ServiceNow Financial Analyst Day

Selected AI-focused highlights:

GenAI financial quantification:

Realizing 30% premium pricing on their “Pro Plus” AI SKU

$1 billion ARR upside from migrating Plus customer base to Pro Plus

$2.5 billion ARR upside from moving all customers to AI SKU

Customer GenAI productivity examples:

30% mean time to resolution improvement

>80% self-service deflection improvement

+25% developer velocity

ServiceNow’s own results from GenAI:

>7x ROI

$10m productivity gains across 20 internal use cases

Given my focus on the ROI of AI1, I wanted to highlight these transcript quotes:

Value-based pricing of GenAI - ServiceNow currently capturing ~10% of AI value created:

So 30% [price premium for AI] on this Pro Plus SKU with the incremental value creation, I feel pretty confident that that's going to be sustainable given the value add. 5 years after Pro, and we're still at 25%, I feel good about that 30%. To your question on pricing versus adoption, I think we'll see. Right now, as Bill indicated, that 30% [price premium] is a sliver of the value. And we did the exact same thing when we priced the Pro Plus SKU that we did when we priced the Pro SKU. And that was about value added. And we give 90% of the value to the customer, and we take a little bit. When we have these conversations with customers, when we show them the value, and they buy into that value add, it's not as difficult a sale as you would think.

Pricing model evolution with GenAI:

There are a couple of little known pricing models that are already out there inside ServiceNow, right? One is a transactional based pricing model. I'm thinking of a very large global bank based in London that is using that transactional pricing model around using ServiceNow for trade settlement exceptions. So small team, massive impact, and obviously, we're working with a transactional based model there. Another model pricing model that we recently launched is more on a commit to consume basis that you'd be very familiar with from Azure or an AWS kind of model, where we've now got a number of large enterprises that know that they're all in on ServiceNow. They know they're going to consume a certain amount of this over the coming 3, 4, 5 years. They want the flexibility to use all of the innovation from CJ's team inside that. They don't necessarily want to have meters against things. They're going to commit to consume a certain amount of product from us. Great. So that's we're going to see a lot more of that. But I think this links back to that very first point, which is particularly when and again, I'm thinking of maybe a small digital bank, right, might have only a team of 800 people, 900 people, but it's acquiring a massive, massive customer base and the work that we are doing is phenomenally valued for them, then we will be moving more to that transaction pricing model as well.

And I think the key thing to take away is this is not new. We are already doing it. But what we're seeing now from Gen AI, now a system, the value it brings is it's an accelerant to those kind of pricing models. They exist. We're just going to start accelerating using them because you're absolutely right. The value that is created is disproportionate to a 1,000 person seat count. But we have the mechanisms to capture value from that.

ServiceNow Lessons “For The Rest Of Us”

ServiceNow is a generational company: their stock is up 40x since IPO, at $10b of ARR with a guidance path to $15b ARR in 2026, and the most impressive cohort chart in SaaS with ~100% *annual* growth for all cohorts through 2016 (‘10-’16 average of 146%) with 90% growth endurance:

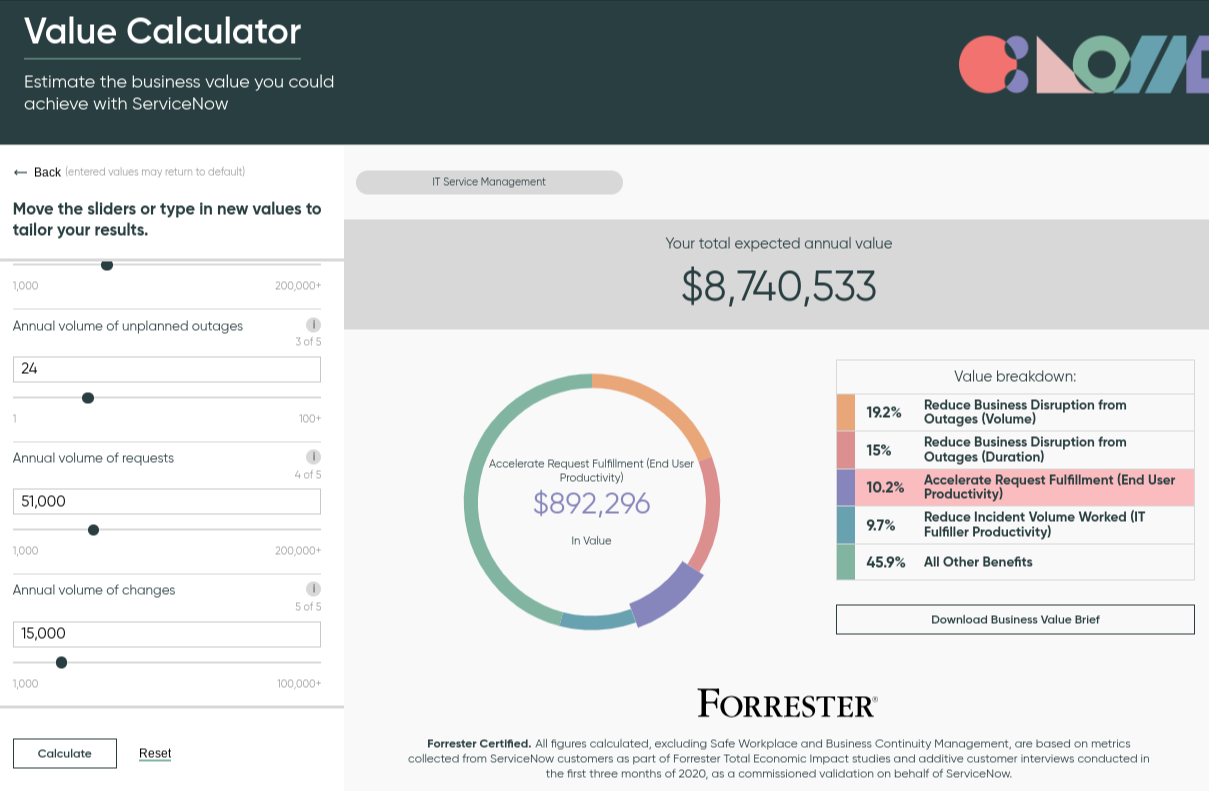

Just like the value-based messaging for Pro Plus GenAI, ServiceNow has used value-based GTM for years:

Other market leaders - like Microsoft, Hubspot, Oracle, Workday, and Salesforce - also employ third-party Analyst ROI Reports - a clear proxy for value-based selling - in their GTM:

In contrast to the playbook ServiceNow et al have laid out for the “rest of us”:

Only ~25% of companies below $100m ARR employ value-based pricing (vs 40%+ above $500m ARR)

Only 10% of middle-market PE-backed software companies have an ROI calculator on their website

If you would like to add analyst-validated ROI messaging to your GTM, Cloud Ratings recently debuted a True ROI offering at a far more accessible price point than Forrester’s Total Economic Impact offering:

