SaaSletter - March 2023 SaaS Demand Index

Plus new podcasts and category quadrants from Cloud Ratings

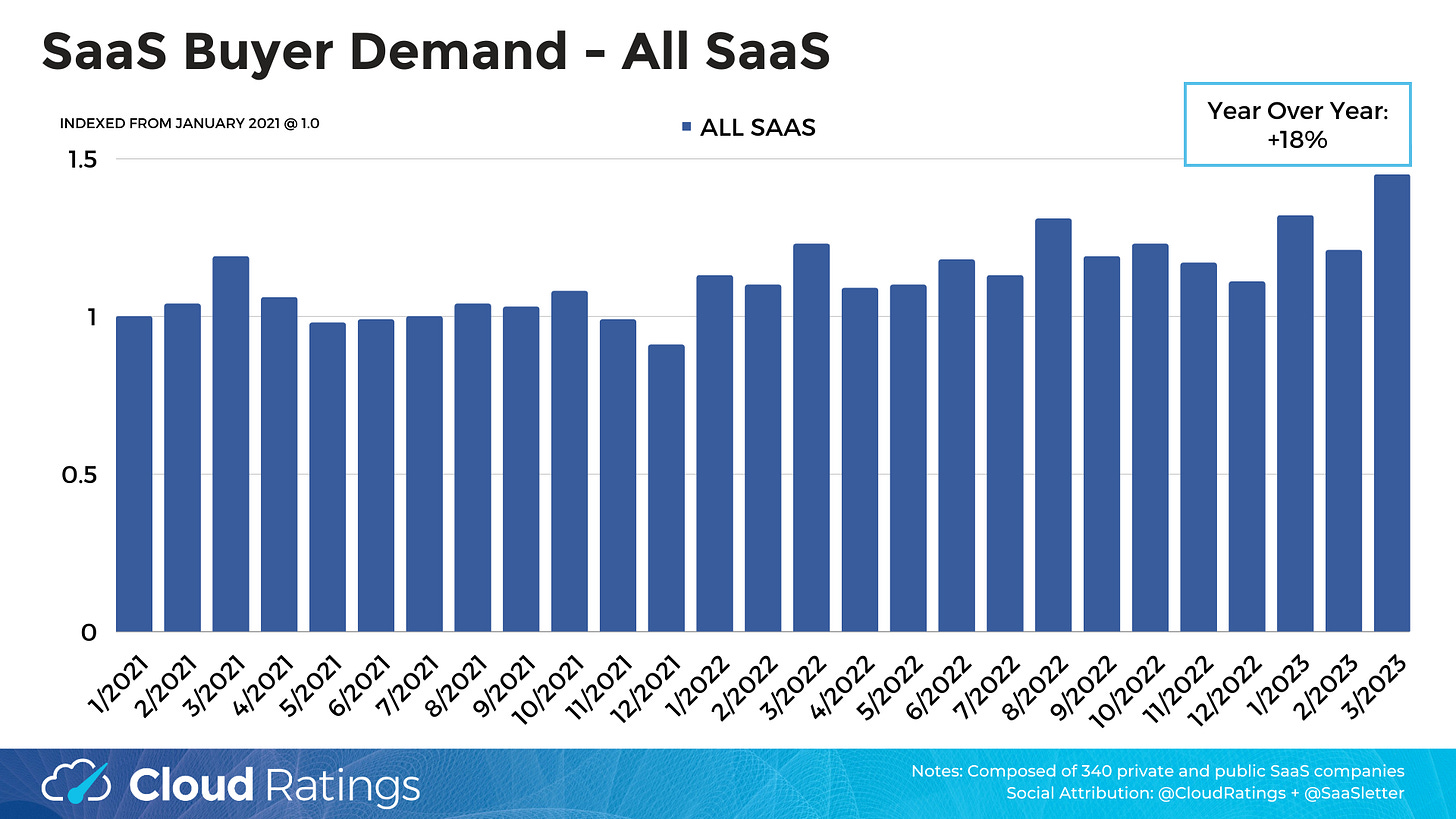

I’m excited to update the SaaS Demand Index with data through March 2023.

The new branding + format reflects our public launch of Cloud Ratings - a boutique analyst firm - in mid-February 2023.

For our new readers: the Demand Index is derived from high-intent (aka “okta pricing”) Google Search volume data.

Reminder: this is a directional, free, and ever-evolving analysis → always do your own due diligence.

Moreover, the data captured here is best characterized as top-of-funnel or dark funnel → factoring in sales cycle length, do NOT use this Demand Index as a predictor of near-term financial results and/or financial guidance.

Industry-Wide Data

With high-intent search volumes up 18% year over year, March 2023 data exceeded my expectations relative to broader narratives, like the Silicon Valley Bank failure.

