SaaSletter - Fullcast 2025 GTM Benchmarks

Plus RepVue's Q3 2025 Cloud Sales Index

LEARN MORE: Revenue Insights As A Service

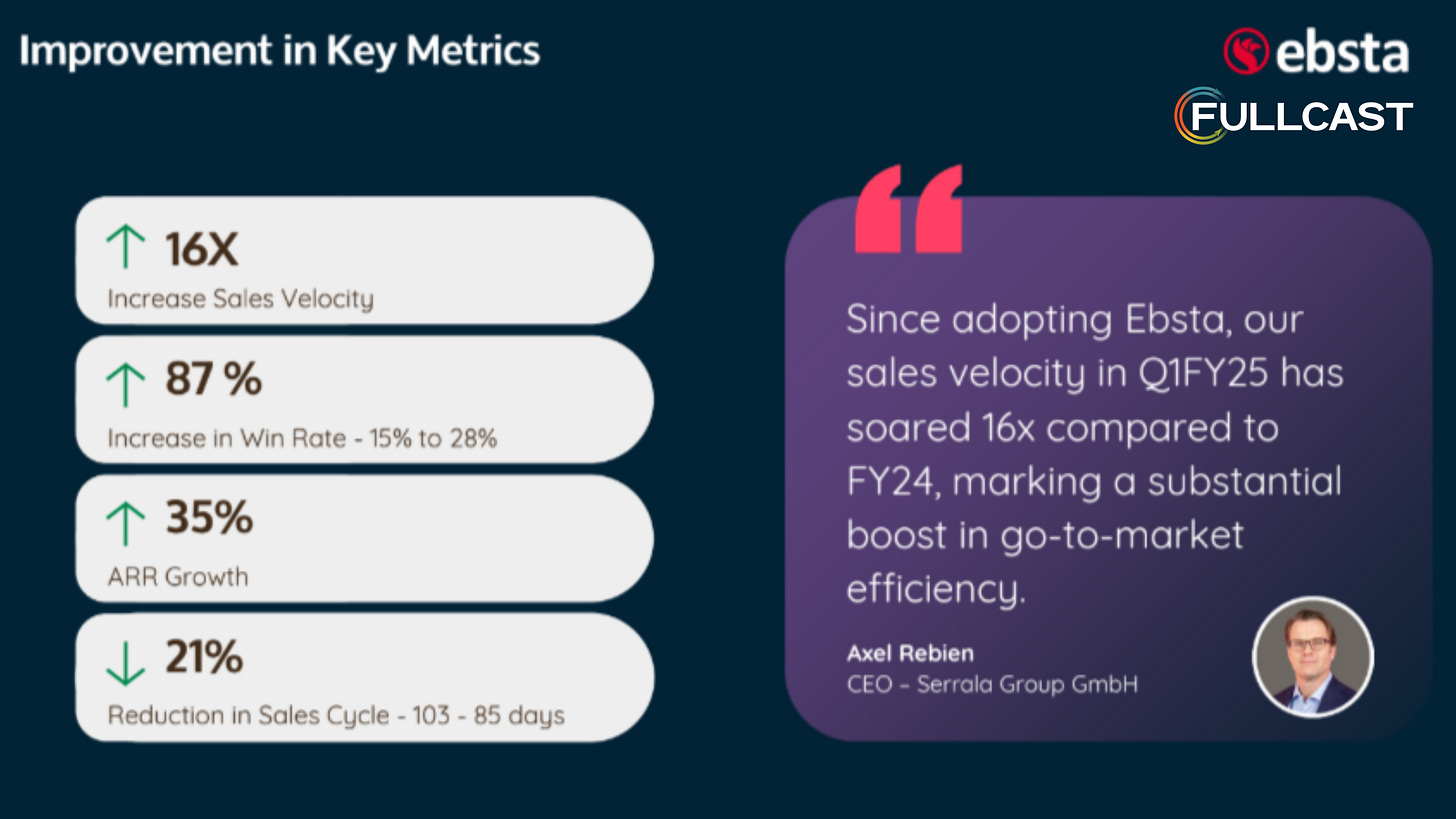

Having first connected thanks to their impressive benchmark data ($40 billion+ of customer pipeline under management) and hosting Guy Rubin on our podcast 2x, we are helping Ebsta (recently acquired by Fullcast) connect with software private equity investment firms to launch their Revenue Insights as a Service (RIaaS) offering:

quarterly deep dives into your portco's sales machine,

using a mix of AI/software (linked into CRMs, email, and call recordings)

with a professional services element that yields this type of report (attached)

Full Ebsta RIaaS overview deck here + book a demo

Fullcast 2025 GTM Benchmarks - ICP Mix

Fullcast and Ebsta recently released their 2025 GTM Benchmarks, covering $43 billion of pipeline across 440,000 opportunities.