Podcast Re-Highlight: Deep Dive Into Sales + AE Metrics

VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

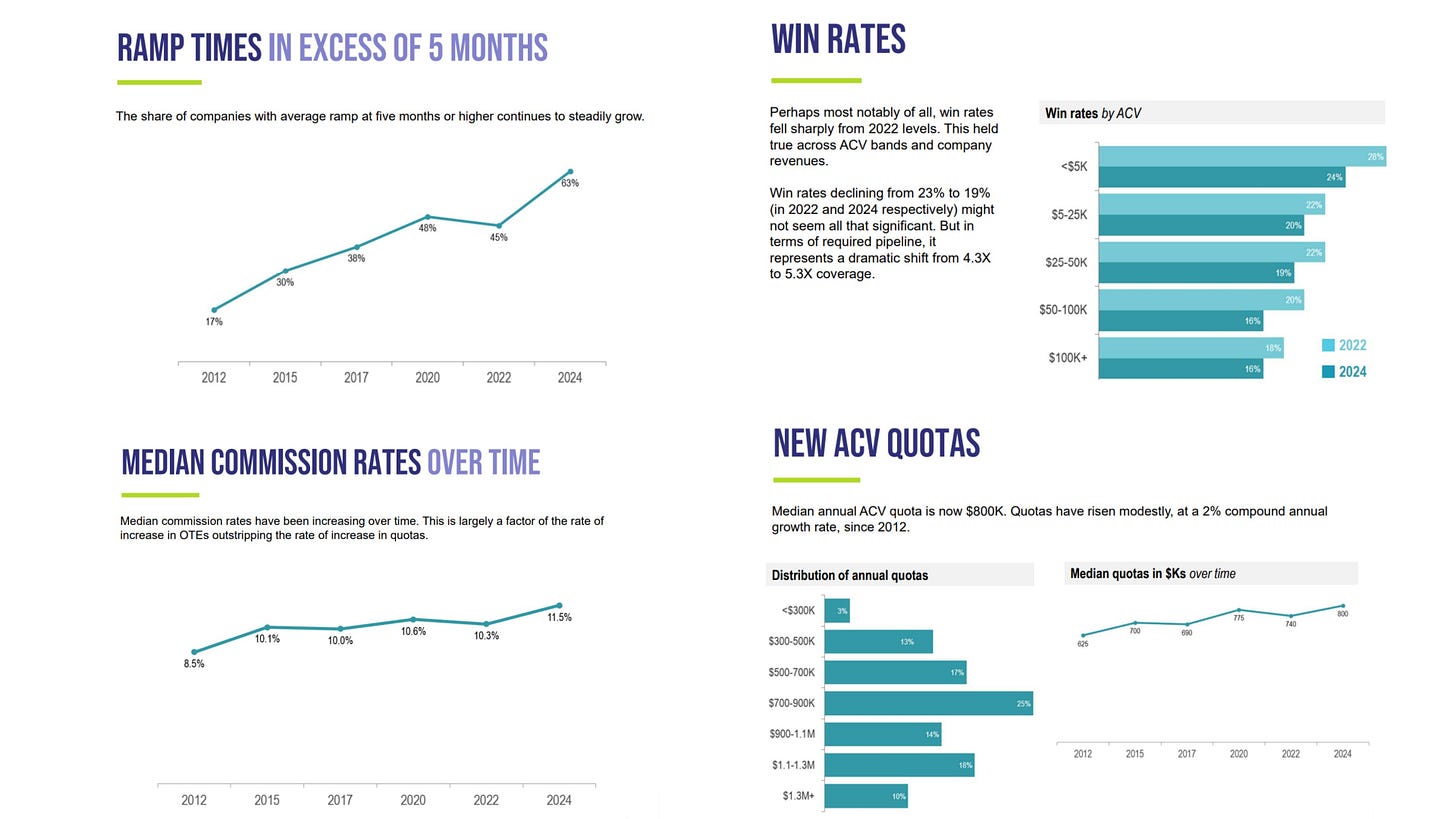

We did a deep dive into The Bridge Group’s excellent “2024 SaaS AE Metrics & Compensation: Benchmark Report” (50 slides, excerpt graphs below), and then starting at 59:29, we switched to broader sales in 2024 Q&A

Curated Content

Scott Brinker (an Episode 14 podcast guest) and Frans Riemersma released their 101-slide “ State of Martech 2024” report (excerpts pictured above)

“2024 Benchmarking Metrics for Bootstrapped SaaS Companies” - from Nick Perry at SaaS Capital

G2’s “State of Software” included a great ROI / payback period chart:

Two posts from Dave Kellogg: “You’re an Operator and Maybe Don’t Even Know It” and “Does Your Marketing Pass the Duck Test?”