SaaSletter - Best Of The Best Separation Points

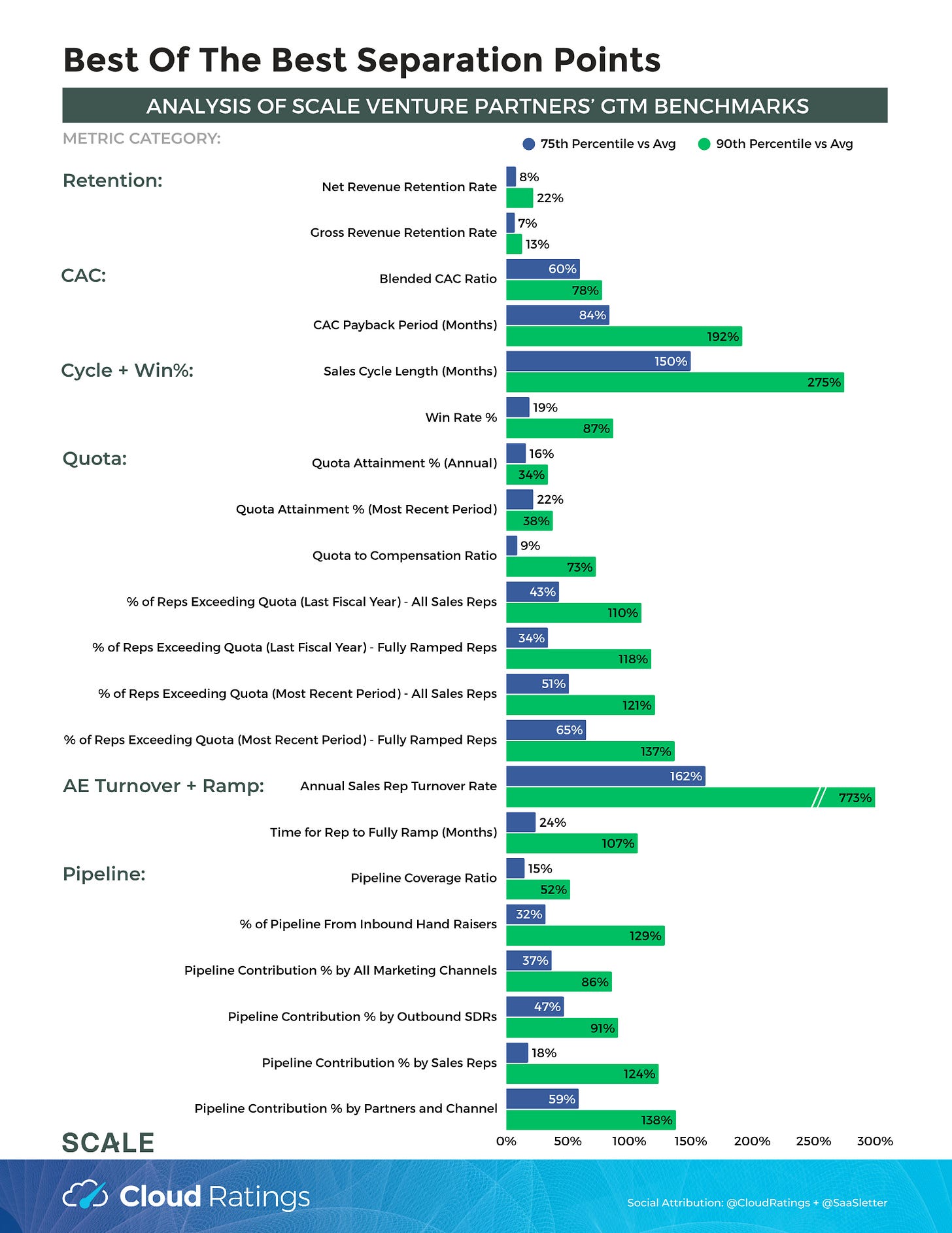

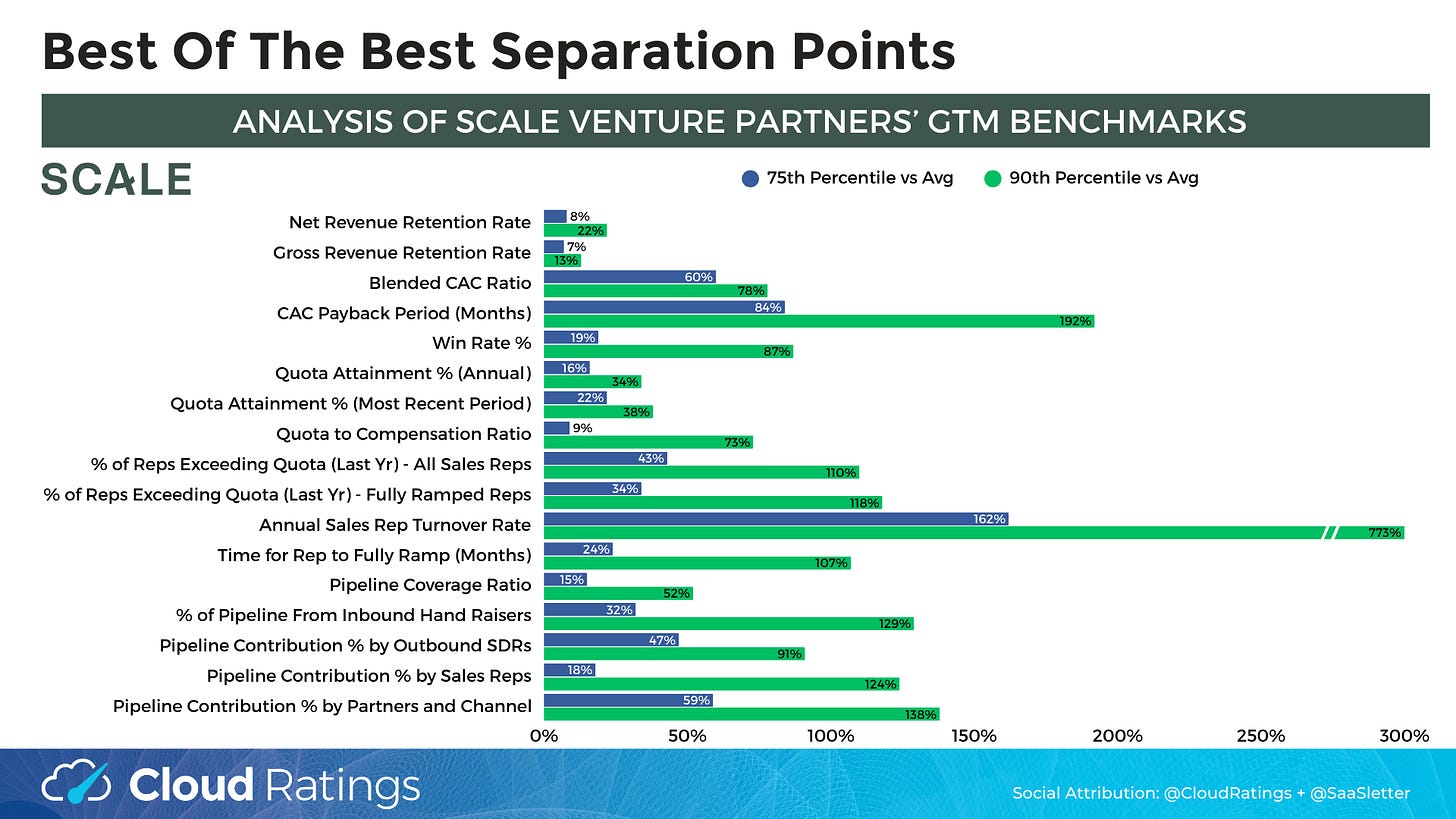

Our Analysis Using Scale Venture Partners' GTM Benchmarks

Scale Venture Partners GTM Benchmarks

Scale Venture Partners (h/t Mark Gustaferro + Craig Rosenberg), in partnership with Ray Rike and Benchmarkit, recently debuted their GTM Benchmark interactive database.