Of note, this 18% increase matches Gartner’s 2023 SaaS Spending expectation of 18%.

That said, we note the possibility that some portion of these searches are contractionary - as in, a controller searching “asana pricing” to reduce spend.

Given the correlations and small differences, presenting the above without comment.

Trends By Product Category

While certain consensus narratives continued to hold - “Security = strong” and “E-Commerce + Marketing = weak” like past reports (Feb 2023, Jan 2023, Dec 2022) - a broader mix of categories showed improvement:

A few call-outs focused on March 2023 (with the caveat at the individual company level sample sizes and month-to-month variances can be meaningful):

Communications: Strong March from Calabrio and Genesys

Data + Analytics: Some of March's improvement is due to Aiven and Collibra lapping oddly weak February numbers. With strength from Domo, Databricks, Segment, Talend, and Thoughspot.

Development + IT Management: notable months from Docker and Retool.

Sales: Exceptionally strong March numbers for Apollo.io, Impact.com, and Mindtickle

Security: Strong numbers for Cyberark, Drata, OneTrust, Proofpoint, Vanta, Varonis, and Wiz

All of the category drill-downs - like these Marketing and Security examples - are available in this slide PDF:

A New Podcast From Cloud Ratings

We’ve released three podcast episodes:

#3 Building on RepVue’s sales quota attainment data: EPISODE

#2 Building on Zylo’s excellent “2023 SaaS Management Index” report (with my highlights Twitter threaded here): EPISODE

#1 Invited ScaleMatters CEO on given their visibility across all phases of GTM: EPISODE

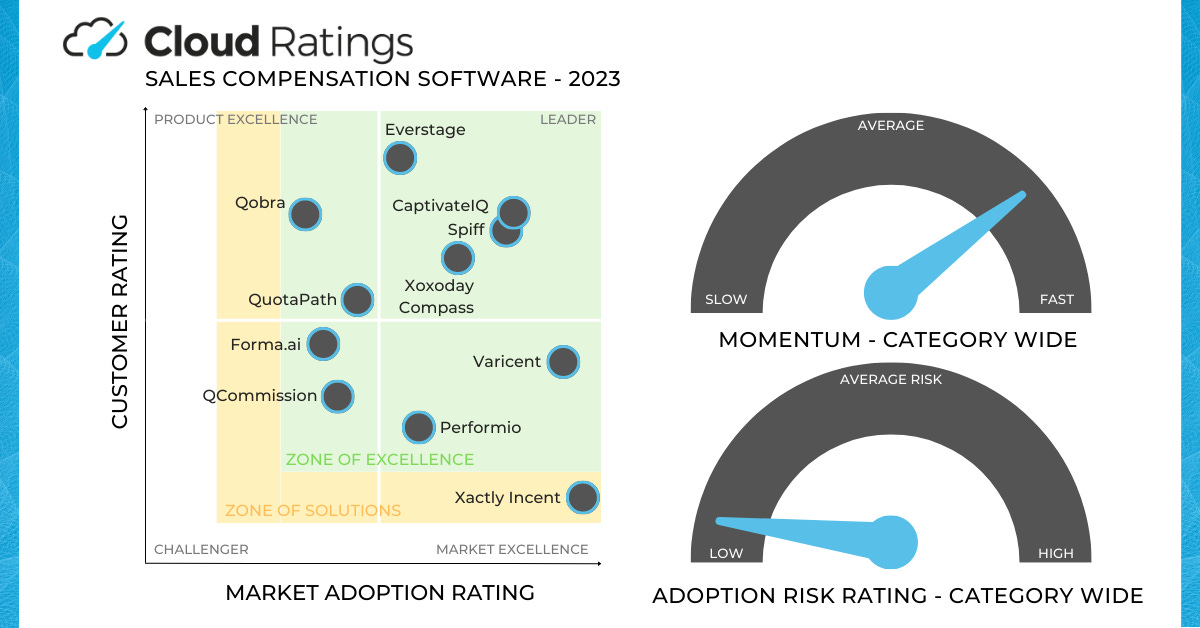

Category Quadrants From Cloud Ratings

We’ve recently initiated coverage across:

Pay It Forward → Participate In Benchmarks

The transparency in SaaS is amazing, especially for metrics and benchmarks. They are invaluable to investors and operators alike.

Pay it forward by participating (or having your portfolio participate) in Ray Rike + RevOpsSquared's 2023 Benchmarking Study:

Curated SaaS Content

100 slides from Anand Sanwal (Founder of CB Insights) on “100 Things NOT To Do When Building A SaaS Company”

2 related articles going deep on the growth vs profitability trade off:

And thanks to TechCrunch for featuring my data collaboration with Brex in “Late-stage startups are getting the hang of spending less”