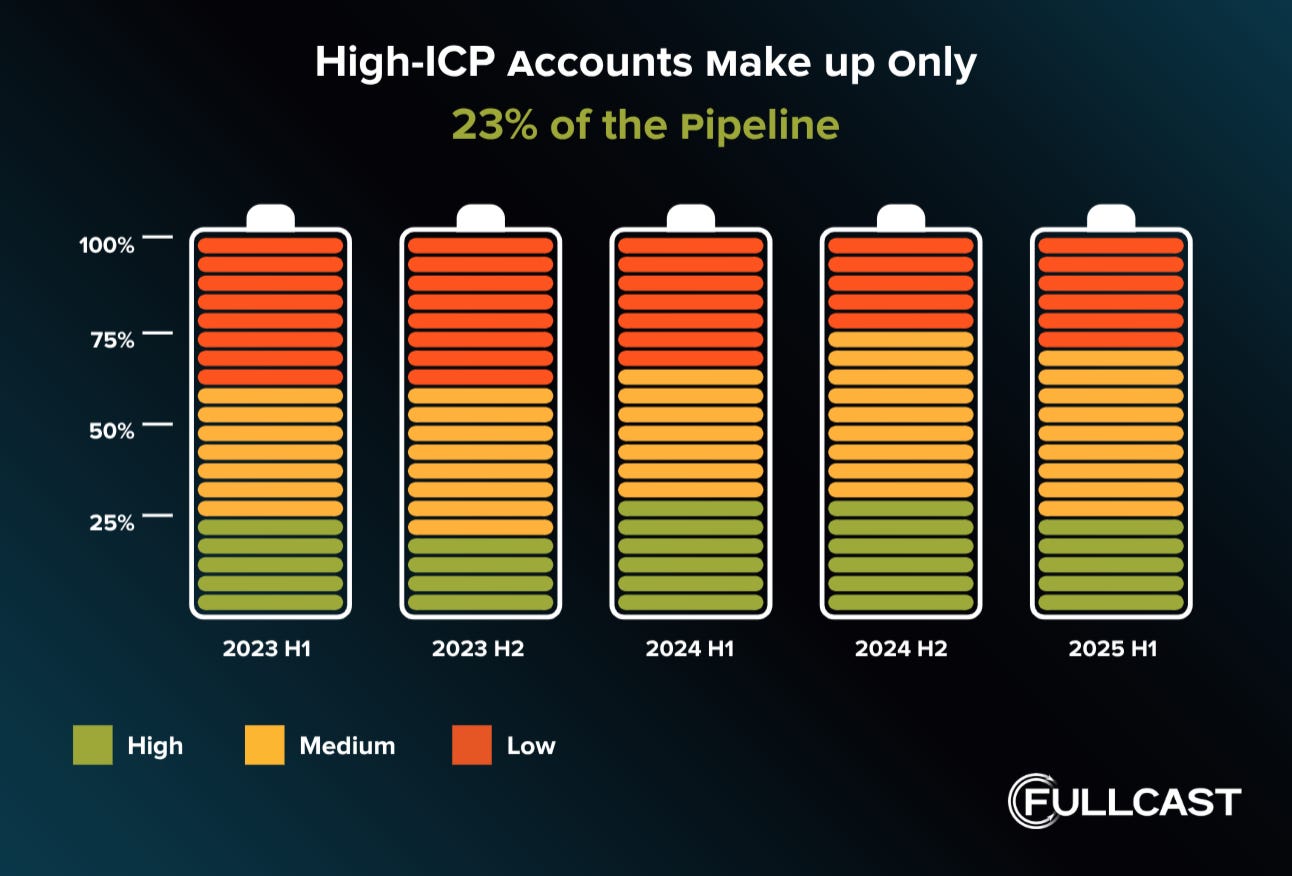

My #1 callout: only 23% of pipeline is high-fit ICP (Ideal Customer Profile). ~45% is medium-fit ICP, and ~30% is low-fit ICP.

This mix has improved somewhat: in 2023, ~40% of pipeline was low-fit ICP, with this trendline fitting the narrative of GTM “getting fit” after the 2022 peak.

What does the ICP fit data really mean?

Poor ICP Mix = Opportunity: The *Marketing* aspect of improved ICP targeting + eliminating GTM waste is obvious. Taking low-fit ICP from 30% to 10%, should theoretically yield 20% in areas like ad spend savings. This is easier said than done: for example, there are limited ways to gate low-fit ad clickers on Google Ads.

