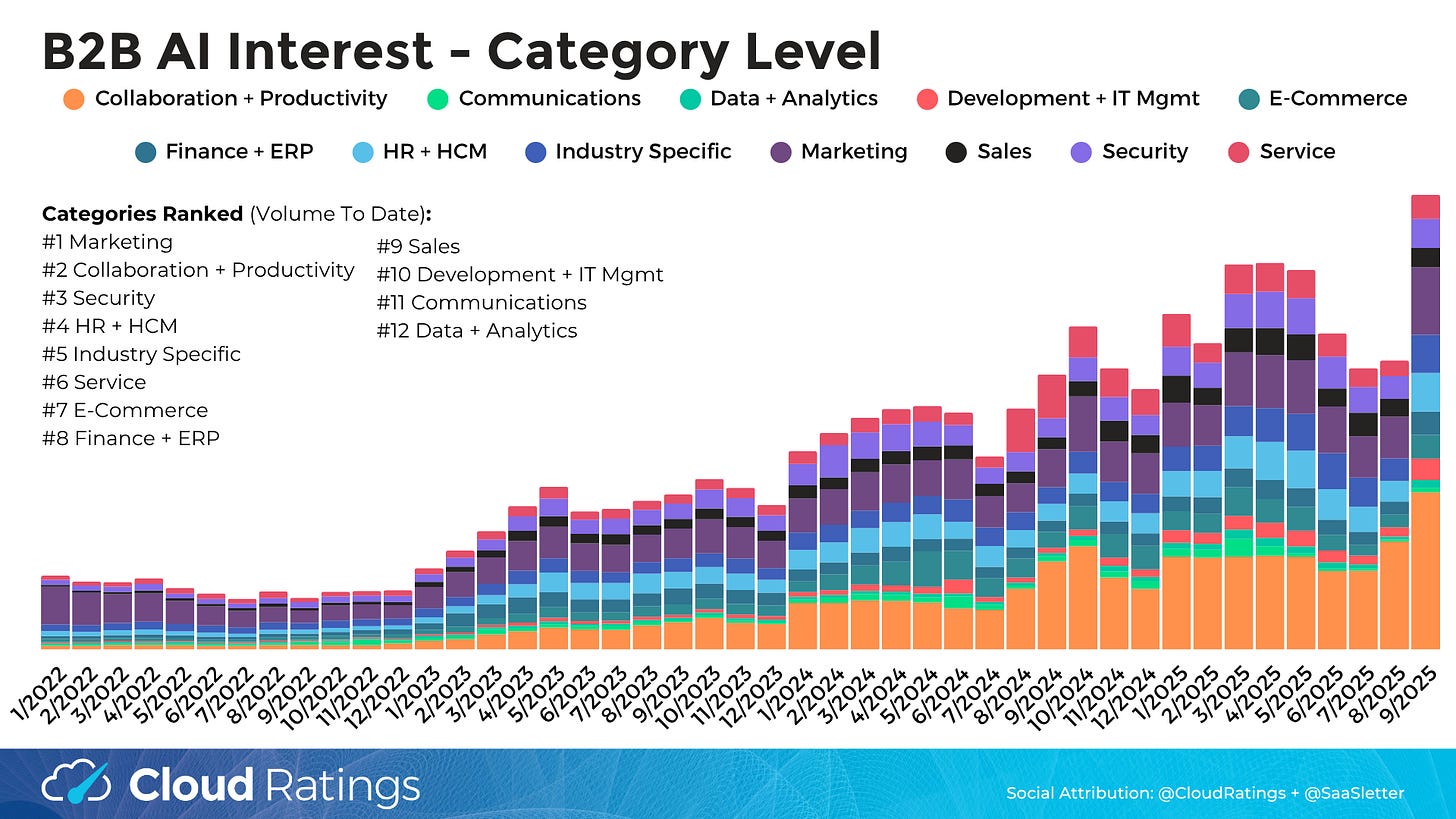

We’ve updated our Cloud Ratings B2B AI Interest Index through September 2025 - full slides below:

B2B AI interest trends overall reversed recent weakness. Of course, beware of seasonality exiting summer + winter months.

Thematic Category Interest (n = 47 sub-categories tracked - i.e. “manufacturing AI” or “supply chain AI”) reversed a summer lull.