We further analyzed their data to examine points of separation, meaning where the “best of the best” differentiate themselves from the median company.

Our downloadable 7-page document includes more on GTM motion (i.e., PLG vs Inside Sales vs Outside Sales vs Channel) and volatility:

A caveat: Some of these variances are structural (i.e., an enterprise ERP vendor will have a significantly longer sales cycle, regardless of execution; or a PLG vs Channel vs Sales-Led motion will have many different baseline metrics). Taking into account that dynamic, our key call-outs:

SALES REP TURNOVER: 773% Delta

This is the single most glaring “off the chart” stat in the entire dataset.

For the top 10% of companies, annual sales rep turnover is significantly lower than the mean, with a 773% difference between the best and the average.

The elite performers are playing a different game: Retention. You cannot build compounding momentum when you are constantly replacing your GTM engine parts. The “Best of the Best” have essentially solved the turnover problem, keeping institutional knowledge in-house.

CAC PAYBACK PERIOD: 192% Delta

The separation here is stark: the 90th percentile outperforms the average by 192%.

While the average company struggles with payback periods that drag on, top-tier firms are recovering their acquisition costs nearly 2x faster. Which allows them to reinvest in growth cycles significantly faster than their peers.

QUOTA + RAMP: >100% Delta

It’s all about having ramped productive reps hitting their number.

Exceeding Quota: The separation for “% of Reps Exceeding Quota” in the most recent period is 121%.

Ramp Speed: This is fueled by a 107% advantage in “Time for Rep to Fully Ramp”.

This suggests the “Best” aren’t just hiring better; they also have superior enablement, Finance → GTM hiring coordination, and territory-planning infrastructure.

Related Research Call Out:

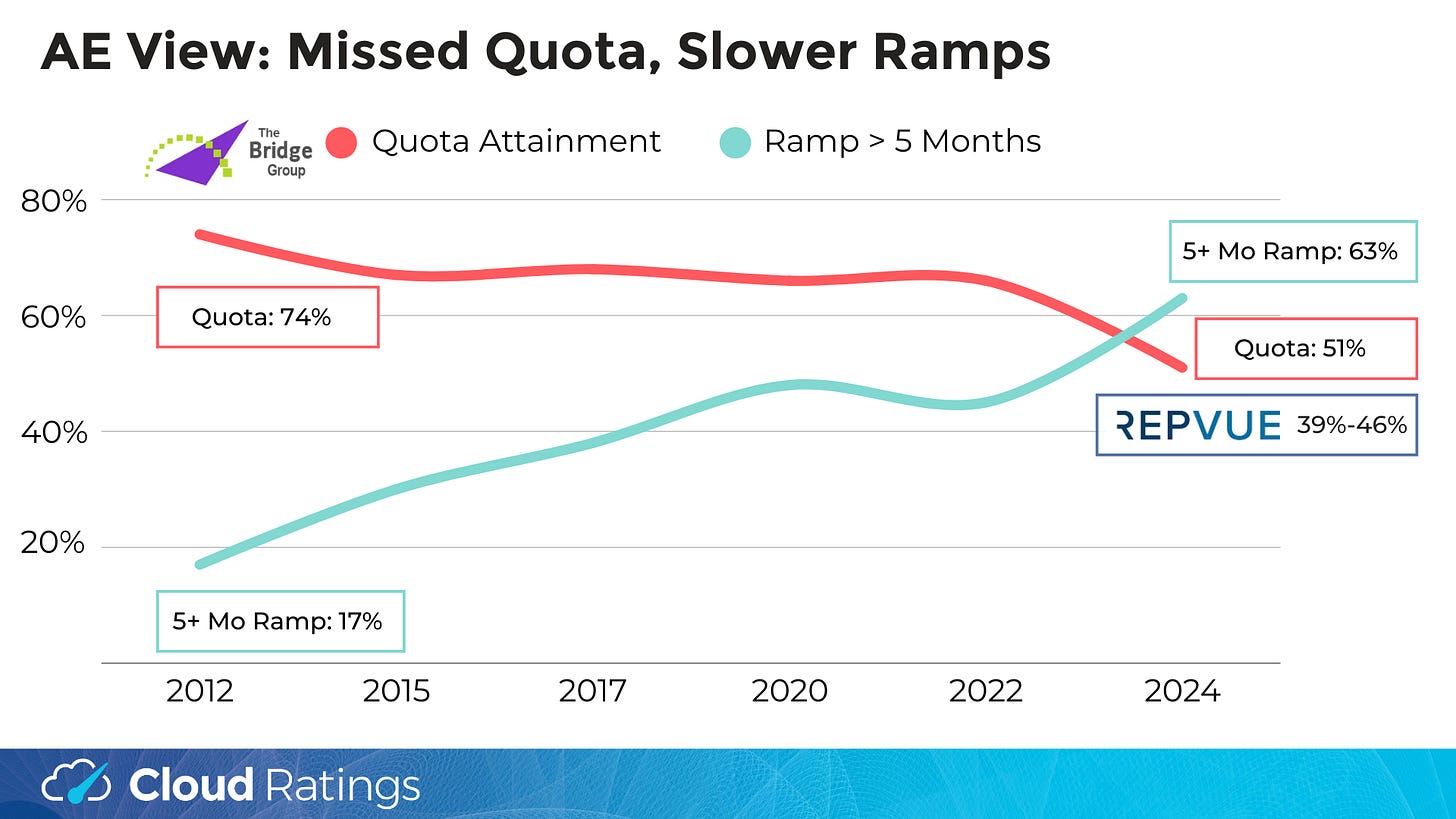

Declining quota attainment and slower ramps have been relentless long-term trends in a “maturing growth industry” - see our 2024 “State of Software” (Full slides, 1st presented at Bowery Capital’s 2024 AGM) - perhaps making top decile outperformance all the more impressive.

INBOUND HANDRAISERS: 129% Delta

The “Best of the Best” generate 129% more pipeline from Inbound Hand Raisers than the average.

Put differently, the top decile has a “Brand Dividend” with enough market pull that prospects come to them.

Reminder - we have the Scale GTM Benchmarks available in a downloadable PDF here:

Curated Content + Upcoming Coverage

Dave Kellogg released his excellently comprehensive 2026 Predictions →

His callout of Jaya Gupta and Ashu Garg of Foundation Capital’s “AI’s trillion-dollar opportunity: Context graphs” may raise some solutions to the poor success rates covered in our “Is AI An Abject Disaster?”

Flagship reports have been in full bloom this January → we hope to cover these individually… but might as well give you the underlying links too:

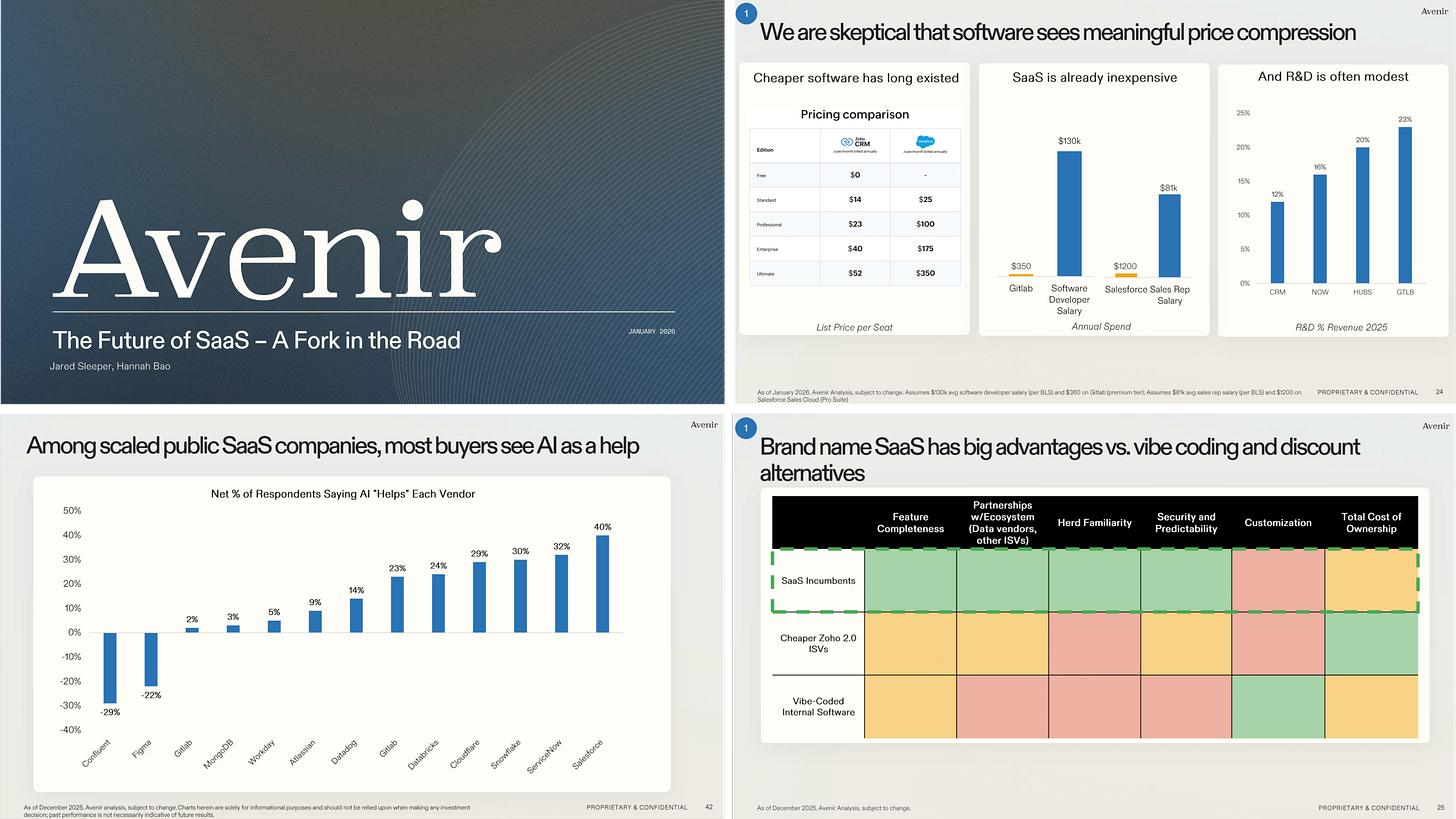

Avenir (h/t Jared Sleeper + Hannah Bao + co) published their excellent “Future of SaaS”- our excerpts here

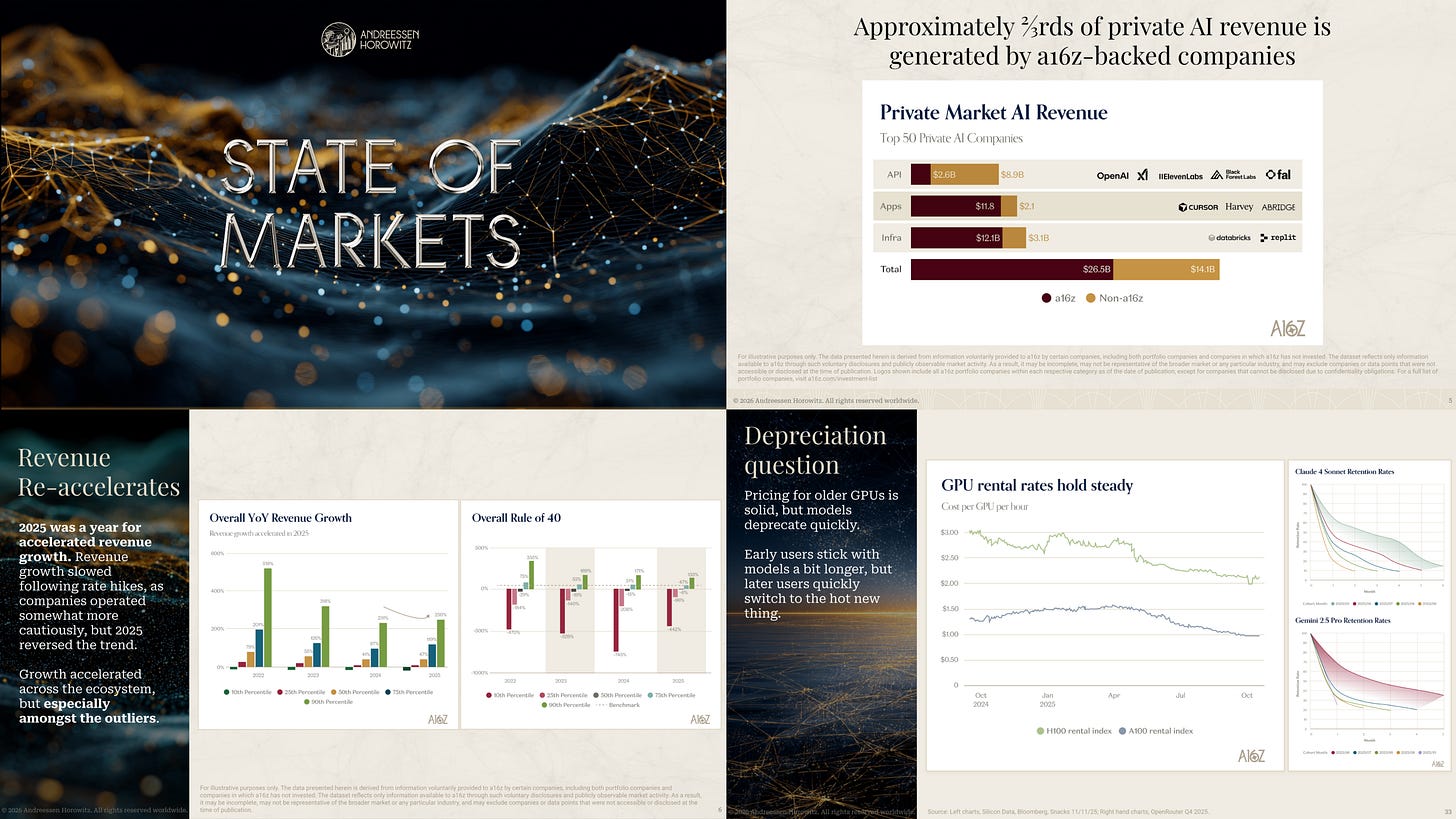

a16z (h/t David George + co) released their “State of the Markets” - our excerpts here

Mayfield released a report on “Enterprise Agentic AI” (n=266, h/t Gamiel Gran)

About Cloud Ratings

In mid-2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software) release, this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm:

The 773% delta on sales rep turnover is absolutly staggering. What really strikes me is how it compounds over time, the institutional knowledge advantage becomes insurmountable. I've seen companies obsess over CAC optimization while ignoring turnover, and they burn so much cash retraining the same role over and over. This data should be a wakeup call.