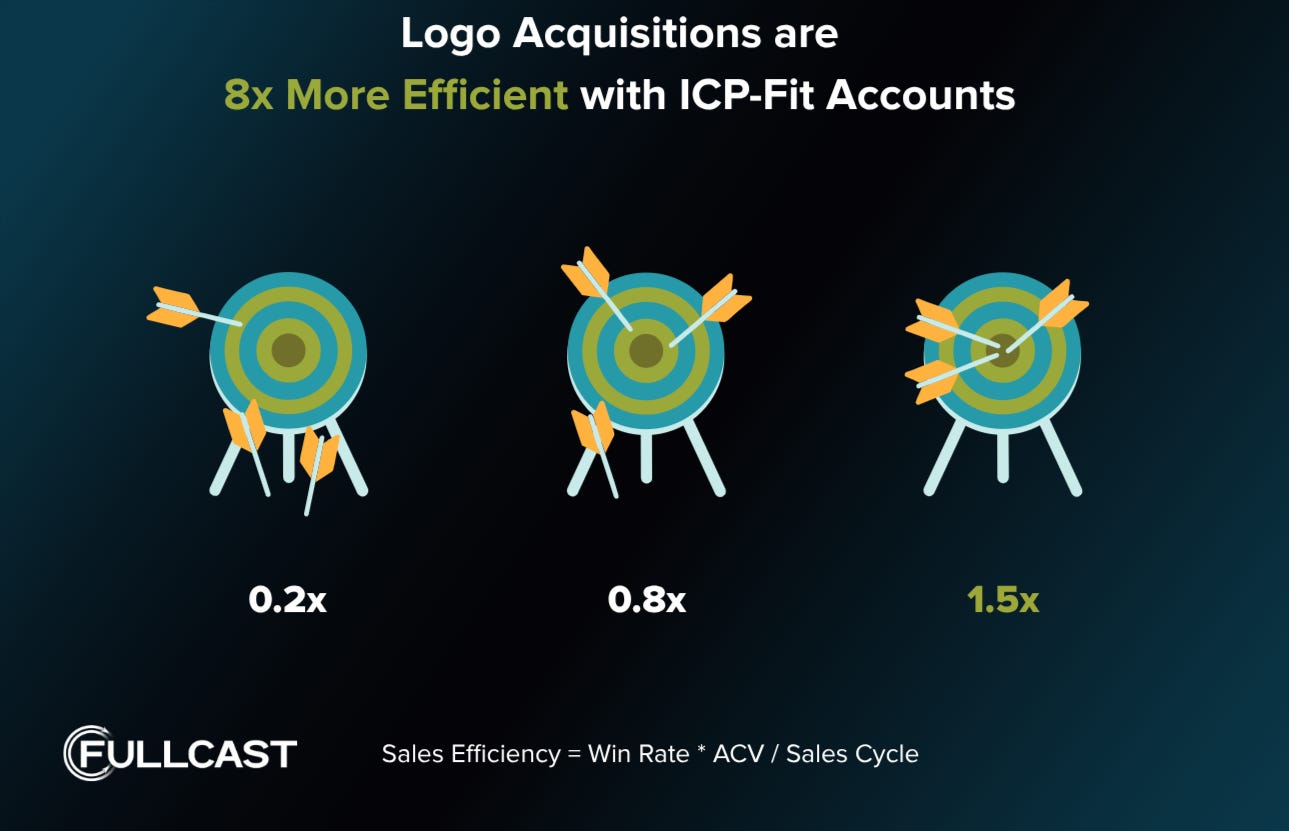

The less obvious (at least to non-operators) issue from a poor ICP mix is the *ongoing drag* of bad-fit deals through the sales cycle. The Fullcast benchmarks show low-fit ICP deals have 87% lower Sales Efficiency (= (Win Rate * ACV) / Sales Cycle).

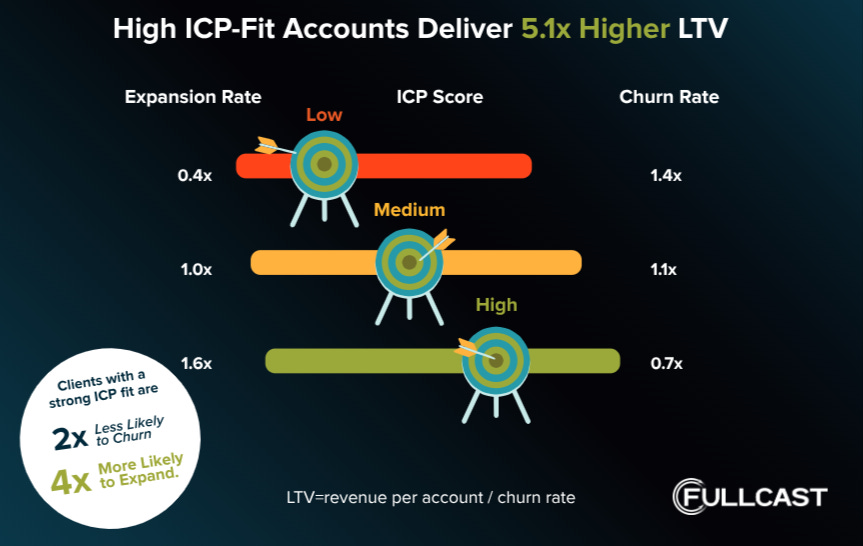

Let alone their post-sales underperformance, even *if* a seller can win a low-fit ICP buyer:

or…

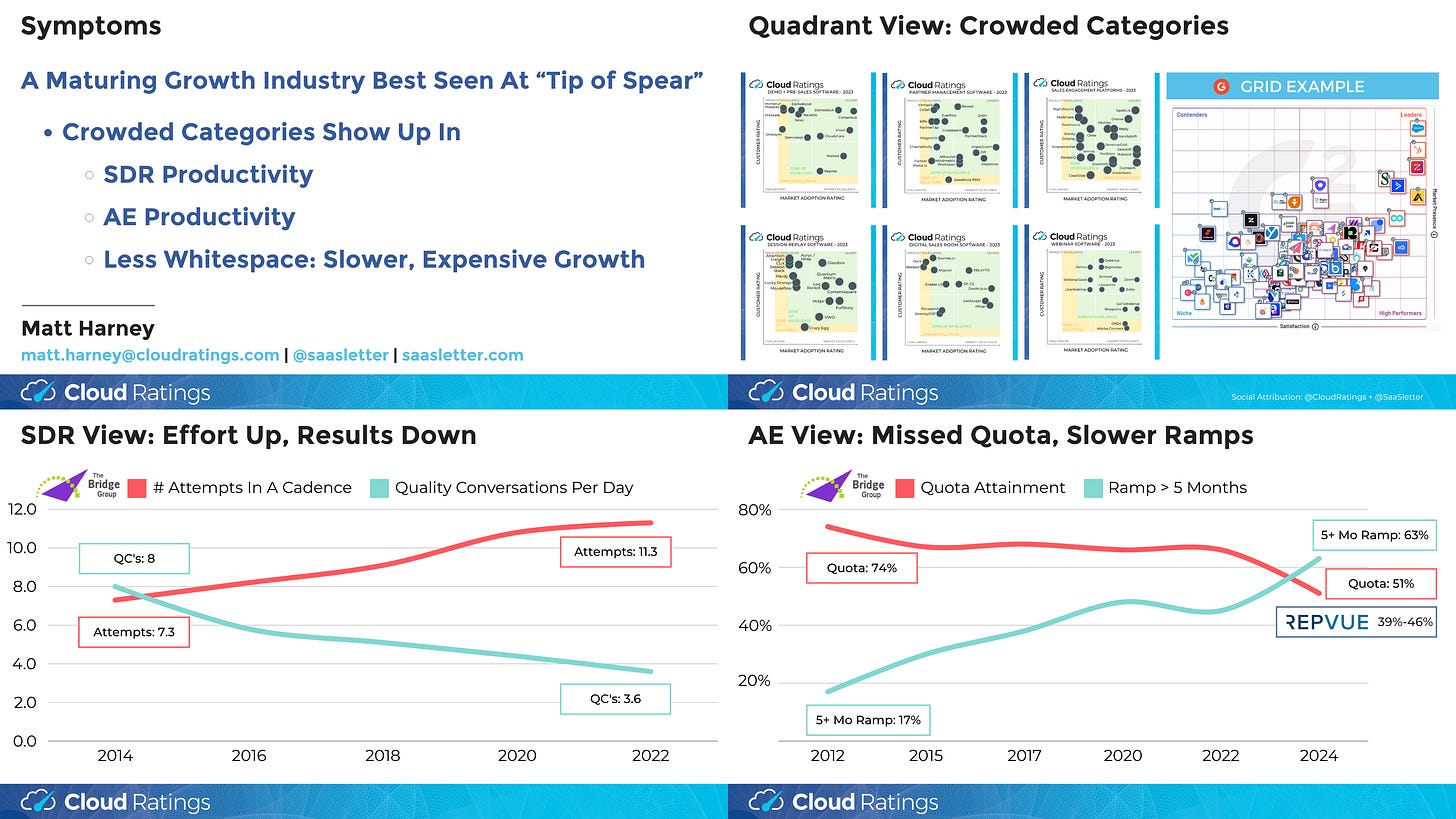

Poor ICP Mix = Symptom Of Crowded, Maturing Growth Industry:

Or are these poor ICP leads simply a function of overly crowded categories, causing GTM leadership - under pressure to hit often unrealistic forecasts - *needing* to target marginal-fit buyers?