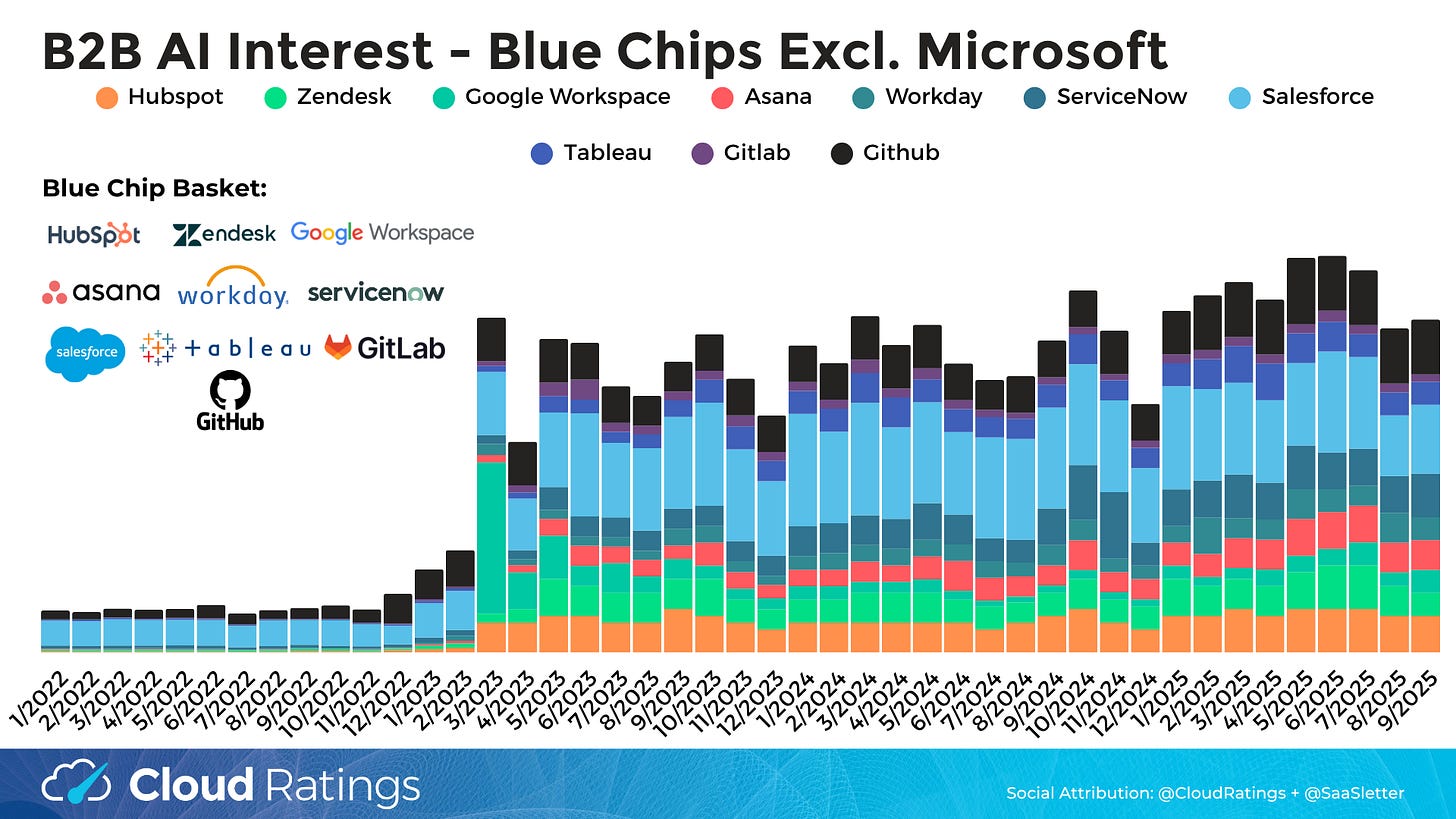

Bellwether Microsoft Copilot accelerated in September. Other “Blue Chips” (i.e., Hubspot, ServiceNow) remain range-bound at best and small in absolute terms.