VIDEO | SLIDES | NEWSLETTER RECAP

Fullcast 2025 GTM Benchmarks - More Highlights

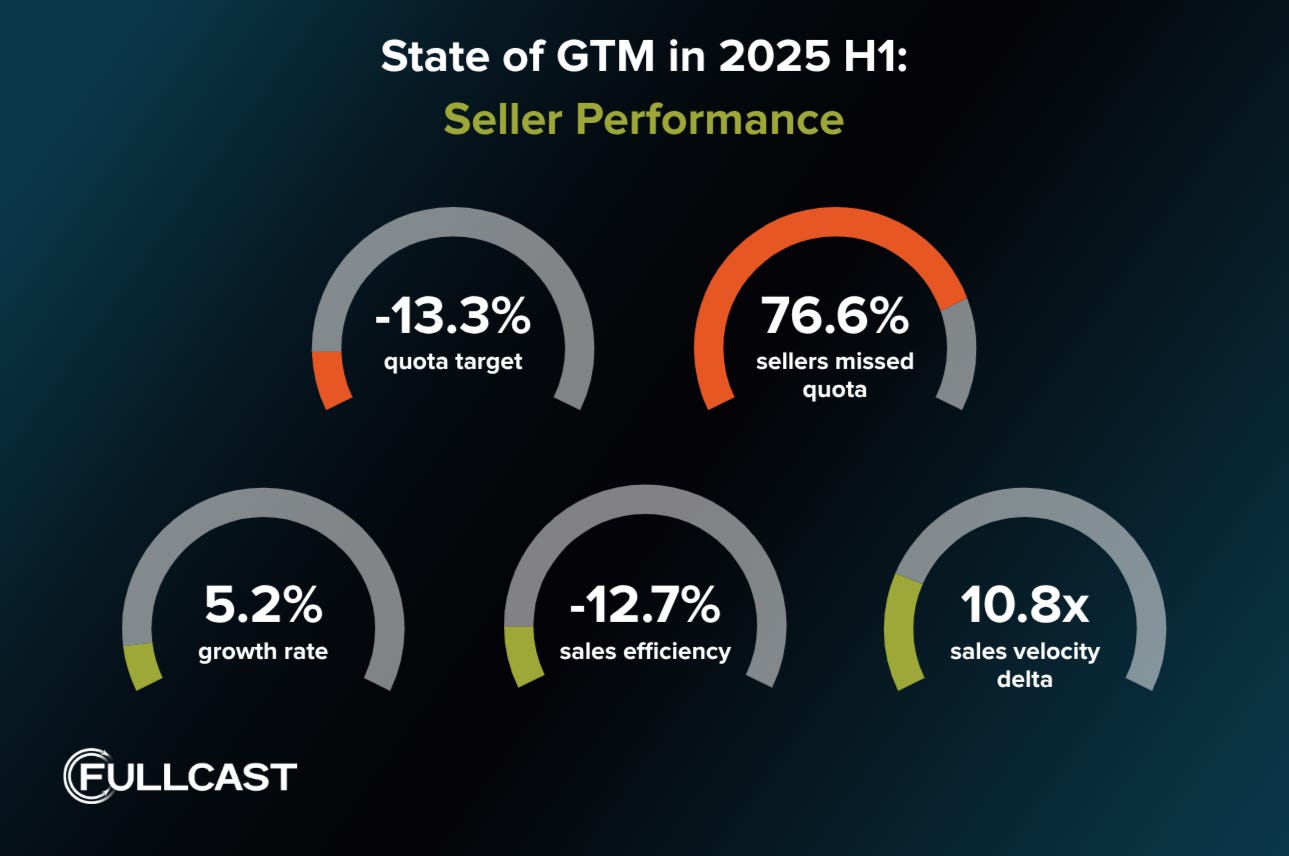

The Fullcast benchmarks reflect continuing market challenges:

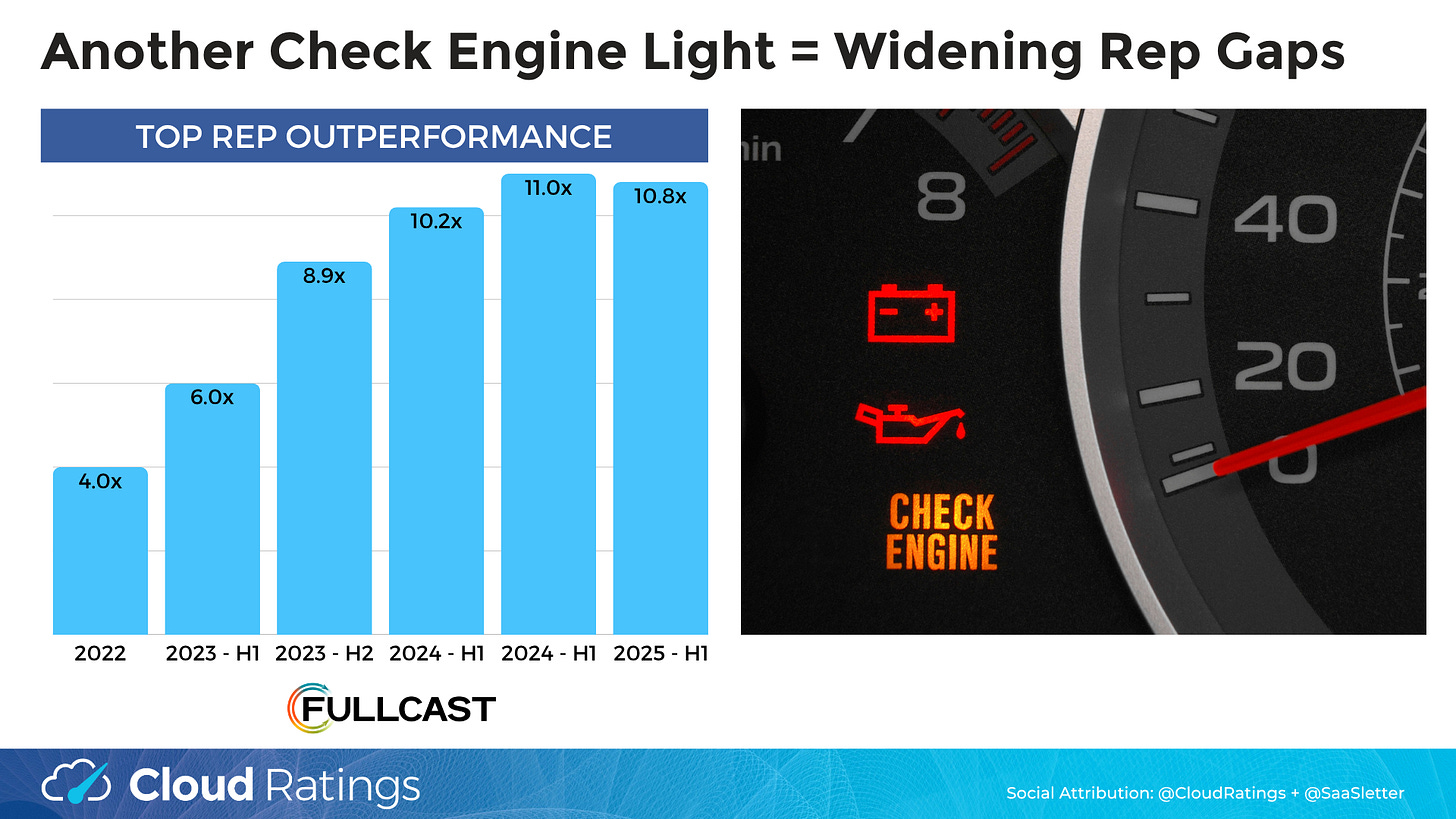

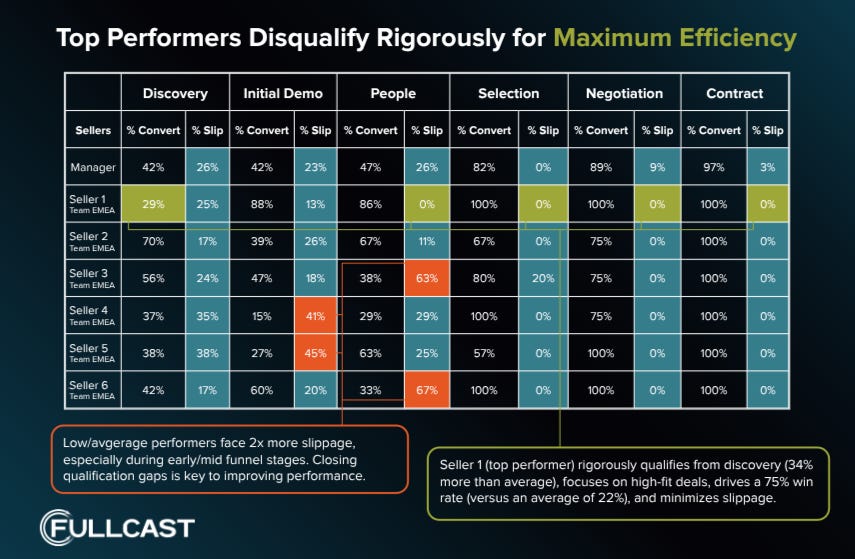

Interestingly, the “sales velocity delta: (i.e., top rep outperformance gap) has stabilized… though it remains a “check engine light” in terms of sales sustainability (fewer AEs driving revenue = more risk):

There is a lot more in the full Fullcast 2025 GTM Benchmark report, like these excerpts below - as always, go read the full source.

Guy Rubin’s RIaaS Context + Demo

Fitting this newsletter, here is Guy Rubin’s talk at our July Value Creation Summit that covers the Revenue Insights as a Service offering.

RepVue Q3 2025 Cloud Sales Index

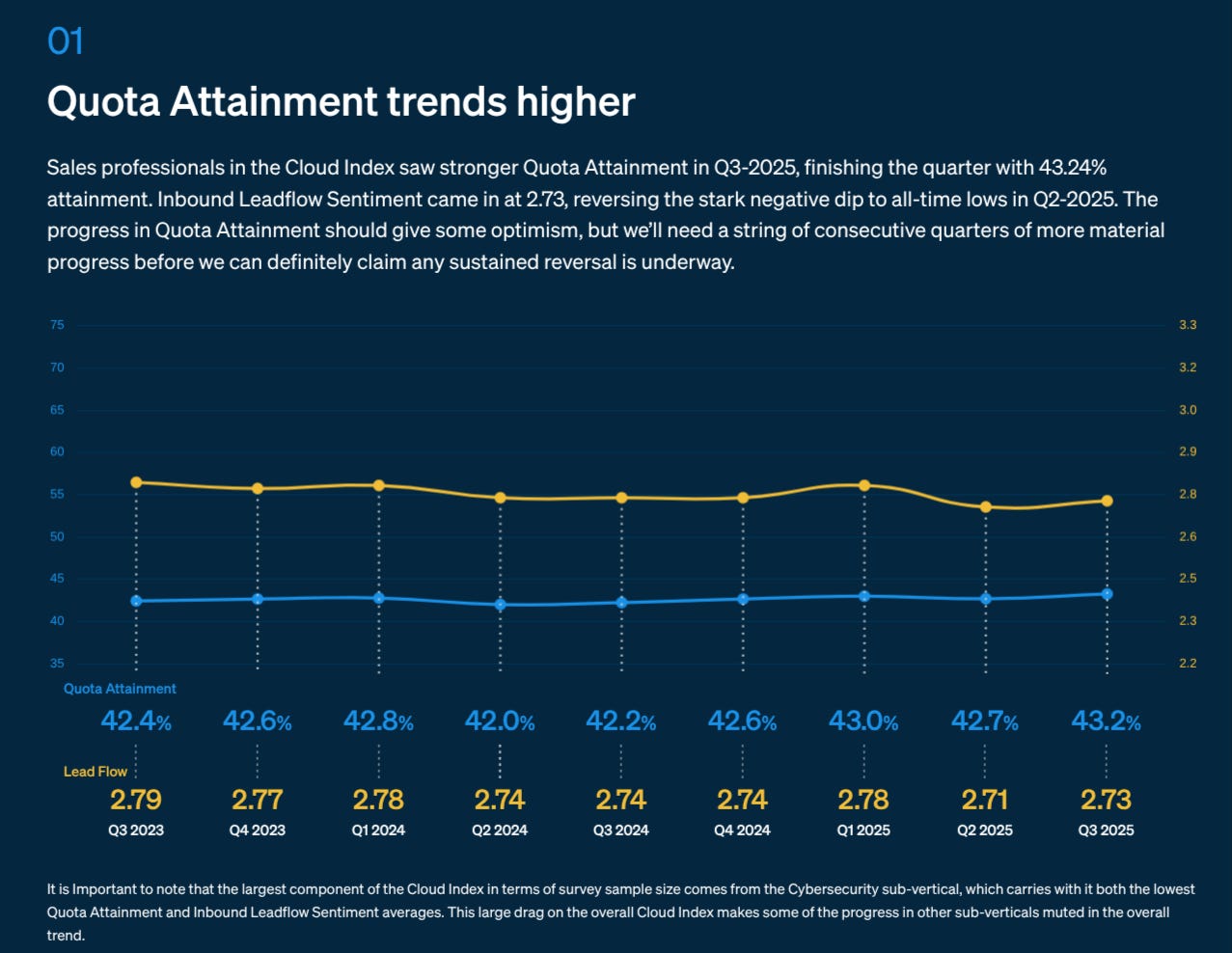

RepVue (h/t Ryan Walsh + Adam Little) released their Q3 2025 Cloud Sales Index.

Their data was more favorable than the Fullcast benchmarks, with quota and leadflow stable to slightly improving:

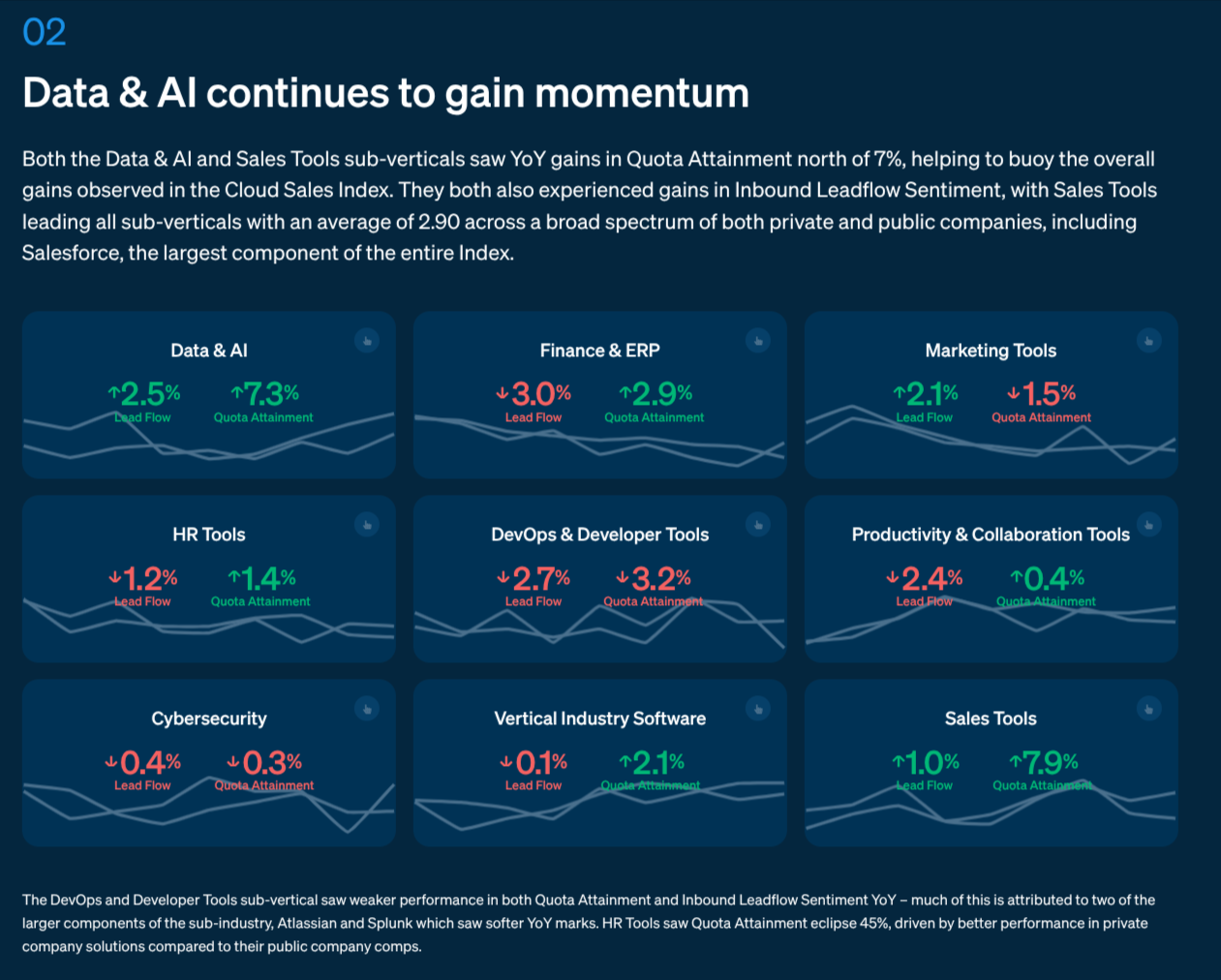

For our many investor subscribers, I would encourage you to visit the expandable category drill-downs:

… with these flags for *public* companies:

Favorable: Amazon Ads AND AWS ($AMZN), Twilio ($TWLO), Monday ($MNDY), VMware ($AVGO), ServiceTitan ($TTAN)

Negatives: Many of the top performers are private (like Databricks, Apollo.io) → with possible read-throughs to their publicly traded counterparts.

About Cloud Ratings

In mid-2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm:

* Disclosure: Cloud Ratings has a commercial partnership agreement with Fullcast / Ebsta