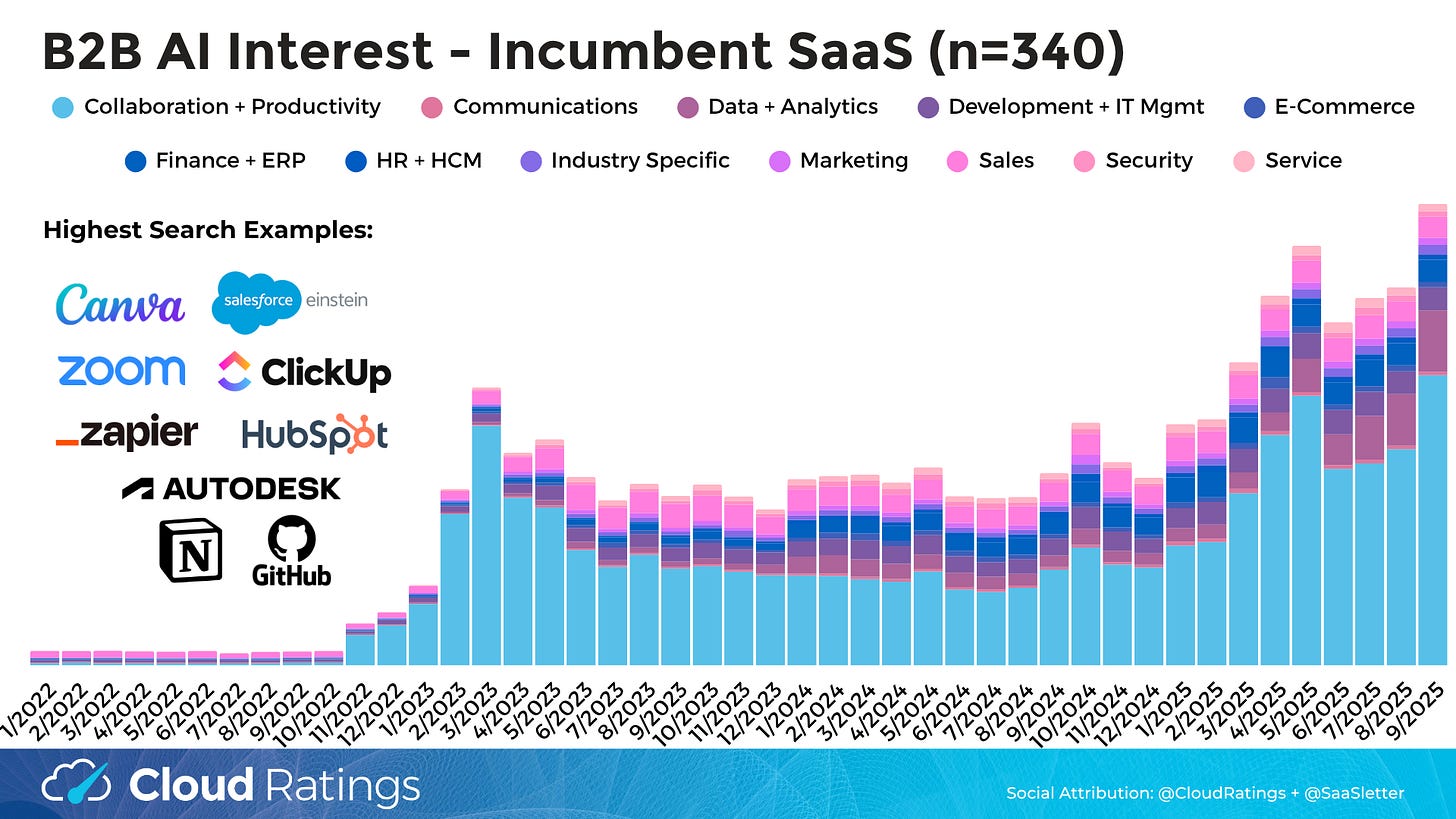

SaaS Incumbents (n=340: the same 340 vendors tracked in our top-of-the-funnel focused, forward-looking SaaS Demand Index) have seen a notable 2025 breakout relative to a very range-bound 2024. With September acclerating:

Only in slides: AI Native B2B apps (n=50) have shifted from strength to decline.

Software Investing Podcast With Joey Brookhart

FULL EPISODE: VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

Given the public market theme thanks to Coatue, I wanted to highlight our recent podcast with Joey Brookhart, Co-Founder of AlphaRepo and a longtime long-short software investor, as Managing Partner and Portfolio Manager of Sandbrook Capital.

About Cloud Ratings

In mid-2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: